U.S. Truck Driver Shortage Elevates Importance of Real Estate in Supply Chain Cost Structures

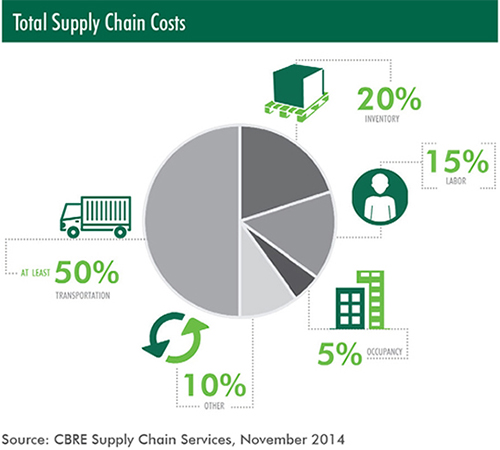

Real estate supply chain management is more crucial than ever, and U.S. markets with intermodal infrastructure are now best positioned for industrial space growth.

The U.S. industrial real estate market expansion has been driven, in part, by the ongoing evolution of supply chains, as businesses seek to distribute goods across the country ever more quickly and efficiently.

However, a nationwide shortage of truck drivers poses a risk to existing distribution chain strategies and elevates the importance of real estate in supply chain structures, according to a new report by CBRE Group, Inc.

While trucking plays a large role in the distribution of goods across a supply chain, the higher costs stemming from a shortage of truck drivers and the hours-of-service regulations is spurring users to find other options for transport over land.

Rail is an obvious and very cost-effective choice.

Demand for warehouse and distribution space in markets that feature a significant intermodal component has been a strong indicator that users are choosing access to the rail network as a solution to some portion of their long-haul transportation needs.

CBRE projects that distribution markets with significant intermodal facilities - the Inland Empire, Indianapolis, Baltimore, Dallas/Ft. Worth, Orlando, New Jersey Central, Portland, San Antonio, Virginia Northern and Houston - will grow their inventory of industrial space most quickly over the next 12 months.

Much of the new construction in these markets is on or near intermodal pathways, largely to take advantage of the link that rail lines provide to ports and major distribution hubs.

“Rising transportation costs, particularly those associated with trucking, are forcing supply chain users - manufacturers, importers, and exporters - to devise blends of warehouses and distribution centers that will most efficiently service the need for port access while enabling quick delivery to end users in densely populated metropolitan areas,” said Scott Marshall, Executive Managing Director, Industrial Services, The Americas, CBRE.

Source: CBR

Related: Rail & Intermodal Providers Continue Their Service Promises to Shippers

Intermodal Weight - Most Common Issue For New Intermodal Users

The most common issue for shippers transitioning their freight from truckload to intermodal is loading the container to be legally compliant with gross weight and the distribution of weight across the vehicle.

The Federal Gross Vehicle Weight Limit of 80,000 pounds for tractor/chassis/container is the same for both intermodal and truckload. The difference lies in the 53’ COFC domestic intermodal container is roughly 2,500 pounds heavier than a standard dry van. This translates into the recommended maximum bill of lading weight to not be over 42,500 for an intermodal load versus the 45,000 shippers are accustom to for a truckload shipment.

Unfortunately, many shippers entering into an intermodal strategy for the first time are either not properly coached through what needs to be done to account for the intermodal weight difference or they do not take it as seriously as they need to. Either way, not running within the legal weight specifications will cause a great deal of frustration for the shipper, as costs and delays are incurred through reworking the intermodal container to be legally transported.

The intermodal shipper is responsible for the load to be within legal weight limits, which in turn makes them accountable for all costs associated with a load being out of compliance. This responsibility comes as a surprise to many new intermodal shippers. The expectation is load weight and the distribution of weight is the carrier’s responsibility, which is understandable considering this is what they have come to expect from their OTR carriers. The costs associated with a non-compliant load and re-working it to be legal include: scaling costs, possible fines, additional freight charges, labor cost to rework the load and other charges incurred to make the load compliant.

The 42,500 pound recommendation is based on the average container, chassis weight and drayage tractor weight. Also, the shipment must be legal at both origin and destination ramps. There are occasions a load would be legal at origin, but not legal at destination. How you ask? The below scenario is an example that intermodal providers see play out almost every month for new intermodal shippers:

A shipper pushes the weight limit of 42,500 and edges over it. The load remains below the legal 80,000 pound limit because at origin the dray was done with a day cab, with less than half a tank of fuel. The trouble then comes in because the container is pulled at the destination ramp with a larger cab that came straight from a fueling station. The additional weight in the cab and fuel pushes the total weight to be greater than the 80,000 pounds. Now there is an overweight issue.

Since intermodal shipments, by definition, will have different dray equipment on both sides of the transaction this situation does occur. While we see this happen with newer intermodal shippers, it also happens with the most seasoned shippers, as well.

Permissible Federal Gross Loads for Vehicles

In addition to the Federal Gross Vehicle Weight Limit of 80,000 pounds for tractor/chassis/container gross weight, there is also a weight distribution requirement, which states axle maximums of 12,000 lbs. – Steers; 34,000 lbs. – Drives; and 34,000 lbs. - Trailer/Chassis. The diagram above illustrates the requirement in more detail.

With the weight distribution requirement, there are times where a shipment could be legal on gross, but not on the distribution of weight and vice-a-versa. Also, much like the gross weight scenario, there are situations where a load is legal at origin, but not at destination. How could this potentially happen, as it relates to weight distribution? Well, blocking and bracing is more than protecting the product, it also holds the product in place throughout its transit to ensure the weight does not shift and cause the shipment to be overweight on the steers, drives or trailer/chassis. Like the gross weight requirement, where the shipper is responsible, the distribution of weight is also the shipper’s responsibility and they will bear all costs of the rework, as outlined earlier.

Also, shippers should know that some states may enforce additional limits on specific highways or on bridges and California limits the spacing from kingpin to the center of real axle to a 40’ maximum.

While all this may sound complicated, it really is not all that cumbersome when a shipper partners with a reputable intermodal provider. The intermodal provider will walk the shipper through the requirements; engage the Class I Railroad for recommended load plans when there are questions; and in the more difficult cases, will send a Class I railroad representative to the shipper’s location to provide additional education. The long and short of it is, the IMC and the railroad wants the shipper to be successful in the transition of truckload to intermodal, so there are plenty of resources in place to make a smooth transition for the shipper to enjoy the cost savings; the additional capacity; the environmental savings; and the consistent service intermodal brings to the marketplace.

Source: Integrated Distribution Services

Related: Intermodal Service Issues Persist But Conditions Are Slowly Improving, Say Carriers and Analysts

Download the Paper: Do you really know Intermodal? A Look at the Misconceptions

Article Topics

Integrated Distribution Services News & Resources

Creating Mutually Successful 3PL Partnerships through Systems Integration R2 Freight & Logistics Acquires IDS Transportation Services Rail Still Dominates the Logistics Landscape The Ins and Outs of Intermodal Transportation Why Shippers Need Domestic Intermodal in Their Logistics Strategy U.S. Truck Driver Shortage Elevates Importance of Real Estate in Supply Chain Cost Structures Has Truckload Capacity Improved Since “The Perfect Storm” of 2014 More Integrated Distribution ServicesLatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation