U.S. Manufacturing Competitiveness Rising

The United States is expected to be the most competitive manufacturing nation, moving China into the number two position by 2020, according to the 2016 Global Manufacturing Competitiveness Index report from Deloitte Touche Tohmatsu Limited and the Council on Competitiveness.

With the release of the 2016 Global Manufacturing Competitiveness Index (GMCI), Deloitte Touche Tohmatsu Limited (Deloitte Global) and the Council on Competitiveness (the Council) in the US build upon the GMCI research, with prior studies published in 2010 and 2013.

The results of the 2016 study clearly show the ongoing influence manufacturing has on driving global economies.

From its influence on infrastructure development, job creation, and contribution to gross domestic product (GDP) on both an overall and per capita basis, a strong manufacturing sector creates a clear path toward economic prosperity.

Manufacturing Related Activities Among Global Nations Are Rapidly Evolving

Manufacturing earnings and exports are stimulating economic prosperity causing nations to increase their focus on developing advanced manufacturing capabilities by investing in high-tech infrastructure and education.

Nations and companies are striving to advance to the next technology frontier and raise their economic well-being.

And as the digital and physical worlds of manufacturing converge, advanced technologies have become even more essential to company- and country-level-competitiveness.

In fact, technology-intensive sectors dominate the global manufacturing landscape in most advanced economies and appear to offer a strong path to achieve or sustain manufacturing competitiveness.

In the 2016 GMCI, CEO survey respondents were asked to rank nations in terms of current and future manufacturing competitiveness.

Top performing nations have each demonstrated strengths across multiple drivers of manufacturing excellence. They also clearly illustrate the close tie that exists between manufacturing competitiveness and innovation.

The 2016 study takes a closer look at six focus nations: United States, China, Japan, Germany, South Korea, and India. Collectively, these countries account for 60 percent of world’s manufacturing GDP, demonstrating the influence these nations have on global manufacturing trends.

Report Highlights

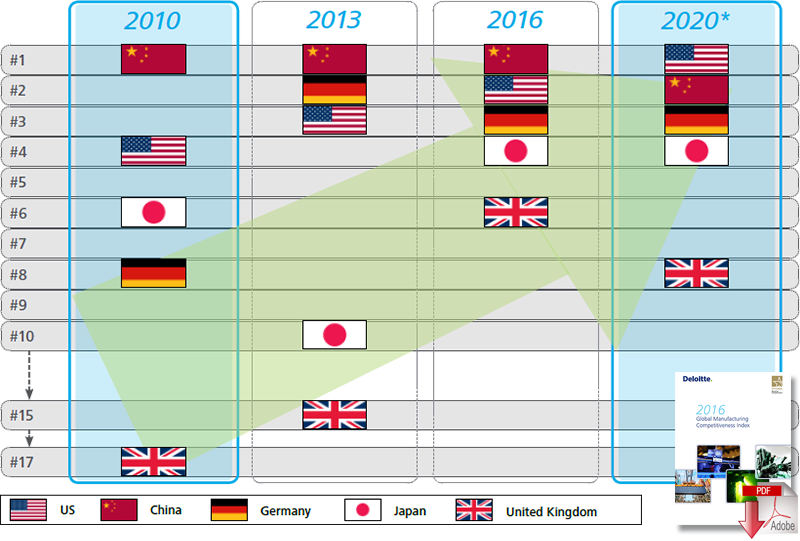

China and the United States jockey for top honors while Germany holds firm

- China is the most competitive manufacturing nation…for now: Consistent with the previous 2010 and 2013 Global Manufacturing Competitiveness Index studies, China is again ranked as the most competitive manufacturing nation in 2016, but is expected to slip to second position as global executives provide their perspective on how the next five years will play out.

- The United States is expected to take over the number one position from China by the end of the decade while Germany holds firm at number three: The US continues to improve its ranking from 4th in 2010 to 3rd in 2013 to 2nd in this year’s study. Moreover, executives expect the US to assume the top position before the end of the decade while Germany holds strong and steady at the number three position now through the end of the decade.

Global CEO survey: Manufacturing powerhouse rank trending and future forecast

Source: Deloitte Touche Tohmatsu Limited and US Council on Competitiveness, 2016 Global Manufacturing Competitiveness Index. *Represents projected 2020 ranks.

Shifting dynamics among global manufacturing nations

- CEOs say advanced manufacturing technologies a key to unlocking future competitiveness: As the digital and physical worlds converge within manufacturing, executives indicate the path to manufacturing competitiveness is through advanced technologies.

- Shift to higher value, advanced manufacturing tilts the advantage to developed nations in the future: As the manufacturing industry increasingly applies more advanced and sophisticated product and process technologies and materials, traditional manufacturing powerhouses of the 20th century (i.e. the United States, Germany, Japan, and the United Kingdom) are back toward the very top of the 10 most competitive nations in 2016.

- Two regional clusters of strength emerge: Out of the top 10 manufacturing competitive nations, two regions, North America and Asia Pacific dominate the competitive landscape. All three North American countries in the top 10 today and are expected to remain in the top 10 ranking five years from now. As many as five Asia Pacific nations (China, Japan, South Korea, Taiwan and India) are expected to factor in the top 10 by 2020, leaving only two spots remaining for Germany and the United Kingdom to represent Europe in the top 10.

- BRIC breaks down: Of the BRIC countries (Brazil, Russia, India and China), only China is viewed by executives as a top manufacturing nation in 2016. The other three BRIC nations have experienced a decline in their rankings over the last few years.

- The rise of the “Mighty Five”: The five Asia-Pacific nations of Malaysia, India, Thailand, Indonesia and Vietnam (MITI-V or the “Mighty Five”) are expected to be included into the top 15 nations on manufacturing competitiveness over the next five years.

Top drivers of manufacturing competitiveness

- Talent remains number one: Consistent with the 2010 and 2013 Global Manufacturing Competitiveness Index studies, manufacturers continue to rank talent as the most critical driver of global manufacturing competitiveness.

- Cost competitiveness (number two), productivity (number three), and supplier network (number four) are also key: In an era of sluggish economic growth, containing costs and increasing productivity to boost profits remains critical for manufacturers, alongside building a strong network and ecosystem of suppliers.

Global CEO survey: Drivers of global manufacturing competitiveness

Source: Deloitte Touche Tohmatsu Limited and US Council on Competitiveness, 2016 Global Manufacturing Competitiveness Index.

Impact of public policy

- A more favorable policy environment for manufacturing: Executives throughout the United States, Europe, and China indicated their respective nations have a number of more favorable policies around key elements of manufacturing competitiveness than even three years ago. Specifically around the areas of technology transfer, as well as science and innovation, executives indicated their nations have favorable policies to encourage manufacturers to increasingly use advanced technologies to improve their manufacturing competitiveness. Intellectual property protection also rose towards the top of competitive advantages in the US and Europe, while it was absent from the list of advantages in China.

- US perspective: US executives were more favorable toward policies in the US than the last study three years ago. According to US executives, favorable US policies centered on sustainability, technology transfer, monetary control, science and innovation, foreign direct investment (FDI), intellectual property protection, and safety and health regulation help to create a competitive advantage for their businesses. On the other hand, US executives identified policies around corporate tax rates, healthcare policies, labor, and taxation of foreign earnings as disadvantages for manufacturers in the United States

- Chinese perspective: In China, policies either encouraging or directly funding investments in science and technology, technology transfer, sustainability, and infrastructure development appear to be helping Chinese-based companies to create a competitive advantage. Chinese executives indicate that some policies are inhibiting their competitiveness, including corporate and individual tax rates, labor laws, and government intervention and/or ownership

- European perspective: European business leaders see the continent’s antitrust and product liability laws along with policies around intellectual property protection, healthcare, technology transfer, sustainability, and science as competitive advantages for them. At the other end, only four policies were cited as contributing to a clear disadvantage, including labor policies, individual and corporate tax rates, and economic and fiscal policies.

Download the Study: 2016 Global Manufacturing Competitiveness Index

“Made in the USA is making a big comeback,” says Deborah L. Wince-Smith, president and CEO of the Council on Competitiveness. “Contrary to the view that manufacturing is dirty, dumb, dangerous and disappearing, our study points to a manufacturing future characterized by innovation-driven growth. Manufacturing is sustainable, smart, safe and surging – and America will lead the world in this transformation.”

“The U.S. is currently among the top nations unlocking advanced manufacturing technologies including smart, connected products and factories, predictive analytics and advanced materials that are core to future competitiveness,” says Craig Giffi, vice chairman, Deloitte LLP and Deloitte U.S. Automotive Sector leader.

“The U.S. excels at creating connections and synergy between people, technology, capital and organizations to form a cohesive ecosystem of innovation, generating tremendous value from investments in research and development”

While the U.S. lead is a positive signal, the existing engineering and manufacturing workforce that pushed the country forward is beginning to get older, observed analysts.

“Therefore, it is important that public and private sectors collaborate on the nation’s educational and technological future to remain a top manufacturing competitor.”says Michelle Drew Rodriguez, manufacturing leader for Deloitte U.S.’s Center for Industry Insights.

According to Rosemary Coates, President of Blue Silk Consulting and Executive Director of the Reshoring Institute, the US must not become complacent regarding the competition from China.

She notes that Xi Jinping’s “Made in China 2025” initiative is laser focused on competitive advanced manufacturing and it will be a challenge for America to keep up.

“With 80% of China’s economy dependent on manufacturing, the Chinese government is much more attuned to supporting its industrial development than are the US President and US Congress,” Coates says.

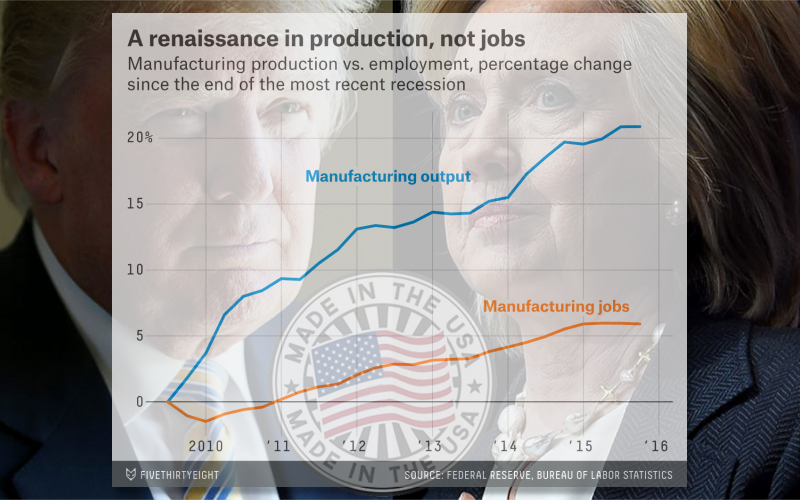

She adds that in reshoring manufacturing to the US, they are developing new technologies and innovative automation.

“The manufacturing rebound in America is all about advanced manufacturing, not bringing low-wage, low-level manufacturing back. That will make us competitive at the high-end of advanced manufacturing where jobs are fewer and require a high level of skills. This is an evolution, not a revolution.”

Source: Deloitte

Related: Stop Talking About US Manufacturing Jobs Coming Back, Because They’re Not! (read comments)

Article Topics

Deloitte News & Resources

MHI Report: Investment increases as supply chains become more tech-forward and human-centric Global Trade Tensions, Material Shortages Not Expected to Ease in 2024 Blockchain in Supply Chain Continues to Mature Supply Chains Struggle to Access Reliable Emissions Data from Suppliers State of the industry: MHI releases annual report at ProMat 2023 MHI and Deloitte launch 2023 Annual Industry Report survey How Amazon Is Preparing For Fully-Electric Drone Delivery More DeloitteLatest in Supply Chain

Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs Ranking the Best Countries for Private Business in EMEA Frictionless Videocast: The Importance of Water at the U.S./Mexico Border with Commissioner Maria-Elena Giner, International Boundary and Water Commission Why are Diesel Prices Climbing Back Over $4 a Gallon? Plastic Pollution is a Problem Many Companies are Still Ignoring Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws 80% of Companies Still Unsure How to Best Leverage AI, Study Finds More Supply Chain