TMS: The key enabler

Our technology correspondent takes a look at TMS’ evolving role, explains the drivers that are pushing development in the sector, and illustrates how new delivery methods could change the face of transportation management.

In survey after survey, year after year, analysts continue to find the same, somewhat surprising number: Only about one-third of “eligible” companies—those that would benefit from using a transportation management system (TMS)—are currently using a TMS.

This finding certainly proves that there’s plenty of growing room for TMS under the supply chain execution (SCE) umbrella for providers of the technology. And considering that the domestic and global economies are finally entering a slow-but-sure rebound mode, it would stand to reason that more companies should be adopting TMS to ferret out transportation spend reductions, improve route planning and optimization, and achieve better collaboration across the supply chain.

Well, according to Dwight Klappich, research vice president for Gartner, Inc., 2010 actually did see an expansion in the size, functional breadth and depth, and geographical scope of the TMS market, as users sought out technologies to help reduce costs, improve efficiency, and “generally run their freight operations more effectively.” Klappich calls TMS a growing market for shippers of all sizes—from those that spend as little as $15 million on annual freight, to shippers that spend hundreds of millions of dollars per year on transportation.

“TMS continues to be seen as the key enabler that will help freight organizations reduce total and empty miles, enable better utilization of freight capacities, minimize unnecessary moves, combine loads to use more economical modes of transportation, and ensure that the least-cost modes and carriers are routinely chosen by users,” says Klappich.”

Over the next few pages we’ll look at TMS’ evolving role as that “key enabler,” explain the drivers that are pushing development in the sector, and give shippers some insight into the future viability of TMS. We’ll also illustrate how far TMS functionality has come and where it’s headed in terms of delivery methods.

Riding the growth curve

Klappich and the Gartner supply chain research team expect the TMS market to maintain growth for several years, with double-digit growth emerging in 2011 and a projected five-year compound annual growth rate (CAGR) of 9.4 percent.

Growth drivers include the basic fact that TMS remains in high demand along with the emergence of alternative delivery methods, such as software as a service (SaaS). The latter gained traction in 2009, mainly due to the weak economic climate that, according to Klappich, favored the short-term cost advantage of SaaS.

Credit the fact that transportation—unlike warehousing or supply chain planning—relies on a multi-enterprise, geographically dispersed network that includes a supplier, shipper, third-party logistics provider (3PL), carrier, and/or customer. All of these entities are involved in the process, and that setup “really lends itself to network-based solutions that favor SaaS,” says Klappich.

Also working in TMS’ favor right now is the fact that a significant capacity crunch could once again rear its head in 2011, pushing more shippers to purchase new or upgrade existing management systems. While finding a carrier at an affordable—or even cheap—rate was fairly easy during the recession, Klappich expects that high capacity trend to reverse as the sluggish economy picks up steam. Increasing fuel costs and upswings in industries like construction could compound the situation further, says Klappich.

“By the end of 2010 we were also seeing some of these issues surface for shippers, but they really didn’t stick,” he explains. “We’re still in the ‘lull’ stage, but the more challenging environment is imminent and has more shippers thinking about the role that a good TMS will play in helping them work through those issues.”

Road to improvement

One doesn’t necessarily relate TMS to a company’s sustainability efforts, but that could change in the near future as more of the software’s vendors integrate green-centric features into their solutions. Carbon footprints—or the total set of greenhouse gas emissions caused by an organization, event, or product—are of particular interest.

“The whole idea of carbon footprint reduction is gaining momentum,” says Erik Van Dort, vice president of Capgemini’s supply chain management practice. “And TMS has historically focused on that issue.”

Future iterations of TMS software, for example, will likely incorporate tools that address issues like sustainability and carbon footprint reduction, says Van Dort, with functions like advanced planning and scheduling that could play a “key role, but currently don’t.” He says that shippers, who are under increased pressure by federal regulations and standards to reduce their operations’ negative environmental impact, are driving that movement. “They want their providers to give them the tools and means to get there,” says Van Dort.

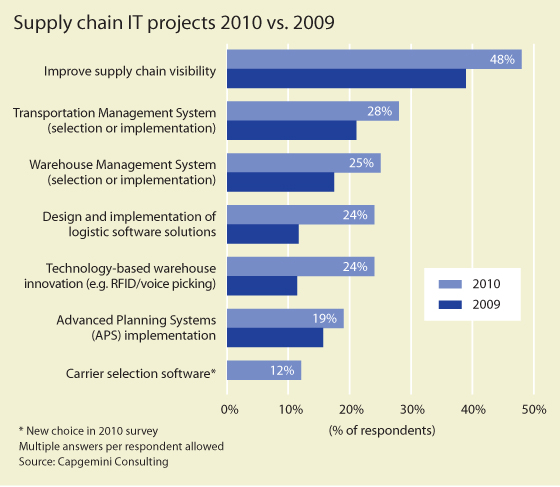

Van Dort sees a growing need for improved visibility as another important TMS driver right now, and he expects that movement to continue in 2011. “The levels of supply chain visibility achieved so far by shippers are pretty disappointing overall,” he explains, noting that the easier connectivity made possible by shared TMS platforms is one step in the right direction. “Expect visibility to improve as vendors hone their solutions to better address the challenge.”

Answering the call

TMS vendors have expanded the breadth and depth of their solutions to the point where most shippers can source most, if not all, their needs from a single vendor, according to Klappich.

At a minimum, most support North American multimodal planning, execution, and settlement. Many vendors also include network design and optimization, freight procurement, asset-based/fleet routing and scheduling (R&S), appointment scheduling, multi-carrier parcel management, and performance management in their solutions.

When selecting among those options, shipper size comes into play. According to Klappich, Gartner sees growing demand from what it calls small to midsize businesses (SMB), or those with less than $50 million in annual freight spending. But he notes that many of the systems on today’s market are beyond the scope or budgets of many of those smaller shippers.

To answer the call, Klappich expects a new TMS market segment to emerge that is focused on those SMB shippers. That sector, he says, will emphasize ease of use, simplicity, time to value, and cost of ownership, and not just on application characteristics.

“Although no SMB TMS leader has yet emerged, vendors such as Infor, MercuryGate, and LeanLogistics have shown success in this space, and offer some interesting SMB characteristics,” says Klappich. Infor, for example, offers a “clean and intuitive user interface that would appeal to users where managing freight is only one of their daily tasks.”

Klappich points to LeanLogistics’ Vector Planning feature as another attractive point for smaller shippers because it enables the simple grouping of orders into truckload shipments based on geographical proximity. “This is easy for less sophisticated users to set up and understand,” says Klappich. “MercuryGate is also in the mix, with its ability to leverage domain expertise, functionality, and lower cost of ownership to grow its presence in SMB 3PL organizations.”

On the horizon

As one of the more mature supply chain software sectors, TMS is expected to continue gaining ground in 2011, with that growth spurred on by the drivers mentioned above. Concurrently, Adrian Gonzalez, director of ARC Advisory’s Logistics Executive Council and Logistics Viewpoint, says vendors will be working to fill in any “white spaces” left by previous versions, or those areas that current TMS offerings simply don’t address—such as functions that aim to improve containing and load building, for example.

Demand forecasting, including the ability to accurately predict how much of a certain product should be on a retailer’s shelves for an upcoming promotion, could also become a mainstay of the future TMS, says Gonzalez. With a brighter economy ahead, for example, 2009 and 2010 data may not always be the best indicator of future sales.

“Many shippers are doing demand forecasts based on the previous year’s data,” says Gonzalez, “but how can they convert current sales data into more accurate transportation forecasts? That’s an area where a TMS can help.”

Van Dort says Capgemini is optimistic on TMS’ future prospects for 2011 and beyond. Longer-term IT investments are, once again, back on the agenda of most companies, he says, with TMS making up the lion’s share of new supply chain software adoptions. “All shippers and 3PLs are looking for improved visibility in the supply chain,” says Van Dort, “so the solutions that deliver that benefit, plus IT projects like TMS and WMS implementations, are all showing a clear increase.”

There’s an “app” for that!

Adrian Gonzalez envisions a time when a logistics manager can use a computer or handheld device to pull up a simple TMS “app,” download an appointment scheduling program, run through a setup wizard, and start using it within a few hours. If it sounds far-fetched, consider the fact that companies like Apple and Google are already offering up apps menu-style across myriad industries. So, asks Gonzalez, why not the supply chain?

“It’s about taking a TMS and further modularizing it in a way that allows companies to use certain aspects of the software without having to do a complete implementation.”

Gonzalez says vendors like LeanLogistics and OneNetwork are already offering up app-style TMS functions, and he expects more providers to follow suit in 2011. The notion won’t appeal to every shipper, but it may draw in the smaller firm that’s still using spreadsheets and fax machines to manually handle their transportation component.

“We’re not going to see ‘software-as-a-self-service’ being used by large, global operations,” says Gonzalez, “but it’s a great starting point for the small firm that wants to test out a TMS function in one facility.”

For more news, articles, information on Transportation Management Systems (TMS) click here