The Supply Chain Talent Trap

The definition of a trap is something designed to catch a person or animal, either figuratively or literally.

Nine out of ten companies are stuck.

Their supply chains are not improving corporate performance.

Despite multimillion dollar technology projects, and tones of strategy documents, they are stuck in their ability to overcome market factors and rising complexity to drive continuous improvement on a portfolio of metrics.

I have spent the last month working with clients that are out of balance. They quickly acknowledge that they are stuck.

What does that mean?

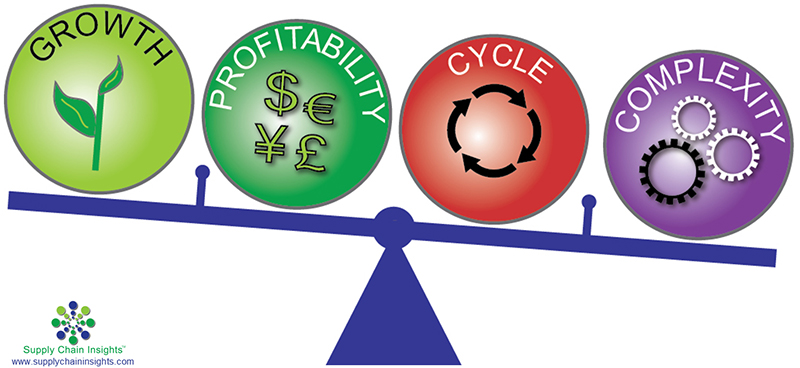

In short, they have been able to drive improvements in one or two metrics; but, they are struggling to improve a portfolio of metrics that includes customer service, cost, inventory turns, and growth.

They struggle to manage the supply chain as a complex system and power improvement on the Effective Frontier (shown below).

The Supply Chain Effective Frontier

A large factor in success versus failure is the management of supply chain talent. Last week, I taught a public training class. As we were discussing the pending supply chain talent shortage, and the lack of mid-management talent, I was asked a great question. The class participant said, “Lora, I get it. I need to build talent. I cannot wait. But, help me, what are the talent traps to avoid?” Here are the five areas that we discussed. I loved the rich discussion with the group of ten.

- Don’t Be a Know-It-All. I love doing strategy days with teams. Often, I will walk into a strategy day to face a group of managers that have not worked together before. Due to the shortage of supply chain talent, many have come from different companies. The fun starts when I expose that each thinks that they know what supply chain excellence is, but they lack a broader understanding. What they do not know before the class is that each of them carry a fixed mental model of the supply chain that they knew from their prior job. What they do not realize is that each supply chain has a unique combination of rhythms and cycles. Each is different. The value statement for each supply chain needs to be aligned to deliver on the business strategy in a way that delivers strength (year-over-year improvements), balance (a balanced portfolio of metrics to deliver against the strategy), and resiliency (consistency despite market shifts) in corporate performance. It is unique for that company. As complexity shifts happen, the supply chain has to be redesigned to absorb the changes. Most supply chain leaders are too comfortable in thinking they have the answers. Breaking out of the pack requires new thinking. Traditional technologies and processes are not equal to today’s challenge. As a result, leaders have to understand the past, to unlearn what they think are “best practices,” to enable new thinking to drive new solutions. This requires embracing new mental models.

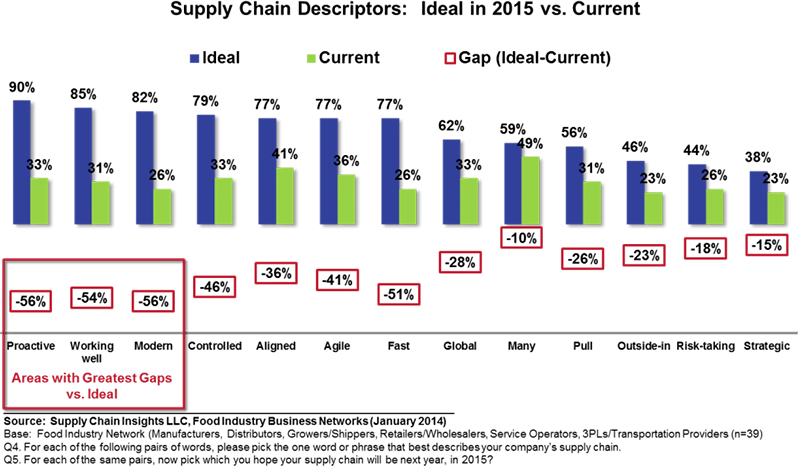

- Get Clear. One of the barriers to delivering on corporate performance is a lack of clarity of terms. Words like agility, responsiveness, efficiency, and flexibility need to be clearly defined to take strategy to action. Without clarity in definition, the supply chain teams cannot drive action. All too often, there is an assumption that the words can easily be translated to action. Without clarity of definition, the teams have difficulty aligning. Some of the frequently used terms are outlined in the chart below “Supply Chain Descriptors.” This chart is from a study of 46 leaders in the food industry. Note the range of frequently used words and the gaps. The use of any of these would require a careful definition to drive it to action. Let me give you an example. One of the most overused terms is the word “team.” When I ask people what this means they look at me like I am crazy; but, the definition of a team is important. The games of football, baseball, swimming, track, and tennis all have different definitions of team play with different rules. You would never ask a swimming team to play by the rules of a football team. How can you ask a team to play together if the rules are not defined?

- Carefully Design Regional/Global Governance. A major trap is the lack of definition of regional/global governance. Each discussion will usually start with the statement, “You know Lora, that we are global. And, that we are different and more complex than anyone else.” However, when I ask how they have defined Regional/Global governance, I get blank stares. It is not obvious. Global is not global. Strategic and tactical planning is usually global and done with a product or category focus. Operational and executional planning processes are usually focused on geographic implementation by factories, distribution centers, and third-party manufacturers and distributors. In 2006, I met a man by the name of Dick Clark that traveled the world working on role definition of planners for Procter & Gamble. This year P&G will be over $83 billion in revenue. There is no doubt about it. The company is a consumer products giant. The P&G system has thousands of planners operating in a very complex matrixed organization. Unfortunately, Dick is no longer with us. Sadly, he died of lung cancer several years ago. But, if he were here, I would love to continue my dialogue with him. In 2006, I asked Dick why it was taking him so long to define the roles of planning within P&G. He had been at it for a few years, and I just could not understand why it was taking him so long. As a result, I would continually ask Dick why it could not be quicker. He had been at it for three years. In Dick’s words, he would say, “Lora you don’t understand. Our work processes are very complex with many conflicting priorities and political agendas. It is not as easy as your writing says. We are global with new employees with little experience and senior employees with lots of experience. Both need guidance. We cannot assume that they know what to do. If we do not help employees understand how their inputs tie into the greater whole of the company, we cannot win in the market. It is that simple.” Unfortunately, there are too few companies that understand the need for the work that Dick did. It was a great lesson for me, and I think it was a major factor in the corporate performance of P&G in the period of 2006-2010.

- Step Up. Focus on Mid-Management Training. While companies have training programs for entry-level employees and “high-performance” achievers, only 22% of companies have training programs for mid-management employees. With the number of open positions, and turnover of planning positions, investment in talent becomes more important. The changes in analytics, supply chain processes, and technologies require a constant focus on training. The future is going to be quite different from the world today. I am convinced that this traditional sandwich approach will leave many well-intentioned companies with a talent vacuum.

- Focus Equally on the Important and the Urgent. Today, one of the gaps is the focus on the urgent without leaving time for the important. People think that they need to be busy. They reward the urgent. However, planners need time to plan. Getting good at strategic and tactical planning is essential to be able to manage continuous improvement in inventory turns and operating margin. As a result, leaders need to ensure that rewards systems and job progression paths equally reward the urgent and the important. Work on “what-if planning” and audibles to ensure alignment as the business changes. The best job that I have seen of a company that ties Sales and Operations Planing to operations execution is Eli Lilly. At Lilly, the teams build play books to crystallize what plays need to be called within the month to ensure that the operating teams understand how to adapt the cross-functional plans in play-based market shifts. It is much like a football team sensing what play to call based on how the other team lines up on the field. A football team would never line up without spending time to develop the audibles. Sadly too few supply chain teams take the time to develop the plays based on “what-if analysis” to help the teams know how to operate on the field and in global markets. Only 11% of companies are satisfied with their “what-if capabilities.”

- Measure Progress in Inches not Miles. Progress in supply chain performance happens slowly over many years. It is measured in inches, not miles. Supply chain leaders have to persevere and stay focused. I loved the quote from Marty Kisliuk, Director of FMC, in the book Bricks Matter, “Progress in supply chain improvements needs to take at least three years.” However, too many companies focus on ”the program of the month,” or “the yearly plan” without ensuring year-over-year continuity.

What do you think of my answer? Interestingly, the overwhelming sentiment of the members of the class was that the biggest issue for them is item #1: The leader that thinks that they know it all. I would love to hear your thoughts.

About the Author

Lora Cecere is the Founder and CEO of Supply Chain Insights , the research firm that’s paving new directions in building thought-leading supply chain research. She is also the author of the enterprise software blog Supply Chain Shaman. The blog focuses on the use of enterprise applications to drive supply chain excellence. Her book, Bricks Matter, published in December of 2012.