The Road to Big Data Visibility Doesn’t Run through Your 3PL Technology

You don’t get anywhere near the depth and breadth of visibility with 3PL tools as you would if you engaged a standalone TMS solution from any of the leading providers especially with respect to rate data, carrier acceptance data and overall visibility.

So you’re a shipper intrigued by “Big Data” tools and technology to improve transportation management initiatives.

Should you implement a 3PL technology solution, or is it more effective to select a pure-play TMS provider to leverage your data? Your current 3PL has a technology they’ve been offering and that seems like a neatly bundled offering.

But, before you agree to use their tool though, consider the following strategy which delivers the best of both worlds.

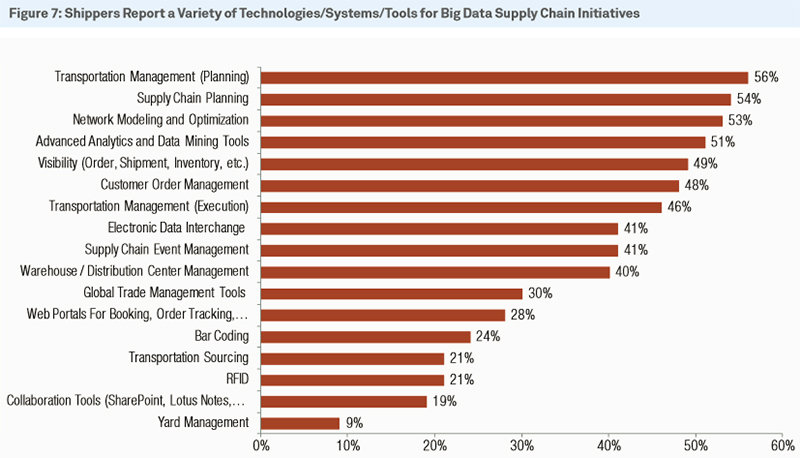

The 18th Annual CapGemini Third Party Logistics Study revealed some interesting data regarding shippers’ usage of technologies, systems and tools to leverage Big Data in their supply chain initiatives.

To dispense with the question of whether or not shippers are interested in Big Data, the chart below reveals that a majority of those polled reported using Big Data technologies for transportation management (TMS), supply chain network planning and optimization, while a plurality tapped tech tools for things like order management, shipment tendering and communications.

So it is clear that shippers realize the potential, and those that are not currently leveraging IT for logistics are interested in doing so in increasing numbers as well.

Source: 2014 18th Annual Third-Party Logistics Study

So back to the question of whether it makes more sense to source best-in-class Big Data technologies from vendor-agnostic, third party providers (like UltraShipTMS) or from 3PLs offering technologies as part of a bundled offering. Many shippers gravitate toward the 3PL supplied technology model for a number of reasons; one throat to choke, one less relationship to manage, etc.

However, there is a pronounced advantage to engaging a vendor-agnostic, third-party technology tool like a TMS or optimizer which is summed up in one very important word: visibility. We’re not suggesting that the tools offered by 3PLs don’t offer improved control and a degree of visibility to improve a shipper’s transportation management.

What we are saying is that you most definitely don’t get anywhere near the depth and breadth of visibility with their tools as you would if you engaged a standalone TMS solution from any of the leading providers. This is particularly true with respect to rate data, carrier acceptance data and overall visibility into underlying carriers.

Again, not to suggest that 3PLs willfully manipulate the tools they provide to their advantage. But they certainly don’t have a strong incentive to help you drill into the data to learn what is driving rates and preventing you from finding a lower rate elsewhere. After all, they are moving your loads as your broker of record.

It is also important to realize that using a third-party tool doesn’t preclude a shipper from having a strong relationship with their favored 3PL. But it does ensure that the shipper has full visibility into all the data the tool collects enabling much more robust and actionable Big Data analytics.

This means the shipper secures greater accountability from their 3PL. It also means the shipper can effectively source capacity through both a trusted 3PL and through direct arrangements with carriers to provide even more flexibility.

Source: UltraShipTMS Blog

Big Data Helps You Ask The Right Questions

Abby Mayer, Supply Chain Insights

There’s a lot of buzz these days about big data. But big data just for the sake of being big has little to offer supply chain. A spreadsheet with a million rows is no more or less insightful than one with ten rows. It depends on what is in the data and what tools we have to analyze the data. The tools and skill set component is a critical one. In fact, I think that big data can sometimes paralyze overwhelmed and understaffed supply chain departments.

Check out the results of a recent survey we did. The top pain for all respondents was the ability to get to data. Does more data make that task any easier? I would argue no. In some instances it is probably true that data doesn’t exist. In others, data exists and it is the task of slogging through it to find meaning that is the challenge.

At Supply Chain Insights, we have spent more than two years buried in financial data trying to understand the relationship between supply chain performance and financial performance. There is a large quantity of both. The challenge is finding meaningful relationships and actionable insights from the data.

This is a journey without a clear end and a math problem without a single solution. For me, coming from school, I spent a long time looking for the single answer. I am slowly coming around to accept that there is not a single answer. Why does the Index model depend so heavily on inventory turns and operating margin? It’s a good question.

Those metrics are some of the most meaningful for supply chain leaders, they are objective and they are harder to game than other metrics. Would gross margin be better? Or days of inventory? Or something else entirely? Maybe.

This is wholeheartedly a journey without a clear destination. The further we go, the more we discover and the better we are at asking important questions. I think what I’m trying to say is that more data doesn’t solve your problems. In fact, if you’re using it right, it probably just forces you to ask better questions.

Related: 3PLs Investing Heavily in Big Data Capabilties to Ensure Seamless Supply Chain Integration

Download the White Paper: Big Data Handbook