Price Risk Mitigation: Cold storage market participants

An overview of derivative risk hedging strategies to hedge key industry risk factors that have a material impact to a company's financial performance.

The cold storage market is experiencing and is expected to experience significant growth on the demand side from both the existing tenant user groups and new user groups emerging at a meaningful rate requiring cold storage for their products – i.e. online grocers.

Given the significant demand and the current supply shortage, cold storage rental rates will continue to increase for frozen/refrigerated product companies that lease space at cold storage properties around the country. To maximize profit margins given this increasing occupancy expense, the industry’s cold storage tenants needs to look at how they can hedge the price volatility that they are exposed to on the revenue and expense side via derivatives – i.e. futures, options & OTC swaps, etc.

For example, electricity costs are very significant with cold storage properties for tenants and landlords. There are derivatives available to hedge the risk of volatility and increasing electricity costs – i.e. via electricity and weather (temperature based) derivatives: futures, options, swaps, spreads, etc.

What are derivatives and how do they mitigate risk

A derivative is a financial security with a value that is reliant upon or derived from, an underlying asset or group of assets—a benchmark. Derivatives consist of futures, options, OTC instruments such as swaps. Basically, the hedger is locking in a price today for a purchase/sale of a product at some time in the future. Regardless of which way the product’s price move in the cash market in the future, the hedger’s price doesn’t fluctuate.

One of the best derivative products available are options on futures contracts, where you pay a premium (similar to an insurance premium) on an options contract – which gives you the right to exercise the purchase or sale of a futures contract at some future time and if the cash/spot market price moves adversely against you when you go to buy or sell the product causing your purchase price to increase or sale price to decrease, you make a profit on the derivatives position that can offset the adverse cash price movement (assuming you had constructed the right hedge).

Options are like insurance policies where you pay a premium and if there is a negative event causing loss, you are reimbursed via insurance proceeds. For example, with an options contract to hedge against the risk of rising diesel fuel, by paying the premium for buying a ULSD (Ultra Low Sulfur Diesel) call option you have an insurance policy should diesel fuel costs increase. However, unlike futures, if prices decrease you can still benefit from the reduced costs and the only risk is the premium you paid. With a futures contract you would experience hedging losses.

Examples of the position you would take – 1) if the participant is a freezer/refrigerated user and wants to mitigate the risk of increasing electricity prices, it would go “long” on the desired derivative position so that if prices did increase causing its utility expenses to increase and profit margins to decrease, the profit from the derivatives position would offset the increased cost (assuming that the hedged position was appropriately constructed). For reefer carriers that are selling trucking capacity to shippers and want to hedge the risk of decreasing trucking rates which would reduce its sales revenues and profit margins, it would go “short” on the desired trucking freight futures contract so that if trucking rates decreased, the profit from the derivatives would offset the decreased sales revenue resulting from decreasing rates.

Derivative Instruments

The derivatives market provides a variety of ways for market participants to hedge their exposure to a wide variety of market and price risk factors - both exchange based (futures & options) and over-the-counter (OTC transactions can be customized and include: swaps, spreads, etc.):

| DERIVATIVE INSTRUMENT | DESCRIPTION |

|---|---|

| Futures Contracts | A futures contract is a standardized contract between two parties to buy or sell a specific quantity and quality of a commodity at a price agreed to today but for payment at a specified time in the future. Fuel users such as trucking carriers would hedge the risk of increased fuel costs by going “long” on the ULSD futures contract (s). If fuel prices increase, its fuel costs will increase but the profit from its long position would offset its increased fuel costs. If fuel costs decrease, the consumer’s net fuel cost would be the retail price + the loss of the futures position. |

| Options | Options are like an insurance policy. An option is a contract which provides the buyer of the contract the right, but not the obligation, to purchase or sell a particular futures contract (s) at a specific price. A call option provides the buyer of a call option with a hedge against rising prices. Conversely, a put option provides the buyer of the put option with a hedge against declining prices. Unlike futures or swaps, the call option buyer will have a hedged position but if fuel moved down, they would not incur a loss aside from the option premium that was paid and would able to participate in the reduced prices. It is the best of all worlds. |

| Swap | A swap is an agreement whereby one party (i.e. trucking carrier) exchanges their exposure to a floating fuel price for a fixed fuel price, over a specified period(s) of time – basically swapping cash flows. A swap locks in the purchase price at a future date for the fuel user. The obvious downside is that if the price drops, the fuel user will be paying much more than the market price for fuel due to their losses on the swap position. Many fuel hedgers like swaps over futures as they serve as a better hedging tool as most fuel swaps generally settle against the monthly average price vs day such as with futures contracts. |

| Basis Swap | Basis risk is the difference in price between a forward (futures) market and a cash (spot) market. For example, in the energy markets there are three primary types of basis risk: 1) locational basis risk, 2) product/quality basis risk, and 3) calendar basis risk. A basis swap is contract which provides the buyer or seller of the swap to hedge their exposure to basis risk. |

| Collar Hedge | For example, there are other hedging strategies that can be used for hedging fuel prices, including using a combination of futures and options or collars. A collar hedge uses multiple call and put options to hedge the user from increased fuel costs and at the same time limits their downside. There are a variety of collar hedges including more complicated strategies such as three and four-way collars to hedge fuel. |

Industry Risk Factors and Available Risk Hedging Derivatives

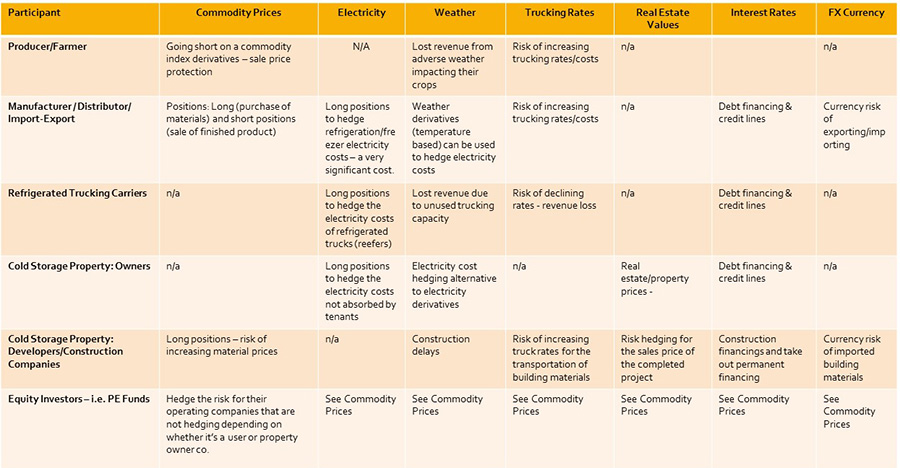

The market participants in the cold storage space include: landlords (developers/operators); users of cold storage including producers, distributors and importers/exporters (frozen/refrigerated dairy, meat/seafood, produce, bakery items, prepared meals, cold pharma, and the fastest growing segment – online grocers); reefer trucking carriers; and developers/construction companies for cold storage. In addition, if one of companies in this space is not directly risk hedging themselves, the equity investor funding them can hedge their exposure to the operating company’s specific risk factors.

Each of these participants can benefit from derivatives risk hedging in different ways as set forth in the chart:

Derivative Hedging Process

Given the complexity of derivatives, market participants should work with a licensed derivatives broker that specializes in the derivatives that hedge that risk. In that regard, the process that the derivatives broker goes through to get to a derivatives trade and live position are as follows:

- Comprehensive risk exposure assessment of the various risk factors (with available derivatives) that the participant wants to hedge. This will involve a review of historical and projected financial information regarding the costs of the risk factor and sensitivity analyses to determine what impact the various outcomes have on future financial results.

- Correlation analysis – an effective hedge results from using a derivative instrument that has an underlying benchmark indices that is very correlated with the price risk factor the participant is trying to hedge – for some risk factors, a direct derivatives instrument is actively traded with adequate liquidity. Alternatively, some risk factors do not have exact matching derivatives and the participant will need to use an indirect hedge combined with a “basis spread” derivative to account for that. One of the biggest issues affecting the hedge is the underlying cash market indices’ price changing at a different rate than the derivatives price resulting in basis risk.

- Contract determination and position sizing – whether to hedge over a period time or hedge all at once. In addition, it would require determining how many contracts to trade given the risk exposure that is being hedged. For example, reefer carriers or frozen/refrigerated users can hedge the trucking rate risk of their active lanes or their overall corporate trucking revenue or expense – or a hybrid of both.

- Trade execution on exchange or off exchange.

- Hedged position monitoring to make sure that the desired position is still providing an effective hedge.

Benefits of Derivative Risk Hedging

There are many benefits to hedging price risk via derivative instruments including:

- Decreased volatility and increased stability of revenues, expenses, cash flows and profit margins.

- Improved financial budgeting and forecasting allowing senior management to make more informed decisions.

- Increased market valuation – for any company, especially those that are publicly traded, the value of the company or stock is based on the risk adjusted return requirements of investors which is dependent on the perceived level of risk that the company’s cash flows and profit margins will decrease. Investors will add a risk premium to their return requirements if they perceive above average risk and will reduce the return requirements if they perceive lower risk, which decreases and increases valuations, respectively. Derivative risk hedging reduces financial performance volatility and therefore lower the required risk adjusted return requirements translating to higher valuations

- Improved debt financing terms – like with investors, a lender’s debt financing terms/rates and underwriting depend on the perceived risk to receiving the debt service and principal repayment. Reduced risk perception translates to better terms, rates and underwriting.

- Increased competitive position on the price it charges for goods and services. Derivative hedging would allow it to offer a lower price to its customers which would result in increased revenues.

- Price discovery – derivatives are a very useful price discover tool as it relates to the futures forward curve and its representation of where market participants expect prices to be in the future.

- Profiting – in addition to hedging applications, derivatives can be used to profit from price speculation or arbitrage opportunities. For example, a reefer carrier who has great trucking supply/demand insight on some of its active lanes might find that the market is underpricing or overpricing a trucking freight futures contract. If the carrier feels that a trucking freight futures contract based on the market’s expectations for future supply / demand conditions in that lane are not reflecting certain factors it knows about – it can speculate on rate direction. Speculation profits can be an alternative revenue source to offset dead head mileage or to allow a carrier to drop its rates to secure more business with shippers. For preferred equity investors, derivatives can provide enhanced returns to a fixed return investment in a refrigerated food distributor that it is vested with.

Trucking Freight Futures Insight

For additional information regarding derivatives available for the logistics industry – i.e. trucking freight futures and fuel hedging, visit our portal on the trucking freight futures market on Logistic Management website which includes a series of informative articles we wrote on the A-Z of hedging trucking rates and fuel hedging with trucking freight futures and fuel derivatives - Link: Trucking Rate Futures Portal via Logisticsmgmt.com.

This article along with all the content in the above portal is provided by Gary Saykaly who is the head of Lakefront Futures’ Cold Storage Derivatives Group which helps market participants in both cold storage and the frozen/refrigerated product sector hedge 7 different risk factors unique to those industries including electricity hedging – [email protected].

Past performance is not necessarily indicative of future results. The risks associated with trading futures and options are substantial. Futures and options trading are not suitable for all investors.