Ocean Cargo: Carriers, shippers continue to navigate choppy waters

While there’s no single solution, our analysts suggest that shippers enhance their communication with ocean carriers, particularly by providing good forecasts of their shipment volumes and booking early so that planning of capacity and operations is improved.

Meanwhile, Xeneta Shipping Index reports that long-term contracted ocean freight rates climbed by 7% in March, pushing shipping prices up 96.7% year-on-year. These escalating rates have resulted in high profits for container lines, however.

Last year, many realized record annual revenues. A.P. Moller-Maersk, for one, earned a record $61.8 billion in 2021, up 55% over 2020 revenues. Drewry Supply Chain Advisors predicts the container shipping sector will continue its extraordinary profitability cycle in 2022.

At present, analysts see the ocean sector in a state of transition from a major undersupply of capacity toward one that is more balanced between supply and demand. “However, this change will take at least a year to take effect,” comments Thomas Cullen of London-based Transport Intelligence.

In the meantime, Philip Damas, head of Drewry Supply Chain Advisors, sees the industry in the middle of “peak uncertainty,” meaning companies aren’t sure what to expect from consumer demand. “This is making forecasting and planning difficult for ocean carriers, exporters, importers and other stakeholders,” he says.

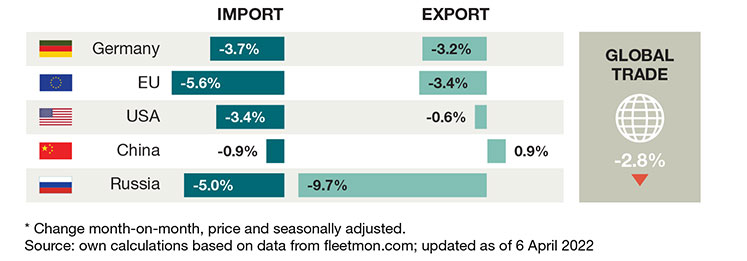

Kiel trade indicator (March 2022*)

Mounting storm clouds

U.S. fiscal stimulation has been the underlying driver of what has escalated supply and demand. Challenging the industry further is fast rising inflation, continued supply chain bottlenecks, Omicron surges, and Russia’s escalating war on Ukraine.

“The global economy is highly volatile,” says Cullen. “This is reflected in freight rates. If consumer demand falls, and it looks like it is beginning to, resulting a combined reduction in congestion and shipping containers on the market, this could lead to a big fall in rates. There is also the issue of escalating fuel prices. We could see some wild swings.”

World container index for week April 21, 2022

| Route | April7 2022 |

April14 2022 |

April 21 2022 |

Weekly Change (%) |

Annual Change (%) |

| COMPOSITE INDEX | $8,042 | $7,945 | $7,874 | -1% |

60% |

| Shanghai-Rotterdam | $10,845 | $10,577 | $10,364 | -2% |

32% |

| Rotterdam-Shanghai | $1,455 | $1,402 | $1,405 | 0% | 0% |

| Shanghai-Genoa | $12,232 | $12,094 | $12,079 | 0% | 53% |

| Shanghai-Los Angeles | $8,824 | $8,782 | $8,758 | 0% | 108% |

| Los Angeles-Shanghai | $1,275 | $1,275 | $1,276 | 0% | 142% |

| Shanghai-New York | $11,303 | $11,353 | $11,229 | -1% |

80% |

| New York-Rotterdam | $1,183 | $1,183 | $1,183 | 0% | 51% |

| Rotterdam-New York | $6,903 | $6,929 | $6,934 | 0% | 162% |

Source: Drewry

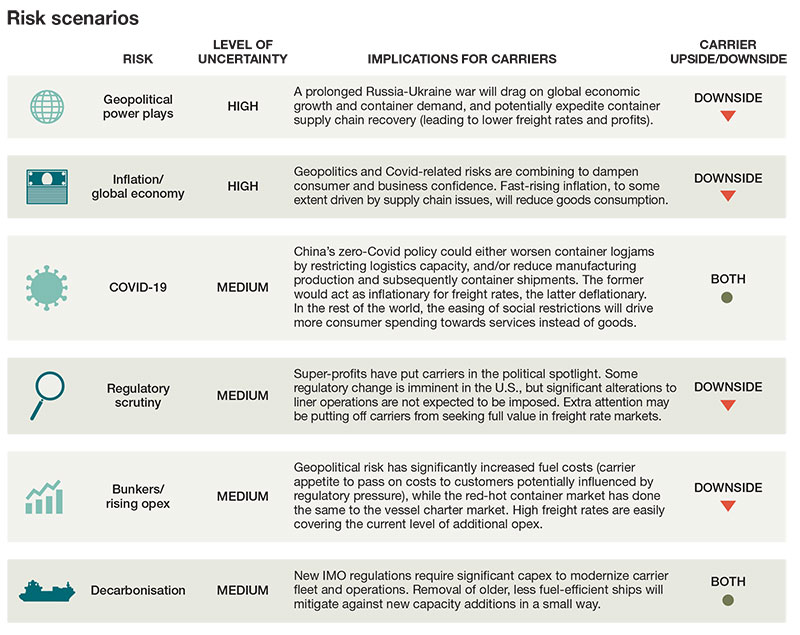

Damas identifies five areas of valid concern. They are as follows.

- Factors affecting macroeconomic such as a slowdown in GDP, a slowdown in ocean-borne container volumes, the duration of high fuel prices, inflation, a switch of consumer spending between goods that caused the recent boom in container shipping, and services.

- Supply chain-related problems, including Chinese lockdowns, production outages in China, and Ukraine-dependent supply chains disruptions.

- Transport-related pinch points such as chronic port congestion, ILWU port labor issues, shortage of drivers, shortage of ships, and a loss of China/Europe rail capacity via Russia.

- Geo-political and regulatory changes, including Ocean Shipping Reform Act legislation in the United States, IMO 23 rules globally, potential China/Taiwan risks, and regulators scrutinizing ocean carriers more.

- Cost pressures such as record freight rates, high fuel charges, and cost of delays and penalties.

“The slowdown in the global economy and in ocean traffic volumes will shorten the current under-supply and congestion crises in shipping, but the question on everyone’s lips is when,” Damas adds.

Today’s “mega issues”

High ocean rates and lack of capacity are by far the biggest factors affecting the industry today. Shipping rates are continuing to climb in 2022 in all major trade lanes as shippers continue to show willingness to pay premium rates to secure capacity, especially for high-value goods.

In fact, on average global container shipper rates increased to four to five times their 2019 levels, while some spot markets saw even higher rates, reports McKinsey & Co.

Global trade research firm Panjiva finds that freight rates have risen 285.6% since the beginning of 2020. In the meantime, container prices fell some 30% this spring, but industry experts hesitate to identify this as a continuing trend given current global events.

According to Damas, his firm has heard from ocean shipper customers that extreme freight rates have forced them to stop exporting certain low-value products or to move manufacturing closer to the consumer market. “Not every business can absorb $15,000-per-container freight costs,” he says.

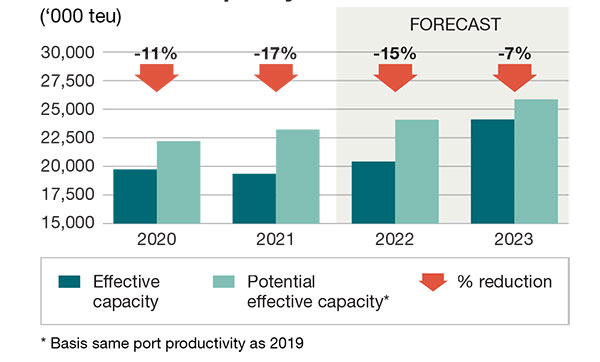

Numerous steamship lines are addressing capacity shortages by purchasing more containers and ships. “The supply of new-build vessels is picking-up, but it will be 2023 before the major orders seen at the back-end of 2021 are launched,” remarks Cullen.

Meanwhile, Rolf Habben Jansen, CEO of Hapag Lloyd AG, says: “Every ship we have and ship we can get our hands is sailing. We are postponing drydocks and regular maintenance to keep ships in services.”

Hapag-Lloyd does not have new ships on order, but has purchased over half a million containers over the last two years. “But getting those boxes returned is slow,” Jansen says. “So, buying equipment does not solve all the problems.”

Capacity on the trans-Pacific particularly remains a challenge given China’s lockdown of Shanghai. According to maritime intelligence company Windward, its platform reports that as of April 12-13, 1,826 of all container vessels globally—or 20%—were waiting outside of ports worldwide. Nearly 28% of them were stuck outside of China’s ports. For comparison, in February, they represented 14.8%.

Empty containers continue to gather in the United States as well, as repatriating them back to Asia remains a struggle. Gene Seroka, executive director of the Port of Los Angeles, describes the situation as akin to squeezing 10 lanes of traffic into five. “We’re still moving record amounts of cargo, but it’s not enough with all those boxes coming our way,” he says.

Congestion there has been worse. Last year, nearly 100 vessels waited for almost two months to berth at Los Angeles/Long Beach. By December 2021, congestion had removed around 16% of global container ship sailing capacity compared to September 2020.

In the meantime, numerous initiatives have been taken by various stakeholders to alleviate congestion at seaport terminals, including extending port hours and pop-up yards. “But as of yet, nobody has found the solution,” says Damas. “Governments around the world are getting more proactive, but it’s hard to see what they’ll be able to achieve that the private sector on the ground hasn’t already done.”

Damas surmises that could take both a slowdown in demand and the introduction of reformed port operations to end chronic port congestion. “Such a slowdown,” he says, “could come from lower economic demand and lower growth rates in commerce, as well as companies deciding to cancel certain product or business lines.”

Carriers now cover all bases

The lockdown in Shanghai reinforces the high level of variability and vulnerability at which trans-Pacific carriers continue to operate.

Consequently, C.H. Robinson advises shippers to look hard at all potential problem points to properly plan delivery schedules. The exercise builds a case that a 2022 C.H. Robinson customer research study already confirms: many shippers are using new strategies to manage shipments during this time of continued disruption.

“This includes a shift of more freight from ocean to air,” says Matt Castle, C.H. Robinson’s vice president of airfreight. “Specifically, 52% leveraged new modes, ports, or trade lanes during the pandemic that they plan to continue using in 2022.”

Seeing opportunities, steamship lines are spending some of their big profits to capture this business. In early April, A.P. Moller-Maersk launched a new air freight division, Maersk Air Cargo, which replaced its in-house air freight division.

Its new aircraft are expected to be operational between the second half of 2022 and 2024. It also announced its $1.68 billion acquisition of Pilot Freight Services that specializes in big and bulky freight in North America.

CMA CGM founded CMA CGM Air Cargo in 2021 and is currently implementing a major expansion plan to more than double its fleet. CMA CGM also signed an agreement to buy a 90% stake in the Fenix Marine Services (FMS) terminal in Los Angeles.

Bolloré Logistics announced that after taking a $157 million stake in a China based logistics provider, Cosco Shipping now holds 7.3% shares in a newly established logistics supply chain group, which it launched with other shipping companies and port terminal operators in China.

- Karen Thuermer

Another potential development in the sea-freight industry is change in port connections. Anne-Sophie Fribourg, ocean business development director for Bolloré Logistics, indicates that carriers will reduce some services linking multiple regions in an attempt to return ships to scheduled sailings and regain good quality of service.

“It remains a difficult situation,” says Hapag Lloyd’s Jansen. “Every day we’re trying to do our utmost to save as many voyages as we can from blank sailings, even if it means we have to skip ports.”

Going forward

While predicting the future is difficult, Drewry has defined a few market scenarios for the remainder of 2022 and 2023. Its top scenario shows that operational disruptions and extremely high ocean rates will continue through 2022, and that the most likely time when disruptions and port congestion will finally unwind is the first half of 2023.

“Mind you, there could still be residual problems—such as a shortage of drivers for inland moves to and from ports and lack of infrastructure capacity—even in late 2023,” Damas says.

He estimates that freight rates will slide in 2023, when more traditional supply-demand dynamics come to the forefront and the super-charging effects of port congestion and other disruptions are no longer a big issue.

Another scenario will unfold depending on how relationships between many exporters and importers and the level to which their ocean carriers and non-vessel operating common carriers (NVOCCs) have become strained given how providers took advantage of the boom market and maximized short-term profits. Damas believes that the behavior of the top eight ocean carriers—who control 82% of global capacity—will largely determine the future commercial and capacity structure of container shipping.

As markets improve, the industry could face an oversupply of vessels and containers as ocean carriers invest their record profits in ordering new vessels. McKinsey reports that an additional 4 million to 5 million TEUs of new capacity are expected by the end of 2024.

In the meantime, Drewry research see strong indications that ocean carriers will not go back to deploying excess capacity in the market, and contract freight rates in the medium term will be at least 50% higher than pre-COVID on some routes. With this is mind, Damas suggests that shippers develop new ways of building relationships with ocean carriers who control this capacity. “They can do this by cutting back their use of NVOCCs,” he says.

Drewry also advises that shippers enhance their communication with ocean carriers, particularly by providing good forecasts of their shipment volumes and booking early so that planning of capacity and operations is improved.

Finally, given current uncertainties, Damas advises that shippers also plan for several “scenarios” and watch the development of the spot market in late 2022 and early 2023 given that the spot market is a leading indicator that can determine how to approach annual contract negotiations.