MIT Report Identifies Keys to New American Innovation (and Jobs)

"We must take steps now to regain U.S. manufacturing momentum if we want to sustain the nation’s signature economic advantage: innovation" MIT President L. Rafael Reif

What kinds of industrial production can bring innovation to the American economy?

An intensive, long-term study by a group of MIT scholars suggests that a renewed commitment to research and development in manufacturing, sometimes through creative new forms of collaboration, can spur innovation and growth in the United States as a whole.

The findings are outlined in the preview of a report issued by a special MIT commission on innovation, called Production in the Innovation Economy (PIE). Among the approaches the report recommends are new forms of collaboration and risk-sharing — often through public-private partnerships or industry-university agreements — that can enable a wide variety of firms and industries to grow.

The report follows two years of in-depth research on hundreds of firms across various industrial sectors, ranging in size from high-tech startups to small “Main Street” manufacturers and multinational corporations. While there are a variety of reasons why the nation should seek to retain its own manufacturing base, from defense capacities to job creation, the report aims to highlight the larger potential that manufacturing holds for innovation-based economic growth in the United States.

“It has been suggested by previous reports that sustaining the strength of U.S. manufacturing is essential to America’s future; a strong advanced-manufacturing base is crucial to national security, and it represents a key source of good-paying jobs,” MIT President L. Rafael Reif says. “But as the PIE report makes clear, local production is very important to sustaining a vibrant innovation ecosystem in a region. Thus, we must also take steps now to regain U.S. manufacturing momentum if we want to sustain the nation’s signature economic advantage: innovation.”

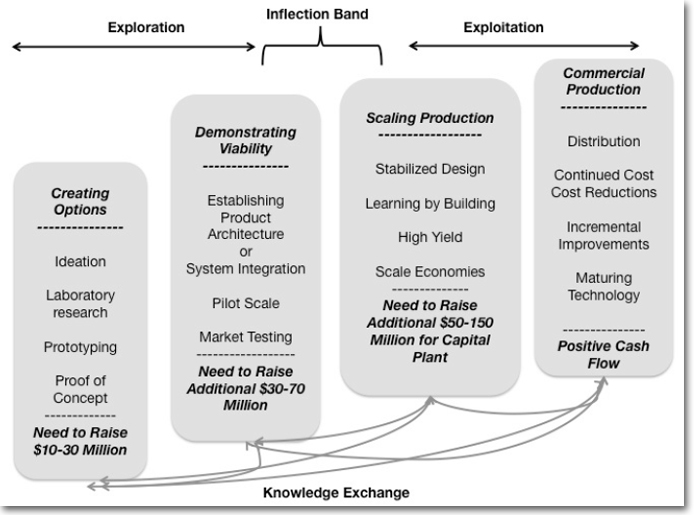

Figure 1: Scaling up Adapted from Figure 2.1, “The four stages of energy innovation,” page 11, in Richard K. Lester and David M. Hart, Unlocking Energy Innovation: How America Can Build a Low-Cost, Low-Carbon Energy System (Cambridge, Massachusetts; London, England: The MIT Press, 2011).

Among other conclusions, the report emphasizes that manufacturing should not be regarded as a small group of traditional, shrinking industries. Instead, manufacturing is a diverse, evolving group of industries in which new products and knowledge frequently emerge from firms of all sizes throughout the country.

“There is no reason manufacturing has to disappear in an advanced industrial society,” says Suzanne Berger, the Raphael Dorman-Helen Starbuck Professor of Political Science at MIT and a co-chair of the PIE commission. “There is much greater innovative capacity all across the United States than we realized.”

From Main Street to multinationals

The current report is based on the work of the 21-member PIE commission, formed in 2010, which includes 20 MIT faculty members. Two books on the subject are forthcoming from MIT Press in the fall.

“The work of PIE is trying to understand how producing goods feeds back into the innovation process,” says Martin Schmidt, a professor of electrical engineering and computer science and associate provost at MIT, who served on the commission.

The commission conducted in-depth research on 255 manufacturing companies, of which 178 were located in the United States. Faculty members asked all of the companies a series of questions in order to find out what innovations firms had attempted to deliver in the last five years, and to determine which elements — capital, skilled workers, suppliers, or expertise — had been hard to find.

The commission interviewed officials at four types of companies: U.S.-based multinationals that invest heavily in research and development; startup firms; small-scale “Main Street” manufacturers that are local or regional in scope; and foreign firms in China and Germany.

The researchers spoke to officials at 30 multinational firms, often discussing the reasons why those firms have kept manufacturing operations in the United States or moved them abroad. Among other factors, Schmidt notes, many companies are concerned about encountering quality-control problems if their R&D and production staffs are on opposite sides of the world: “Companies that had separated manufacturing from product design are recognizing that they’re losing opportunities to be efficient, or produce better products.”

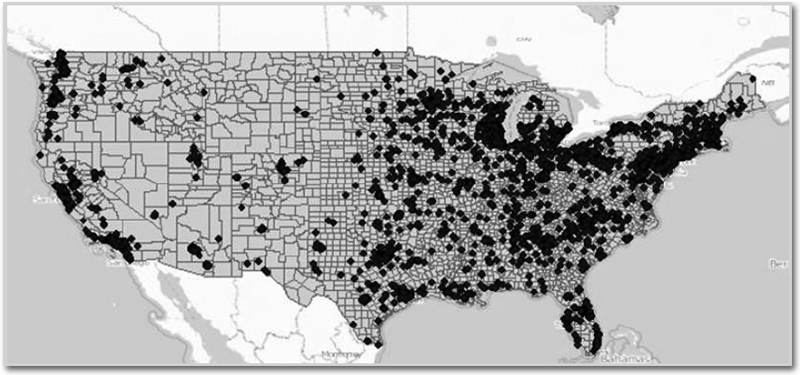

Figure 2: Company locations of the 3,596 High-Impact Companies with more than $5 million in annual revenues and more than 20 employees

Among startups, the PIE research found that financing issues are often critical, since it can take 12 to 15 years for startups outside the software sector to bring in revenue. But in discussions with 150 startups whose technology was first developed in MIT labs, the researchers also found that location matters: not necessarily being in a “cluster” with other firms in the same industry, but being located near other firms with complementary products and abilities. This often helps startups surmount the diversity of obstacles they find on the road to production.

“If there’s a [diverse] production ecosystem, it gives them an advantage,” Schmidt says. “That proximity effect is incredibly valuable.”

The PIE researchers also spoke to managers at small and medium-sized U.S. manufacturers with more than $5 million in annual revenues and at least 20 employees; these companies often repurpose existing technologies or techniques and apply them to make new products. And they often bundle products together with services — thus blurring the boundary between the manufacturing and service industries, as Berger points out. In this sphere, as the PIE report suggests, proximity and collaboration matter as well: A key to innovation for these firms is being located in a diverse industrial ecosystem that offers many complementary resources, such as training and opportunities for collaborative research.

Such collaborative efforts could take the form of what the report calls a “convening function,” where a private firm or public institution creates new resources that others can build on and contribute to. New York state’s collaboration with the industrial semiconductor consortium SEMATECH is one example; another example the researchers found came when the Ohio-based Timken Company, which makes bearings, helped to establish a new lab at the University of Akron in which multiple firms, as well as academic researchers, can work. Such new research facilities can benefit firms, universities and local economies.

Collaboration can also help startups grow. One firm the PIE researchers studied, Mass Tank, of Middleboro, Mass., fabricates tanks for chemical companies and other types of firms; it is currently working with five area startups as they develop prototypes. Mass Tank itself belongs to a trade association, the Steel Tank Institute, for testing, expertise and insurance. Such risk-sharing within industries is one form of cooperation that allows firms to expand.

Are the workers there?

One working group within PIE, led by Paul Osterman, an economist at the MIT Sloan School of Management, focused on the skills workers need for advanced manufacturing.

Researchers surveyed officials at roughly 1,000 manufacturing establishments, as well as leaders of community colleges, high schools and labor-market programs.

The results are nuanced: Only 7 percent of respondents in firms thought skill requirements for manufacturing have increased significantly in the last five years. And slightly less than 20 percent of establishments have long-term job vacancies (of three months or more), equivalent to about 5 percent of core production jobs.

Where problems filling jobs do exist, the biggest problems involve job skills not usually available in a particular region; jobs requiring advanced math; and jobs in very small companies, which may lack a local network of connections to bring in workers.

In addition to Berger, the other PIE co-chair is Phillip A. Sharp, Institute Professor and professor of biology. Olivier de Weck, an associate professor of engineering systems and of aeronautics and astronautics, serves as the commission’s executive director.

Source: MIT news

More resources on SC24/7 for “Massachusetts Institute of Technology”

Related: Reshoring Initiative’s Harry Moser Prevails in Economist Debate on Offshoring Manufacturing