Manufacturing Day: Cities Leading a U.S. Revival

While economists debate how much manufacturing drives the U.S. economy, there is no question that industrial growth remains a powerful force in many regions of the country.

Today is Manufacturing Day.

Manufacturing Day is a celebration of modern manufacturing meant to inspire and inform the next generation of manufacturers.

Industrial employment has surged over the past five years, with the sector adding some 855,000 new jobs, a 7.5% expansion.

Several factors are driving this trend, including rising wages in China, the energy boom and a growing need to respond more quickly to local customer demand and the changing marketplace.

To generate our rankings of the best places for manufacturing jobs, we evaluated the 373 metropolitan statistical areas for which the U.S. Bureau of Labor Statistics has complete data over the past decade.

Our rankings factor in manufacturing employment growth over the long term (2003-14), medium term (2009-14) and the last two years, as well as momentum.

The Rust Belt Is Back

No part of America suffered more from the de-industrialization of the past 40 years than the Great Lakes states.

Yet as manufacturing has come back, particularly the auto industry, many of the region’s economies have begun to resurge.

Despite all the fashionable chatter over the question of whether we’ve reached “peak car,” the auto industry has enjoyed six straight years of increased sales, driven by low interest rates, the need to replace older cars and rising consumer confidence.

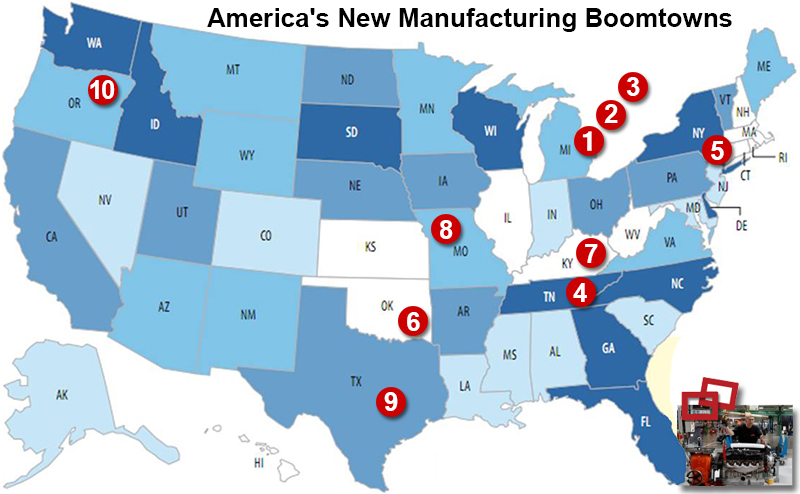

The epicenter of this trend is exactly where the industrial decline hit hardest: Michigan, which sweeps the top three places on our list of the big cities generating the most new manufacturing jobs. The state has now recovered about 40% of the manufacturing jobs it lost during the recession.

The Detroit-Dearborn-Livonia metropolitan area ranks No. 1 among the country’s 70 largest metropolitan areas for manufacturing employment growth over the time period for our study.

Since 2009 the Detroit area has seen a remarkable 31.3% rebound to 89,300 industrial jobs, including a 9.8% expansion last year. This growth has helped begin to reverse a long-standing decline in employment overall - still down 12.3% since 2003 - with overall employment up 5.9% since 2009.

Detroit’s recovery is not just a matter of inertia, but reflects a unique combination of circumstances. The area is home not only to many skilled workers, but boasts the second largest concentration of engineers among the country’s 85 largest metro areas, behind only Silicon Valley.

In second place is Warren-Troy-Farmington, in the Detroit suburbs, where manufacturing employment is up 38.8% since 2009. In third place is Grand Rapids-Wyoming, a longtime furniture-making hub where an uncommonly high share of jobs is in manufacturing, one in five; the metro area has seen industrial employment rebound 27.9% since 2009.

Another Midwest hotspot has been Toledo, Ohio, only 60 miles from Detroit, which ranks first among the mid-sized cities we evaluated, with a 17.4% jump in industrial employment since 2009.

Southern Cooking

The other big cluster of industrial hotspots is in the Southeast. Manufacturing has been heading to the region for several decades, recently primed by major investments from German and Japanese companies, among others.

A prime example is Nashville-Davidson-Murfreesboro, Tenn., No. 4 on our list, where manufacturing employment has jumped 23.9% since 2009. Japan’s Nissan and Bridgestone have establishing manufacturing plants in Central Tennessee, which has also created opportunities for small domestic parts companies in the region.

Nissan also relocated its U.S. headquarters to the area in 2006 from Southern California. And domestic auto makers are have become major players in the Southeast - Ford employs some 14,000 in the Louisville, Ky., area, which checks in at No. 7 among our largest MSAs.

The South, notes a recent Brookings study, now has the highest number of workers in the country employed in “advanced industries,” which tend to be the higher paying, more technically oriented parts of the factory economy.

Other areas that have become primary places for new industrial investment include such Deep South locations as Savannah, Ga., No. 2 on our mid-sized list, as well as No. 8 Columbia, S.C., a major center for German car companies, and No. 10 Charleston, S.C., which has benefited from the expansion of Boeing and aerospace suppliers there.

These areas missed much of the industrial revolution a century ago but are playing an impressive game of catch-up. Each has seen their industrial workforces grow over 20% since 2009. Other southern stars include Cape Coral-Ft Meyers, Fla., No. 4 on our mid-sized city list. Our small cities list also turns up Southern outperformers: No. 2 Naples-Immokalee-Marco Island and No. 3 Sebastian-Vero-Beach, Fla.

The Energy Belt

Falling oil prices may be causing the oil and gas industry to rein in exploration and drilling budgets, but it provides an enormous boon for downstream industries such as refining and petrochemicals. This could keep industrial job growth going in two of our top MSAs that are in the oil patch.

Oklahoma City, where manufacturing job growth has soared 23.1% since 2009, ranks sixth, and Houston, where the industrial workforce has expanded 19.8% over the same time span, ranks ninth. Houston now is home to 257,300 manufacturing jobs, the third largest concentration in the country.

As in Detroit, Houston’s industrial rise is powered by more than by brawn. The area ranks sixth among the nation’s major metros in number of engineers per capita. If the Bay Area is master of the digital economy, Houston ranks as the technological leader of the material one; it is the capital for the energy-driven revival of U.S. industry.

Smaller energy-rich areas that have also experienced rapid industrial growth. These include two Louisiana metro areas, No. 3 Baton Rouge and No. 7 Lafayette, third and seventh, respectively on our mid-sized metro area list, as well as Midland, Texas, fifth on our small areas list.

Perhaps most surprising, given its location in anti-carbon California, has been the steady growth in Bakersfield, which stands fifth on the mid-sized list and is home to some of the nation’s largest oil fields. With 20.3% industrial growth since 2009, the area, sometimes known as “little Texas,” is the only metro area in the Golden State to make it to the top 10 in either the large or mid-sized list.

A Shift To Smaller Cities

Once American industry was identified predominately with big cities: New York in 1950, according to economic historian Fernand Braudel, had the largest industrial economy in the world, employing a million workers, mostly at small manufacturers. In the 1970s and 1980s, the industrial zeitgeist moved increasingly to Los Angeles, which vied with Chicago as the largest center for factory jobs.

Today this pattern is changing dramatically. Besides the move toward the south and energy hotbeds, industry has been expanding in smaller cities as well as suburban areas beyond the core cities, says University of Washington geographer Richard Morrill.

This is not unique to the United States; Germany, which has perhaps the most admired industrial sector in the world, also has dispersed its industrial base, largely to smaller cities.

The reasons for this shift vary, from strict environmental laws in Northern cities, as well as stronger unions, and cheaper land elsewhere.

For example, although the New York state capital Albany ranks fifth on our big metro area list, driven in large part by semiconductor manufacturing, New York City stands at a weak 62nd out of 70. Since 2009, New York has lost 3.3% of its manufacturing jobs; the city’s industrial workforce now stands at a paltry 74,700, a dramatic decline from some 400,000 as recently as the early 1980s.

Yet with its powerful array of media, business service and hospitality businesses, New York appears to be able to withstand deindustrialization more than the two largest industrial MSAs, Chicago and Los Angeles. The one-time “city of big shoulders“ and its environs has also lost industrial jobs since 2009, down to 278,000 from 286,500 in 2011, and a far cry from the 461,600 it had in 2000.

The decline has been, if anything, more rapid in 59th place Los Angeles. This process began with the loss of more than 90,000 aerospace jobs since the end of the Cold War. Los Angeles’ industrial job count stands at 363,900 - still the largest in the nations but down sharply from 900,000 just a decade ago.

Does Industrial Growth Still Matter?

Clearly deindustrialization has a bigger impact in some areas than others. Cities like San Francisco and New York appear better positioned for the post-industrial transition than Chicago or Los Angeles, where manufacturing lingered longer and the elite service or tech industries are not nearly as predominant. Yet the impact of industrial decline - or resurgence - may be more important in the future than many suppose.

This is particularly critical for blue-collar workers, for whom industrial jobs tend to pay more. Welders and other skilled workers are increasingly in short supply, particularly as baby boomers begin to leave the workforce.

Many of the cities which did well in our rankings are among the best in building new training partnerships with their industrial employers - these are skills that are decreasingly taught in the modern secondary and college curricula. In some places, vocational skills have recently been commanding higher post-graduation salaries than traditional college degrees.

Industrial growth also provides an opportunity for emerging cities, particularly in the South and the energy belt, to add to their employment base and, in some cases, their connections with international markets.

Over-dependence on manufacturing, as the Rust Belt experience showed, can be dangerous, and the need to diversify employment remains critical. Threats to future growth include the strong dollar, the decline in the energy sector and economic weakness abroad reducing exports.

But factory jobs remain an important asset for many regions. They may not be the central force they once were, but these jobs seem likely to continue making a big difference in the fates of many economies, both big and small.

About the Authors

Joel Kotkin is executive editor of NewGeography.com and Roger Hobbs Distinguished Fellow in Urban Studies at Chapman University, and a member of the editorial board of the Orange County Register. He is also executive director of the Houston-based Center for Opportunity Urbanism. His newest book, The New Class Conflict is now available at Amazon and Telos Press. He is also author of The City: A Global History and The Next Hundred Million: America in 2050. He lives in Orange County, CA.

Michael Shires, Ph.D. is a professor at Pepperdine University School of Public Policy.

Source: New Geography

Related: Building the Manufacturing Talent Pipeline

Article Topics

Manufacturing Institute News & Resources

Industry to celebrate Manufacturing Day 2023 Is a manufacturing supercycle on the way? Global Labor Rates: China is no longer a low-cost country MFG Day 2021 commences in person and virtually amid record career opportunities in manufacturing Manufacturers launch digital series highlighting innovation U.S. Manufacturing’s Biggest Recruitment Day Launches Amid Covid-19 130 women selected to receive a STEP Ahead Award More Manufacturing InstituteLatest in Business

Ranking the Top 20 Women in Supply Chain Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Business