Involving Execution Managers with Sales and Operations Planning

Execution managers may not need to attend S&OP meetings, however, they should be given the details of the S&OP-generated plans and forecasts in order to drive their operations planning.

I recently got two calls from trade publication writers interested in how warehouse (and perhaps other supply chain execution) managers might get involved in their company’s sales and operations (S&OP) processes.

It seems S&OP teams often have little to do with execution/operations managers regarding synchronizing execution to plans.

While some software companies purport to do this - perhaps from a computer systems perspective - the business processes of supply chain planning (e.g., S&OP) and execution ought to be integrated.

These managers often don’t need to be at S&OP meetings because supply chain planners typically represent their interests.

However, S&OP supply plans ought to be communicated to operations managers because they need them to drive their own short- and long-term planning efforts. This is the way to tie business strategy to operations (e.g., strategy executed daily on the manufacturing plant floor and in the warehouse).

Synchronizing Operations with Planning is Strategic

Operational managers don’t necessarily need to attend S&OP meetings because these meetings are focused on more aggregated business views over longer planning horizons than the managers are interested in.

SO&P plans that typically focus on six months to 18 months out, and on a weekly or monthly basis, don’t provide operations managers with enough detail about products, customers and geographies.

These include managers in warehousing, transportation, procurement, manufacturing, and inventory management. Lacking a detailed focus, S&OP meetings are usually of less interest to them. An exception to this is in distribution-intensive businesses, such as wholesale distributors, retailers and e-tailers.

The reason that execution managers in these industries might be more interested in S&OP is that distribution limitations and constraints might significantly affect meeting customer demand and achieving corporate performance goals.

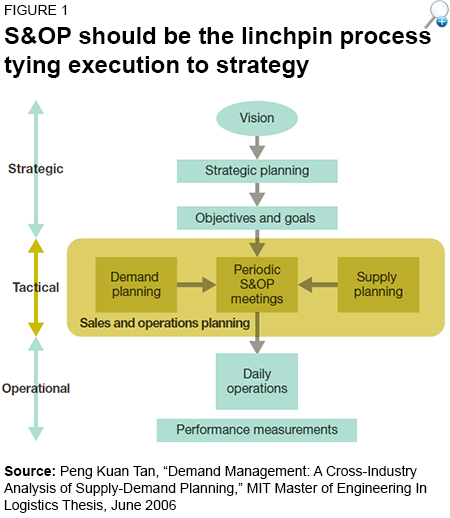

My column, “S&OP: The Linchpin Planning Process”, Supply Chain Management Review, November, 2011, discussed three levels of planning and how S&OP - if driven by strategic goals and objectives - can tie operations to strategy.

The three levels of planning were: strategic (long-term); tactical (medium-term); and operational (short-term). Major differences among the planning levels are: the length of their “planning horizons,” and the planning “time buckets” they focus upon.

Strategic plans have long planning horizons, are developed at aggregated levels and change infrequently - often lasting multiple years until a change in strategic direction is warranted. Tactical plans have medium-term planning horizons, are more detailed and are changed more frequently. Lastly, operational plans have short planning horizons, are the most detailed and are routinely and frequently changed as real-time business activity unfolds.

Figure 1 depicts how the S&OP process is sandwiched in the middle of the planning processes.

S&OP is the routine tactical planning process in which tactical supply and demand (i.e., marketing and sales) plans are synchronized, matching future supply and demand. S&OP should be driven by strategic objectives and goals in order to develop plans that, in turn, drive operational plans and execution.

This renders S&OP the “linchpin” process that connects the strategic plans to operational execution.

The accuracy of its plans invariably determines how well a company is able to achieve its strategic operational goals and objectives, as well as annual financial goals.

Each planning level is unique in how it deals with the future, yet all need to be integrated to ensure that operations ultimately synchronize to strategy. While this may sound straightforward, the length and time buckets of planning horizons differ, making it complex to carry out. In addition, the amount of detail needed within the planning processes differ, with operational planning requiring the most detail for the shortest planning horizons.

A Hierarchy Enables Synchronization

A forecasting/planning hierarchy is a key enabler of an S&OP process as it fosters cross-functional collaboration, consensus and synchronization.

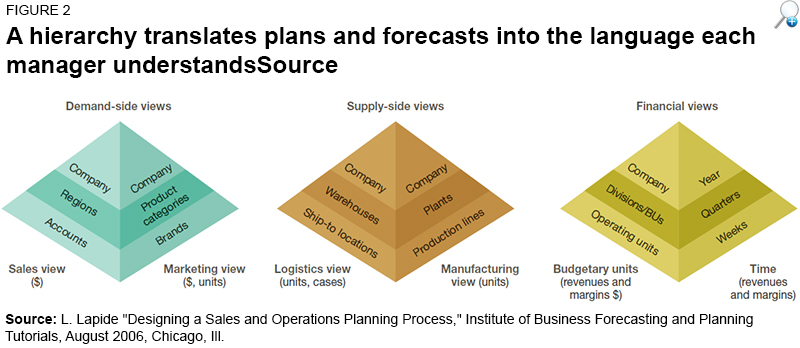

Figure 2 depicts an illustrative forecast/planning hierarchy that I discuss when I conduct forecasting and S&OP process design training sessions.

This figure has three pyramids representing forecast and plan aggregations that various functions might need to view before agreeing to be accountable and committed to achieving plans. The lowest details are on the floor of the pyramids, and aggregations are specific views tailored for each functional manager. The three pyramids comprise two demand-side and two supply-side aggregated views, as well as a two financial views.

Cross-functional teams comprised of members from supply chain, operations, marketing, sales, and finance organizations discuss the views. To get commitment from all organizations requires that forecasts/plans be aggregated and disaggregated to various levels to be reviewed and revised by each function in terms that they best understand. The hierarchy maps and translates all the levels among themselves to the highest, the lowest, and the most detailed planning levels.

Operations Needs More Detail

By their nature, S&OP meetings need to focus on aggregated plans and forecasts.

Conceptually, they focus on the upper portions of the pyramids because bogging down meetings with discussions about excruciating details tends to draw the focus away from synchronization and achieving consensus.

Thus the supply-demand plans generated by an S&OP process are too aggregated to drive operational plans and execution.

The lower portions of the pyramids show what operations managers need. For example, specific country, product and account-level detail would be needed by demand-side managers to drive sales and marketing execution.

Supply-side execution management from manufacturing, transportation, warehousing, and inventory management might need specific warehouse-, ship-to location, plant-, production equipment-, and product-level detail. They might also need item-level detail about new product launches and promotional campaigns.

In addition, procurement managers might need detail for scarce raw materials/components that are used in the manufacturing process.

Financial management might need specific budgetary operating account, country, and divisional-level detail to drive financial performance.

Also, operations managers need shorter planning horizons and time buckets that are in terms of days and weeks, rather than weeks, months and fiscal quarters.

Planning Functions

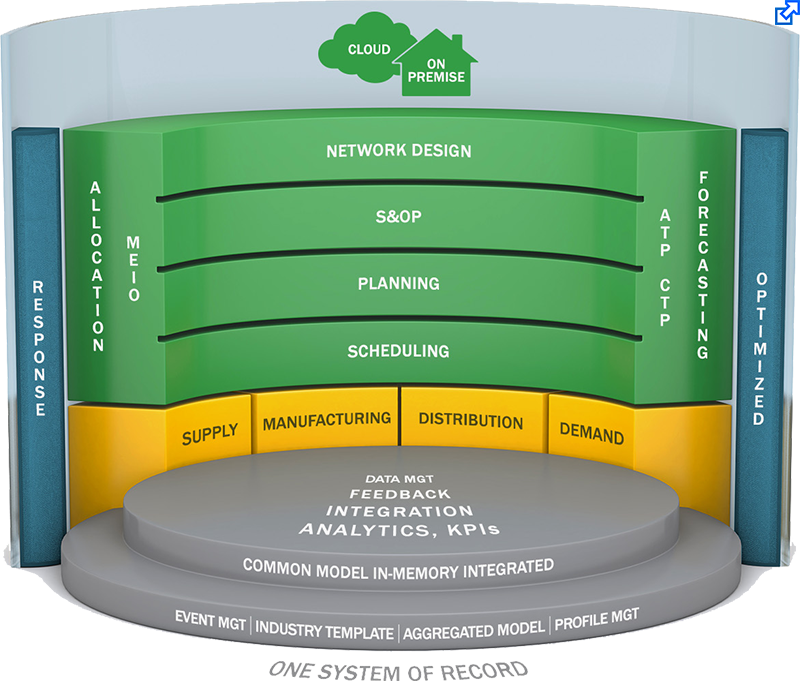

OM Partners OMP Plus acts as one system of record and is highly praised by analysts for this. So, it is your one stop for all planning functions, with a common, in-memory integrated data model for optimal performance and scalable architecture.

OMP Plus covers multiple planning areas, from supply including external tolling, subcontracting, purchasing… to manufacturing including contract manufacturing and multi-tier plants, distribution with DRP and deployment, and… demand.

Forecasters and Planners Should Provide the Detail

An S&OP team’s job is not entirely done once S&OP plans are finalized. In order to synchronize with operations, the S&OP plans ought to be disaggregated into the details needed by various operations managers.

Conceptually, this is most easily done if the upper-aggregated portions of the pyramids are synchronized with the detailed lower portions throughout the S&OP planning process, rather than after the upper portions are finalized. Top-down, bottom-up and middle-up-and-down forecasting and planning methods are most useful for this.

Take the example where monthly aggregated-product demand forecasts are discussed during S&OP meetings when getting to consensus.

A manufacturing plant usually needs a weekly item-level master production schedule (MPS) as input into its materials requirement planning (MRP) system.

To generate the MPS, weekly item-level demand forecasts are required, and the forecasting organization ought to provide them along with the aggregated S&OP forecasts.

I recall some research some students and I did with a major CPG company that only generated monthly demand forecasts that were given to its manufacturing organization. Because the plant managers needed weekly forecasts they did their own forecast by dividing the monthly forecast by four to estimate each week.

This is rarely a great method to develop weekly from monthly forecasts. In essence the forecasting organization abrogated its responsibility to support these plant managers. They should have, at minimum, helped them develop reasonable methods for generating weekly demand forecasts from the monthly forecasts provided.

The ultimate accountability for forecasting performance should always lie with the forecasting organization. Similarly planning accuracy is the responsibility of the S&OP team.

In summary, execution managers may not need to attend S&OP meetings. However, they should be given the details of the S&OP-generated plans and forecasts in order to drive their operations planning.

If they haven’t done so already, forecasters and planners that support an S&OP process should meet with these managers and find out what detail they need. Why? The “devil is in the details” and, in this case, the details affect strategy execution on a day-by-day basis.

About the Author

Dr. Lapide has extensive experience in the industry as a practitioner, consultant, and software analyst. He is currently a lecturer at the University of Massachusetts’ Boston Campus and is an MIT Research Affiliate. He received the inaugural Lifetime Achievement in Business Forecasting & Planning Award from the Institute of Business Forecasting & Planning. He welcomes comments on his columns and can be contacted at [email protected].

Related 3 Primary Components of Sales & Operations Planning: People, Process, and Technology

Sales and Operations Planning White Papers

Enterprise Social Collaboration Fuels Innovative Sales & Operations Planning

By applying common metrics to social S&OP you can develop a consistent method of performance evaluation throughout the entire supply and demand planning chain. Download Now!

Successful Sales and Operations Planning in 5 Steps

Armed with the right information, the S&OP team can fully understand the range of considerations that must be included in their decision making and make the tough choices that ultimately determine how well the company performs. Download Now!

Commit with Confidence: The Four Must-Haves of S&OP

As supply chains become increasingly complex, it’s no surprise that supply chain leaders see great opportunity for improvement in S&OP. Download Now!

Article Topics

Blue Yonder News & Resources

Blue Yonder announces an agreement to acquire One Network Enterprises for $839 million Blue Yonder Acquires One Network Enterprises for $839M Frictionless Podcast: Understanding Your Supply Chain Goals with Ann Marie Jonkman Blue Yonder announces acquisition of flexis AG Supply Chain Management (SCM) applications keep the supply chain humming How Collaborative Efforts Can Enhance Reverse Logistics Netlogistik partners with SVT Robotics to resell SOFTBOT platform More Blue YonderLatest in Supply Chain

Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants More Supply Chain