Industry Experts Discuss the Strategic Management of Ecommerce Logistics

Shippers are starting to see the incredible advantage that can be gained through the strategic management of ecommerce, especially as logistics professionals move out of their silos and into the c-suite - three industry experts further contend that walls will continue to be torn down before this disruption reaches an advanced and fully evolved stage.

Ecommerce Logistics: Leverage New Thinking

The rapid growth of ecommerce is driving deep changes in logistics and transportation management, from tightening up trucking capacity to elevating the importance of final-mile delivery processes.

To respond, logistics managers now need to leverage diverse systems and new ways of thinking in an effort to improve carrier partnerships and increase speed and efficiency.

This month, Logistics Management rounds up three logistics and transportation thought leaders to share advice and suggest some tools that savvy managers can implement now in order to meet evolving requirements and shifting operational constraints.

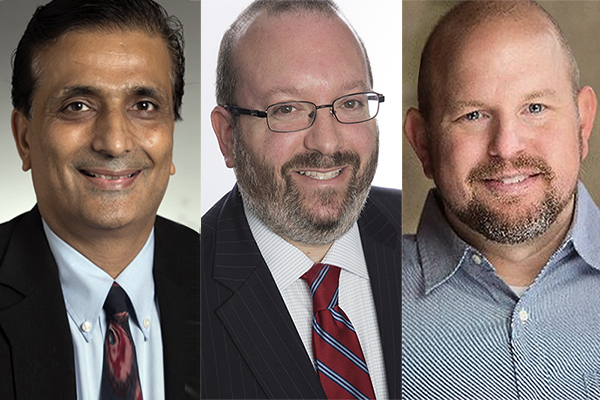

Roundtable Participants:

Nick Vyas (pictured left), executive director of the Center for Global Supply Chain Management at the Marshall School of Business at the University of Southern California.

Jonathan Gold (pictured center), vice president of supply chain and Customs policy for the National Retail Federation.

Steve Osburn (pictured right), managing director at Kurt Salmon, a part of Accenture Strategy specializing in the supply chain.

Ecommerce Logistics Q&A

How is ecommerce changing the way we approach logistics/distribution network strategy?

Jonathan Gold: By eliminating the physical constraints of how much merchandise will fit into a physical store, ecommerce allows a retailer to offer a virtually unlimited selection of merchandise. However, by offering more merchandise, shippers are faced with more challenges. As retailers expand into options like selling products that are drop-shipped directly from the manufacturer to the customer or selling their products through third-party online marketplaces like eBay or Amazon, the complexity is even greater. Delivery and opening the box also take on added importance.

Steve Osburn: Indeed, ecommerce customers in the United States are becoming increasingly demanding. A recent study from Accenture Strategy found that 62% of U.S. consumers expect orders - with free shipping - to arrive within three days. Many retailers are struggling to deliver on this expectation. Therefore, rethinking inventory placement is key to gaining a competitive advantage. Networks are shifting from one or two big central distribution centers to multiple distribution centers closer to the customer allowing goods to get to them faster - which is now a key differentiator.

Nick Vyas: Both Jonathan and Steve make good points, but also consider this: The increased demand for ecommerce and omnichannel markets has created an immense focus on last-mile delivery. As high-density population growth in Tier 1 cities and vertical residential complexes challenges the delivery of parcels to individual units within large complexes, the importance of the last 100-feet has directly increased. This consumer-driven demand has made replenishment and dynamic visibility of inventory pivotal in new network design.

Any insight on how logistics networks will change in the coming years?

Vyas: What the micro/macro trends of emerging technology in supply chains show us are that artificial intelligence, machine learning, blockchain, robotic process automation, and advanced robotics will play a crucial role in the supply chain. The data-driven intelligence will augment future supply chain leaders’ ability to make decisions and drive strategy for logistical decisions. Historic tribal and domain knowledge will become obsolete and managers will have to adapt to new trends and drive network decisions in rapid ways to adapt to new environments.

Gold: Focusing on delivery time, customer satisfaction and supply chain transparency are going to become increasingly important for retailers and brands. Our research has shown that customers not only want their online purchases delivered quickly but also insist on being able to track a package or know when it’s going to arrive.

Osburn: Agreed. Networks will become much more sophisticated. Retailers do not have enough inventory to get all SKUs close to the customer, so companies will have to differentiate SKUs by velocity and take a more thoughtful approach to distribution instead of keeping inventory all in one location.

Labor availability - from warehouse workers to truck drivers - will also continue to be an issue, driving companies to explore new technologies that enable automation. Furthermore, capacity constraints, particularly around the holidays, will continue to be a challenge. So, with all this said, logistics managers need to build flexibility into everything they do. The market is changing quickly, and networks cannot be the reason that prevents companies from keeping up.

How is ecommerce changing the way shippers approach carrier relationships?

Gold: The relationships and partnerships between shippers and carriers are becoming increasingly important. As previously noted, the ability to provide services including last-mile delivery is crucial.

Osburn: That’s right, Jon. Companies used to negotiate with shippers once every three years to five years where they would select a partner and manage the relationship. This ‘set it and forget it’ model is dead. Today, shippers need to constantly re-evaluate to ensure that the current set of partners they work with can deliver on the needs of the business and monitor projections and volumes by lane to ensure that there are no unexpected surprises.

There’s an enormous amount of talk around it, but how important is data and information to logistics professionals as they work to improve ecommerce delivery efficiency?

Gold: Data collected through ecommerce sales is critical to help retailers plan their supply chains down to the customer level. The data is incredibly important to properly plan inventory and additional resources.

Vyas: There’s no doubt that advanced data analytics models along with predictive and prescriptive algorithms are capable of assisting resource requirements much ahead of actual demand. The challenge for ecommerce lies in the capture, synthesis, and management of the vast forms of data required to synchronize and draw various informed decisions.

Osburn: I couldn’t agree more. Data analytics, predictive technologies and increased communication up and down the chain are key. Not just within the shipper’s company, but with the shipper’s partners as well. Today and tomorrow, accurate projections are the key to success.

Now, let’s look at the downside. What are the major risks for logistics managers embracing an ecommerce strategy?

Osburn: Inflexibility is a major risk in ecommerce. There are so many unknowns because the customer is now the true driver of the workload, and flexibility is the real key to success. Companies need flexible networks that can rise to meet the high demand, but still, process low demand economically as well as a flexible workforce - something that’s becoming harder to achieve in a demand-driven environment.

Vyas: Ecommerce is so new, and we need to keep in mind that the Internet itself is nascent compared to the age-old trade systems of the past. Very little oversight from regulatory agencies has been applied, thus resulting in minimal restriction for large players. It has also become difficult for new players to viably compete in the ecommerce market due to barriers of entry. This trend will continue unless regulatory bodies or government intervention were to restrict the growth of monopoly of the market.

How is ecommerce changing the way logistics managers need to apply software and technology?

Osburn: The bottom line is simple: Technology is the glue that holds the ecommerce logistics network together. Having integrated systems is important for shippers and their partners, as is predictive technologies that can help preempt demand and returns and improve the preparedness of a company.

Has technology reached a level of maturity that certain key players such as ocean shippers, industry clearinghouses and public-private partnerships will step up and fully optimize the tools available to them?

Osburn: Yes, and there will be big rewards for those that step up. However, many of these companies are operating at full capacity and running at full speed just to keep up with current business demand. This leaves a gap for new players to develop solutions that can help solve problems that shippers are not currently focused on.

Gold: Indeed, we’re seeing technology continuing to evolve with ecommerce. It’s important that all players in the field work together to develop seamless and interoperable standards that will work across many different platforms.

Vyas: In many instances, we’re seeing new collaborations start up between ocean players and tech, like recent announcements by IBM and Maersk and GE and the Port of Los Angeles. These are important collaborations that will drive the next generation of data visibility and integration in the supply chain. Partnerships are a low-cost way to decrease barriers of entry for organizations and companies to enter the world of technology investments and developments.

How has the growth of ecommerce affected how the market manages labor?

Gold: Finding the right labor workforce has always been a challenge for retailers, and especially so right now in time with some of the lowest unemployment levels we’ve seen in decades. Ecommerce is certainly in a similar situation as far as the needed skillset for a continually expanding workforce.

Osburn: And because the labor challenge has been present for a few years now, this is driving the need for distribution center automation. Logistics operations also have to get more creative with their hiring and retention strategies and policies.

Will logistics managers start tracking productivity per worker in order to ensure ROI for new technology and worker investments?

Osburn: Tracking productivity per worker is not a new thing in the industry, but with the increased investment in automation, there’s certainly renewed focus from logistics operations. Activities such as training time required, machine downtime and shift ramp-up/ramp-down inside warehouse and DC operation are being managed much more closely.

Vyas: As Steve mentions, productivity tracking has already been in place for decades. New emergent technology and tracking activity software aim to further trace data increments to granular levels for productivity and quality of automatic processing. However, the ROI on new productivity tracking may be blue sky potential, because logistics operations face many more intrinsic problems such as seasonal labor.

As we wrap up, any thoughts about a sudden surge in ecommerce demand?

Vyas: Yes, and glad we’re ending this discussion with this question. During peak season, shippers become heavily reliant on seasonal labor, most of which is not well-trained or invested in the organization - thus high turnover and lack of morale become the linchpin of the shipper’s human resources dilemmas.

Though seasonal laborers do their best in each given situation, the workforce is untrained. Therefore, even if with sophisticated productivity tracking systems, they both have nothing to lose and very little to gain. Even if technology becomes more robust, the seasonality of demand creates a conundrum for itself.

Related: Ecommerce Logistics Leader Series, part 1 of 2 Navigating Ecommerce with Your Existing Supply Chain Relationships & Capabilities

Related Resources

Ecommerce Logistics Leader Series

Co-written by Adrian Gonzalez and Mike Glodziak, this ecommerce logistics leader series describes how you can get to market faster, by leveraging your existing network, resources, and relationships to their fullest potential as well as how you can use logistics as a competitive weapon. Download Now!

International Transportation: Price Matters, But At What Cost?

This ebook is a comprehensive guide to international transportation, that will help logistics managers better evaluate and plan their; supply chain strategy, logistics infrastructure, and risk mitigation strategy. Download Now!

Keeping Up with the Retail Consumer

6 supply chain disciplines retailers must master - developed by Adrian Gonzalez, founder and president of Adelante SCM and LEGACY Supply Chain Services, with a foreword from Rick Blasgen, president and CEO, CSCMP. Download Now!

Rapidly Improve the Performance of Your Warehouse

The Rapid Performance Evaluation identifies opportunities and potential improvements in every aspect of warehouse operations; performance, productivity, service, quality, and systems. Download Now!

Creating Superior Customer Experiences through an Optimized Supply Chain

This paper describes in detail the Jagged Peak ACES model and how it can be used as a methodology for measuring each element of the order lifecycle and its impact on customer experience. Download Now!

Why Outsource Your Direct-to-Customer eCommerce Channel?

To better focus on their core competencies, more and more manufacturers recognize that outsourcing is an effective and economical way to manage their direct-to-customer (D2C) eCommerce channel. Download Now!

More LEGACY Supply Chain Services Resources

Article Topics

LEGACY Supply Chain Services News & Resources

Outsourcing eCommerce Fulfillment to a 3PL Rapidly Improve the Performance of Your Warehouse Logistics 20 Warehouse & Distribution Center Best Practices for Your Supply Chain Warehouse Contingency Planning Template 7 Last Mile Logistics Delivery & Ecommerce Trends You Don’t Want to Overlook Increase Inventory Visibility across Your Supply Chain and Optimize Omni-Channel Fulfillment Omni-Channel Logistics Leaders: Top 5 Inventory Insights More LEGACY Supply Chain ServicesLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More TransportationAbout the Author