Global Supply Chain Property Market Remains Strong

Coming off of a record-breaking 2015, 2016 looks to be another banner year for supply chain real estate occupiers and investors, according to a logistics survey report recently issued by industrial real estate firm Jones Lang LaSalle.

In its second annual Global Logistics Sentiment Survey, Jones Lang LaSalle (JLL) culled feedback and opinions from 659 global logistics market experts on key property sector performance indicators by taking a look at the last six months and their expectations for the next six months.

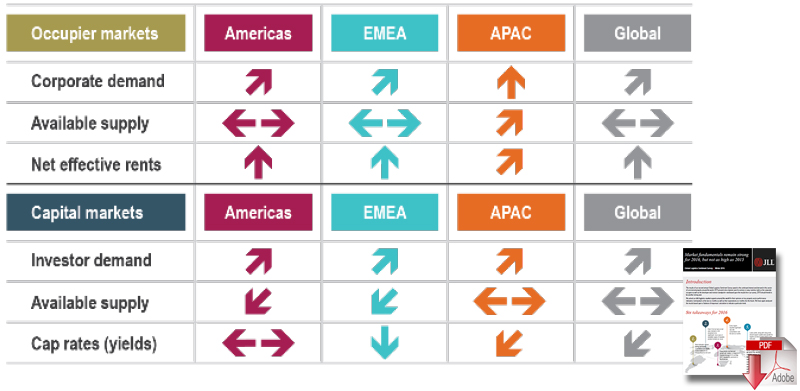

JLL found that demand for logistics facilities is expected to remain intact on a global basis in 2016, with rental growth expected to continue throughout all global markets in 2016 and 2017.

Some of the key takeaways of the survey included:

- available supply is expected to contract with new development adding more Class A product to the market, with demand continuing to exceed supply for sophisticated global real estate investment;

- rent growth is expected to continue, specifically in the EMEA and Asia Pacific regions, with more than half of respondents from the Americas predicting rents will peak in their region in late 2016;

- investor demand is expected to remain high, while demand for global logistics real estate fell from 74 percent in 2014 to 57 in this survey, which JLL said, while down, is not insignificant in terms of investor attraction in the sector, and it added that demand in the Americas did not change in 2015 and demand dropped significantly in EMEA and Asia-Pacific;

- prime investment opportunities are expected to be strong in first half of 2016 even though logistics real estate for investment remains tight globally and respondents expect more properties to become available in the next six months with sellers looking to capitalize on high market values; and

- industrial and logistics real estate values will head up at a moderate pace, with cap rates falling more than rising in most markets, especially in EMEA, and rising rents and improving market fundamentals expected to drive market growth going forward.

In an interview, Kris Bjorson, Head of JLL’s Retail E-commerce Distribution, said that this underlying theme of this research could be one of good news for everybody in that rents are going up and although availability of product is shrinking there is still a good supply of spec product and build-to-suites happening.

“2015 could be viewed as the up side of the rollercoaster, and the difference between the first quarter of 2016 and the fourth quarter of 2015 is that in this quarter there is just not as much available right now. There is a lot in the pipeline to begin 2016, but quality, 250,000 square-foot big box options are pretty slim, with a lot of absorption over the last two quarters.”

As for whom the primary renters of bog box logistics real estate space are, Bjorson said there is great demand from retailers for 500,000 square-feet and above, with 3PLs looking for space more in the 250,000 square-feet and above. The third tier of demand is coming from CPG and food and beverage players that are acquiring and renting space based on what demand looks like.

E-commerce growth also continues to serve as a major driver for logistics real estate demand, too.

“The amount of stuff people are getting delivered to their home compared to five years ago even is considerable, and the way consumers are buying online is changing the whole supply chain,” he said. “We are seeing the early adopters, whether it be companies like Walmart, Home Depot and others that started early on that quest and were the ones three years ago rolling out these 1 million square-feet spaces. Now, we are seeing more activity from 500,000-to-1 million square-feet from what we call the mid-adopters or the next tranche of retailers and e-tailers that are delivering online orders to your home while expanding their distribution centers. If this is a nine -inning game, we are still in the third or fourth inning.”

And that is being played out by logistics stakeholders still working on their strategy in terms of if they want customer options in-store pickups and returns or goods sent to their homes. This speaks to the strong demand prospects for 2016 and the first half of 2017, explained Bjorson, as some of these mid-adopters are still in the implementation phase.

“There are people that are starting to get mature about how they handle their e-commerce business and they are also getting into the next level of distribution nodes, which are smaller facilities in close proximity to consumers, along with the mid-adopters in the 500,000 square-foot facilities,” he said.

While demand for global logistics real estate saw a 17 percent drop from 74 percent in 2014 to 57 percent in 2015, Bjorson said it represents how it is becoming a tougher market to buy in, as well as tighter inventory.

In 2014, he said, there was a lot of large portfolio trading activity, with more deals now being made in a “one-off” fashion, as they are not available in terms of abundance and more parties becoming sellers, too.

And while there are more sellers in the market, there is a large amount of competition among buyers as well, said Aaron Ahlburn, JLL director of research for industrial and retail property markets.

“There is still a lot of attraction for investments in the industrial sector and a lot of large institutional investors….and a lot of competition in this space,” he said. “But it is still tougher to be a buyer today.”

While 2016 is expected to be another good year of leasing and capital markets activity for the logistics and industrial real estate market, JLL said there are some signs of cooling as well.

Bjorson and Ahlburn said some of these signs include; the need for reasonable and fair buyers and sellers; a steady decline in capital from corporate clients, which is needed to deploy new facilities; a volatile global economic environment; and variability of growth in different global markets, with some slowing down and some steaming ahead.

Expectations for the next six months

Article Topics

JLL News & Resources

JLL Q2 report shows ongoing strong industrial real estate market trends Q1 industrial real estate activity sees continuation of strong market conditions, states JLL Q1 industrial real estate activity sees continuation of strong market conditions, reports JLL JLL research highlights the supply and demand imbalance for industrial real estate space JLL report highlights the supply and demand imbalance for industrial real estate space JLL’s industrial real estate report: Q3 trends point to record-setting 2021 Q3 industrial real estate data points to a potential record-setting 2021 More JLLLatest in Supply Chain

Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Supply ChainAbout the Author