Fundamental Supply Chain Changes in a Post-COVID-19 World

Even after the dust has settled, there are eight steps an organization needs to reach and maintain a resilient and agile state in order to absorb the shock of disruption in order to adapt, even to something as serious and devastating as a pandemic.

A Post COVID-19 World

The world is undergoing a fundamental change that began before the pandemic and will continue in a post-COVID-19 world.

In my view, it boils down to one thing: People are treating each other as human beings and being more kind to one another.

That may seem out of step with the state of our political discourse, especially in an election year, but if you look around, it is happening and it is a growing trend.

To get us through COVID, CEOs and their boards temporarily put their salaries on hold in solidarity with their workers.

Companies extended benefits to furloughed employees. And, let’s not overlook that the U.S. government passed a $2 trillion stimulus package that was unprecedented in its reach and scope.

While the outcome is uncertain, at the time of this writing, negotiations continued on another stimulus package.

In a recent New York Times column, Tom Freidman noted this phenomenon, quoting his friend Dov Seidman who said: “In my view, trust is the only legal performance-enhancing drug. Whenever there is more trust in a company, country, or community, good things happen.” Could we be experiencing a paradigm shift from a “profit first” to a “people first” culture?

Read: How to Deal With Company Culture “Eating” Your Supply Chain Strategy

That may seem like a loaded question, especially at a time when the word socialism is bandied about as a weapon. However, putting people first does not signal the end of capitalism; rather, it is capitalism for the long term.

When a company puts the needs of its customers and employees first, it is investing in its long-term growth, not limiting it. Employees who realize that their company truly cares about their welfare and trusts them to do the right thing, in turn, trust their companies. Employees become more engaged and loyal.

Customers also react positively when companies develop a people-first culture. They realize that the company has their best interest at heart and become loyal customers. Loyal customers and loyal employees are worth their weight in gold. This marks a truly successful company.

What’s Old Is New

It sounds like a radical idea, but people's first cultures aren’t new. They were quite common from the end of World War II through the 1960s.

However, that all changed in 1970 when economist Milton Friedman published an article in the New York Times espousing the concept of shareholder primacy. He argued that the purpose of a corporation is “to conduct the business in accordance with their desires, which generally will be to make as much money as possible while conforming to their basic rules of the society, both those embodied in law and those embodied in ethical custom.”

Basically, the corporation’s purpose was simply to maximize shareholder value as long as it didn’t break the law.

Since the 1970s, the concept of shareholder primacy has grown, taking over the majority of executive suites and business schools. But a few organizations did not buy into Friedman’s doctrine. Among them are companies such as Apple, Disney, and Southwest Airlines that still believe in people first.

Another shift began to emerge in the early 21st century with a movement focused on corporate responsibility, especially toward the environment. More recently, the Business Roundtable redefined the purpose of a corporation from one that endorsed the principles of shareholder primacy to one that included all stakeholders including customers, employees, suppliers, communities, and shareholders. The order here is important; people first, then profits. This must become the order of importance in a post-COVID world.

Steps Toward People First

A people first culture will have a direct impact on how an organization does business and how its supply chains should be managed.

Supply chains need to be resilient in order to absorb the shock of disruption and agile to be able to respond quickly, in order to adapt, even to something as serious and devastating as a pandemic. Resiliency plus agility equals adaptability.

Below are eight steps an organization needs to reach and maintain a resilient and agile state:

- create a vision and culture of true end-to-end visibility;

- leverage technology that speaks to the vision;

- implement a company-wide continuous improvement (CI) program;

- emphasize planning over forecasting;

- segment your supplier and customer bases;

- develop a supply chain risk analysis plan;

- switch from purchasing to procurement and collaboration; and

- implement S&OP.

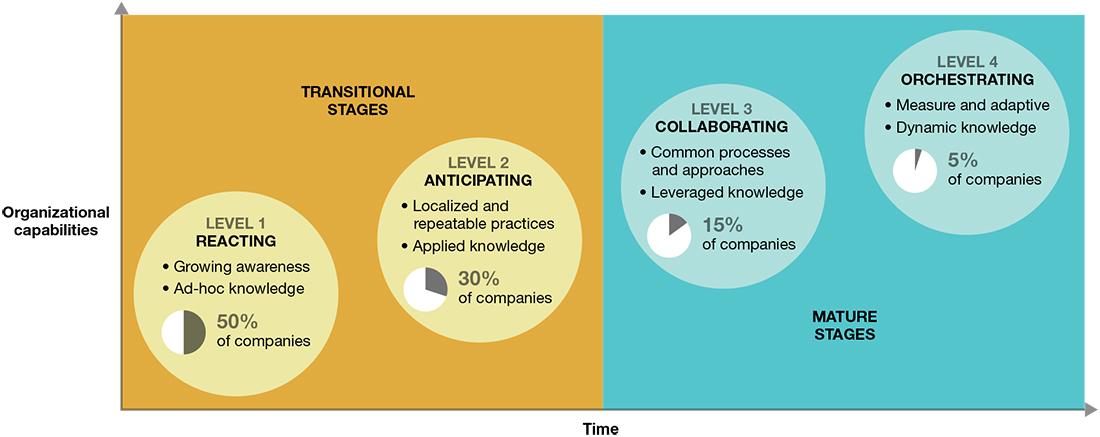

The eight steps, in order from broad to specific, affect the maturity of the supply chain. Gartner’s four-step supply chain maturity model is shown below.

Four-Step Supply Chain Maturity Model

Source: Gartner

According to Gartner, currently, 80% percent of organizations are at level 1 and level 2. Yet, as an organization implements the eight steps, its supply chain maturity moves from a reactive mode to one that is proactive. At the same time, the supply chain moves from transactional to collaborative.

Finally, the supply chain transitions from siloed operations that operate separately and at the time against each other, to one that is integrated, where operations automatically flow from one operation to another in a seamless and fluid manner.

Let’s look at each of the steps in detail.

Step 1: Create a Vision and Culture of True End-To-End Visibility

End-to-end visibility is and should be the goal of any supply chain. It is a requisite in a people-first environment. At a minimum, it is the ability to be able to track and trace material from the time it is ordered to the time it is consumed, used, sold, and delivered to the customer or other end-user, from Tier 1 supplier through Tier 1 customer. Visibility should occur at the serial number, lot number, date code, and SKU number wherever possible and practical. If an issue occurs with an item, it should be locatable and dealt with appropriately.

Transparency is a vital part of end-to-end visibility. Company operations and processes should be readily communicated and known to all. The material should be lookup traceable by most people within the organization. Also, dashboards should be viewable by everyone in the organization along with explanations for each key performance indicator as needed (e.g., what it means and how it is calculated).

Developing end-to-end visibility and a transparent organization will, in many cases, require the organization to undergo a culture change. Culture is the sum of an organization’s beliefs and behaviors tempered by customs, morals, and the goals of the group. Within an organization, it is often expressed by how people act “when the boss is not around.” Organizational cultures run the gamut from communal to draconian, however, the requirements for culture and vision where the organizational goal is to have end-to-end visibility should, at a minimum:

- be inclusive and participative and respectful of all;

- embrace change and allow a free exchange of ideas;

- encourage open communication in all directions, up, down, and across the organization;

- be process and not functionally driven, containing no silos; and

- allow for experimentation, provide and support formal and informal learning, and support failure

Step 2: Leverage Technology That Speaks To the Vision

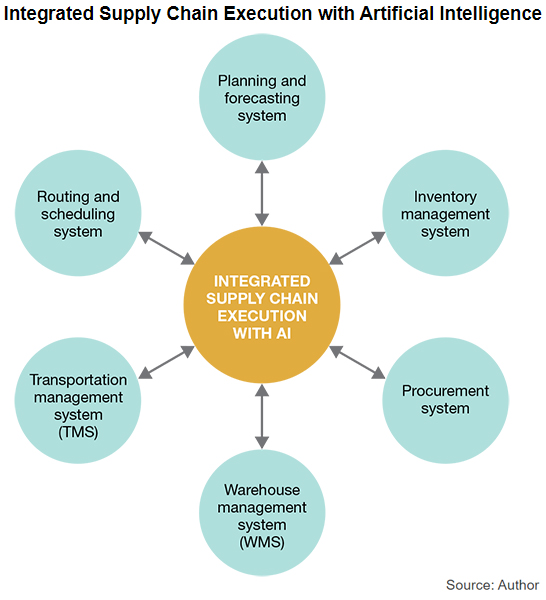

As organizations develop their visions and cultures to support true end-to-end visibility, they need to create a technology system that reinforces it (below/right).

The system must be fully integrated, in such a way, that updates and changes can be reflected in all affected systems.

Central to the system is a supply chain execution system with Artificial Intelligence (AI) capability, allowing the system to make many routine decisions that are normally the job of humans. AI allows the system to operate with fewer FTE’s and at a faster rate. Execution systems will vary from organization to organization but at a minimum should include, or have integrated bolt-on modules.

- Planning and forecasting. Allows the system to optimize inventory and forecast and simulate consumption alternatives.

- Inventory management. Manage inventory levels, orders, sales, and deliveries.

- Procurement. Manage and optimize organizational spend on goods and services.

- Warehouse Management (WMS). Optimizes warehouse and distribution functionality.

- Transportation Management (TMS). Streamlines the inbound and outbound shipping process.

- Routing and scheduling. Optimizesload planning of outbound loads and creates routes and schedules for delivery.

The functionality and level of sophistication of each system will vary by organization. More and more companies will invest in commercial off-the-shelf (COTS) software packages as opposed to developing their capabilities in-house via customization. They will also investigate systems that are Cloud-based or provided as a service (SaaS). Such services allow organizations to mitigate risk and provide the most up to date versions of the software. They also allow for growth and the addition of new services as required.

Step 3: Implement Company-Wide Continuous Improvement

Continuous improvement (CI) programs are based on the premise that work can always be improved. The Japanese refer to this as kaizen. Improvements come in two forms, incremental and breakthrough. Incremental improvements occur in small steps that build toward success slowly. They are the foundation of CI. These improvements are usually low-cost and low-risk solutions that are implemented by employees. Incremental improvements are usually localized, meaning that they only affect a small area such as a functional area in a distribution center, the procurement department, etc.

Breakthrough improvements are just that. They are major improvements that affect entire business processes and create an order of magnitude savings in cost or time. They are usually riskier and require investment in effort, materials, and equipment to implement. Many times, they will require a pilot program to test the improvement on a small scale in order to validate.

It is best to focus on CI programs on fundamentals. There are three fundamental, but critical, requirements for the long-term success of any supply chain. These are opportunities that reduce cost, reduce cycle time, or improve organizational processes.

- Cost measures value to the organization. A low-cost supply chain delivers value to the organization, its suppliers, and to its customers.

- Cycle time is an indicator of the organization’s agility. The faster material is received, picked, and shipped, information or orders are processed, products are manufactured, new products are brought to market, decisions are made, bills paid and revenue is collected allows inventory and the cash-to-cash cycle to be minimized.

- Organizational process improvements measure the precision and accuracy of processes. Process improvements also impact agility because they indicate an organization’s ability to change quickly and effectively. Cost and cycle time reduction leveraged with process improvement ensure an organization’s ability to survive in down cycles and thrive in up cycles.

The basis for all CI programs is the PDCA cycle. PDCA stands for plan, do, check, act. During the planning cycle, a problem is identified and stated clearly and concisely. Do involves experimentation, data gathering, data analysis, finding a solution, and testing it on a small scale. The check step involves verification to see if what has been done meets expectations. This ends with the action step when the improvement is fully implemented.

One of the most popular methodologies used for CI programs is Lean/Six Sigma (LSS). LSS combines Lean, which has its roots in manufacturing (it is the foundation of the Toyota Production System or TPS), and Six Sigma, which originated in the quality movement. These methodologies are both focused on perfection and therefore complement each other. Lean/TPS is focused on minimizing waste and reducing lot sizes. Six Sigma strives for perfect quality, as its name indicates one error per 3.4 million opportunities. Together in an LSS program, they eliminate waste and improve product, service, and process quality.

The concepts of LSS programs are easily understood and employees at every level can be trained to identify opportunities for improvement and continually improve operations. They improve employee engagement because employees solve problems in teams that elicit their input and participation. Implementing a company-wide CI program changes the culture of the organization to one that values improvement and innovation. Everyone develops a mindset where change is good. It spawns a questioning attitude and critical thinking. It is the hallmark of a people-first organization.

Step 4: Emphasize Demand Planning Over Forecasting

A supply chain’s purpose is to be the conduit for supply to meet demand. But demand by its very nature is uncertain. It’s generated by customers and regardless of whether the customer is a person or another organization (public or private) that customer is ultimately fickle to some extent. Fickleness is the essence of uncertainty. So, to reduce uncertainty, organizations develop forecasts, predicting future demand based on past results, current inputs, and trends. Forecasting is the very definition of an educated guess.

Today’s forecasts are usually produced using sophisticated computer software. As a result, too many organizations are too reliant on forecast packages to provide all the answers. They also may not update their forecasts on a timely basis. This leads to forecast errors regardless of the method used. And the more uncertainty, the worse the forecast results can be. To quote Carol Ptak, partner at the Demand Driven Institute: “There are two kinds of forecasts; lucky and lousy.”

The better alternative is demand planning. Planning explains a course of action and identifies the strategic thinking behind the plan, who is responsible for executing the plan’s various parts, the timing, and identifies the likely results. The basic difference between the two is accountability. Plans have accountability, forecasts do not. Plans can proactively change as situations and markets change. Forecasts, while changeable, are reactive because they are usually not changed until after the errors occur and the damage has been done.

Organizations should invest in and develop AI planning systems that include forecasting modules that can develop simulations of various planning scenarios. This is vital in creating sales & operations plans.

Step 5: Segment Supplier and Customer Bases

Just as all suppliers should not be treated equally; neither should all customers. There are various segmentation strategies for both, depending on the organization’s requirements and strategy. For example, suppliers can be segmented by performance, sales, or risk. Customers can also be segmented into various groups such as volume, sales, geography, profitability, or demographics.

Segmentation is used to develop an overall management strategy. Supplier and customer management includes developing appropriate metrics, communicating those metrics, developing relationships, creating positive communication, and developing trust. When suppliers and customers are properly managed, both good and bad news can be communicated in a positive and constructive way and programs such as collaborative planning, forecasting and replenishment (CPFR), joint ventures, collaborative new product design, and cost savings innovations are possible.

Step 6: Develop a Supply Chain Risk Analysis Plan

Many organizations operate multiple supply chains. They do this for a variety of reasons; some operate in diverse industries requiring radically different supply chain strategies and operations, others operate omnichannel environments, still, others operate different channel strategies - think consumer and industrial paper products. However, every organization needs a single supply chain risk management methodology so that the interests of the many outweigh the interests of the few (divisions/channels). Without such a plan, business units will always operate from a position of self-interest, optimizing risk within their own span of control over the needs of the entire organization. The supply chain impacts the entire organization, so developing a single supply chain risk management plan that applies to the entire organization will benefit everyone.

The risk analysis plan should consist of the following:

- develop a team structure;

- develop a list of risks;

- calculate risk probability and cost impact;

- develop a strategy for each risk; and

- monitor risk.

Each step is important but the key to steps two through five is not only to understand the risks themselves but to understand that risks are the result of a cascade of decisions or events that must happen in order for the ultimate risk to occur. For example, the bankruptcy of a key supplier or customer can be extremely hard for a supply chain partner to predict. It is usually the result of many things conspiring together until they reach a tipping point and by then it may be too late. This process is known as the cascade effect. Organizations guard against such risks by taking out insurance or by subscribing to third-party services that specialize in understanding such risks as credit.

Step 7: Transition from Purchasing to Procurement and Collaboration

Just as organizations need to plan more and forecast less, they also need to procure more and purchase less. Purchasing is associated with “one-size-fits-all” transactional operations where suppliers are pitted against one another resulting in a win/lose buying event. Win/lose events always leave one party (usually the supplier) feeling short-changed and can lead to passive/aggressive retaliation in the form of providing poor quality items, late deliveries, inflated prices, and poor communication. In short, one-off transactional purchasing is best left to situations where the item is purchased infrequently and the cost is relatively low.

In most other situations, organizations need to transition to procurement events. Organizations utilizing procurement processes experience much better supplier relations than those who rely on transactional purchasing techniques. Procurement professionals develop relationships with suppliers. And while all suppliers are treated with respect, all suppliers are definitely not treated the same.

The differences between procurement and purchasing are subtle, and the subtlest is the difference between value and price. To a supply chain professional, the only thing these two words have in common is that they both contain five letters. Value is about the utility and worth of an item. Price is the amount paid for it. Beware of the transaction that is based on price only. It is rarely, if ever, the best choice. An item’s value may include the quality of the item - its useful life. The item may be extremely easy to use, may be used with a wider variety of other items. It may be easily repairable or easily upgraded to an even more valuable product. Like beauty, value is also in the eye of the beholder (or customer).

Another subtle difference is that procurement involves sourcing an item or service. Sourcing is the process of qualifying suitable suppliers of an item, qualifying them, and working with them to obtain the best value. The purchasing process is about developing a product or service specification, preparing a Request for Proposal (RFP), bidding the RFP, and negotiating a price. In short, purchasing is about buying an item or service, procurement is about developing a relationship with a qualified and responsible supplier.

Step 8: Implement Sales and Operations Planning

Sales and operations planning (S&OP) is the process of balancing demand and supply by providing the organization one version of the truth in the form of a single operating plan for a specific time period, usually one month. A longer-term plan of usually 18 months to 24 months is developed simultaneously and set on a rolling schedule. The length of the schedule is ultimately determined by the forecasted item with the longest lead time. This schedule outlines the future needs (demand) along with the S&OP committee’s determination of how best to satisfy demand based on capacity and system constraints.

Demand is planned and orders are placed for raw materials, supplies, and MRO materials to meet future requirements. This plan is more fluid and the farther out it extends, the more fluid it is. The one-month plan is known as the Frozen Zone. Here any changes in the schedule are usually forbidden, or require executive approval to change. The cost to change the schedule in the Frozen Zone is usually very high. The next period, usually two months to 12 months in length is called the “slush zone.” During this time, the schedule can be changed at a minimal cost. Outside of this is the “free zone.” Here changes can be made with almost no cost penalties.

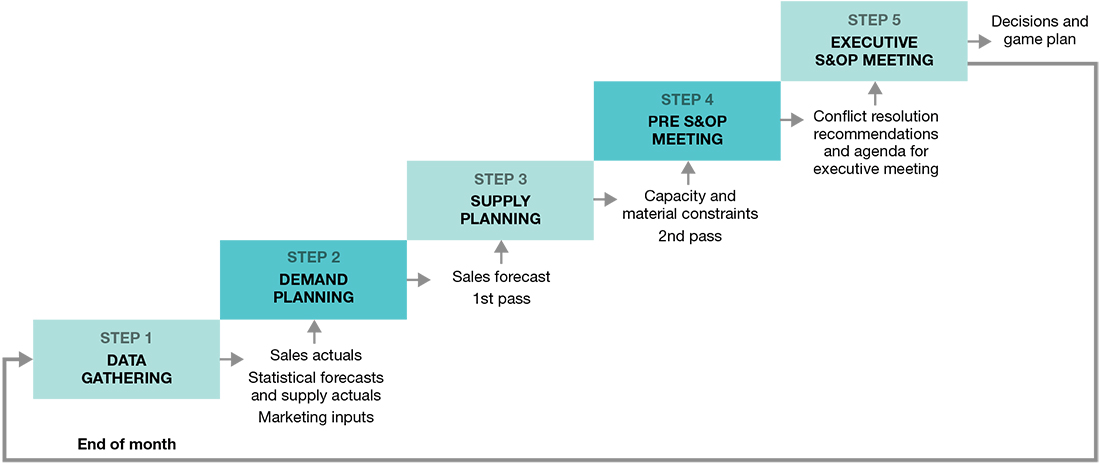

S&OP is a five-step process that is repeated monthly (below). It is run by the S&OP Committee which consists of senior members of the major functional areas including operations, finance, marketing, sales, manufacturing, supply chain, procurement, and logistics.

Sales and Operations Planning Process

Source: Author

The monthly process starts with data gathering (step 1). Here all pertinent data such as actual sales from the previous month, current inventory, expected receipts, marketing data, and operating budgets are gathered and analyzed.

This analyzed output is used to develop the demand planning process (step 2). At this point the demand plan is unconstrained, also referred to as infinite capacity scheduling.

Step 3 is referred to as supply planning. In this phase, unconstrained demand meets the constraints of the system in the form of capacity. Capacity constrains the system in two ways, one is labor, the number of people that can effectively do the job, and the second is physical, the amount of work area available to do the work. For example, receiving capacity is constrained by the number of dock doors available and the number of people assigned to the receiving area.

Once the capacity plan is reviewed, the pre-S&OP meeting (step 4) is possible. Here the S&OP Committee finalizes the monthly schedule and the rolling schedule and resolves most, or all, major conflicts.

They then develop the agenda for the executive S&OP meeting (step 5). The Executive S&OP Meeting reviews the results of the previous month, what went right, what went wrong, and steps to improve the process. It then identifies any issues and their resolution for the current month’s schedule as well as any outstanding conflicts that were not resolved.

Lastly, the S&OP committee presents the final schedule to the executive committee who either approves it or makes modifications to the schedule and plan. The final schedule is then signed off and all parties commit to a single plan.

Change Is In the Air

If COVID-19 has taught us anything, it’s that supply chains need to change. Organizations have designed supply chains so that material is sourced from low-cost countries, inventory is minimized at every single point, and suppliers are squeezed, all in order to beat quarterly projections. That worked fine until along came a virus that spread so fast, with such deadly consequences, that it shut down the whole world. Clearly, the current design was, and is, not up to the task.

But the tools are there. The technology is there. And the processes are there. The issue is that most organizations have it backward. They put the cart before the horse. They have not intelligently used the tools that they themselves developed. They put profit ahead of people.

As supply chain professionals tasked with putting our supply chains back together, we need to follow the steps in the right order. We need to invest to move them to the third and fourth levels of the Maturity curve, following the eight steps outlined here. We have to invest in the technologies, processes, and organizational cultures that put people and the good of our planet ahead of shareholders. We have to play the long game for the future. It is the only way we - customers, employees, communities, and shareholders - can all thrive.

By implementing the eight steps detailed here, supply chains will become resilient and able to withstand the shocks of disruption. Supply chains will become agile, allowing us to pivot and change direction quickly, adapting to virtually any situation that comes our way, including a pandemic.

Resiliency plus agility equals adaptability, with people at the center. This is the new paradigm.

*This article was prepared by the author, acting in his personal capacity. The views and opinions expressed do not constitute, nor necessarily reflect, a statement of official policy or the position of the author’s employer.

About the Author

*Gary A. Smith, CPIM-F, CSCP-F, CLTD-F is Chief, EAM/SCM for New York City Transit. He is responsible for implementing supply chain concepts with the MTA’s Enterprise Asset Management system to reduce cost, reduce cycle time, and improve system accuracy. He can be reached at [email protected].

Related Article: Managing Supplier Risk in the Age of the Coronavirus

Related Resources

How to Build a Pandemic-Proof Global Supply Chain

This guide explains how businesses can mitigate supply chain risk, including the latest coronavirus pandemic, as they navigate logistics decisions on an international scale. Download Now!

The Paperless Pandemic: How Ditching Documents Keeps People Safe and Makes You More Efficient

This paper details why health and safety is not the only reason to go paperless - we look at a few others, including cost savings, accuracy, and, of course, the environment. Download Now!

5 Steps to Start Building Digital Inventory During the COVID-19 Pandemic

With digital transformation on the rise, supply chains are becoming highly networked environments, enabled by data and analytics, as well as end-to-end automation. Download Now!

More Resources on the Coronavirus Pandemic

Article Topics

C3 Solutions News & Resources

Efficient Automation Can Significantly Increase Warehouse Productivity C3 Solutions Major Trends for Yard and Dock Management in 2024 Replace Your Antiquated Spreadsheets with C3 Solutions’ Cloud Based Software Adapting to New Realities Shaping the Next-Gen Grocery Shopping Experience The Shipper’s Handbook to Managing Expectations This Holiday Season Dock Scheduling Allows Food Distributor to Avoid Detention Charges The Dynamic Grocery Market More C3 SolutionsLatest in Supply Chain

How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations How Much Extra Will Consumers Pay for Sustainable Packaging? FedEx Announces Plans to Shut Down Four Facilities U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency More Supply Chain