Five Major Changes Happening Right Now in Industrial Distribution (The Alibaba Effect)

Industrial distribution is experiencing a huge transformation - you must make substantial improvements in experience, convenience, selection, price, and competition.

Big things are happening in today’s industrial distribution landscape - five big Bolts things, to be exact.

And they are causing an uproar in the industry as they all occur simultaneously.

The five big changes happening now are:

- Experience

- Convenience

- Selection

- Price

- Competition

Let’s take a closer look at experience.

This means everything from real-time product availability and enhanced search, to improved product descriptions and streamlined checkout. Experience also includes mobile, order history, personalization, workflow management system, and free shipping and returns.

In terms of convenience, today’s speed of delivery is “getting local.” This is evolving rapidly as industrial distribution consolidation continues to pick up pace, and it is also fueled by both eager sellers and eager buyers.

Multipliers are high and both financial and strategic buyers have the available funds to invest. As a result, this consolidation is in more physical locations closer to their customers, and therefore available for delivery.

Today’s customers demand a selection that has broader variety and depth of product offerings. This can be done through mergers and acquisitions (M&A). By buying distributors who offer different products and then integrating these distributorships, you are able to offer a larger selection of products to both your customers and the customers from the firm you acquired.

Many customers want to buy from fewer distributors, so M&A not only offers customers a wider selection, but also results in increased revenues.

Another way to increase selection is by acting as a marketplace. You can do this by offering products for which you do not stock inventory, but rather pass the order onto your marketplace partner who drop- ships the product to your marketplace customers. This stockless production can literally allow you to offer an “endless aisle” of product offerings without increasing inventory.

Of course, price is always an important factor. Again, this is a potential benefit of M&A. By broadening your selection, you are able to sell more products to each customer (and thus have larger orders). By having larger orders, you can create more efficient operations and reduce final delivery costs. This results in lower prices passed on to your customers.

Another price reduction avenue is to cut out your supplier and go directly to the source and offer your clients private label. This can often not only result in reduced selling price, but also bring increased margins and brand loyalty.

Finally, you have to work in a competitive environment to change the landscape of the industry. Since other distributors are addressing the above five changes, you need to as well. They are improving experience and convenience for your customers, and they are selling a broader selection of products at a reduced price.

To maintain your position in the marketplace, make a strong stand on these five fronts. In addition, there are new competitors you need to understand:

- Product manufacturers who create their own website for MRO components that includes extensive knowledge considered a unique selling position by distributors. Your customers would go direct to these manufacturers and cut the distribution link out of the supply chain.

- Product manufacturers who list on marketplaces and sell directly to your former customers for MRO. To grasp the potentially largest threat going forward on this topic, understand the positioning of e-marketplace Alibaba. Learn more about what Alibaba means for your company in the video, The Alibaba Effect (above).

- Pure online B2B players who sell products to your customers.

You can’t stay where you are and expect to be successful.

You must make substantial improvements in experience, convenience, selection, price, and competition. Industrial distribution is experiencing a huge transformation - and so must you.

The Alibaba Effect

If you haven’t yet heard about Alibaba, you will soon as it is poised to take the e-commerce world by storm.

Jim Tompkins, supply chain and retail operations strategy expert, reveals what your business needs to know about this Chinese e-marketplace that is quickly becoming the fastest growing e-commerce company in the world.

With more than $1 billion invested in businesses across the U.S., Alibaba and its founder Jack Ma are launching an IPO in New York City later this year and will then release its American marketplace “11 Main.”

Click on the video above to learn:

- The Top 5 things today’s retailers need to know about Alibaba.

- Why they are investing so much in logistics over the next decade.

- How final delivery, the “get local” movement, e-commerce planning, and demand-driven supply chains are vitally important to compete.

- How Alibaba will continue to expand both in the U.S. and globally.

- Why Jack Ma is a global leader, teacher and visionary.

- Why Alibaba is your competition, whether you realize it or not, and what actions you need to take to respond.

Alibaba is changing the game, and they are changing the way supply chains are viewed in the US.

To take advantage of this huge opportunity, plan your counteroffensive now.

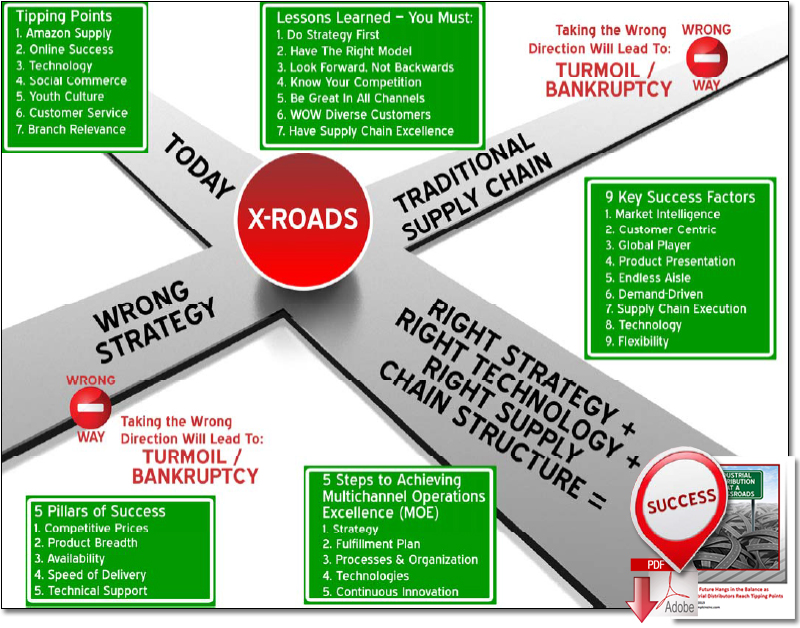

Signs Point To Industrial Distribution Crossroads

Customer expectations are leading the way in this critical industrial distribution crossroads.

Through social media, increased customization, and same-day or next-day delivery, customers are signaling that companies’ successes and failures rest on their continuing high expectations of price, product breadth, availability and speed of delivery.

From business news, at the time of this writing, a clear pattern foretelling the industrial distribution crossroads has emerged. Consider these reports from such diverse sources as The Wall Street Journal, Forbes, Modern Distribution Management, and other industry trade publications:

- The era of the regional, highly specialized industrial supply company is drawing to a close.

- By 2015, online business is expected to be worth $1.4 trillion worldwide.

- Wholesale e-commerce grew at a 34% compound rate from 2000 to 2009.

- W. W. Grainger reported that since 2011, web traffic has grown from 3,000 to almost 11,000 hits per month. They are not alone in this growth. According to research by Modern Distribution Management, the largest MRO distributors say that their online sales have grown at a rapid clip over the past few years. What’s more, online customers tend to have a larger average order size.

- Full service is being replaced by self service, which is all about the Zero Moment of Truth (ZMOT) – the time after a need is recognized and information is gathered for a purchase decision. Because of Amazon’s investment in keyword search, taxonomy and content, they own the ZMOT.

- There is a real opportunity in MRO for capitalizing on the unplanned spend. One large industrial distributor puts the percentage of unplanned spend as high as 75%.

- Distributors have long provided valueadded services without identifying them and making sure they are compensated for them. Not quantifying that value and not being compensated for it is a recipe for long-term margin pressure.

- The number of people who turned to social media as a source to learn about new products more than doubled in less than a year – from 24% in 2010 to 49% in 2011.

- As technology has increased information, transportation and ordering capabilities, the need and want of the local branch has diminished. Waning reliance on the local branch is reducing the need for local inventory. This means new entrants lacking these services aren’t out of the picture.

- Amazon’s decision to go after the MRO market is about economics. It believes that the sector is ripe for a low-cost competitor, and it knows that gross margins in the sector are currently high enough to produce a lot of profit – even with lower prices.

- With more than $1 billion invested in businesses across the U.S., Alibaba and its founder Jack Ma are launching an IPO in New York City later this year and will then release its American marketplace “11 Main.”

Article Topics

Tompkins International News & Resources

The Supply Chain is Dead. Long Live the Ecosystem Apple’s iPhone 7 Facing Supply Chain Shortages as Production Ramps up Ahead of Launch Demand-Driven Supply Chains Speculation that Walmart is in Talks to Buy Online Retailer Jet.com Retail at a Crossroads: Future Hangs in the Balance as Retail Industry Passes Tipping Points Choices That Drive Supply Chain Excellence What Is Supply Chain Network Design & Why Is It Important? More Tompkins InternationalLatest in Business

Ranking the Top 20 Women in Supply Chain TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process U.S. Manufacturing Gains Momentum After Another Strong Month More Business