Five Basic Practices That Can Quickly Close the Gap with Best Practices in MRO Inventory Management

In many organizations, maintenance, repair, and operations (MRO) inventory accounts for a significant slice, as much as 40 percent of the annual procurement budget, yet it is still not managed with the level typically applied to production inventory.

In an earlier job, I was the materials manager in a manufacturing facility. A “tool crib” was the repository for office supplies and safety supplies; the bulk of the maintenance, repair, and operations (MRO) inventory was controlled by the maintenance department and was stocked all over the plant.

My group set out to bring best practice in inventory management to the MRO supply chain.

Fasteners were the first MRO component category that we addressed. We selected a supplier to come in and regularly replenish the fasteners in a central stocking area. The supplier inventoried and stocked the bins and invoiced us monthly.

This simple process change eliminated the multitude of purchase orders and the associated costs that had been typical of the previous arrangement; it was also designed to ensure that maintenance staff always knew where to get the fasteners they needed for their tasks.

However, there was continued resistance to the idea of the materials management function taking control of all MRO supply. The turning point came when the stock of foundry tapping cones—used to control the flow of molten metal from a furnace ladle—was allowed to run out and the purchasing team had to source and expedite replenishment on a Sunday.

It became clear to everyone that it made more business sense to stock foundry supplies in the tool crib. Soon after, additional supplies of tapping cones were moved into the crib. Not only were MRO centrally maintained and ordered after that, but the foundry maintenance area’s housekeeping improved because there were no longer skids of materials sitting around as “maintenance stuff.”

As this scenario demonstrates, it is possible to streamline MRO inventory management practices and produce significant benefits for the organization as a result. This article will address several of the basic steps that organizations can take to improve their MRO supply chain activities.

MRO Inventory: The Opportunity

First of all, let’s be clear about what we mean by “MRO supplies.” We are talking about supplies consumed in the production process but which do not become part of the end product or are not central to the organization’s saleable output.(1)

That definition includes items such as repair components, cutting fluids, lubricants, and tooling as well as office supplies, cleaning and other janitorial products, furniture, lighting fixtures, building supplies, safety supplies, and other consumables that are not tied directly to the organization’s core products or services.

The spend on MRO inventory can be very substantial. Just two examples: The Helicopter Association International’s annual survey of operating performance shows that 40 percent to 45 percent of expenditures are maintenance-related.(2)

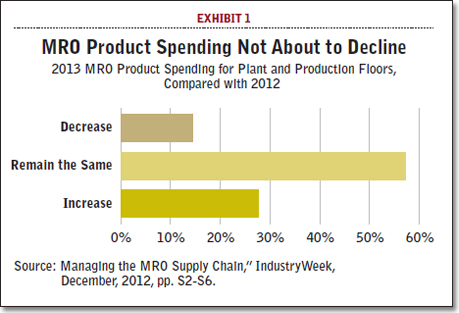

And at a Tier One automotive supplier, approximately 40 percent of the annual procurement expenditure is consumed by MRO materials. As companies continue to do battle on the cost front, few see the likelihood of MRO spend falling. A recent survey showed that nearly 60 percent of manufacturing industry managers surveyed expect to maintain their levels of MRO spend in 2013. (See Exhibit 1.)

Unfortunately, though, MRO supply is often overlooked as an “inventory” responsibility; as a consequence, it is rarely handled with the rigor and attention that it should be. It is all the more regrettable in 2013, and all the more crucial for organizations to understand and manage their costs, given the many uncertainties and the volatility of the global economy.

Yet in my experience, MRO supply activities have little direct accountability, and are driven too often by stockouts rather than to any overarching supply chain plan. Frequently, I have seen situations where MRO inventory is expensed and sits in an area without any identifiable locator system, ID, or a usage history.

Although more companies are coming round to the view that MRO supplies are true costs that can be tracked and controlled, clearly there is room for systematic control and more efficient methods of handling.

MRO vs. “Real” Inventory Management

Traditional inventory management—covering raw material, component parts, work in process (WIP), and finished goods—is controlled and managed to optimal levels, providing enough supply to cover current production needs and allow for the most probable contingencies.

The inventory is generally checked through a process known as cycle counting, using ABC analysis costing. The inventory is received and located in a warehouse or WIP location and decremented as it is used.

When an enterprise resource planning (ERP) system is utilized, the inventory may be replenished through a reorder advisement through MRP or through a kanban type of system where the supplier or vendor is notified and the inventory is replenished. Bills of materials are kept for the end products; they detail the amount and costs of the inventory.

There is never an issue of senior management doing an end run around the system to expedite the process; that would hurt everything from back flushing to inventory accuracy, and many other key performance indicators.

However, MRO inventory often lacks most of these controls or practices. It is very rarely measured in terms of inventory on-hand, turns, obsolescence, or usage. It generally turns less than once a year; request-to-fill rates are usually less than 80 percent.(3)

Frequently, many of the supplies required for MRO tasks are actually in stock but they just cannot be located. Another performance shortfall: many of the items required for maintenance or repairs are obtained with spot buys that ignore price in favor of availability.

Even worse: expedited freight becomes a factor as well. There is also the cost of unplanned downtime, waiting for repair components that might already be somewhere in the facility.

At the same time, there is the issue of diverting highly paid maintenance personnel from repairs and planned maintenance activities. Having them carry out materials management work is not the best use of their skills and time.

I’ve heard more than one plant manager complaining about maintenance staff sitting in an office talking to vendors, and in the same breath, groaning about equipment downtime.

There are also big differences in management of cash flow when we compare traditional inventory management practices with what is still typical with MRO. It is not uncommon for a maintenance manager to attempt to “save money” by buying larger quantities of, say, machinery components in order to get the price break.

But that generally means a large cash outlay for inventory that is expensed when received rather than being on the books—and which may get lost or become obsolete.

On the production side, supply chain professionals facing similar volume issues will handle the negotiations allowed for receiving the volume discounts, but will usually split the deliveries into multiple dates, thus lessening the expense impact, reducing the amount of shelf space required for stock, and allowing for order cancellation in the event that the items are no longer required.

Rooting Out the “Hidden” Inventory

Another common MRO practice is the use of “hidden” or “private” inventories of material that individuals keep in order to insure they have the items when they need them. The material may be in tool boxes, shelves, or hidden in work closets. This squirreled away inventory comes at some considerable cost to the organization—everything from the obvious excess inventory to expedited freight fees.(4)

I have participated in several plant clean-ups where large areas have been reorganized and material has been disposed of because the equipment it was purchased for no longer exists or more commonly, no one remembers why the material was purchased in the first place.

In the same facilities, I have seen parts expedited for an emergency repair job, only to have the second-shift maintenance person perform the repair with the parts already in his tool box. Another example: in one Tier One automotive facility, we had machining bits that were stocked on an honor system. One day, there were no bits on hand and nothing on order.

While purchasers made frantic calls, operations people made plans to extend the usage of the remaining bits. It was assumed that the operations would suffer within 12 hours. As it turned out, there was enough stock in operators’ tool boxes to run the operation for more than 48 hours without doing any of the gymnastics required to extend the operating life of each bit.

There is a bit of a “Superman complex” on display in such circumstances; the employee saves the day because he has the right parts right there.

Five Best Practices in MRO Management

So what are the hallmarks of good MRO inventory management? In my experience, there are five aspects that constitute best practice:

1. Central location of MRO inventory. It is invariably more efficient to store MRO supplies in one central location per facility rather than keeping them in various unidentified locations. It is crucial to have computer systems to track, manage, and control inventory. Armed with usage data and transaction costs, an organization can “right-size” its MRO inventory in accordance with supply chain performance standards.(5)

In a Tier One automotive supplier, we moved all of the maintenance items to a controlled area. The inventory was cataloged, assigned part numbers, and located on shelves that were also identified with a location ID. The inventory was then capitalized, boosting the balance sheet and allowing the costs of routine equipment maintenance to be tracked properly.

The new “stockroom” was then staffed with experienced supply chain personnel who had established relationships with suppliers and who understood the concept of partnering with suppliers to help drive down costs.

Where practical, suppliers were encouraged to own and keep control of the inventory and to ship minimal quantities to cover “as needed” inventory requirements. There were also efforts to control costs by using lower-cost but fully compatible components rather than the “maintenance preferred” parts.

Collectively, these initiatives laid the groundwork for a preventive maintenance program; the program involved scheduling of equipment downtime and establishing a pick list of repair items and supplies, ensuring that equipment repair costs would be recorded accurately and budget forecasting would improve markedly.

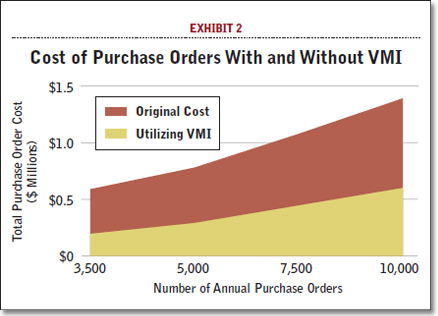

2. Supplier-controlled consignment inventory. Many organizations have successfully used third parties to manage MRO inventory.(6) Vendor-managed inventory (VMI) approaches—well-proven in mainstream supply chain management—often involves the supplier’s personnel being on site to manage the inventory.

This allows the customer’s staff to focus on their core functions, with the assurance that the MRO inventory is being managed properly by a trusted partner. And it means that the supplier, given greater visibility of downstream demand, may be able to offer volume discounts that a maintenance representative at the customer would not have access to.

The VMI approach can also reduce paperwork and reduce the number of inventory transactions on the customer side since the customer is paying for material as it is used.

The invoicing can then be scheduled on a weekly or monthly basis to streamline the payables process, trimming the number of purchase orders created and thus reducing transaction costs.

Those savings can be impressive by themselves:

Figures for costs to process a purchase order (PO) range from $60 to $300, counting the costs of everything from salaries of staff involved to payables costs and communications costs.(7)

Let’s assume a figure of $150; a reduction of 50 percent on an annual volume of 5,000 MRO orders would be $375,000 in PO costs alone. (See Exhibit 2.)

3. An accurate, up-to-date fact base. This is another important element, along with standardizing the processes for stocking, consumption, and analysis for better management. When there are standard business processes, it makes it easier to develop an accurate, timely base of data which in turn enables the maintenance/facilities teams to better plan scheduled maintenance activities and enables them to forecast costs much more accurately.

Also, the timelines required for a scheduled maintenance will be more accurate, allowing operations personnel to better plan around a downtime and not stockpile material because downtimes have always been longer than promised in the past.

Fasteners are one of the MRO parts categories for which an accurate database can be developed very quickly. Many fastener suppliers will supply the storage equipment (shelves, bins or racks), label the locations, and count and stock the locations. The customer then pulls any items that are required.

There is no transaction, and no need for a requisition or purchase order. The supplier restocks on an agreed-upon schedule and invoices monthly or twice a month based on consumption. This reduces the number of purchase orders considerably and significantly reduces the associated time and labor that go into the inventory process.

4. A set of key performance indicators. As in any project or management of an operation, key performance indicators (KPIs) must be established in order to measure factors such as savings, costs, and obsolescence in an MRO project.

If something is important enough to track, it should be measured, so that upper management can not only be kept apprised of the project’s progress but actually see its quantifiable benefits. Some measures to consider might include days or months of on-hand inventory, the number of stockouts, the ratio of rush orders to replenishment orders, and rates of parts obsolescence.

Measures such as these should be tracked and posted so those responsible can see how they are performing and are in a position to act to improve performance. In the example of the foundry items noted earlier, we were able to reduce the number of $500-and-up purchase orders from 10 -12 per week to zero by forecasting usage and ordering in smaller quantities with more frequent deliveries.

The data should be included in the monthly or quarterly reporting to management. If MRO inventory performance is reflected in its implementation and management by supply chain professionals, then its KPIs will likely be positive points in any report.

To begin with, of course, there may be data that is less than flattering to some departments. However, the open reporting of that data will bring the proper attention to the issues, and over time, the improvements in the data will become a positive for the whole organization.

The alternative really is not viable: when an issue is hidden away or ignored, it will soon become even more serious, potentially derailing careers.

5. Supply chain education for MRO staff. Often, continuing education efforts such as a seminar series on inventory management will allow those involved in MRO to understand the importance of adhering to best practice.

Exposure to supply chain professionals’ organizations such as APICS or ISM can be of great help; buyers, planners, and many other categories of supply chain professionals regularly benefit from ongoing education programs offered by such organizations and from the certification programs that they run.

There are other benefits of such programs: supply chain managers indicated that they saw training programs as signs of the companies’ commitment to their careers.(8)

Getting Started

I don’t pretend that reorganization of MRO inventory activities is a snap-of-the-fingers exercise—something that is “one and done” with a simple e-mail from top management. There are many cultural imperatives that sustain the status quo, not least of which are the defense of turf by managers and heel-dragging by the many who fear loss of control and the many more who are distrustful of any different ways of doing things because they want proof that the new way will be that much better.

Change has to start somewhere. The best place to begin is with data showing how subpar MRO activities actually are when compared with inventory management norms. It can be a real eye-opener for senior management to review the annual maintenance expenditures on parts or to see the costs of expedited freight charged to maintenance. These two items alone may be enough for top management to begin asking questions. And with senior executives engaged, real change can start to happen.

As noted earlier, one of the easiest areas to begin an MRO inventory overhaul is with fasteners—ubiquitous, low-cost components whose mainstream supply chain processes are very mature. Many leading suppliers of fasteners offer very advantageous VMI programs.

Once such processes are in place for fasteners, it is a fairly easy step to start moving other simple maintenance supplies into a tool crib or some other method of inventory control. Another simple and practical method is the use of vending machines to dispense basic supplies. The machines feature a code that is keyed in—work order number or employee number, for instance—or they accept the employees’ ID when they swipe their ID card.

MRO efficiencies are within sight. In fact, they have been so for decades. No high-level meetings, no large-scale consulting programs, and no management task forces are needed to justify the savings that can be realized. I hope that this article gives you some of the impetus that your organization may need to get its MRO

supply chain operating to its full potential.

Endnotes:

- InventoryOps.com; “MRO-The Last Bastion of Uncontrolled Expense” by George Krauter, Supply & Demand Executives, March, 2011, Vol. 12, Issue 1, pp. 44.

- “Budgeting & Maintenance,” Conklin & de Decker, Brandon Battles.

- “The $12 Billion Question: How is Your Facility Managing Inventory?” by Deb Oler (VP&GM, Grainger Brand), Industrial Maintenance & Plant Operations, July, 2011, Vol. 72, Issue 6, pp. 24-25.

- “MRO Restructuring in Full Swing” by Nicole Beauclair, Interavia Business & Technology, Winter, 2006, Issue 686, pp. 22-26.

- “Making MRO Inventories Play by the Rules” by Steve Mehltretter, Industry Week, August, 2009, pp. 40.

- “MRO-The Last Bastion of Uncontrolled Expense” by George Krauter, Supply & Demand Executives, March, 2011, Vol. 12, Issue 1, pp. 44.

- 2006 APQC Report showed the range to be $35.88 - $506.52; Supply Management Handbook range is $100.00++ to as high as $300.00; CAPS Research range is $59.00 - $741.00 with an average of $217.00

- “The Three-Stage Implementation Model for Supply Chain Collaboration” by Stanley E. Fawcett, Gregory M. Magnan & Matthew W. McCarter, Journal of Business Logistics, Vol. 29, No.1, 2008.

John M. Donnelly is the materials manager at ITW/Hobart’s Weigh Wrap Group. He can be reached at [email protected].