Ecommerce Disrupting the Consumer Packaged & Fast-Moving Consumer Goods Landscape

This article details how Consumer Packaged Goods (CPG) and Fast-Moving Consumer Goods (FMCG) distributors can thrive in a changing global ecommerce enabled scenario.

How Distributors Can Thrive in the Changing Scenario

Distributors have been an indispensable part of the Consumer Packaged Goods (CPG) and Fast-Moving Consumer Goods (FMCG) supply chain.

CPG and FMCG players have relied on their traditional partners to handle the sales, shipping, and servicing of the products to retailers in a specific geographic area or a particular class of business.

Conventionally, the distributor typically purchases the products from vendors and resells them to retailers.

The distributor takes a margin to facilitate its operations, and thus, the model keeps working.

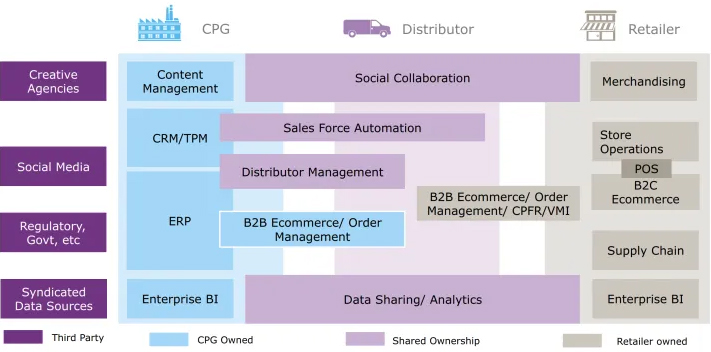

Source: TCS

However, the circumstances are quickly changing. With major e-commerce players like Amazon all set to enter the distributor space, and Uber freight already operating, the traditional distribution model faces the prospect of becoming obsolete.

Let’s have a look at the challenges, opportunities, and potential solutions for the CPG and FMCG distributors in the present scenario:

Consumer Packaged Goods Challenges

A big issue for the distributors in the rapidly growing SKUs for different brands. With niche segments like organic products, personalized goods, and vegan foods coming up, each brand has a significant more amount of offerings.

With more variety of products, the transporting challenges (shipping them together or separately, cold chain requirements, etc.) are also getting complex. Even specialized stores like fresh produce or organic only, have their own sets of requirements.

When retailers order inventories, it sits on their books (and the capital is blocked), resulting in a lower return on the capital invested. Hence the retailers demand to only stock items that can be replenished with a higher frequency.

This has led to the popularity of a lean inventory model amongst retailers, which means that the stores need to be replenished faster (often twice as fast as previously done). This not only means more trips per outlet for distributors but also a smaller size of orders per delivery. Lack of FTL or Full Truckload thus becomes another factor in the increasing expenses of the distributors.

Intense price stress at the retail level also puts downward pressure on distributors, which leads to smaller margins. In addition, distributors are now not only competing with mail orders and catalog sales but also with services such as online stores, auctions, and internet-based direct marketing.

Not only this, the rise of e-commerce has resulted in a massive surge in customer expectations when it comes to last-mile deliveries. With Amazon and other e-commerce platforms making same-day delivery a norm, CPG and FMCG companies are also trying to reach their customer base directly. Even though it may seem like the end for traditional distributors, there are opportunities hidden when looked closely.

Consumer Packaged Goods Distribution Opportunities

With CPG and FMCG brands going direct to consumers (D2C), distributors have a chance to become fulfillment partners of CPG and FMCG brands. Many CPG and FMCG brands are launching D2C online models, where once the order is placed, the brands use their distributor’s warehouse and fleet to deliver the product to the end customer.

However, in order to position themselves as the fulfillment partners, traditional distributors need to adopt advanced tech solutions that can help them with last-mile fulfillment, optimal fleet mix, and tracking of resources amongst other functions.

Consumer Packaged Goods Solutions

AI-backed logistics solutions like Locus ensure that distributors stay ahead of the curve when it comes to fulfillment operations.

These solutions can help distributors with:

- Planning optimal fleets for current business needs and potential growth in the future

- Identifying the number & size of vehicles that provide the lowest cost per mile while ensuring Full Truckload (FTL) capacity

- Leverage the best combination of captive fleets & market vehicles to reduce logistics costs

- Analyzing historical truck routes, determining the size, and the number of trucks required (often leading to fleet reduction), mapping them to specific customers and ensuring that the truck routes don’t overlap – resulting in reduced SLAs and fuel costs

- DIFOT (Delivery In Full On Time): Most of the customer deliveries would follow a particular time-frequency; however, inventory requirements would change without any set pattern. Features like dynamic route optimization & automated sorting engine, factors in all route & inventory details to ensure your trucks are delivering in full on time

- Analyzing the fleet’s performance: The modern solutions allow distributors to analyze the ROI from each of their trucks, measuring the performance & profitability of the entire fleet and reduce further costs with actionable insights

- Improving customer experience: With real-time tracking, customers get SMS notifications on how far their delivery trucks are, and what’s the ETA for deliveries – with tracking links that open real-time maps

- Better contract renegotiation with an estimate of vehicle requirements

- Ensuring high levels of SLA compliance, even during peak periods

- Complete tracking of trucks and personnel

The CPG and FMCG distributor landscape is quickly changing in North America. To stay ahead of the trends, distributors would need to identify new gaps and adopt new technology or risk falling behind.

Related Article: The Curious Case of Fast-Moving Consumer Goods Sales Beats

Related White Paper Reports

Fast-Moving Consumer Goods Insight Report II

This report discusses what goes behind the strategic decisions of Fast-Moving Consumer Goods (FMCG) companies, and how modern network optimization solutions can help improve them. Download Now!

Fast-Moving Consumer Goods Sales Beat Insight Report

In this report, we describe how Locus provides automated sales beat plans to optimize the mobile workforce for increased profitability, resource efficiency, and time savings. Download Now!

More Resources from Locus

Article Topics

Locus News & Resources

How Can White Glove Service Increase Customer Loyalty? Building Your Business Around a Hyperlocal On-Demand Delivery Model AI-Backed Route Planning Solutions for Ecommerce Players U.S. and Canada Border will Temporarily Close amid Coronavirus Outbreak Multi-Echelon Supply Chain Inventory Optimization Slot Management: Customer-Preferred Delivery Time Windows Last Mile Delivery Route Optimization and the Changing Logistics of Grocery Stores More LocusLatest in Supply Chain

How Much Extra Will Consumers Pay for Sustainable Packaging? FedEx Announces Plans to Shut Down Four Facilities U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia More Supply Chain