E-commerce and Freight: Balancing new patterns of demand

We speak with a number of logistics experts to capture their views on the overall impact that e-commerce is having on moving the nation’s freight. One thing is for certain: The current level and speed of churn has irrevocably altered the pattern so many had become accustomed to managing.

The current e-commerce environment resembles panning for gold around Sutter’s Mill in 1849—prospectors shifting to figure out where the value lies then moving away from the elements that didn’t make sense. One factor that seems evident is that the dramatic upward surge in e-commerce during the pandemic has started to level off a bit, yet it’s still predicted to grow at impressive rates.

Bill Hutchinson, long-time supply chain veteran of Dell, Sears, Belk and now senior vice president of enterprise logistics at mega-paper products producer WestRock, watched the packaging market take off in front of his eyes during the pandemic.

“It wasn’t only the volume surge that parcel carriers had to deal with,” says Hutchinson, “it was also the rapid growth of ‘unattractive’ freight originating from stores and other low-density origins, which challenged carrier networks in ways for which they weren’t prepared. Stores don’t have the robust packaging solutions, the dock space, pick density and typically don’t have large back rooms for staging shipments.”

Hutchinson also points out that packaging has evolved as a science, aimed at reducing cube and cost. “Box-on-demand” technologies now allow for packaging to be more closely customized to fit the variety of products running through fulfillment centers, from lipstick tubes to curtain rods. In one of his prior roles, a box-on-demand business case involving a $2-million investment in a single fulfillment center produced payback in eight months—an ROI that’s hard to ignore.

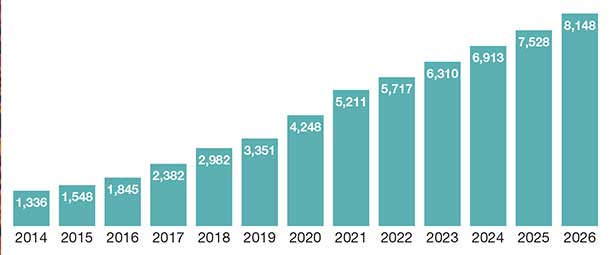

Retail e-commerce sales worldwide (Billion U.S. dollars)

In the meantime, e-commerce has also led to a number of different fulfillment models along with a large proliferation of fulfillment centers, generally smaller and closer to customers. However, which is the right model for fulfillment? Manufacturer to customer? DC to customer? Store to customer? Buy on-line, pick up in store (BOPUS)?

The most progressive retailers will balance these flows and use distributed order management algorithms to allocate orders across their supply chain in a way that balances inventory position, expected margin, logistics cost and proximity to the customer.

I had the chance to speak with a number of logistics experts in and around the transportation business to capture their views on the overall impact that e-commerce is having on moving our nation’s freight. One thing is for certain: It’s a consistently shifting playing field.

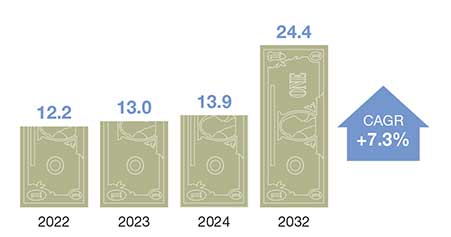

Last-mile market outlook (Billion U.S. dollars)

Last mile delivery cost (as a % of total shipping cost)

Changing behaviors

The ugly head rising out of the mists of the pandemic is the curse of reverse logistics. It was appealing to many, while trapped at home, to order five pairs of shoes, pick one, and send the rest back. It made on-line shopping attractive and convenient, but the cost of reverse logistics soared.

A whopping 30% of online orders last year (representing about $100 billion) were returned compared to 8.89% in physical stores, according to e-commerce consulting firm Invesp. Coupled with the need to manually inspect and classify returns and refresh packaging, the current cost model is unsustainable.

According to a recent Wall Street Journal report, the turnaround in retail supply chains over the past year is getting more painful for e-commerce businesses. Online furniture seller Wayfair is preparing to lay off more than 1,000 workers, adding the company to a growing list of firms that are scaling down as pandemic-driven changes in consumer behavior dissolve.

Wayfair’s restructuring marks its second round of layoffs in six months and is expected to affect more than 5% of its workforce. Wayfair, Amazon, Peloton Interactive and other companies saw business surge, but are now slashing jobs.

Wayfair, like many firms, aggressively added staff in recent years as it expanded warehouse operations and became a hub for a work-from-home population during the height of pandemic lockdowns. However, sales contracted 13% during the first nine months of 2022, and Wayfair is looking for $500 million in annualized cost savings.

“In the past, brands and e-tailers focused largely on online selling experience and in-store experience as the most critical factor consumers cared about,” says Ashutosh Dekhne, EY’s leader of Americas supply chain and operations practice. “With the growth shifts toward e-commerce, last-mile delivery experiences have become equal to, if not more important than, other factors in deciding how consumers choose brands.”

Dekhne points out that last-mile has become increasingly complex due to the many pickup points (store, DC, home, cross-docks); the variety of delivery modes (small trucks, delivery vans, bots, drones); and the many destination types (home, business, locker). “The challenge is not only in having a multitude of combinations,” he says, “but having a high degree of unpredictability—the origin and destination type and service level is typically unknown until orders are received.”

Dekhne’s colleague, Raj Kumar, EY’s leader of logistics and fulfillment practice, says that last-mile is seeing innovative delivery mechanisms to augment traditional human-enabled models. “Innovations have enabled drones, bots and self-driving vehicles to contribute to servicing consumers’ delivery needs and service expectations,” he says. “We’re expecting market growth from about $8 billion in 2022 at 7% CAGR to about $14 billion by 2030. Shippers will need to evaluate and quickly adopt these new technologies.”

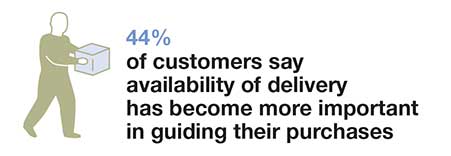

Global parcel volumes (Billion parcels shipped)

According to Scott Fata, principal director of the supply chain and operations practice at Accenture, as e-commerce grows, the “I want it now” experience will be requested more often—and on a repetitive basis.

“Because of this, there will be more forward stocking locations to get product in the hands of consumers within one day or less,” says Fata. “This will disrupt the traditional long-haul transportation service, and require more regional dedicated fleets. LTL companies can take advantage of this by truly becoming the local, last-mile delivery service. It will also be more difficult to attract drivers who won’t be home on the same day; so, this may require more long-haul shipments to go intermodal.”

Kevin Mahoney, managing director for the retail and consumer goods practice at Deloitte, couches his comments in a forward-looking manner. “The impetus for change has already taken place for many in the e-commerce sphere, based on higher cost and eroding margins, which are caused by the increase costs of transportation paired with higher customer service expectations.”

In Mahoney’s view, the growth of e-commerce has made a significant impact on supply chain networks holistically. “Customer mentality has been reset to expect high levels of service,” he says, “and that will only continue to increase, and companies will be challenged by the decision of meeting this expectation with two levers: speed or inventory. Both bring challenges and strains to the existing fulfillment and transportation infrastructure.”

Innovation in delivery

According to Mahoney, what’s most exciting regarding e-commerce delivery is the focus on innovation, alternative delivery models and the enablement of a crowd-sourced ecosystem of providers. “Organizations are incorporating fulfillment into customer and product strategies, enabling services, leveraging pick-up and delivery sites to increase speed of product launches, and capturing the data needed to unlock the not-so-distant reality of using drones,” he says.

When people think of drones, adds Mahoney, they think something that flies, but drone delivery is much more than that, with substantial benefits to the customer and community. “Studies are already showing drone delivery test markets have higher customer retention rates, service appeal, and positive sustainability benefits,” he says. “Customers are realizing benefits from lower cost, increased speed and efficiency, and ability to quickly process returns.”

Mahoney sees organizations unlocking the potential of the entire value chain, leveraging upstream and in-market solutions to serve customers and rethink business to business partnership opportunities. “Organizations have developed partnership strategies where companies can leverage another company’s fulfillment or store network and delivery fleet to achieve localized delivery.”

However, Mahoney cautions that as e-commerce continues to grow, so have returns volumes causing supply chain disruption and having significant cost impacts across the supply chain. “Organizations are rethinking their returns,” he adds, “and leading companies are developing transportation strategies to handle the growing returns volumes, offsetting costs and developing logic to make inventory-based fulfillment decisions that get products back on to the shelf and increase the likelihood of being sold at or near full price.”

Cass Freight Index–Expenditures (January 2010-December 2022, January 1990=1.00)

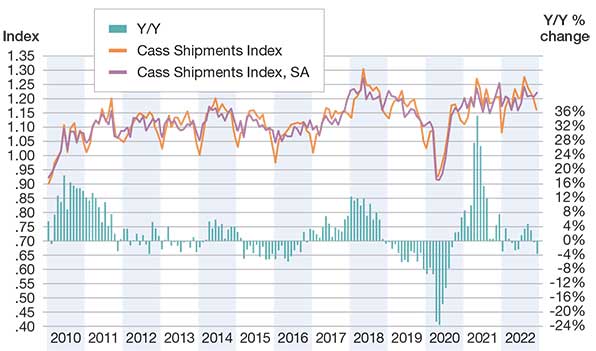

Cass Freight Index–Shipments (January 2010-December 2022, January 1990=1.00)

Parcel

Parcel continues its e-commerce evolution, which largely began with the onset of the pandemic when on-line shopping soared. However, that deafening demand has withered considerably, and, as Satish Jindel of SJ Consulting puts it, has “gone horizontal.”

According to Jindel, when people see a period of rapid growth, they tend to think it will last, and they make flawed judgments about capital spending, capacity expansion and staffing. “Of course, no one in today’s business world has any experience in operating in a pandemic, so some allowances must be made,” he says.

E-commerce did take off, but once the worst of the pandemic was over and things began opening up again, consumers, as social animals, moved away from buying “stuff” to buying services, like air travel, meals, hotels and activities they could engage in outside the four walls.

Jindel says that the prediction back in 2000 that e-commerce would grow to 50% of sales never materialized. Today it’s about 18%.

Former UPS executive Brian Sternberg observed that the overall market is softening in 2023 and both labor and capacity issues have eased. Despite these issues, rate increases—the highest by both UPS and FedEx in recent memory—on base rates and accessorials are continuing along with the proliferation and growth of smaller, regional players seeking to pick off business from the big two.

Sternberg says that shippers should consider bringing in new competitors to help level the playing field. There are also growing numbers of third-party logistics (3PL) players getting into the game. He cautions that, while using a 3PL may be warranted and helpful, they should be carefully vetted to make sure they fit your needs, network and budget.

Parcel volume growth is unlikely to take any meaningful decrease, except perhaps some periodic adjustments, as the order quantity and size in B2C is quite different from large-volume B2B shippers. This is a trend unlikely to ever revert to prior levels.

Brian Broadhurst, SVP of supply chain consulting at Transportation Insight, says that although parcel capacity constraints will subside in 2023, the industry will still feel the impacts of e-commerce volume spikes from 2020 to 2021. The most evident is the record 2023 rate increases, created by capacity constraints in years prior.

As published rates increase at record paces and the market softens, says Broadhurst, there will be a tipping point where shippers become motivated to renegotiate contractual discounts. “One key component will be the UPS Teamsters agreement expiring July 31, 2023,” he says “The outcome of those negotiations will directly affect UPS’s pricing strategy.”

Trucking & air

The impact on trucking has been mainly on middle-mile and last-mile delivery, as B2C grew. Sellers are morphing to a distribution model that has more and smaller facilities closer to the end-user, which affects LTL more than TL.

According to a recent Wall Street Journal report: “Trucking companies’ expectations for a rebound in U.S. freight demand are focused on the second half of the year. Carrier executives say a broad inventory glut that has swamped the retail sector should run out by mid-summer and that shipping customers expect to resume restocking shelves at that point as they prepare for the fall. The outlook is based on projections by shippers that suggest a return to a more normal ordering and shipping cycle after two years of turbulence driven by the pandemic.”

The boom in e-commerce has been good for the airfreight business, according to Ole Ringheim, former SVP of global air for Exel Global Logistics, as it has accelerated and grown the traditional usage of transportation by air—and clients expect a rapid delivery on time. One could argue that it has changed consumer spending and habits dramatically and will continue to do so in the future.

New volumes have been injected into the airfreight networks, especially benefitting the integrators, but also the forwarding community. In the meantime, the largest retailer of all, Amazon, is now operating its own airfreight network.

Recently, however, there are signs of slowing demand. A January report from the Wall Street Journal revealed that Cathy Pacific’s cargo volume fell 21% in December from last year and was 40% below the 2019 level.

Rail intermodal & carload

Larry Gross, president of Gross Transportation Consulting and producer of “Intermodal in Depth,” the industry’s leading analytical and forecasting report, views the e-commerce trend as “neutral” for intermodal. “The goods are still moving into DCs, which is the normal role for intermodal,” he says. “Forward movement from the DCs onward has generally been the province of trucks and will remain so.”

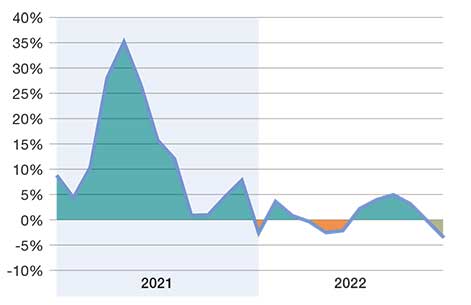

Cass Freight Index monthly shipments (Change from previous year)

Gross also observes that we have seen something of a retrenchment on e-commerce in 2022, as post-pandemic effects faded with many returning to conventional brick-and-mortar establishments. “This can be seen in the trailer on flatcar [TOFC] numbers, which have been particularly weak,” he says. “This has not solely been due to e-commerce, but also the continuing efforts of the railroads to convert TOFC to domestic container.”

It’s a wrap

While we got used to the ups and downs in pricing and volumes before the pandemic, with peak, shoulder and off-peak impacts, the current level and speed of churn has irrevocably altered the pattern so many had become accustomed to.

There’s much talk of making the supply chain more resilient, but it will require changes in planning and operational execution across the patch to make it a reality. Cross-functional and cross-enterprise collaboration will prove critical for improving supply chain performance.

Another word thrown around with much enthusiasm is “optimization.” Parochial optimization of your own slice of the supply chain often suboptimizes end-to-end performance. Building cross-enterprise trust and “statesmanship” that’s good for the whole is key to a better and more resilient supply chain.