Do You Really Need to Replace Your Warehouse Management System?

Despite the benefits of upgrading to more modern supply chain software, many firms have resisted the call to upgrade or replace their warehouse management systems.

Picture this: One day, you see your neighbor Bob carrying in a bunch of packages that UPS has just delivered to his house.

Bob has always been a bit of an odd fellow. For one thing, he’s the only person you know who still heats his house with coal. One cold morning, he’s outside shoveling coal into an ancient hopper before the sun comes up.

When you ask him what all the packages are for, he explains that it is so expensive and risky to replace his coal heating system, that he’s purchased a bunch of space heaters, electric blankets, and cashmere scarves to keep his family warm through the winter.

Sound a little crazy? Perhaps. But the situation is analogous to something that has been occurring in American distribution centers for years as companies go to great lengths to avoid replacing their aging warehouse management software (WMS) systems.

Structural changes to supply chains and demand patterns over the last two decades have created a host of new process requirements for distribution centers. Many companies’ WMS systems have failed to keep abreast of these new requirements, creating operational inefficiencies that eat away at corporate profits.

Despite the benefits of upgrading to more modern supply chain software, many firms have resisted the call, and instead have sought less expansive solutions to address their needs. However, several technological advances, which have roots in the 1990s, have finally come of age and are offering alternatives to wholesale platform replacements.

Factors Driving Upgrades

Over the last 12 months, Commonwealth Supply Chain Advisors has conducted an ongoing poll of distribution companies in an effort to understand what factors are driving companies to upgrade their WMS software, or, alternatively to find some kind of a workaround. We have interviewed numerous companies at all three major stages of the supply chain: manufacturing, wholesale distribution, and retail.

Our interviews have encompassed both large and small companies, and companies with a variety of current WMS solutions ranging from large best-of-breed solutions to basic, internally developed systems. Based on our research, Commonwealth has identified three primary drivers of technology replacement:

- Functionality Needs

- IT Simplification

- Changes to the ERP Landscape

Let’s look at each in more detail.

Functionality Needs: A Tale of Two Companies

Functionality gaps are the top reason companies cite when asked why they are considering a WMS replacement. But the specific functionality in question varies widely based on the company’s present WMS maturity level. Companies can be divided into two basic classes here: Firms that already have a mature WMS in place cite the need for slotting, labor management, and pick wave planning, while companies without a WMS are struggling just to achieve basic transaction conformation (Exhibit 1).

Class A: Software From The Last Century

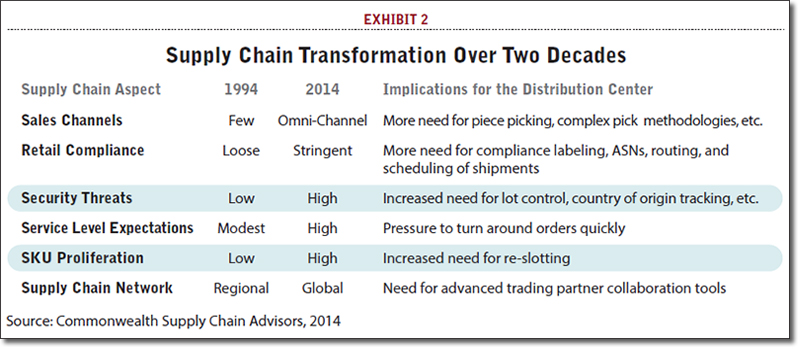

When Fortune 500 companies began broadly implementing WMS systems in the 1990s, supply chains were very different than they are today. The standard features available in the software back then mirrored those supply chain requirements. Consider some of the characteristics of the supply chain of the mid-1990s (see Exhibit 2):

- Fewer channels. The dominant sales channels for companies manufacturing consumer goods were retail and wholesale. Amazon.com had just been founded and was still limited largely to books and CDs. This meant that warehouses were primarily picking full cases of product and shipping to stores or other distribution centers via truckload or LTL shipments. Overall “cost per piece” was low, and pick methodologies did not need to be as complex. Additionally, inventory could be stored in simple tiered models, with a single, fixed primary pick location for each SKU with additional overstock locations.

- Fewer retail compliance requirements. Retailers were just beginning to discover the value of compliance programs with their vendors, and WMS systems were not well tuned to accommodate these requirements.

- Fewer security threats. In the pre-9/11 era, there was less need for visibility, traceability, and lot control in the distribution center.

- Less competitive service level environment. Retailers required less time-specific deliveries, and consumers had far more modest expectations for when they would receive catalog merchandise.

- Slower rate of SKU proliferation. Craft beers, flavored water, and organic pet food weren’t on the radar.

- More regional rather than global supply chains. The major shift of U.S. manufacturing to the Pacific Rim was just starting to occur. Trading partner collaboration was simpler.

These macro level socioeconomic changes have transformed the way that distribution operations need to work, and the support they require from their software systems. Yet, many large companies are still operating on software systems that were purchased more than 10 years ago and only sporadically upgraded in the intervening years.

These companies have to deal with the present reality of business conditions, but must rely on software from the last century. The situation isn’t that different from Bob: His old coal furnace does keep the pipes from freezing, but his reluctance to upgrade has left him several generations behind in technology and efficiency.

Class B: Tied to Paper

On the other side of the spectrum are companies that aren’t burdened with legacy systems - in fact, they aren’t burdened with any systems at all. A surprising number of companies that have experienced rapid growth still do not have a true WMS in their distribution centers - one that features real-time inventory control, system-directed workflows with mobile devices, and automatic data capture. Instead, these companies operate with paper-based picking instructions, spreadsheets to track bin locations, and manually keying confirmations back into the ERP system.

This phenomenon is not limited to Tier 3 and Tier 4 organizations or mom and pop operations. There are a surprising number of companies in the $100 million dollar revenue range that still operate this way, including some household name retailers. They seem to be able to fill orders on time and with sufficient accuracy, but often at the cost of significant amounts of manual labor to muscle the shipments out the door.

Not surprisingly, these companies have a more modest wish list than the previous group: They would happily settle for things like real-time transaction confirmation and system-directed put-away.

Let’s take a more in-depth look at what specific functionality is pushing companies to upgrade or replace their WMS systems.

Functionality Overview: Inventory and Transactional Control

The Inventory and Transactional Control category is one that is near and dear to the hearts of Class B companies. By far, the most important feature they are looking for is Real-Time Transaction Confirmation - that is the simple ability to confirm that a system-directed task like picking or put-away has been completed correctly. This is generally done via a bar code scan of either a bin label or product label. Using automatic data capture for confirmation eliminates the need for paper logs, for clerks to enter the logged data into the software system, or for armies of “checkers” to manually verify that the proper goods have been picked.

There are other aspects of Inventory and Transaction control that are also on the minds of supply chain executives. As traceability throughout the supply chain becomes more important, the ability to use a bar code scanner to capture lengthy lot numbers during a number of warehousing operations will become more and more important.

End users tell us that being tied to paper for confirmation is labor intensive. “We have to confirm a SKU number and lot number lot every time we touch a product,” says Dennis Agan, facility manager for Agreliant, one of the largest agricultural seed distributors in the U.S. “We can’t afford to have mistakes so we have people checking every outbound order before it ships. We get the accuracy, but it drives up our labor costs significantly.”

Companies working with multiple pack sizes - master packs, inner packs, and each-level units - tell Commonwealth that they also struggle with manual conversions in the warehouse. “It’s become cumbersome to deal with our various pack-size issues, in all areas of our operation - purchasing, sales, customer service, receiving, and picking,” says Bob Gormley, director of operations for Phillips Pet Supply.

Another item on companies’ wish lists is having fewer “location limitations.” Many older, legacy WMS systems only allow a SKU to have one fixed forward pick location. This can be very limiting if companies want to have separate pick bins for cases and eaches, have the same fast moving item spread out to multiple bins to avoid congestion, or use a dynamic forward pick location system to streamline replenishment. This fundamental weakness in the way the WMS thinks about locations can be very difficult to change, even with extensive software modifications.

Functionality Overview: Receiving and Put-Away

On the inbound side, having more sophisticated directed put-away was high on the functionality wish list for many companies interviewed as part of this project. Receiving and put-away are simple if every SKU has a fixed home location. But it quickly gets complicated: What happens if the SKU resides in more than one bin? Where does the new product get put-away? What if there isn’t room in one of the current bins for the new product? How can FIFO rotation be maintained? Questions like these - and many, many more - make it challenging to execute the put-away process without the benefit of enabling software.

Functionality Overview: Picking, Order Management, and Shipping

The need for more sophisticated pick processes featured prominently on the wish lists of both Class A and Class B companies. Paper-based warehouses often have a significant need to cluster pick effectively. Transitioning from discrete order picking to cluster picking is one of the biggest single warehouse efficiency gains that a company can ever make. Simply put, it can enable a worker to pick 10 orders in a single trip through the warehouse rather than 10 trips, drastically reducing walking. WMS is a major enabling technology that makes cluster picking possible.

A related methodology, batch-picking, is also facilitated with a modern WMS. Batch picking involves picking the entire amount of a SKU required for multiple orders at once, and then separating the batch into individual orders in a secondary step. WMS systems direct which SKUs are to be picked, how to stage them, and then step the workers through a “put to order” process to ensure accuracy and speed.

Other key outbound capabilities enabled by a modern WMS are zone picking, tandem picking, and cartonization (picking items directly to the shipping container).

Functionality Overview: High Performance Warehousing

A handful of additional functionality items can be considered “high performance warehousing,” and may only have applicability in operations with certain volume levels or complexity levels.

Slotting improvements are likely on the wish list of every warehouse manager, but only require complex solutions in certain circumstances. Simple operations with few changes in SKU demand patterns can often slot their distribution centers using spreadsheet-based tools. However, for operations with extreme seasonality, high rates of new product introductions, or fashion-based distribution, slotting becomes a more frequent and complex requirement. These companies require the sort of dynamic, integrated slotting module which is available from a top tier WMS provider, or from a handful of best-of-breed slotting developers.

Labor management is similarly on the minds of many operations managers. In operations with a high level of transaction uniformity (i.e. every pick is a case pick at the floor level), it may be possible to set some credible performance targets for picking based on past history, and to hold workers accountable for reaching these levels. However, the rise of multi-channel commerce has created distribution centers in which picking can involve pieces, cases, and pallets, along with a number of different pick methodologies under one roof.

In this environment, it is impossible to hold workers accountable to performance targets when each workflow differs so vastly from the others. Labor management software (LMS), either as a stand-alone system or as a module of WMS, can help implement engineered labor standards which calculate a specific target time for every task in the warehouse every day. This technology is used to successfully implement incentive-based pay systems even in complex warehouses with unionized workforces.

Improved integration to materials handling systems is another wish list item for many high-performance warehouses. In facilities with conveyor-based picking systems, this functionality can include improved zone-routing to ensure that cartons are only sent to zones where there are picks required, and the capability to induct new orders at multiple points in the system.

Another key feature that can be enabled by WMS is the ability to confirm on a line-by-line basis whether all of the required picks in a certain zone have been made before an order is routed to shipping. Without this feature, the conveyor control software (CCS) can track whether a carton has made stops at all of the required zones, but cannot determine if all of the picks in those zones have been made. Closer integration with the WMS can make this a level of accuracy possible.

IT Simplification

In addition to functionality requirements, the need for IT simplification is another major factor behind the desire to upgrade or replace WMS systems. The levels of IT complexity that exist at many companies today can be attributed to four factors:

1. Macroeconomic changes. For the most part, companies have responded to macroeconomic changes in a piecemeal fashion, implementing individual software “fixes,” small software sub-systems, and manual workarounds as needs arise. This approach leads to an incredibly complex array of software systems at many companies, with applications such as WMS, TMS, ERP, POS, OMS, EDI, LMS, SCV, WCS, and RFID all stitched together in ways that no one person at the company can easily explain.

2. M&A activity. Many large companies that have made mergers or acquisitions have found it simpler to leave the new company’s existing supply chain applications in place. For evidence, just look at the large number of companies that run different WMS systems and even ERP systems in different facilities or business divisions.

3. Multi-channel silos. As multi-channel commerce began developing in the late 1990s, WMS providers emerged with strengths in specific channels. Many companies, for example, implemented one WMS to manage a retail distribution center and a different one to manage their e-commerce DCs. Many WMS providers have now developed strong capabilities across multiple channels, but the siloed software infrastructure still exists among their customers.

4. Regionalization. Many global enterprises have implemented different WMS and ERP solutions in each region, often based on the strengths of one provider’s service and support in one region over another. Additionally, many enterprises have the same “brands” of software around the world, but have upgraded inconsistently, leaving different regions on vastly different versions of the same software.

When combined, these factors have created a patchwork quilt of supply chain software applications, and have swelled the ranks of the internal IT departments required to maintain these disparate ecosystems. This situation has led many companies to contemplate massive ERP or WMS replacement initiatives in an effort to simplify the architecture, reduce support costs, and to make it easier to upgrade software in the future.

Changes to ERP Landscape

A final factor leading companies to contemplate WMS upgrades or replacements involves changes which have been driven by the software providers themselves. For nearly three decades, the ERP vs. best-of-breed debate has raged in the business community. Is it better to have a single ERP system controlling most major applications at a business, or is it better to have a number of best-of-breed solutions each managing what it does best?

Proponents of the ERP solution tout the simpler interfaces and smaller IT footprint, while best-of-breed advocates cite the improved functionality available from having applications that are truly specialized.

In the last five years, the lines have blurred. Oracle and SAP have both released new versions of their WMS that are significantly more functional than their predecessors. While still not on a par with best-of-breed solutions, ERP WMS systems are at last closing the gap. This has caused many user companies to revisit the debate, and in some cases to make changes to their software roadmaps.

Why Companies Avoid Upgrades

So, with all of these compelling reasons to upgrade a WMS, one might expect nearly every distribution operation to be engaged in some form of upgrade or software replacement to take advantage of new features and simplified IT infrastructure. This is not the case. While many WMS companies are in fact reporting strong sales as the U.S. economy rebounds, the vast majority of distribution operations are not engaged in any major WMS replacement projects at the present time. Why is there so much reluctance to replace software in the face of so many apparent benefits?

Commonwealth’s research suggests that the major factor holding companies back from undertaking WMS projects is fear of implementation issues that will outweigh all of the hoped benefits (Exhibit 3).

“There is a general feeling that these projects take twice as long as proposed, the cost will probably double, and there will be major service disruptions along the way,” says the vice president of engineering at a wholesale distribution company with $5 billion dollars in annual revenue. “There are plenty of stories out there of companies that struggled with these projects.”

Why is it that WMS software at times seems so much harder to implement than even ERP systems? Five major factors contribute to a disproportionate number of problems with WMS software:

- lack of true process standardization in distribution,

- multiple exceptions to the rule in the warehouse,

- less business savvy users,

- materials handling interface requirements, and

- high rate of simultaneous active transaction volume.

These inherent challenges with implementing distribution software often result in cost overruns, resource monopolization, and risk of operational disruption.

To be sure, it is certainly possible to succeed with WMS replacements and upgrades, as numerous companies can attest. In fact, it is nearly impossible to run a warehouse that is both accurate and cost efficient without some form of WMS.

However, many companies still respond to these pressures like our long-suffering neighbor Bob, unwilling to replace an outdated heating system, even as ice crystals are forming on his television.

In the next section, we’ll learn about a few technologies that fall into the category of “space heaters and scarves” that can offer alternatives to full scale software upgrades.

Alternatives to Upgrades

Voice comes of age. One of the biggest alternative strategies in use today involves voice technology in the warehouse. The primary driver behind speech-based warehousing in the past was the prospect of allowing workers to operate in a hands-free environment, especially in full-case picking operations, where picking involved lifting heavy, awkward items. Not having to juggle a piece of paper or a handheld computer can significantly boost pick rates.

That was then. Our unscientific survey of recent voice adopters reveals a startling reason why voice technology is in vogue at the moment. Rather than adopting voice for the traditional reasons - hands-free operation - more and more companies are implementing it for three side benefits that voice software offers: more flexibility, less risk, and less cost than legacy software systems.

More flexibility. Voice software is often more flexible and easy to adapt. Most of the voice software systems today have been written in the last ten years, many of them utilizing the principles of Service Oriented Architecture (SOA). Companies like Voxware and Lucas Systems recognized early on that speech hardware would quickly become a commodity, and focused their development efforts on creating software that could extend the functionality of the underlying WMS system, rather than just speech-enabling WMS instructions. The result has been software that plugs functional gaps and is easily configured by the user to create new workflows. For many companies, this stands in stark contrast with their aging legacy WMS systems that cannot be easily modified.

Less risk. Voice deployments can be done in a piecemeal fashion - adding layers of software on top of legacy WMS systems to address a few functionality areas. If the voice deployment fails, the underlying WMS hasn’t really been affected and the operation can continue as before. Thus, voice deployments are less risky than a wholesale WMS upgrade or replacement.

Less cost. Even if a user has been on an annual maintenance agreement and can avoid new license fees, the professional services fees for a full scale WMS upgrade can be very high. To date, voice vendors still have a “new kid on the block” mentality and continue to offer attractive pricing levels in an effort to build their client base. Voice vendors also seem more willing to quote fixed costs for deployment and to stand behind those costs, within reason.

While deploying a voice system can plug many of the functionality gaps in an operation, it actually increases the amount of IT complexity in the organization. There is another software application to be supported, and another set of interfaces to be maintained. So, it could be said that deploying voice purely to avoid a major WMS upgrade may be a short or mid-term strategy, with a larger, enterprise level software project still looming on the horizon at a future date. But, as seen from the experiences of companies we surveyed, voice deployments can provide a swift, tangible ROI that will improve a company’s profit margins until the larger project occurs.

That brings us back to our neighbor Bob, with his assortment of stay warm alternatives. A few pertinent questions can be raised as we compare his situation to companies implementing voice as an alternative to a new WMS. Is voice technology like a space heater - it fills an immediate need but winds up being more costly in the long run when you add everything up? This author predicts that 10 years from now, the companies above will look back on their experience with voice and say it was more like the cashmere scarf: marketed for style, but bought for warmth; a simple device that got the job done without breaking the bank.

Now, let’s talk about the electric blanket.

Another Alternative: WCS. Warehouse Control Software (WCS) supports large material handling systems, providing a single communication platform to conveyors, carousels, scanners, printers, and other devices. WCS systems have largely been developed by material handling manufactures or systems integrators. Some are little more than development platforms, with each installation differing vastly from the others. Some providers, however, have developed WCS systems that are true applications, with a common underlying source-code from one deployment to the next and regular enhancements and upgrades.

However, some of today’s WCS systems are exceeding their original mandates of communicating with material handling systems, and, like voice systems, are being deployed to achieve functionality that is too challenging or risky to develop in the company’s WMS. Some of the newer WCS systems have also been developed with flexible architecture, and can be used to fill gaps without the resource drain and risk of a wholesale platform replacement.

Take for example the experience of Regis Corporation, a leader in the hair care industry. The company runs two distribution centers in Chattanooga, Tenn. and Salt Lake City, Utah to service its 9,700-plus retail locations worldwide. Regis uses a conveyor-based picking system with zone-routing, and has a legacy WMS system that is no longer supported or enhanced by the original provider. The WMS had two limitations that were creating problems in the operation. To begin with, an order had to start being picked in the first zone where picks existed. When there was heavy demand for a certain SKU, nearly all of the orders in the wave had to start in the same zone. That approach flooded the zone and created a bottleneck. Secondly, it was not possible to group orders for cluster picking by SKU or zone commonality. As a result, pickers would travel excessive distances in order to pick all of the items for a group of very disparate orders.

Modifying the WMS to fix these issues was not practical given the amount of coding that was required. Instead, Regis turned to its WCS provider, Invata Intralogistics. Invata’s FastTrack WCS was about to be deployed to manage a pick-to-light system in the facility. It was discovered that the WCS could also address the two functionality issues listed above relatively easily. “We’re going to use the WCS to allow orders to start in any zone we want,” says Jeff Crowell, Regis’s logistics project manager. “This will balance out and level-load the volumes in the pick module [a continuous loop conveyor design allows the orders to loop back and enter any upstream zones where picks exist].”

Additionally, the WCS allows orders to be grouped together such that the cluster of orders can all be fulfilled with picks from a relatively small geographic area, greatly reducing walking and improving efficiency. The result is quicker turn around and better service to Regis’s local salons and their guests. These changes are in the process of being developed and implemented and are expected to dramatically improve the operation. “This was certainly a lot easier than trying to modify our WMS to make these changes,” says Crowell.

How Sustainable is The Trend?

It is reasonable to expect that the David and Goliath situation that has driven voice providers to be so accommodating to user requests will cease at some point? There are already reports of some of voice providers being spread extremely thin as they simultaneously support multiple implementations with a limited staff of technical resources. Voice developers have, by and large, not developed the integration partner networks that WMS provides have, and so have fewer choices to supplement their resources when times get busy. So, the next few years could see voice providers taking on more overhead to support growth, and being less willing to guarantee the cost of implementations. While this trend may take some of the punch out of the strong voice headlines that are making news today, the underlying business case for voice deployment as outlined in this article will likely still exist.

The same question can be asked of WCS providers. As noted previously, most of these developers are primarily in the business of selling materials handling equipment. The 2000s were littered with failed initiatives by WCS providers to re-brand their software as WMS, some of them rather high profile. Many of the providers realized that their core, profitable business was selling equipment, and that trying to sell and support a “real” WMS added a layer of resources and cost to their organization that they were not willing to bear. Still, examples like that of Regis are compelling. If a WCS provider is content to use their software to manage materials handling equipment, and occasionally to stray into new areas and fill some functionality gaps outside of the conveyor system, this may be a sustainable model for both provider and user.

Looking Forward

The broad lesson to be learned here is that while enterprise level software initiatives have value, they can be long and expensive, and companies should take advantage of some of these interim steps along the way to address specific operational issues with smart use of technology. Both voice and WCS are mature products that fill a specific need. Both can be effectively adapted to fill peripheral functionality needs in a distribution operation and shorten the time to value.

And what of good neighbor Bob? The author admits that the analogy isn’t a perfect one. In reality, Bob’s wife would have moved in with her sister a long time ago, and taken the kids with her.

About the Author

Ian Hobkirk is the founder and managing director of Commonwealth Supply Chain Advisors. Over his 20-year career, he has helped hundreds of companies reduce their distribution labor costs, improve space utilization, and meet their customer service objectives. He has formed supply chain consulting organizations for two different systems integration firms, and managed the supply chain execution practice at The AberdeenGroup, a leading technology analyst firm. He can be reached at [email protected].

Selecting the Right WMS

What You Need to Know Before You Buy a Tier 1, Tier 2, or Tier 3 System

WMS: Three Tiers or Six Categories?

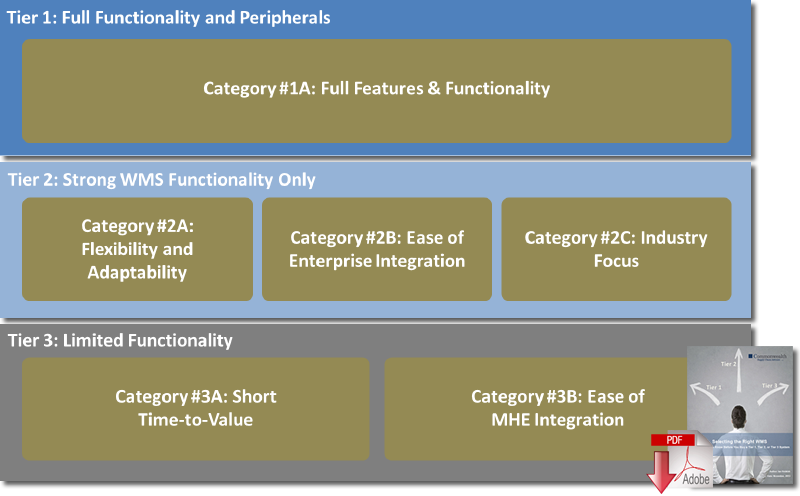

We always resist over-simplifications here at Commonwealth Supply Chain Advisors, and perhaps nothing is more over-simplified than the notion that it is possible to carve up the entire universe of one-hundred or more Warehouse Management Software (WMS) providers into three neat categories and calling them Tier 1, 2, and 3.

The vendor landscape is infinitely more complex than that, and companies’ reasons for choosing providers are multi-faceted and don’t fit easily into just three buckets. Furthermore, the three-tier categorization ignores the ERP vs. Best-of-Breed religious debate, which rages on after more than two decades.

For this reason, Commonwealth has always viewed the WMS provider landscape as being made up of six groups of vendors, each of which has their unique strengths and weaknesses.

However, we are also realists here at Commonwealth, and as such, we are forced to admit that the three-tier paradigm does reflect the way that most companies tend to think about software providers, even if it does ignore many of the important nuances amongst vendors.

So, for this report, we have taken our long-standing categorization method and blended it into a way of thinking about WMS providers that features the best of both the three-tier and the six-category model (below).

Download the White Paper “Selecting the Right WMS”

Article Topics

Commonwealth Supply Chain Advisors News & Resources

KPI Integrated Solutions acquires consulting firm Commonwealth Supply Chain Advisors This Month in Modern: The future is now at the MMH Virtual Summit This Month in Modern: Take a fresh look at the world around you 7 Ecommerce Enabled Warehouse Best Practices 8 Steps to Next-Day Delivery Fulfillment Efficiency Slotting’s elevated place in an omni-channel world The Future Legacy Warehouse Management System More Commonwealth Supply Chain AdvisorsLatest in Warehouse|DC

Microsoft Unveils New AI Innovations For Warehouses Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility Taking Stock of Today’s Robotics Market and What the Future Holds U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs More Warehouse|DC