Do You Have the Right Supply Chain Partners in Innovation?

The model described in this article helps companies to choose the right partners and maximize their chances of developing the innovations that will help them maintain their competitive position.

One way to identify, develop, and implement the innovations that enable supply chains to maintain high performance levels is to partner with suppliers.

But how do you identify suppliers that are capable of such collaborations and possess the creative horsepower needed to push the envelope?

Supplier choice is routinely based on factors such as cost, volume, and location, but the ability to engage on supply chain innovation projects is gaining in strategic importance. This is particularly the case in dynamic markets characterized by rapid technological change and shorter product life cycles that increase operational uncertainty and complexity.

Research completed at the Zaragoza Logistics Center, Spain, the European member of the MIT Global Scale Network, identifies the factors that companies need to consider when evaluating suppliers as collaborative partners in critical areas such as innovation.

The research findings were validated in a study carried out for Luis Herrero’s Ph.D. dissertation, advised by Prof. Maria Jesus Saenz. The study analyzed strategic supplier relationships at the European company Leroy Merlin, the third-largest do-it-yourself retail chain in the world, with annual revenue of more than 15 billion euros and 65,000 employees. The researchers analyzed data on 148 companies for the study.

Three Dimensions

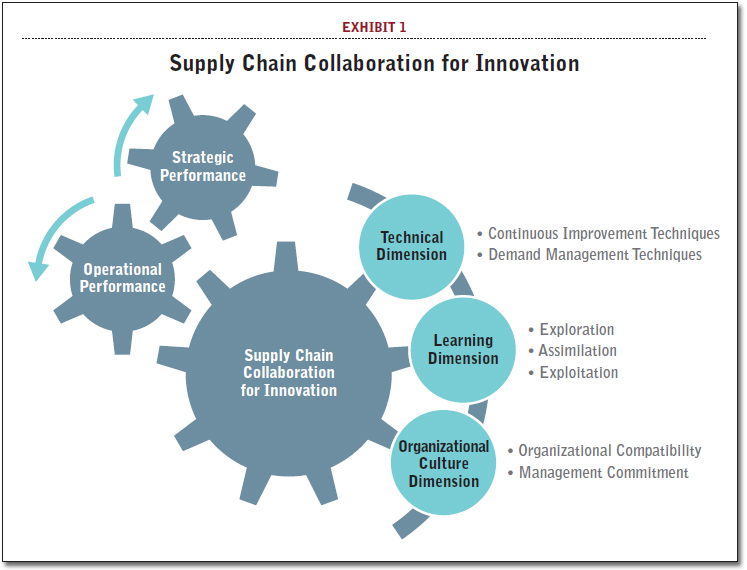

There are three main components or dimensions of a supplier’s profile that shape its effectiveness as a collaborative partner for innovation. The dimensions are interrelated, and drive both the operational and strategic performance of the relationship (see Exhibit 1).

- The Technical Dimension. This dimension pertains to the compatibility of the supplier’s IT systems and technical resources in areas such as demand forecasting, customer service, and inventory management. Supply chain managers often focus on this dimension initially because it is relatively easy to evaluate and implement.

- The Learning Dimension. The supplier’s ability to recognize the value of new knowledge from the other partner and then to assimilate and apply it for the benefit of the supply chain relationship is covered by this dimension. This ability is called Absorptive Capacity (AC). AC can be evaluated when choosing a collaborative partner by assessing the number of innovative ideas that the company has analyzed and implemented as part of its supply chain relationships. A vendor company that is resistant to new ideas and inept at realizing change will not be an effective partner.

- The Organizational/Cultural Dimension. Is the supplier a good fit in terms of its organizational structure and corporate culture? Do the partners share the common goals, norms, and values that are essential to establishing a mutually beneficial partnership? Depending on the context of the relationship, how compatible the two organizations are in terms of fair dealing norms such as transparency in sharing production and scheduling data, flexibility, mutuality, or openness, can definitively help working relationships to endure. Additionally, senior management needs to participate in and support the strategic relationship, even assuming that innovations can fail in the short term.

As mentioned, these three interrelated dimensions shape a supplier’s ability to create and foster new ideas, and to translate them into innovations that improve supply chain performance. Surprisingly, the research study shows that the technical dimension has the least impact on overall performance, while the learning and organizational culture dimensions show stronger links.

Take, for example, a successful collaboration between Leroy Merlin and a supplier of ceramics. The shared “technological sophistication” norm gave the collaborators confidence that new ideas would be technically feasible. Once the ideas were explored and accepted, the shared “transparency” norm aided in internalizing them by removing ambiguity about their respective roles, responsibilities, and capabilities.

The important lesson here is that supply chain managers who focus primarily on a supplier’s technical competence need to readjust their approach to finding collaborative partners in innovation. First, they should select those partners that are culturally compatible (like-minded when it comes to values such as flexibility and fairness with a similar business philosophy). Next, select partners with the ability and willingness to learn, and want to create synergies.

Delivering Innovation

When supply chain partners are attuned in this way they are much more effective at discovering and applying innovations that enhance competitiveness.

For example, Leroy Merlin identified a new way to display a flooring product in its stores by introducing smaller rolling formats. The innovation would boost sales and facilitate the distribution and handling of the product. The retailer proposed the idea to the supplier, which agreed to explore the concept in collaboration with Leroy Merlin. Both organizations supported multi-disciplinary cooperation, and respective departments were open to new ideas. This compatibility provided a solid platform for the flow of ideas and the development and implementation of the new type of display.

The project’s success took both partners by surprise. Sales of the product increased by 18 percent, a dramatic improvement given that average sales growth for other comparable products averaged 3 percent without the benefit of the new formats. “We have been growing together spectacularly with this product,” said the supplier.

Another example at Leroy Merlin involved the implementation of a cross-channel sales strategy that encompassed both store and e-commerce distribution fulfillment models. The retailer has been working to transform its business model to combine these channels, and some suppliers are part of the project. Certain partners, such as a manufacturer of equipment machine tools and a curtain maker, were selected to test different supply chain fulfillment processes.

Leroy Merlin and its chosen suppliers combined their supply chains, interchanged key information (orders, inventories), and used their infrastructures (DCs and transportation networks). One of the tests was to use the complete joint distribution center network to deliver the products. The partners also explored ways to manage orders. Deliveries were dispatched from either the suppliers’ or the retailers’ DCs depending on a combination of lead time and cost.

The retailer commented on the project during a recent meeting with Tier 1 and Tier 2 suppliers. “The idea was simple, but not easy to implement. The supply chain processes are horizontal but the operation and management is, in practice, vertical, and divided between separate entities depending on each company, supplier, or retailer. One key factor was the openness of our suppliers to explore and experiment with the different alternatives,” said the company.

The Right Match

Engaging with core suppliers to develop supply chain innovations is increasingly important, especially when competing in highly dynamic markets.

However, leading suppliers or collaborators that are a good technical match are not necessarily effective partners in innovation. Supply chain managers tend to focus too much on the operational and technical capabilities of suppliers when developing these partnerships.

The model described here helps companies to choose the right partners and maximize their chances of developing the innovations that will help them maintain their competitive position. Along the way, they will align and enhance the learning process and improve their ability to drive innovations to successful exploitation.

The right integration of the three components will bring opportunities for improving the operational and strategic performance of supply chains in dynamic markets.

About the Authors

María Jesús Sáenz is the Ph.D. Program Director and Professor of Supply Chain Management for the MIT-Global Scale Network. She can be reached at: [email protected]

Luis Herrero Ph.D., is the CIO & Supply Director for Leroy Merlin, Spain. He can be reached at: [email protected]

Editor’s Note: This is the second in the series of Innovation Strategies columns from the MIT Center for Transportation & Logistics.

Part 1: How Many Supply Chain Innovations Are Truly Revolutionary?