Dire Situation with Driver Shortage Remains

According to a new analysis by the American Trucking Associations, the shortage of truck drivers has grown to nearly 48,000 and could expand further due to industry growth and a retiring workforce.

At a certain point, it seems like the ongoing truck driver shortage cannot get any worse, right?

Well, think again, because of myriad reasons we could well be in the very early innings of a game that is, and continues, to be hard to watch.

That was made clear in a report issued by the American Trucking Associations (ATA) today, entitled “Truck Driver Analysis 2015” by ATA Chief Economist Bob Costello and ATA Economic Analyst Rod Suarez.

The main takeaway of the report, which comes as it almost always does with these types of reports, arrives in the form of a staggering data point.

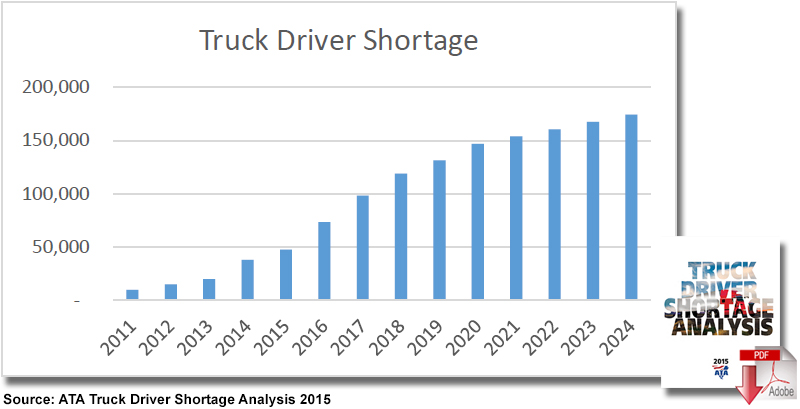

And here it is: the current shortage of truck drivers now stands at almost 48,000 and has the potential to go higher, due in large to industry growth and drivers parking their trucks on the way to retirement.

These are both prevalent industry themes to be sure, which, as per the usual, continue to raise more questions than answers, when it comes to how this issue is truly alleviated.

If you thought that 48,000 driver shortage figure cited by the ATA was extreme, the ATA has another one in its report: if current trends remain intact, the driver shortage could rise to around 175,000 by 2024.

And there is also the fact raised by ATA President and CEO Bill Graves in a statement accompanying the report that there continues to be a major challenge in finding qualified drivers, with Costello adding that that there is not only a numbers problem but also a quality problem in that while fleets are receiving applications for open positions, the majority of candidates don’t meet the required criteria to be hired.

According to ATA data, 88 percent of motor carriers indicate that most applicants are not qualified.

And here is some more data from the ATA’s report just to drive the current situation home:

- over the next decade, trucking will need to hire 890,000 new drivers, or an average of 89,000 per year

- roughly half, 45 percent, of demand for drivers comes from the need to replace retiring drivers

- industry growth is the second leading driver of new hiring, accounting for 33 percent of the need

While the report provides a pretty grim outlook of what the future may hold, it also provides a succinct course of action for possible solutions to this years-long problem, including:

- driver pay increases, which is already happening; more at-home time for drivers

- lowering the driving age from 21 to 18, noting the 18-20 year old segment has the highest unemployment rate of any age group

- improved driver image as the public perception of a truck driver is often negative

- getting veterans to enter the market

- receiving better supply chain treatment, as there are reports of mistreatment at shipping and receiving facilities, and

- autonomous trucks, which is far from being ready now but could eventually be used for longer, line-haul movements, with local pickup and delivery done by local drivers

Again, looking at the data really puts into perspective just how dire this predicament truly is, as well as what the future could hold should things not materially improve, especially if the dearth of unqualified candidates remains the same and carriers continue to deal with the ongoing challenges and realities in hiring and retaining qualified drivers.

What’s more, if there were to be real sustained GDP growth in the form of 4 percent or more, the current truckload capacity environment, which remains tight to be sure, could become far more challenging than it is today.

Add in the resumption of the hours-of-service restart rules and the federally-mandated electronic logging devices (the ATA said its analysis does not factor in the impact of federal regulations, like HOS and ELDs) on the shortage that will be in use sooner than later, and the recipe for a long and difficult road comes much more closer to reality every day.

Related: This Falls Hours of Service (HOS) - It’s Complicated!

Article Topics

American Trucking Associations News & Resources

March trucking tonnage trends down, reports ATA Trucking industry balks at new Biden administration rule on electric trucks: ‘Entirely unachievable’ Groups warn of $1 trillion cost for electrification of America’s trucking industry New coalition is focused on fighting new Labor Department independent contractor rule ATA data points to truck tonnage declines to start 2023 December Truck tonnage ends 2023 with a modest gain, reports ATA ATA warns of ‘tangled mess’ due to latest Labor Department independent contractor ruling More American Trucking AssociationsLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More TransportationAbout the Author