Cyber Risk, Superstorms and Economic Pressures Challenge Shipping Safety Progress

Shipping losses continue their long-term downward trend with 85 total losses reported worldwide in 2015, according to the Allianz Global Corporate & Specialty fourth annual Safety and Shipping Review 2016, which analyzes reported shipping losses of over 100 gross tons.

According to the Allianz Global Corporate & Specialty fourth annual Safety and Shipping Review 2016, “the economic downturn – and its impact on the shipping sector - is likely to have a negative impact on safety.”

The report, which analyzes reported shipping losses of over 100 gross tons, indicates:

- 85 large ships lost worldwide in 2015, down by 45% over a decade.

- Cyber exposure, “mega ship” salvage issues, and extreme weather heighten risk environment.

- Ship losses and piracy attacks up in top global hotspot – South East Asian waters.

- Economic and market conditions are pressurizing costs, raising safety concerns.

2015: Safest Year in Shipping in the Last Decade

Although the number of losses remained stable, declining by just 3% compared with the previous year (88), 2015 was the safest year in shipping for a decade. Losses have declined by 45% since 2006, driven by an increasingly robust safety environment and self-regulation.

Cargo and fishing vessels accounted for over 60% of ships lost globally, with cargo losses up for the first time in three years. The most common cause of total losses is foundering (sinking), accounting for almost 75% of losses, up 25%, and often driven by bad weather.

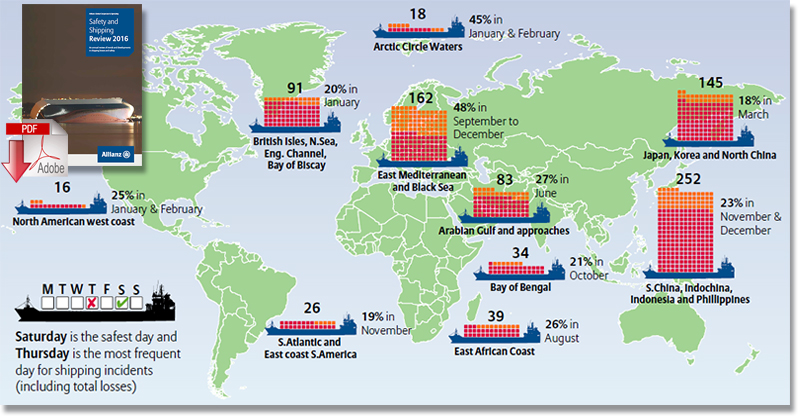

Thursday is the most frequent day for shipping incidents

Regional Comparisons

There were 2,687 reported shipping incidents (casualties including total losses) globally during 2015, down 4%. More than a quarter of all losses in 2015 occurred in the South China, Indochina, Indonesia and Philippines region (22 ships). Losses increased year-on-year, unlike other major regions. The U.S. eastern seaboard and North American west coast each reported two total losses in 2015.

Cyber Risk Evolves, As Piracy Threat Grows

The shipping industry’s reliance on interconnected technology poses risks. Cyber risk exposure is growing beyond data loss. There have already been a number of notable cyber incidents and technological advances such as the “Internet of Things” (IoT) and electronic navigation means the industry may only have a few years to prepare for the risk of a vessel loss.

“Pirates are already abusing holes in cyber security to target the theft of specific cargoes,” says Captain Andrew Kinsey, Senior Marine Risk Consultant, AGCS. “The cyber impact cannot be overstated. The simple fact is you can’t hack a sextant.”

For the first time in five years piracy attacks failed to decline in 20151. South East Asian attacks rose, accounting for 60% of all incidents. Piracy attacks in Vietnam surged year-on-year.

Superstorm Ship Sinkings

Exceptional weather events are becoming more commonplace, bringing additional risks and disruption to supply chains. This year, the effect of a “super” El Niño is expected to lead to more extreme weather conditions. Meanwhile, bad weather was a factor in three of the five largest vessels lost last year, including the El Faro, one of the worst US commercial maritime disasters in decades.

Read: 3 Ways El Niño Could Impact Your Supply Chain and What You Can Do About It

“The fact that superstorms are causing ships to sink is concerning,” says Sven Gerhard, Global Product Leader Hull & Marine Liabilities, AGCS. “We are seeing more and heavier natural catastrophe events. Weather routing will continue to be a critical component to the safe navigation of vessels.”

Economic Pressures Challenge Safety Advances

While the long-term downward trend in shipping losses is encouraging, the continuing weak economic and market conditions, depressed commodity prices and an excess of ships are pressurizing costs, raising safety concerns. AGCS has seen an increase in frequency losses over the past year that can likely be attributed to some extent to this environment.

“The economic downturn - and its impact on the shipping sector - is likely to have a negative impact on safety,” says Captain Rahul Khanna, Global Head of Marine Risk Consulting, AGCS. “Many sectors, such as general cargo, bulk and offshore, are already challenged and any drop in safety standards will be a serious case for concern.”

As well as impacting investment in vessel maintenance, cost pressures can impair crewing conditions, passenger ship safety and salvage and rescue. AGCS has seen an increase in fatigue-related insurance claims over the past decade. With crew numbers already often at their lowest possible level, and a future staffing shortage anticipated, longer shift patterns could exacerbate this issue. Meanwhile, training remains below par in some areas, such as electronic navigation, which should not be seen as panacea but as a complementary tool.

“Mega Ship” Salvage Issues

The appetite for ever-larger container ships has seen cargo-carrying capacity of the largest vessels increase by 70% over 10 years to 19,000+ containers. Two “mega ships”, the CSCL Indian Ocean and APL Vanda were grounded in February 2016, raising questions about a more serious incident. There are concerns commercial pressures in the salvage business have reduced easy access to the salvors required for recovery work on this scale. The industry may need to prepare for a $1bn+ total loss scenario.

Image: The Telegraph - Hoegh Osaka cargo ship aground in the Solent, in pictures

Related: Amazon’s New Status as an Ocean Freight Forwarder