Crude Oil Crashes Below $30 a Barrel for the First Time in 12 Years

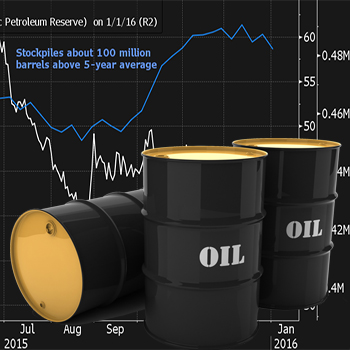

Oil dropped below $30 a barrel in New York for the first time in 12 years on concern that turmoil in China’s markets will curb fuel demand.

As reported by the Business Insider, oil prices continue to tumble.

The price of a WTI crude oil fell to as low as $29.96 per barrel.

This is the first time the price crossed below $30 since December 2003.

It happened in the blink of an eye before bouncing back a bit.

Falling oil prices seem to reflect a simple story of supply and demand.

Supply is high with the US fracking tons of crude out of its robust shale basins and Middle East producers refusing to cut production significantly.

Demand has been cooling with the global economy decelerating.

There’s also the strong dollar, which is known to move in the opposite direction of dollar-denominated commodities.

Meanwhile, stock prices are down again. The Dow is down 60 points (0.3%) and the S&P 500 is down seven points (0.4%).

The stock and oil markets have been moving in tandem as unusually low oil prices have been devastating to the bottom lines of the energy sector. Estimates for Q4 earnings having been coming down in recent weeks, largely due to the persistent weakness in the prices for commodities like oil. Stock market strategists at Goldman Sachs, Deutsche Bank, and RBC Capital Markets have all recently warned their clients about these risks.

“We expect [the energy sector of the S&P 500] will post a $2 per share loss in 2015 EPS, the first time that [last 12-month] Energy EPS has been negative since our data series began in 1967,” Goldman Sachs’ David Kostin said. “The write-down in Energy company assets has exacerbated the earnings hit from the 35% fall in Brent crude oil prices in 2015 following a 48% plunge in the commodity price in 2014.”

BP to Cut 4,000 Jobs in 2016 Amid Oil Rout

BP plans to cut another 4,000 jobs from its global oil-production operations this year, including in the United States, to cope with the ongoing downturn in crude prices.

That’s roughly 16 percent of the British oil major’s upstream operations around the world, and the cuts will double the number of layoffs BP had already announced during the 19-month oil-market slump.

BP on Tuesday was the first oil company in 2016 to signal another round of sweeping job cuts is coming even after oil companies shed more than 250,000 jobs worldwide last year, according to energy recruitment firm Swift Worldwide Resources. In the United States, the oil industry lost 70,000 jobs, the Federal Reserve estimates.

The firm wouldn’t say how many U.S. jobs it plans to cut but its domestic Lower 48 and Gulf of Mexico drilling operations are headquartered in Houston.

“We recently informed staff that we plan to further reduce numbers in our upstream segment by 2017 as we continue to simplify our business, improve efficiency and reduce costs,” BP spokesman Brett Clanton said in an email. He said the company would not make cuts at the expense of safety, BP’s “number one priority.”

BP’s upstream operations this year will shrink to about 20,000 employees.

Related: 2016 Logistics Rate Outlook: A Global Ripple Effect

Article Topics

The World Bank News & Resources

Increased Policy Uncertainty & Maturing Global Value Chains Weakened 2016 Trade Growth Trade Developments in 2016 U.S. Oil Closes Below $40 a Barrel for 1st Time in Nearly 4 Months Crude Oil Crashes Below $30 a Barrel for the First Time in 12 Years Understanding the Plunge in Oil Prices: Sources and Implications Customer-Driven Rail Intermodal Logistics: Unlocking a New Source of Value for China Containers on Rail: China’s Next Big Opportunity in Supply Chain Logistics More The World BankLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More Transportation