Building Supply Chain Resilience Is Much More than Fixing Supply Problems

Companies need to map these critical linkages in their supply chains when evaluating risk and resilience. When one element is disrupted, it is likely that other parts of the system will be impaired as well.

Last month, General Motors announced that shortages of microchips were partly to blame for a 40% drop in revenues in the second quarter of 2022. GM’s troubles are symptomatic of the supply shortages that continue to disrupt supply chains worldwide.

In such an environment, it is hardly surprising that fixing supply capacity issues is a top priority for companies. Moreover, as our analysis of operational failures underlines, supply capacity losses represent a leading cause of supply chain disruptions in general.

However, stabilizing this key capacity should not distract companies from other failure modes that threaten the integrity of their supply chains. Companies need to keep in mind that supply failures are often linked to other capacity losses, and understanding these interdependencies is important when planning responses to disruptions.

A laundry list of capacity problems

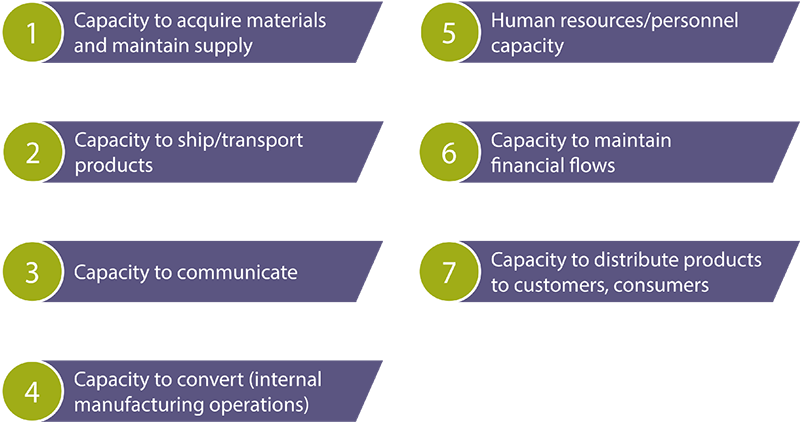

There are seven ways in which a supply chain can fail. Every supply chain failure involves the loss of at least one of the following core capacities:

The 7 Core Capacities of Supply Chains

Last year, we conducted an analysis of supply chain failures, comparing and contrasting eight disruptions in terms of these seven building blocks of supply chain resilience. These disruptions include Hurricane Katrina in 2005, the Sendai disaster, the start of trade wars between the US and China in 2019, and the Covid-19 pandemic. Our analysis shows that losing one or more of the seven core capacities hobbles supply chains in various ways. But supply capacity is the only capacity loss that occurred in some manner in every one of the crises analyzed.

A multifaceted challenge

The prevalent shortages in supply capacity that companies are experiencing today has surfaced an age-old question — how much capacity should we have? These are complex decisions that involve many factors including go-to-market strategy, target and minimum service level, financial requirements (working capital and capex), anticipated demand, risk tolerance, desired resilience and market conditions. And while making such assessments, it is important to understand the interdependencies that knit the seven core capacities together.

The furor over a scarcity of baby formula offers an example of the multifaceted nature of resilience. A root cause of the problem was the closure of a plant owned by Abbott, one of the few manufacturers serving the US domestic market for baby formula. This is a failure of a capacity to convert, Core Capacity No. 4 in the above list, which led to supply shortages at the retail end of the supply chain.

Take the example of the war in Ukraine, which is disrupting grain exports from Russia and Ukraine. For companies that use grain as a feedstock, this can be interpreted as a failure to maintain supply. However, a critical choke point is the closure of ports due to the conflict — a loss of capacity to ship and/or transport products. A recent agreement to allow some grain shipments out of Ukraine has eased the situation, but restrictions remain.

Companies need to map these critical linkages when evaluating risk and resilience. It helps if they understand the challenges associated with restoring each of the seven core capacities. Here is a summary of these factors.

- Supply: Capital intensity of supply system, achieving full utilization of replacement capacity, and the long cycle times required to recreate capacity (from months to multiple years).

- Transportation: Availability of mode, route, labor, and equipment. For example, ocean-going conveyances are capital intensive and acquiring them can be a lengthy process. Replacing over-the-road transportation requires capital and cycle times vary from long (e.g., when buying new trucks), to relatively short (e.g., when truck capacity is available for hire).

- Converting/Internal Ops: Availability of labor, equipment, and facilities. The TTR for a facility will range from short-term for basic ones (e.g., warehousing space) to several years (e.g., building semiconductor fab facilities).

- Human Resources: Availability of people, which varies according to their skills levels. This is a relatively short-term constraint, although demographic trends suggest longer cycle times.

- Communications: Availability of tech equipment and protocols for communicating internally and externally. The cycle time to recreate capacity is relatively short-term.

- Financial Resources. Capital and cash position, cash conversion cycle or CCC, working capital ratios, profitability, and debt-to-equity or D/E ratio. Relatively short-term issues if the firm has favorable ratios, but longer term or intractable if the firm’s ratios are poor. Businesses often fail through a lack of cash and/or credit.

- Distribution to Customer. Availability of distribution outlets to customers (i.e., retail and online stores and processes). This factor has become more complicated as e-commerce has grown and brick-and-mortar retailing has declined.

Anticipating the next threat

It is impossible to predict with certainty what the next large-scale disruption will be, especially at a time when there is so much uncertainty in today’s business environment. For instance, current tensions between China and the US over America’s support for Taiwan represent a long-term threat.

Military exercises carried out by China have demonstrated that the country could easily blockade Taiwan’s ports. There are no signs that this will become reality any time soon, but it is a scenario worthy of consideration given Taiwan’s importance as a global trading power.

One as-yet unrealized scenario that merits attention, however, is the likelihood of a large-scale cyberattack on supply chains. Cyberattacks can impact several capacities, including supply, shipping/transporting products, internal manufacturing, and distributing products. There are several ways in which companies might begin to prepare for such disruptions, here we offer a few suggestions.

Firms can identify suppliers that are digitally interconnected or have embedded code (such as microchips). These suppliers are therefore vulnerable to cyberattacks, and the firm should develop protocols for procuring from and testing those suppliers for cyber-vulnerabilities.

Firms also ought to coordinate with upstream and downstream partners to develop response and business continuity plans; this should include checking partner security measures and, if necessary, collaborating with them to reinforce IT systems against attacks.

Scenario planning is a useful tool for evaluating potential situations and response protocols, and past cyberattacks can provide a foundation for building initial scenarios that depict possible outcomes. A more thorough treatment is called for, but these are some starting points.

Overall, it helps to envision the seven core capacities as a system that makes up the foundation of the supply chain. When one element is disrupted, it is likely that other parts of the system will be impaired as well.

Supply Chain 24/7 Education Resource Center

Find the latest educational resources, degrees, and programs.

Visit: Supply Chain 24/7 Education Resource Center

Article Topics

MIT Center for Transportation and Logistics News & Resources

Supply Chain’s Next Decade of Dealing With the Unknown Sustainability Efforts Continue to Ramp Up, Research Finds Supply Chain Sourcing Alternatives to China DAT’s Caplice Reviews Spot Market Strategy for 2024 Budget Planning Yellow’s Demise Underscores the Need for a New Labor Relations Narrative Is Your Supply Chain Talent Ready for the Future? The Rebound Podcast: Yossi Sheffi and The Magic Conveyor Belt More MIT Center for Transportation and LogisticsLatest in Business

Ranking the Top 20 Women in Supply Chain Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Business