Best Practices for a Freight Market that is Heating Up

Anyone who has talked to a motor carrier knows that it costs a lot more to operate a truck today that it did three years ago.

You’ve heard the tale about the frog placed in boiling water—if you put it directly into boiling water, the frog has the sense to immediately jump out.

But if you put the frog in water that is room temperature and gradually heat it up, the frog will stay in until he goes to frog heaven.

Well, the freight market is starting to heat up, and smart shippers need to evaluate their supply chain strategies if they are going to control their costs before it’s too late.

Anyone who has talked to a motor carrier knows that it costs a lot more to operate a truck today that it did three years ago.

Despite the increased operating expense, shippers have been able to avoid significant rate increases to this point.

Why haven’t shippers seen more significant rate increases?

First, carriers these days are able to manage cost increases much more efficiently. Based on several ATA webinars as well as some recent conversations I have had with trucking company executives, the truckload and LTL carriers are doing a much better job of managing their operations and customer relationships. They have learned how to differentiate between attractive and unattractive freight and can price it accordingly.

Related: Top 50 Less-than-Truckload & Truckload Trucking Companies

The weak economy has also constrained rate increases, providing shippers with leverage in their rate negotiations. But after speaking with Gary Shilling and other noted economists, we predicted that if annualized growth in GDP grew by more than 2.5%, shippers would see capacity tighten followed by carriers instituting more aggressive pricing.

And that is exactly what has happened. With GDP growth in the last two quarters of 2013 exceeding 2.5%, it was no surprise that the ATA freight indexes also made advances while shippers and brokers saw sharp rate increases in the truckload spot market.

Smart shippers are considering these types of “Best Practices” to manage costs

While no one can predict whether this country is finally experiencing the type of sustained recovery that we have all been hoping for, forward-thinking shippers are looking at what they need to do right now in order to have the reasonably-priced trucking capacity they will need to run their business down the road.

Here are a few best practices for smart shippers to consider as they manage their freight costs:

- Evaluate which sales and procurement practices can be changed in order to reduce freight costs. For example, several companies throughout North America are focused on lean initiatives in terms of minimizing their inventories. But smart companies recognize the impact of lean initiatives tied to freight costs. Smaller and more frequent shipments are great, as are higher inventory turns, but as freight costs continue to rise, companies need an optimum balance between lean requirements and overall freight costs.

- Examine how carrier bids and souring events are conducted. The “core carrier” concept, taken to an extreme, can result in significantly higher costs when shippers force a core carrier to accept freight that doesn’t fit in their network. Companies committed to best practices look at “right carrier” initiatives where they select carriers based on the carrier’s networks and where their freight is moving. For LTL bids, look at the value of a customized base tariff in managing your LTL spend. We know from experience that shippers who claim the base tariff isn’t a big deal (because the carriers will just adjust the discount accordingly) are leaving a lot of money on the table. Looking at which base tariff, or whether a customized tariff, is right for your LTL shipments can be an extremely valuable cost-saving initiative.

- Commit to being a “carrier friendly” shipper. If you are wondering what a carrier friendly shipper looks like, you can download the white paper TranzAct published in conjunction with Logistics Management. In particular, you may want to take the Carrier Yield Test that is included in the paper. You can also check out C.H. Robinson’s excellent white papers on this topic.

The C-suite is paying more attention to freight costs

Finally, here is a word of encouragement—or caution, depending on your perspective. C-level executives are starting to pay attention to corporate freight costs.

At a recent conference with several CEO’s, the issues of managing freight and corporate supply chains received far more attention than I have seen previously. In fact, some CEOs told me that reducing freight costs was their company’s top three corporate objectives.

Some readers may view that as good news; others might be thinking, “Uh-oh.” Either way, committing to best practices and assembling the right team will allow you and your company to manage and reduce your annual freight costs. And that is good news for you and your C-level executives.

About the Author

Mike Regan, Chief of Relationship Development, TranzAct Technologies

Mike helped grow TranzAct Technologies to become one of the largest privately held logistics information and freight audit and payment companies in the United States. He is extremely active in and participates on numerous boards of industry specific organizations and is a highly sought after speaker for transportation related topics across the country.

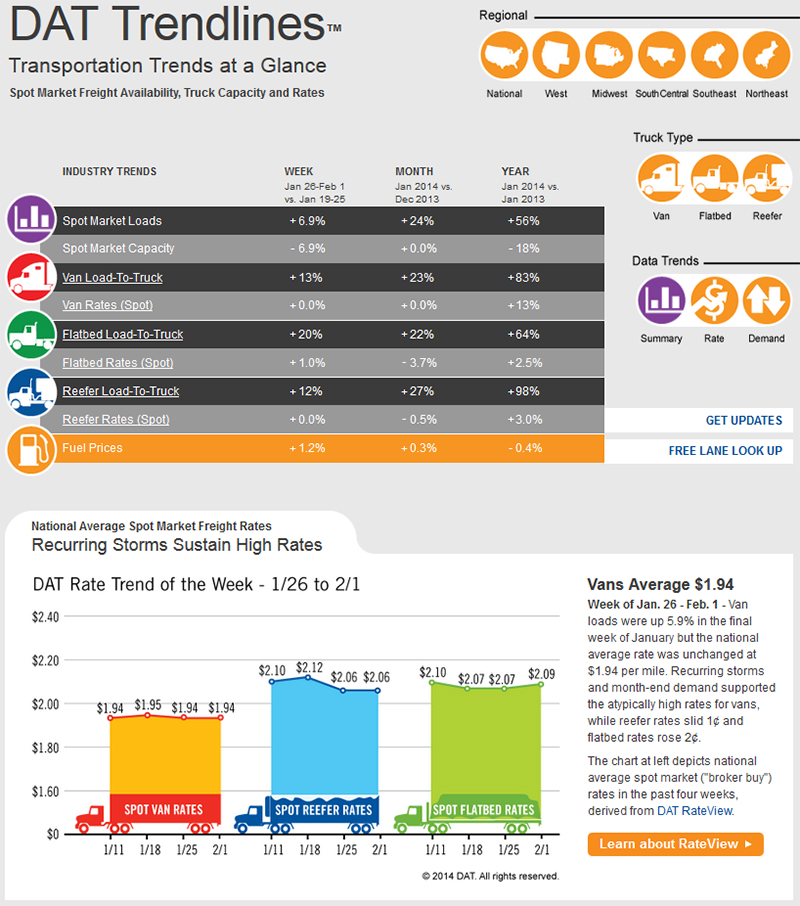

Transportation Trends at a Glance