Automotive manufacturing leads digital factory market, grows to $673 billion in 2030

Research suggests the companies that follow automotive OEMs’ lead and scale technologies with proven value will gain a competitive advantage.

The digital factory market will grow at a compound annual growth rate of 33% to reach $673 billion in 2026, according to a new report published by ABI Research, a market-foresight advisory firm.

Digital factory sales include the actual hardware revenues for entire industrial robots, collaborative robots, connected PLCs, intelligent industrial battery management systems, electric motors, pumps, tank management systems and smart glasses as well as data and analytics service revenues, device and app platform revenues, connection revenues, network service revenues, professional service revenues and security service revenues for all the above applications plus asset tracking and other equipment monitoring. Of these applications, only asset tracking includes connections both on and off the factory floor.

“Currently, most manufacturing equipment still communicates in proprietary protocols and connecting it in a cost-efficient way without too much custom code often requires the expertise of IIoT integration specialists,” said Pierce Owen, principal analyst at ABI Research. “For new factories, we have started to see how telcos and network infrastructure vendors can deploy private LTE, but so far, it only works if the plant owner has the negotiating power to demand cellular connected equipment from all its suppliers. These early deals could build trust and open new opportunities for cellular in factories.”

The automotive industry leads the way in the adoption of most digital factory technology technologies and represents the largest opportunity globally with $139 billion in digital factory revenues forecast for 2030, but ABI says this does vary somewhat country to country. For instance, by the end of 2022, digital factory revenues in electronics manufacturing will overtake those in the automotive industry in South Korea, the fifth largest smart manufacturing market.

“The automotive industry has demonstrated a willingness to scale transformative technologies ranging from generative design and additive manufacturing to IIoT connectivity and robotics of all kinds more than any other industry, but other industries will start to catch up over the next decade,” Owen said. “The companies that follow automotive OEMs’ lead first and scale technologies with proven value will gain a competitive advantage. Likewise, vendors that not only compete at the highest level in automotive but also continuously pursue new types of customers in other industries will build sustainable relationships and advantages across the sector.”

These findings are from ABI Research’s Digital Factory market data report. This report is part of the company’s Industrial Solution, which will help manufacturers digitize operations to create better quality products at lower costs. Market Data spreadsheets are composed of deep data, market share analysis, and highly segmented, service-specific forecasts to provide detailed insight where opportunities lie.

Automotive Products and Accessories

ABR series of imager-based bar code readers

ABR series of imager-based bar code readers

Compact bar code readers support track and trace.

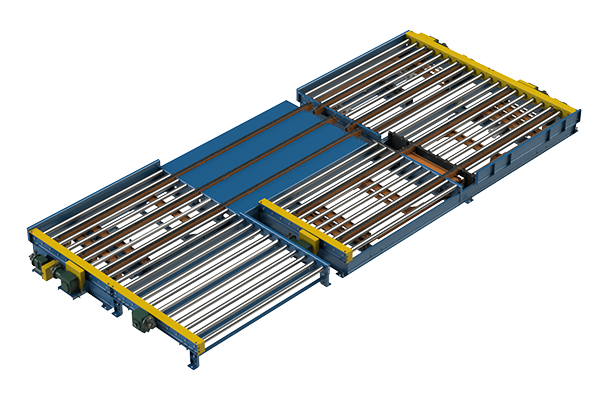

Automotive Pallet Staging Queue

Automotive Pallet Staging Queue

Pallet staging queue for automotive manufacturing.

UWB asset tracking products

UWB asset tracking products

System upgraded with real-time 3D tracking.

INS1000 inertial navigation system

INS1000 inertial navigation system

System ideal for maneuvering through challenging environments.

Drive Caster packaged solutions

Drive Caster packaged solutions

Powered caster moves 5,500-pound loads.

SK2000 closed back, tubular roll form columns

SK2000 closed back, tubular roll form columns

Strength enhancing features hallmark of racking.