Advanced Planning & Optimization in Transportation

The current industry trends in Transportation show that the transportation sector can be further optimized by using Advanced Planning and Optimization solutions.

Introduction

In this article we will provide examples of reliable forecasts that lead to better strategic and tactical decisions, but also examples of actual orders that influence and optimize operational and real-time decisions which lead to improved efficiency and customer service.

Subsequently we will explain the positioning of Advanced Planning and Optimization in relation to other IT solutions (e.g. ERP, WMS, TMS) and the opportunities and challenges faced by specific industries like postal & express, bulk & liquid and contract logistics and groupage.

We will conclude by providing some recommendations. This article is based on best-practices applied at various midsize and international companies on multiple continents.

Industry trends

The current environment for the transportation industry is recognized as challenging, given low margins, pressure on volumes and increasing fuel prices (see [1]). Additionally, the industry is characterized by a large number of smaller companies, although there is currently a strong trend towards further consolidation through mergers and acquisitions.

The extent to which transport is outsourced from shippers to third-party logistics providers (3PLs) varies by country, but is showing an increase as companies explore the potential for further synergies. In their 2012 supply chain trends study (see [2]), Gartner recognized a further trend towards improving customer service and innovation, in contrast to focusing on operational cost cutting and efficiency improvements. Their expectations are that freight costs, including fuel costs, will show a steady rise but remain volatile.

The effect of capacity constraints will again become apparent in the coming years, partly due to the retirement of a large section of the driver and logistics employee population, with fewer employees entering the industry. According to Gartner [2], major budget busters in transport are mode shifts (also linked to globalization), lead time compression, volume changes, government regulation, penalties and surcharges, carrier restrictions and performance, as well as regulations relating to the environment/carbon footprint.

Finally, the study identified a significant increase in moves towards horizontal and vertical partnerships. For the longer term (the next ten years) the expectation for western Europe is that transport volumes will continue to grow by 2-3% annually (even assuming 0% growth in the wider economy), while it is anticipated that driver availability will become limited, leading to scarcity in staffing resources.

Against this background, it is crucial to look at ways transportation can be optimized. Advanced Planning and Optimization can support this process in a number of ways: by making better strategic/tactical decisions based on reliable forecasts, and optimizing operational/real-time decisions to improve efficiency and customer service based on actual orders and real-time information.

This article also considers how Advanced Planning and Optimization can support specific logistics concepts and sub-industries, and the positioning of these optimization tools in the IT landscape for transportation. We will discuss these two aspects both for private fleet operators and logistics service providers (referred to as LSPs below).

Related White Paper: Fact-Based Tactical Routing in SAP TM

Opportunities presented by optimization technology

From a technical perspective, traditional routing and scheduling applications for transport use batch planning algorithms to create an optimal set of routes for each day’s deliveries. Running groups of orders through a batch solver allows many alternatives to be considered and, in this way, provides better, more optimized solutions than a manually produced solution.

However, businesses are becoming more dynamic, with users having to make trade-offs between optimal and feasible routes and to adapt to changes in the course of the day. In line with this, newer real-time routing solutions are emerging that enable real-time communication between the routing application and drivers to track their activities and locations. When necessary, drivers are re-routed “on the fly”, which involves a trade-off between cost and service. Initial solutions will be ‘dispatcher-centric’, with limited communication with the driver, but more efficient solutions will follow that can automatically and proactively respond to real-time developments.

From a change management perspective that considers the phased introduction of improvements, Gartner (see [2]) identifies different levels of transport optimization. Gartner defines a progression from (1) basic execution, through (2) cost avoidance and partnership, and (3) productivity and process integration, up to the ultimate level of (4) demand-driven profitability. For transport this implies that the trend is moving from focusing on cost with sufficient capacity towards service in conditions of tight capacity. For the company, this means both embracing adaptive planning and taking a forward-thinking approach.

There are numerous ways optimization software can support this, most obviously by creating more efficient routes and improving utilization (in advance and during execution), but also by improving and centralizing the planning process, and by widening the scope of control.

Integrating real-time information into the optimization engine and using mobile communication devices to keep drivers, management and customers informed improves transparency, employee satisfaction and service. Centralizing transport also creates opportunities for synergies between divisions.

Examples include integrating transport across multiple depots or integrating outbound/inbound or domestic/international movements. Moreover, optimization engines can help to optimize the supply chain as a whole rather than focusing solely on transportation. Examples include balancing the workload at the DC, integrated production and transportation planning for manufacturers, and integrating routing with inventory management at customer sites.

These aspects are discussed in greater depth in the remainder of this document.

Optimizing the planning process and organization

As discussed, optimization technology helps to centralize the planning processes. The physical location of the users may still be decentralized, but they are working within a central system, with aligned centrally agreed planning processes. The software helps to define a clear planning process, to efficiently organize the necessary data and manage the quality of data, as well as define key performance indicators (KPIs) to inform decision-making on quality. In practice only a few KPIs are really important, e.g. service (on-time delivery), cost/efficiency (e.g. cost per unit), revenue/margin per truck/customer, and robustness of the plan (planned against actual).

The job description for each role in the planning department can incorporate target KPIs, such that the focus shifts from a “9 to 5” approach where the aim is for planning to be finished at a certain time to one where the KPIs are met. This goes hand in hand with an increase in related responsibilities, boosting the status of the planner, rather than the introduction of optimization software being viewed as a threat.

In global terms, transport planning activities are split across different roles and functions. Technically speaking this means that each user has their own screen layout, functions and authorization levels. A central “functional manager” (e.g. a key user) maintains the central parameters, configuration and master data. Users can see relevant data from other users (e.g. in adjacent regions or adjacent process steps) to help them align and optimize the entire process. This split also applies at the detail level since filtering and workflow aspects in the software mean the user is focused on specific data or on issues relevant to their role. This and the automation of various steps together with the use of optimizers means the scope of control for each user is significantly increased.

Phased implementation is critical for smooth and effective implementation of the optimization software. This is particularly true for the introduction of optimizers. Planners who are not used to working with optimizers and only get to see the end results may lack a proper understanding of the plan simply because they did not personally create the plan. Creating an initial plan interactively (using the optimizer with a limited number of orders and trucks) helps to keep the planner in control. Once they have become more competent, planners can engage in internal competitions to create the optimal plan using the software (e.g. in a workshop, or by nominating the “planner of the week”). Companies also have the option to (anonymously) publish efficiency KPIs internally or externally on a regular basis.

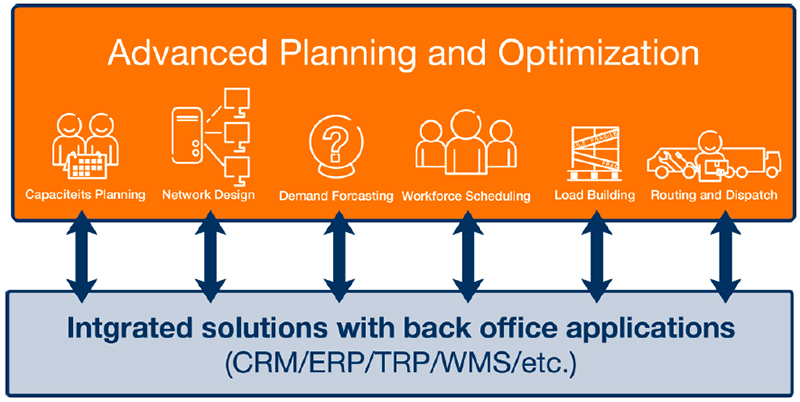

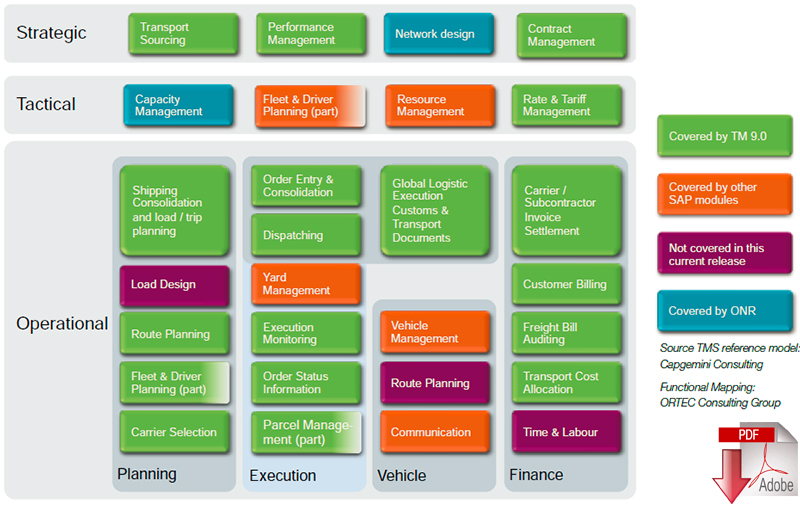

The IT landscape for optimization software

Most ERP and TMS systems also support a number of transport planning functions. Until recently, they only supported very basic manual planning functions, but nowadays they also support geocoding, time/distance calculations, a map and/or Gantt chart, plus integration with Track & Trace systems. However, powerful optimizers that can assign orders to routes (or routes to resources) with more complex decision-making rules, are still not available or only available to a limited extent. This applies in particular to “last mile” delivery functionality, which requires the optimization of a large number of stops within a route, allowing for detailed restrictions such as planned and real-time congestion, vehicle type accessibility, driving time regulations and required capabilities. The consequence of this is that the last 3-5% savings in transport optimization always remain just out of reach. To achieve this you really need advanced optimization that is capable of evaluating multiple options and taking a large number of constraints into account.

WMS systems are focused on managing the storage and picking process, but the business rules for optimizing the efficient loading, routing and utilization of trucks are somewhat limited in scope. WMS systems do not include (or have very limited capabilities for) routing optimization, particularly dynamic routing. Most WMS systems contain functionalities to store static routing patterns for distribution. They provide the necessary information input from the orders to do the routing optimization. This means that the routing optimization software is connected to the WMS system for the input of orders, and returns the output in order to start the picking process in the warehouse.

Mobility solutions are becoming more and more critical in the world of logistics. This is in terms of not only Track & Trace data, but also onboard computers, PDAs, scanning devices, and mobile apps on smart phones. Sometimes the suppliers of these solutions also provide simple routing solutions for the home base.

In conclusion, optimization software forms the bridge between more administration-oriented systems (such as TMS, ERP, WMS) and mobile devices (like onboard computers, PDAs, apps). Optimization software has the lead role in terms of optimizing the transportation, but also in supporting optimization during execution. This ensures planning and execution can work effectively together, with options for integration. To support the connection to other systems, optimization software must have real-time interfaces (or a complete integration) with both the administrative system and the mobile application, whereby the key objective is to effectively manage all the different statuses from both ends, and propose effective solutions for transport execution.

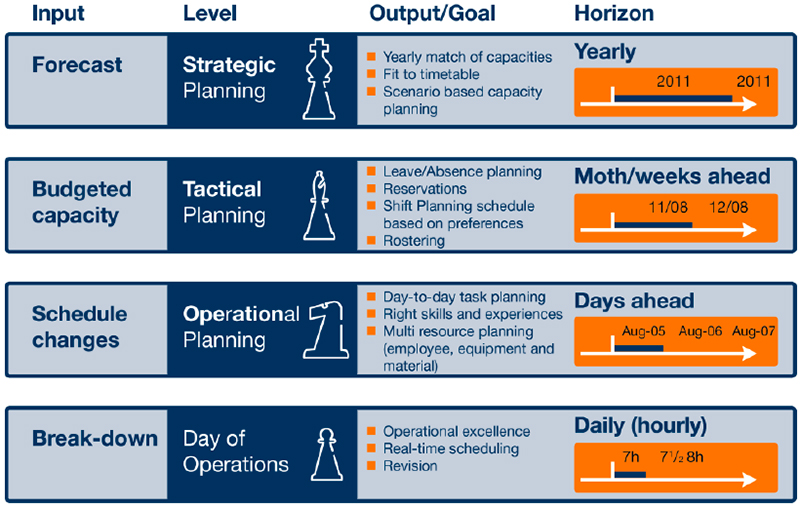

Optimizing at different levels: from strategic level to operational

Optimization software has key benefits for all horizons: from multi-year strategic planning to daily planning & execution. Strategic decisions are decisions for multiple years, like infrastructure optimization: identifying the best location for a DC/warehouse, including assignment of product groups to locations, assigning regional customers to a DC, etc. Tactical decisions are typically for a few months, such as optimizing the fleet (size, type, number), using the in-house fleet or subcontractors (and which subcontractor), and computing the impact of customer changes or new customers.

In various sub-industries it also makes sense to create master routes, e.g. for scheduled visits to retail and manufacturing depots. It is also important here to analyze frequency and delivery days: the goal is to spread the workload over the week, and cluster by day to create efficient routes, while satisfying customer and stock constraints. Note that availability of the product at the DC (or production location) is also relevant here, and whether picking or production allows for and/or is efficient enough to make the proposed transportation plan feasible. In general, the benefits for strategic/tactical optimization are greater than for operational/real-time optimization, but the related impact and implementation aspects must also be taken into account.

At a tactical level, computing the required workforce is also relevant, not only for drivers, but also in terms of the warehouse and other logistics operations (if relevant). This requires forecasting and capacity planning to compute the expected load of all the tasks and their requirements, and to create feasible work shifts from these tasks. This capacity plan is important for computing the size of each team: how many shifts are required to work per 24-hour period or week, and how to plan for annual leave and public holidays.

The main objective in the operational process is to create efficient routes from the given orders and to optimize fleet utilization. Where the order sizes are small and there are a high number of restrictions (e.g. due to service constraints or accessibility of the locations), the power of the optimization software really makes itself felt. Creating routes and assigning routes to trucks can take place in a single step (e.g. in outbound distribution for shippers), but can also be done in separate steps.

There could be a number of reasons for this: (1) timing: creating the routes is important for the picking process in the warehouse, and needs to take place at an earlier stage, (2) centralization: the loads can be created at DC level or division level, but resources can be assigned at a more central level, allowing resources to be shared between divisions, and decisions to be taken on when and where to use sub-contractors, or (3) splitting up tasks has the advantage that routes are created in the most efficient way, rather than on the basis of suggestions from drivers or drivers‟ privileges.

Both creating the routes and assigning routes to resources can lead to complex puzzles with a large number of constraints, including driving time legislation, congestion and required service and capabilities. In some sub-industries this is handled as a daily batch optimization (e.g. in retail distribution), but it can also be a rolling process throughout the week (e.g. in 24-hour business, international transport, etc.). For transport companies it is also important to plan for both the known and unknown orders (e.g. pick-ups), which will be added at a later stage during execution. For distribution planning this is usually resolved by incorporating regular pick-ups (based on history) in the plan at the beginning and by reserving time in the route for unknown orders.

When assigning routes to resources the objective is to utilize the fleet effectively (maximum number of utilized hours per truck) and to minimize repositioning (empty mileage). Additional constraints are driving time legislation, and getting drivers back to their home base. The combination of truck, driver and trailer can be flexible, so there may be the potential to implement logistic concepts such as drop and hook, swap trailer, hot seating or trailer pools. In the case of intermodal transport you can reduce trailer transportation costs by using (unguided) intermodal transport: this means computing the best route for the trailer, given all the modalities with their tariffs, timetables and service conditions.

During execution, real time information is input into the optimizer. This could be new (or canceled or changed) orders from the administration system (TMS, ERP, WMS), but it could also be changes related to execution itself, such as actual arrival time (based on GPS or geofencing), changes to delivery sequence, changed volumes, canceled or refused deliveries, and missed pick-ups. For the latter a new visit should be created, but depending on the reason the cost of the current visit should be charged. Proposals for adding new orders (at the order entry stage if possible, or proposals via the web) are also important functions.

Filters are useful in efforts to minimize disruptions to the current operational plan as they allow the dispatcher to concentrate solely on any disruptions or other issues that arise. This usually involves manual intervention to assess the disruption. Where unacceptable, orders should be planned again. It is also essential to maintain effective control during execution in order to ensure a high-quality operation. Optimization software supports dynamic route optimization with the capability to recalculate and visualize expected arrival times and to inform customers where relevant. During and after execution of the plan, planners can review the operational results by tracking performance, particularly for subcontractors (e.g. costs per vehicle/km, loading rate, vehicle utilization per route, etc.).

Moreover, the real-time integration of onboard computers and mobile devices makes it possible to compare planned versus actual routes, to recalculate ETAs in the event of congestion or delays, and therefore to optimize the entire transportation process. The results of the planned or actual route can be used as the basis for “self-billing”: the pro-forma invoice which the sub-contractor charges to the client.

Fact-based Tactical Routing in SAP TM

Opportunities and challenges for specific sectors

Each sub-industry has its own opportunities and challenges for further optimization. Some examples are:

- Postal and express delivery services: this sector is characterized by large number of stops for collection/delivery, a critical sorting process, and an overnight linehaul and/or air forwarding system for the best possible customer service. Creating tactical linehaul schedules, and computing areas for pickup and delivery (PUD) is essential. In operational terms, dealing with variations in volume and keeping changes to planned schedules to a minimum while still achieving the desired utilization and loading efficiency all represent key factors. This requires effective operational distribution optimizers. It is essential for the planning system to deal effectively in real time with a large number of unscheduled pick-ups. In this industry the combined capabilities of distribution optimization and supporting execution are therefore critical. Computation of the tactical overnight line haul schedule can be a complex task in the postal/parcels industry. This includes the optimal routing of the goods from origin-depot to destination-depot (which intermediate location/hub to use, taking into account volume and service), assembling loads between these locations and creating a schedule, ensuring that trucks are utilized in an optimal way. Pickup and delivery (PUD) must be optimized in such a way that regions remain balanced. Driver workloads should average out as evenly as possible. Boundaries between regions should remain flexible to optimize service and minimize everyday costs; they must not so flexible, however, as to cancel out the benefit of drivers’ familiarity with their own regions.

- Bulk goods and liquids: this sector includes shippers with their own fleets (e.g. oil and gas, animal feeds), as well as companies that transport liquid chemicals and foodstuffs. The key factor for this sub-industry is loading optimization, which involves compartment loading, ulage rate and axle weight constraints as well as contamination and cleaning restrictions. Loading optimization is very complex, but becomes very relevant, due to increased safety and security requirements.Computers can evaluate the options and make decisions based on complex restrictions far more quickly than human beings.

- Logistics contractors/own shipping department: the first step is to compute which orders should be combined to form efficient loads, such that utilization and clustering of deliveries is optimized, and taking all restrictions into account. While creating those loads, stackability or other loading rules can be taken into account to optimize trailer utilization. In retail or production depots, output from this step can be sent to the warehouse to initiate the picking process. The next step is to assign the loads / routes to the resources; in some cases this step will be combined with the previous step. 3PLs may opt for a multi-depot approach: an individual shift for an individual driver may include a number of different customers and DCs in order to minimize empty mileage. In some sections of the industry (e.g. transport of new vehicles for the motor trade) the loading order also represents a complex computational puzzle.

- Groupage: as with postal and express deliveries, in groupage you want to optimize the outbound delivery routes and, during execution, optimally assign the pickups to the best routes. Groupage can be international as well as domestic, and a rolling horizon approach is key. International shipping may involve intermodal transport (ferry, train, shortsea), and a trailer swapping system can be implemented to increase the probability of drivers being able to spend their rest days at home.

Configuring and fine-tuning the optimization software is essential to enable companies in these sub-industries to reduce costs, improve service and keep ahead of their competitors.

Examples, results and recommendations

Given the current economic situation, transportation companies are constantly looking for ways to improve their utilization and market positioning. Advanced planning software has an important role to play here. A number of companies have excelled in recent years, one such company being TNT Express. Use of optimization software has helped this company to improve its operational result by over 200 million Euros over the past few years.

Optimization has now become “part of their DNA”, a fact borne out by TNT Express being awarded the prestigious Franz Edelman Award 2012 (see [3]) for best optimization implementation world-wide. Similarly, Coca-Cola has saved up to $45 million in annual costs and made significant improvements in service and sustainability by moving from static to dynamic routing (see [4]). Medium-sized domestic transportation companies with less than a hundred trucks also stand to gain a great deal from using optimization software. For complex routing puzzles, as with bulk materials and liquids (dealing with compartments), over 5% savings are obtained, even when using only 15 or 20 trucks. Market research conducted by NEA (Dutch Research Institute on Transport) has shown that companies implementing optimization software can expect costs savings of between 5% and 9%.

The present economic crisis can be seen as a unique opportunity to redesign and optimize the operational model currently used by the transport industry. Modern technology and advanced planning systems provide transport companies and divisions with the best weapon not only to survive market pressure to reduce costs, but also to gain an important competitive advantage. This technology also helps to build new services to the customer, centralize and reorganize the planning process, and react in a more flexible way to ad-hoc changes. Given modern technology aspects like SaaS and subscription-based models, the upfront investments are quite limited. It is for this reason that although there is a crisis, we also see a considerable increase in Advanced Planning & Optimization investments.

References

[1] Transport Intelligence, Global Transport and Logistics Financial Ratio Analysis Report 2012.

[2] Gartner, Hype Cycle for Transportation, Dwight C. Klappich, 2012.

[3] TNT Express. ORTEC and Tilburg University, How Operations Research became part of the DNA of TNT Express, Franz Edelman Award winning contribution, 2012.

[4] G. Kant, M. Jacks and C. Aantjes, Coca-Cola Enterprises Optimizes Vehicle Routes for Efficient Product Delivery, Interfaces 38, p. 40 – 50, 2008. Finalist Franz Edelman Award 2007 for best optimization project world-wide.

About the Author

Goos Kant (born 1967) is professor of “Logistic Optimization” at Tilburg University. He is involved in masters courses for the Operations Research department, supervises BA and masters students’ theses, and teaches on MBA courses at TiasNimbas. He is project leader of the Dinalog R&D project on improving urban freight transportation.

Goos also works as a managing partner at ORTEC. He is globally responsible for all solutions, including the transportation industry. His primary area of interest lies in optimizing transportation, taking into account various related processes in the supply chain such as warehousing, production and customer requirements. Particular interest is now being shown in sustainability and collaborative approaches, which will form interesting subjects for further scientific research and innovation projects.

Goos is involved in the TNT Go Academy, was editor-in-chief of the STAtOR journal (STAtOR is the Netherlands Society for Statistics and Operations Research), and is a member of the ORTEC’s supervisory board. He holds both a Masters Degree and a PhD in Computer Science.