7 Actions to Drive Demand Planning During the COVID-19 Pandemic and Prepare for the “Next Normal”

In many industries, demand has never been more volatile and unpredictable than during the COVID-19 pandemic, in this article we detail seven action items to drive demand planning despite an unprecedented crisis.

Demand Planning in a Crisis

Over the past years, demand planning has become a relatively routine task for many company planners.

While still not perfect, many firms established S&OP processes, took advantage of sophisticated ERP systems, and introduced new AI tools.

This resulted in higher levels of planning accuracy than ever before.

Common demand patterns in the crisis

However, the COVID-19 pandemic triggered unprecedented demand shocks - both up and down - and amplified volatility across many industries.

This was (and still is) a stress test for demand management processes.

Here, we require new best-practices to achieve crucial visibility.

Common Demand Patterns in the Crisis

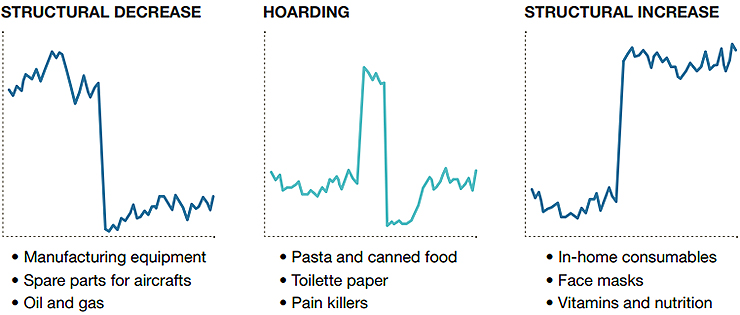

As the virus started to spread across the globe, many industries were hit by developments that were hard to imagine before.

The lock-downs - first in China and later across the globe - forced many manufacturers and retailers to shut down their operations. Major manufacturers like Ford, Volkswagen, and Boeing closed many of their factories. Likewise, non-grocery retailers like Apple, Zara, or Ikea were not considered essential and had to shut their stores in many countries.

As a consequence, orders at suppliers and more upstream partners dropped significantly - often all the way down to zero. Similarly, other demands have structurally decreased due to changing behaviors and new circumstances, everything from special potato varieties used for French fries in restaurants to luxury goods affected by travel bans on Chinese tourists to spare parts for aircraft affected by the grounding of entire fleets.

Given the rapidly increasing uncertainty, many end consumers started panic-buying and emptying supermarket shelves. In particular, goods like canned food, pasta, and pain killers saw huge spikes in demand at the beginning of the crisis that was often followed by drops in demand to below the pre-crisis levels a couple of weeks later. In other settings demand structurally increased, due to channel shifts from out-of-home to in-home or based on higher consumption.

An extreme case is in the medical sector where products like hand sanitizer, face masks, and other personal protective equipment (PPE) saw demands that surged by a factor of up to 100, making it impossible for supply chains to cope.

Shifting Key Challenges and Demand Planning Priorities

Supply chain managers had to change their practices given the completely new challenges.

Key Challenges (Pre-Crisis)

- Automate routine planning processes to reduce planners’ workload

- Incorporate the effect of own and customers’ promotion into forecasting processes

- Manage product life cycles with new product launches and products at end of life

- Ensure discipline to uphold data quality and data timeliness for planning

- Improve statistical forecasting and advanced analytics algorithms by tweaking parameters • Improve capabilities in using the system

Planning Priority (Pre-Crisis)

- Increase forecasting accuracy from high to very high levels while increasing planners’ efficiency

Key Challenges (COVID-19 Crisis)

- Traditional statistical models cannot rapidly capture new demand realities/non-existing historical demand patterns

- Anticipate new and irrational customer behaviors, e.g. hoarding or phantom orders

- Dynamics based on government measures, e.g. plant closures and re-openings, lock-downs and border closures

- Build capabilities for understanding the implications of the whole ecosystem on-demand

- Evaluate external in uences far more and handle new data sources

- Extend activities beyond demand forecasting and forecast other important factors e.g. availability of supply or product capacities

Planning Priority (COVID-19 Crisis)

- Create forecasts that are good enough to enable scenario planning for minimum and maximum demand

In normal times, priorities in planning have focused on increasing forecasting accuracy from already high to very high levels, while striving for automation to reduce the workload of planners. This was difficult given the challenges imposed by poor data quality, changing product life cycles, or frequent promotions.

During the pandemic crisis, however, planners are facing completely different and more fundamental challenges. Their well-established ERP planning systems, which use statistical forecasting models, are not able to adjust quickly to the new demand realities. Any traditional forecasting approach that is based on historical time series needs a longer time period to capture new levels and trends. Besides, customers behaved completely differently than in normal times and often completely irrationally.

Probably the best-known example is toilet paper, which was practically sold out for weeks because replenishments often did not even make it onto the shelf. Many consumers fell for the psychological fallacy and started stockpiling to prepare for uncertain times. In addition, it was difficult to anticipate and incorporate dynamics based on government decisions in the planning processes, and information on down-stream inventories and lead times that might provide some insight into demand trends were difficult to obtain.

As a result, the priorities of demand planning during this crisis have shifted significantly toward enabling forecasts that are good enough for reasonable scenario planning. For cost-intensive decisions such as plant openings, layoffs, or sourcing contracts, it is essential to have a realistic idea of the minimum and maximum demand with a range that is ideally as small as possible. If demand is significantly higher than the maximum expectation, firms have to expedite shipments, need to find costly alternative suppliers, and lose time training more workers. If demand is below the minimum expectation, excess inventories build up, orders must be canceled and staffing costs surge.

Overview of Action Areas and Recommendations for Demand Planning

To match supply - at least loosely - to demand, supply chain managers must leverage all available resources and introduce new practices, which we group into seven action areas.

1. Change Forecasting Models

To better understand the challenges of many forecasting models in rapidly changing situations, it is important to be familiar with some standard forecasting approaches. Many demand planning systems are configured to generate demand forecasts using statistical time-series models, such as exponential smoothing.

These models only consider sales data from prior periods and typically work well if demand is relatively stable, shows clear seasonality or/and growth. However, if demand is rapidly ramping up or down, the models need time to adjust to the new realities and lag behind real-world sales patterns leaving forecasts that are structurally too low or too high.

The chart to the right illustrates how the forecast lags behind actual sales: As demand drops, the forecast is initially too high, and later, it is too low as demand recovers. Therefore, it is important to switch-off these traditional algorithms if demand changes quickly, especially if they are connected to automatic replenishment systems.

Many modern AI systems already generate forecasts with dozens of different algorithms. As the system realizes a poor performance of the algorithm that is normally working well, it can automatically tune to alternative models that currently work better and obtain structural insights from the many SKU-store combinations simultaneously observed. If this is not supported, manual overrides need to do the job - in many situations, even a simple moving average of the sales of the past three days or weeks works well. As more data becomes available and the volatility drops it is time to revisit the model selection.

Recommendation

- Switch-off traditional forecasting algorithms, especially if connected to automatic replenishment

- Implement machine learning algorithms that are able to learn the new situation much faster/auto-selects better-forecasting algorithms

- Override forecasts manually that cannot be adjusted easily by new algorithms

2. Identify Future Demand Drivers

To model structural shifts in demand, it is important to build demand models that consider the factors that really drive the demand. For example, for a food manufacturer, it is important to consider the opening and closing of different channels: Demand for a portfolio of professional products is driven by the number of open restaurants or canteens whereas demand for the consumer portfolio is driven by structural shifts to in-home consumption that is served by online stores or supermarkets. Besides, market shares, price surges, and (de-)listings are important factors to consider. In other industries, demand drivers could be GDP developments, investment activities, or recoveries of down-stream customers.

Ultimately, managers should set up predictive demand models that use the individual demand drivers identified, but also disease and lock-down information. Good examples are airlines that need to predict demands in their network. To estimate passengers on the leg between New York and Munich factors like business trips, canceled events, and travel bans must be considered.

Recommendation

- Forecast structural shifts in demand due to new customer needs, changing distribution channels, or investment stops

- Set-up analytical predictive models, using demand drivers, disease information, and available lock-down information

3. Understand Supply Chain Dynamics

While many companies were directly and immediately affected by demand disruptions at the beginning of the coronavirus crisis, more upstream players, such as in the chemical or semiconductor industry, only see the effects on their demands over time. With many stages between them and the end-user of their products, long lead times, and high safety stocks, these companies will only observe demand changes after months. It is therefore critical to establish transparency on the sale of the goods in which their products are used.

For example, a coatings manufacturer must monitor the automotive market. If sales of new cars shrink by 25%, the company should challenge any customer information indicating that demand is at pre-crisis levels. Secondly, it is essential to understand the dynamics in the supply chain and to estimate the downstream inventory levels and lead times. Thus, it is possible to understand when any demand shift affects an upstream player. If, for example, production for a certain product is ramped up after the shutdown, any uncoordinated supply chain will take months before orders are received by a third-tier supplier. Further, demand patterns might be hugely inflated based on the well-known bullwhip effect and additional stocking and de-stocking of safety stocks. Companies without smart planning could overreact.

Recommendation

- Predict end consumer demand and available capacity in the supply chain to challenge customer orders

- Consider the effect of lead times and inventories on own demand

4. Increase Communication With Customers

Direct interactions with customers are an important element in understanding future demand. In the COVID-19 crisis, intensifying customer collaboration through frequent updates on order forecasts and downstream customer expectations about market developments can help to improve transparency. Establishing joint planning is particularly useful when a few key customers capture a large portion of the demand. However, it is also essential to challenge any demand assumptions to avoid customers inflating their expectations. To avoid any shortage, gaming it out might also be required to play hard and remind customers of their contractual obligations.

In the case of extreme demand-supply mismatches, it is helpful to engage neutral independent parties to help with the allocation. One example is the Japanese Auto Association that was called upon after the Fukushima crisis to take an intermediate role to ensure a fair allocation of short components - with the goal of maximizing the overall output of all affiliated plants.

Recommendation

- Intensify customer collaboration through frequent updates on order forecasts and downstream customer expectations on market development

- Establish joint planning with key customers and challenge demand from customers to avoid shortage gaming

- Use neutral independent parties (Industry Associations) to solve/help allocate extreme demand-supply mismatches

5. Restructure S&OP Processes

Well-designed and properly executed sales & operations planning processes have always been a key asset for successful companies. This is particularly true now: Companies that had set up cross-functional teams, defined clear roles, and engaged in scenario modeling often did not have to change much. These companies just increased the frequency of their S&OP meetings and ensured that any information was synchronized and updated before the meetings. In addition, they paid more attention to monitoring transportation and supply to keep their different scenarios up-to-date.

However, firms that did not do their homework needed to learn their lessons fast - Excel does not provide the required functionality to assess implications of demand and supply disruption on a daily/weekly basis. Companies set up war rooms with cross-functional teams consisting of data analysts, demand planners, and sales, and met frequently to adjust for volatilities in demand. As tools, many companies took advantage of control tower solutions like One Network Enterprises, SAP IBP, o9 Solutions, and E2Open. Clearly, the crisis accelerates the adoption of these tools. Read: One Network Named a Leader in Nucleus Research’s Control Tower Technology Value Matrix 2020

Recommendation

- Set up a cross-functional team consisting of data analysts, demand planners, and sales (if not already done!)

- Increase frequency of S&OP meetings and emphasize a focus on monitoring supply and transportation

- Ensure input on demand and supply changes is synchronized and updated right before S&OP meetings

6. Plan Product Portfolio

During the crisis, many firms streamlined their product portfolio in order to cope with surges in demand. They focused on A-products, standardized packaging for different countries, and stopped producing products on the long tail. As a result, manufacturing processes could be simplified (both internally and at suppliers) and maximum output is increased.

There are also planning advantages as demand is pooled across different SKUs and the challenge of correctly forecasting the SKU mix is greatly reduced. As the crisis recedes and the higher output is no longer required, it is important to see this as an opportunity to plan the future product portfolio. Companies must learn which B and C products are still required in the “new normal” also called the “next normal” (see below). Here, the A/B test can be an important tool to sense the real demand, that is to start experimenting to reintroduce some of the B and C products back into the portfolio; this will drive the agile supply chains much more.

Recommendation

- Focus on fast movers to manage planning effort

- Reduce portfolio of slow-moving products to pool demand and decrease demand uncertainty

- Sense demand developments based on A-B testing

7. Clean Data For The Future

In a final action area, the planners must prepare their data for the recovery. As discussed above, the crisis has affected many demand patterns that might return to normal once the situation improves. However, if a planning algorithm makes forecasts based on “actual” data that was “distorted” during the crisis, automatic forecasts will not achieve the required accuracy.

For example, the demand peaks and dips for toilet paper sales in the winter/spring of 2020 will certainly not be a relevant source of data for forecasting the seasonal demand in 2021. Therefore, planners need to define the right baseline data for forecasting purposes. This could be the data from winter/spring 2019 that might be manually tweaked to link it to new products or other structural changes.

Furthermore, it is difficult to reconcile the aggregated demand data with the demand for different channels/products. Overall demand patterns might be reasonably clean, due to a shift from brick-and-mortar customers to online customers, but the baseline data for both channels need to be revised. What’s more, it is vital to ensure that all functions agree on the same clean baseline data; otherwise, sales, finance, and manufacturing will be working with different data sets and deploying different plans. The clearly defined role of a data steward is essential here.

Recommendation

- Agree on the clean baseline data for forecasting

- Ensure that all functions use the same processes and agree on the same baseline data throughout the company for the time after recovery

On-Demand Webinar Build Resilience, Continuity and Operational Readiness in Your Supply Network: How to Manage Demand/Supply Disruptions In Real-Time

Toward the “Next Normal”

As the crisis continues, many demands will be less affected by COVID-19 but driven by overall economic developments. Many countries will go into recession and demand patterns will become more similar to those observed in previous crises.

However, as managers prepare for demand planning in the “next normal,” they need to carefully consider four important learnings.

First, many companies have been forced to embrace agility in the past months. Important decisions were taken much faster than normal - often within days instead of weeks. More frequent S&OP meetings, tighter cross-functional integration, and better preparation were key enablers here. As war rooms close and operations go back to the new normal, the need for agility will remain. To enable this agility, companies need to bring their S&OP processes and systems on par with their competitors and get their homework done: Data must be clean, and processes and systems must be set up and used in a smart way.

Second, in line with new processes and systems, managers must review the capabilities and skills that they need for the future. Rather than forecasting demand only, planners have to monitor production and shipping at suppliers, estimate their own production capacities, and understand downstream market developments. All of this information feeds into scenario planning, which was often very ad-hoc and Excel-based. The crisis has shown that thinking in scenarios is key and real control tower solutions must be used in the future (and not disregarded as software trials expire).

Third, there has been much opposition to the idea of removing production planners from the plants and demand planners from the local markets to facilitate shared service centers for planning. However, successful communication and interaction from the home office during the crisis has shown that co-location is not a prerequisite for effective planning. Instead, planners can learn from each other and become much more efficient in a shared planning hub. Accordingly, it is the right time to rethink the organizational structures for the new normal.

Fourth, the crisis highlights the need for excellent supply chain planners in all their different roles. While AI systems will continue to support planners and improve their decision making, the crisis has highlighted that the hands-off-the-wheel mentality is still a long way off. As long as AI systems are only extrapolating the past and do not understand the structure of demand, complex planning in situations with high volatility will continue to be AI-supported but human-driven.

To read more on this subject, the authors suggest the following content:

McKinsey & Company The Next Normal: How companies and leaders can reset for growth beyond coronavirus

Alicke, Knut, Hoberg, Kai, Rachor, Jürgen (2019) “The supply chain planner of the future,” Supply Chain Management Review May/June.

Sterman, John D., and Gokhan Dogan (2015). “I’m not hoarding, I’m just stocking up before the hoarders get here: Behavioral causes of phantom ordering in supply chains.” Journal of Operations Management 39, p. 6-22.

Udenio, Maximiliano, Kai Hoberg, and Jan C. Fransoo (2018). “Inventory agility upon demand shocks: Empirical evidence from the financial crisis.” Journal of Operations Management 62, p.16-43.

One Network Enterprises Article/Webinar. Build Resilience, Continuity, and Operational Readiness in Your Supply Network. On-demand, 24/7.

About the Authors

Knut Alicke and Kai Hoberg are frequent contributors to Supply Chain Management Review. Alicke is a partner in McKinsey’s Stuttgart office and leader of the supply chain management practice in Europe. He holds a Ph.D. in logistics and an advanced degree in supply chain management from the University of Karlsruhe. Hoberg, Ph.D., is a professor of supply chain and operations strategy at the Kühne Logistics University in Hamburg. They can be reached at [email protected] and [email protected].

Related Article: 3 Core Supply Chain Strategies Every Executive Must Execute to Remain Competitive

Related Resources

Supply Chain Networks: Impact of Artificial Intelligence Machine Learning Prescriptive Analytics

In the white paper, we offer a new perspective on decision-making analytics, business objectives, and the autonomous supply chain. Download Now!

Your Business Operating System Requires a Dual Platform Strategy

In this paper, we explain how network approaches expand your competitive advantage, and how a dual-platform strategy makes it achievable on a realistic timescale. Download Now!

Journey Through Your Supply Network Digital Transformation

In this paper, One Network Enterprises explains how you can achieve a future based on disruptive network-based product and service models - that unlock enormous value for your business and every business partner. Download Now!

Product Traceability Across Your Supply Network

This report explains how new business network technology enables us to track the full chain of custody for every item from start to finish, providing visibility across final products, intermediates, and raw materials, and it does this in real-time, from their source, across trading partners, and to the end consumer. Download Now!

How to Leverage a Logistics Control Tower

This paper describes how leveraging a logistics control tower can achieve end-to-end transportation insight, actionability, and autonomy and how the entire logistics network gains more visibility, control, and unlocks enormous value. Download Now!

More Resources from One Network Enterprises

Article Topics

McKinsey News & Resources

2024 Global Logistics Outlook: Crisis mode lingers An Increasingly Digital Procurement Function Lacks Talent Required for Future Needs New McKinsey survey highlights steps companies are taking to stay on top on global trade processes 2023 State of Logistics: Third Party Logistics (3PL) Ocean Cargo: Carriers, shippers continue to navigate choppy waters Could Climate Become The Weak Link In Your Supply Chain? 7 Actions to Drive Demand Planning During the COVID-19 Pandemic and Prepare for the “Next Normal” More McKinseyLatest in Supply Chain

Ask an Expert: How Shippers Can Prep for Hurricane Season Apple Accused of Multiple Human Rights Violations South Korea Finally Overtakes China in Goods Exported to U.S. UPS Struggles in First Quarter With Steep Earnings Decline How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations How Much Extra Will Consumers Pay for Sustainable Packaging? More Supply Chain