3PLs Investing Heavily in Big Data Capabilties to Ensure Seamless Supply Chain Integration

In today’s dynamic global marketplace, increasing logistics flexibility is critical as shippers look for greater collaboration with their third-party providers on the way to seamless integration of supply chain activities.

Third-party logistics providers (3PLs) have gotten the message: Shippers expect seamless, value-added logistics services or they’re taking their business elsewhere.

Today’s ideal, optimized offering will need to do more than simply address the bottom line of a shipper’s transportation budget.

To make this happen, most major 3PLs are investing heavily in Big Data capabilities to ensure direct-to-consumer customization, and they’re asking shippers to join them in “gainsharing” relationships as they move forward in the global arena.

“Shippers should not be put off by a 3PL who brings in a team of experienced executives, nor should they feel threatened by this tactic,” says Peter Moore, partner at the consultancy Supply Chain Visions and a Logistics Management columnist. “The shipper should embrace this as a valuable resource that will reduce risk as the joint shipper-3PL team develops innovative solutions.”

Moore advises shippers to empower the people who will be responsible for the planning and execution of global strategies to lead the team in joint solution development. “Get facilitation help if you need it, but don’t leave the table with less than a fair solution that incentivizes both parties to continuously improve the logistics of the shipper and their customers,” Moore adds.

Evan Armstrong, president of 3PL market research firm Armstrong & Associates, endorses Moore’s position, and says optimization tends to be the most important aspect of strategic 3PL relationships.

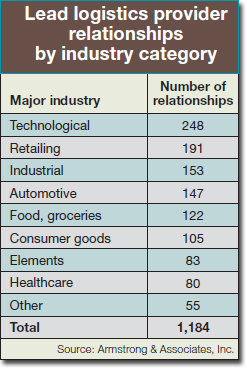

“Of the total 6,398 shipper-3PL relationships we track in our database, 1,184, or 18.5 percent, are strategic, with the 3PLs performing supply chain management or lead logistics provider services,” says Armstrong.

And while large automotive and technology shippers have dominated these types of relationships in the past, Armstrong says that his firm is now seeing an increasing number of strategic partnerships cropping up within the retail and industrial sectors. “To the extent that lead logistics provider relationships have been formed, they’re most likely to occur with those that are more ‘partnership-based’ and often involve larger 3PL accounts,” he says.

According to Armstrong’s research, leads logistics services are prevalent in 35 percent of the 3PL customer relationships it tracks, while another 35 percent are evolving to become strategic.

“Where you have that 18.5 percent that represent a pure strategic relationship, 3PLs tend to be managing significant parts of customer supply chains,” says Armstrong.

“Therefore, they are expected to have significant systems, process engineering and control, and transportation planning and execution capabilities. These capabilities provide for truly optimized supply chain networks.”

Armstrong views the ability to systematically optimize transportation networks as a key differentiator between those companies that are just freight brokers and those that are large scale network transportation managers.

Good examples of this differentiation, according to Armstrong, are C.H. Robinson’s TMC division; Menlo Worldwide; Transplace; Transportation Insight; and Ryder SCS. “Each of these providers has invested heavily in in-house and off-the-shelf modeling as well as supply chain execution systems,” he adds.

Armstrong maintains that in any strategic supply chain and logistics outsourcing initiative, it’s critical for the shipper to determine the requisite capabilities and best operational fit for a 3PL.

“We start by performing an internal analysis of a client’s current supply chain network,” says Armstrong. The firm then works with the shipper to identify its domestic transportation, international freight forwarding, and value-added warehousing and distribution requirements.

“In addition, based upon our 3PL research and benchmarks, we develop a recommended ‘future state,’ which combines leading operations capabilities with 3PL pricing benchmarks,” he adds.

The consultancy then supports the development of a comprehensive request for proposal (RFP). Armstrong then uses that knowledge base and future state forecast in evaluating 3PL candidates and facilitating the final provider selection.

“Warehousing and transportation key performance indicators are a must,” says Armstrong. Other critical elements include IT requirements, network optimization skills, international and domestic transportation management capabilities, specific industry requirements, warehousing expertise, proposed pricing, and, of course, contract terms. “Cultural fit criteria should also be evaluated and never overlooked,” he adds.

Role of Big Data

More market intelligence on the importance of building the 3PL-shipper dynamic is expected to be forthcoming at Armstrong & Associate’s “3PL Value Creation 2013” conference in Chicago this month. Among those giving presentations is Mike Stark, president and CEO of Pacer Distribution Services, Inc.

According to Stark, Pacer has grown its global presence thanks in part to its management of Big Data. He maintains that when systems integration is optimized, data savings are made—for the small shipper as well as giants like Walmart.

“As a general trend, we see that retailers are constantly evolving to direct-to-consumer service, thereby bypassing the middleman,” says Stark. “But 3PLs must evolve right along with them, working with retailers like Cosco through their websites for parcel delivery service to ship direct.”

The contention that we’ve clearly entered the Big Data era was among the major themes surfacing at the recent Council of Supply Chain Management Professionals convention in Denver.

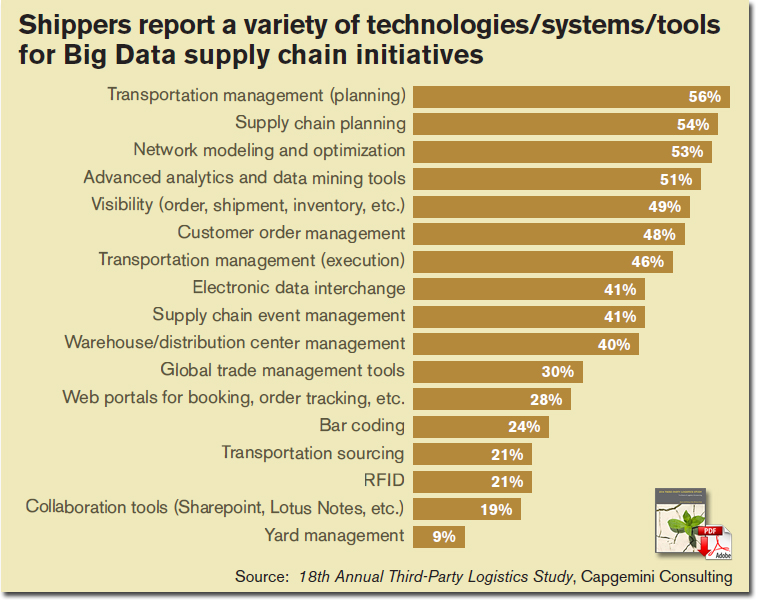

When Capgemini analysts unveiled the 18th Annual Third Party Logistics Study, they emphasized that shippers (97 percent) and 3PLs (93 percent) feel strongly that improved, data driven decision making is essential to the future success of their supply chain activities and processes.

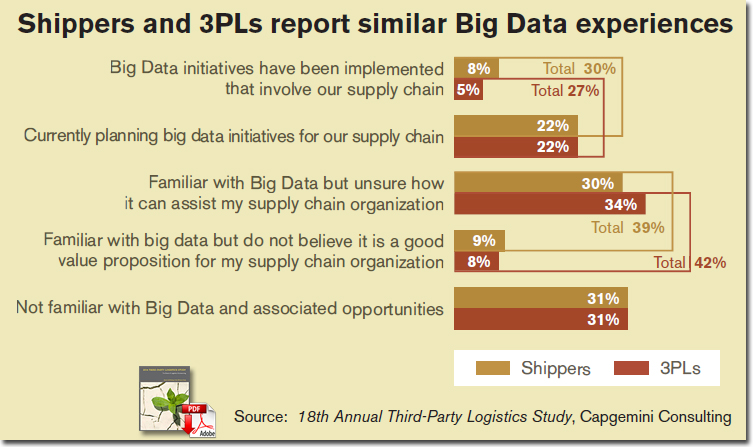

But shippers differ widely in their levels of interest, understanding, and adoption, says Capgemini Consulting analyst Melissa Hadhazy. “While other surveys have reported higher levels of participation, ours found that only 30 percent of shipper respondents and 27 percent of 3PLs indicate that they’re planning or currently undergoing Big Data initiatives,” she says.

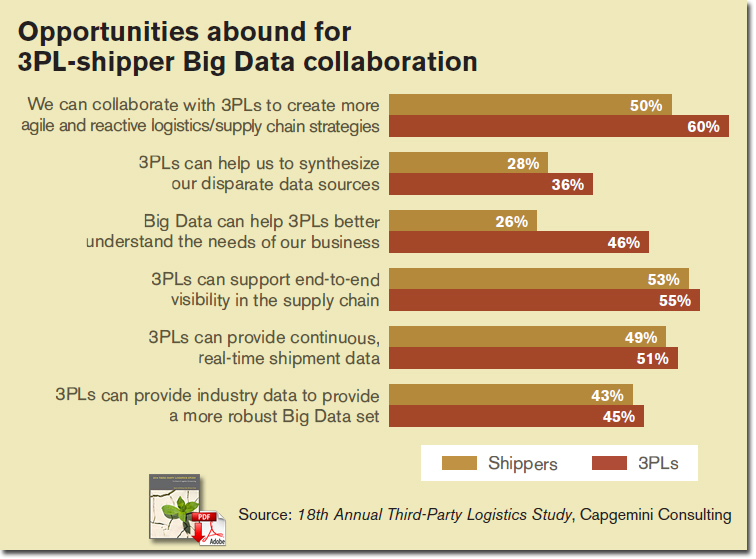

Interestingly, about half of each group disagree that Big Data currently fuels these decisions. Despite this, shippers and 3PLs concur that the concept can be leveraged in both functional and strategic aspects of supply chain operations—as well as to support visibility and the ability to create agile supply chains.

Gainsharing Gaining Steam

The 18th Annual Third Party Logistics Study—conducted in collaboration with Penske, Penn State University, and Korn/Ferry International—also showed the continuing and overall positive nature of shipper-3PL relationships.

According to the report, both parties view their current relationships as being “successful,” while shippers report that they’re seeing encouraging results again this year due to the work of their 3PL. By putting their 3PLs to work, shippers say they’re seeing an average logistics cost reduction of 11 percent; an average inventory cost reduction of 6 percent; and an average fixed logistics cost reduction of 23 percent.

According to the results, shippers agree that 3PLs provide new and innovative ways to improve logistics effectiveness, and that they are sufficiently agile and flexible to accommodate future business needs and challenges.

And despite ongoing churn in shipper-3PL relationships, shippers report that they’re increasing their use of outsourced logistics services, while both parties now say that they’re about equally satisfied with the openness, transparency, and communication in their relationships. As suggested in last year’s report, however, several ongoing factors are having an impact on the progress toward the advanced end of the maturity model for shipper-3PL relationships.

While “gainsharing” and collaboration with other companies—even competitors—to achieve logistics cost and service improvements would appear to be markers for advanced relationships, it seems that these approaches are more preferred in certain shipper-3PL relationships, and less in others. Capgemini says that there are some encouraging results that suggest a slight increase this year in the outsourcing of strategic, customer-facing situations, as well as IT-intensive logistics activities.

Hadhazy and others involved with the survey observed that innovation—when it finally surfaces in the optimization process—is fast, but not disruptive. “And disruption is often precisely what we need,” concludes Hadhazy.

Are You Fully Leveraging Your Current 3PL Relationships?

Joel Anderson, president and CEO of the International Warehouse Logistics Association, believes that every shipper needs a “check list” when selecting a 3PL that promises that services will be optimized. Here are some suggestions and questions that Anderson says every shipper should think through before signing on the dotted line.

- The shipper/customer needs to clearly define its market and service expectations. For example, if the shipper does not have any trading patterns outside of a defined area, look for someone with a proven track record of services and promises kept within that service area.

- The shipper should always be able to get answers to the questions of inventory in storage, in transit, expected delivery dates, immediate notification of any delays, and expected resolution of the delays.

- Did the 3PL, when presenting responses to an RFP, also ask deep questions about the shipper’s supply chain and the shipper’s customer requirements? Third-party providers provide substituted services for the shipper and to provide at the same level or better, the 3PL must know all the “ins and outs” of the shipper’s supply chain, including what the shipper’s customers expect.

- Does the 3PL bring innovation to the shipper’s supply chain? After examining the deep questions in No. 3, does the 3PL mull it over and then respond with an alternative approach that can reduce the time and cost, and improve the reliability and efficiency of the supply chain.

- Does the shipper have the commitment of the senior management of the 3PL? Often, the most successful 3PLs that secure new business contracts are the ones where senior management participates in the service offering. Nothing says “I care” better than senior management participating in making the proposal a reality.

View all SC24/7 ‘Papers’ on “Third-Party Logistics”