2023 Rate Outlook: Will shippers catch a break?

Our annual gathering of freight transportation industry analysts reveals some common themes, largely around the notion that rates are not likely to increase much—if at all—in some modes and will continue declining in others. Does this mean things are stabilizing?

There is much turmoil in the world on many levels, from conflict, to economic challenges to energy uncertainty and social and political issues, right down to the basic, fundamental activities of moving the world’s freight. The North American economy remains strong, despite predictions of a recession on the horizon.”

Does this sound familiar?

Well, this was the lead portion of the 2019 Rate Outlook that I wrote, just before COVID took hold. These words are equally relevant today, as does the line that “…there are so many moving parts and indecipherable variables that predictions are in lock-step with the old adage that ‘forecasts are either lucky or lousy.’”

Register for the 2023 Rate Outook Webcast for more in depth analysis of the latest freight rate data.

Turmoil has risen markedly, with the war in Ukraine and the ripple-effect on the cost of fuel around the globe and in the United States, coupled with the unusual circumstance of full employment, spiking inflation, and yet more predictions of a looming recession.

Developing a point of view on what will happen with freight rates in 2023 is a bit like picking who will win the World Cup: There are the odds-on favorites and then there are the unexpected dark horses. In the spirit of what goes up, must come down, we’re seeing major adjustments in pricing and capacity as the players on the field—carriers, shippers, beneficial cargo owners (BCOs), and third parties—struggle placing their bets.

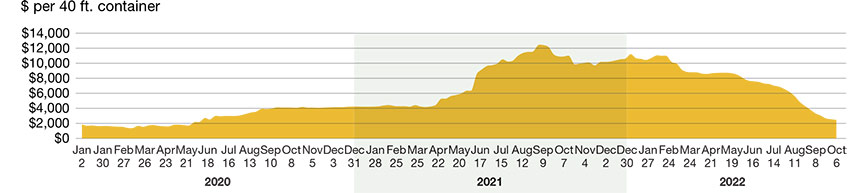

Drewry World Container Index–Shanghai-to-Los Angeles

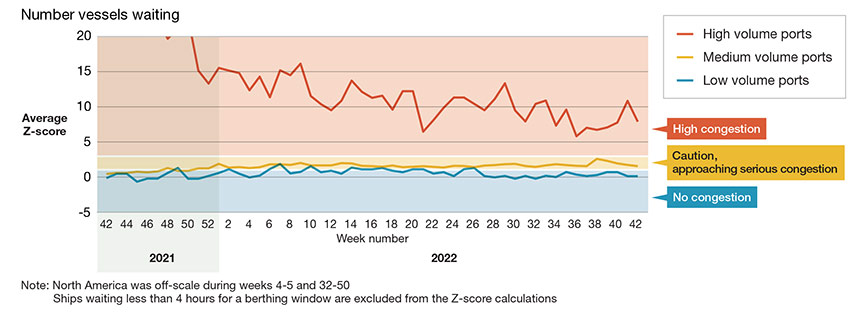

North America: Port congestion Z-score indicators

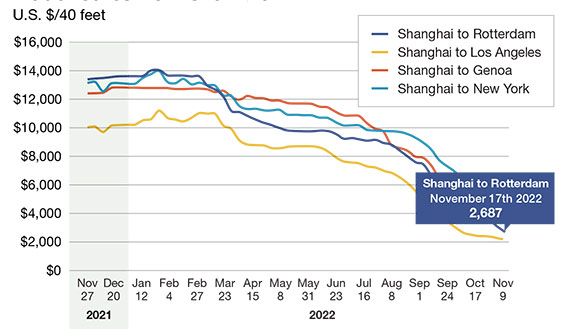

While we will touch on all the major modes here, the focus is more on ocean and truck since they currently appear to be the most volatile. According to a recent report in the Wall Street Journal, “the weekly Shanghai Containerized Freight Index, which measures shipping prices out of China, recently dropped to $1,443.29, about one-third the level it hit in early June.”

The separate Drewry Worldwide Container Index (WCI) measuring the average price to ship a 40-foot container reached $2,773 in early November, the lowest level in two years. Drewry, a UK-based data provider, said that the average rate to ship a 40-foot container from Shanghai to Los Angeles had fallen to $2,262 in the first week of November from $11,197 in late January.

At the same time, spot rates for both container and truck services have declined significantly. DAT Solutions, a load board matching shipments and trucks in the U.S. spot market, says that its load board was down about 52% year-over-year in October, and average rates were down nearly 16% from last year. The average rate of $2.37 per mile that the company measured in early November would mark the lowest price for shipping goods by truckload since September 2020.

All of that portends a year of change, largely in favor of shippers/BCOs, particularly as domestic inventories remain high, limiting the robust demand for import cargo we typically see. Much of the freight is presently moving on contract rates, which will only change when contracts are renegotiated. And while spot rates are a bellwether of what’s in the offing, material impact won’t occur until major contracts are renegotiated.

Interviewing a number of industry experts revealed some common themes, largely around the notion that rates are not likely to increase much—if at all—in some modes and will continue declining in others. Let’s dive in.

Waves of change for ocean carriers

The unrelenting decline in container freight rates from Asia, caused by a collapse in demand, is compelling ocean carriers to blank more sailings than ever before as vessel utilization hits new lows.

Drewry’s WCI Asia-North Europe component slumped a further 18% late November, to $2,192 per 40-foot and is down 75% since August. Meanwhile rates from China to North European hub ports, now being touted by forwarders, sank below the watershed $1,500 per 40-foot benchmark.

Trade routes from Shanghai

As John Keenan, former president of Horizon Lines, recently remarked: “The big storm on the horizon is—again—the emergence of overbuilding and overcapacity, with a predictable drop in rates. Rates peaked in 2022 at levels never seen before, but are receding to more reasonable levels.”

Trade routes from Shanghai

FMCSA-regulated carriers by number of power units

Producer-price index of freight rail transportation

According to Philip Damas, of Drewry Shipping Consultants, “the phrase ‘what goes up must come down’ will be the key theme for exporters and importers using international ocean transportation in 2023.” He believes exporters and importers will benefit hugely in 2023, after two painful years of extremely costly—and record high—prices since the onset of the pandemic, driven largely by unsustainable consumer goods demand, shipping under-capacity and chronic shipping disruptions.

“Instead, the ocean transportation sector will largely ‘normalize’ in 2023,” says Damas.

Consumers are shifting back from buying physical goods, typically moved by ocean vessels, to buying services, and inflation is cutting back their ability to spend on discretionary imported products. Drewry expects that more than half of the post-pandemic ocean freight cost increases will disappear during 2023.

For the spot market, this means that importing goods from Shanghai to Los Angeles by sea will likely cost less than $2,000 per 40-foot container in 2023, a level last seen in early 2000. Contract rates of $8 to $10,000 per 40-foot container will disappear, and that new contracts will be negotiated next spring 30% or more below current levels.

Factors which could keep ocean contract rates higher than pre-pandemic include: the higher cost base of carriers; new regulatory costs; the potential return of port congestion; retailers rebuilding their inventories; the effect of ocean carrier consolidation/concentration on capacity; and the likelihood that many carriers will do whatever they can to remove surplus capacity from the market to stop a freefall in prices.

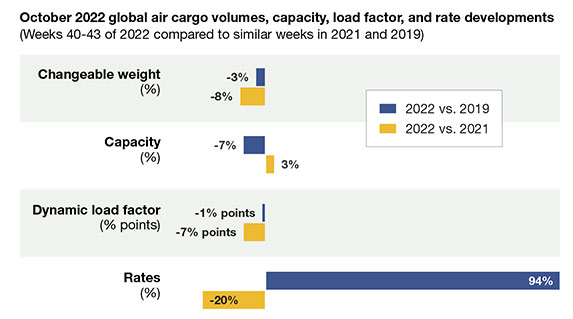

Air cargo volumes

Drewry expects a big increase in the number of “canceled sailings” in 2023, a development that will reduce frequency and predictability when planning shipments. Medium-term, importers and exporters should expect higher regulatory costs (e.g., new carbon taxes) and green fuel costs to affect ocean freight rates, as the shipping sector transitions to decarbonization.

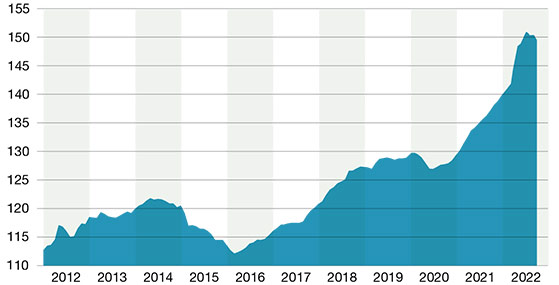

Recent data shows that port congestion at major ports is gradually lessening, but remains about eight times pre-pandemic levels. Drewry’s expectation of steep cuts in freight rates in 2023 is predicated on the view that port congestion—and more generally the current major disruptions across the container shipping sector—will have gone by around mid-2023.

Overall, Drewry is confident that double-digit reductions in ocean freight rates, combined with an improvement in shipping service timeliness and fewer disruptions, will definitely happen in 2023—the question remains around how soon in 2023 and how big the cost reductions will be. Based on Drewry data and models, the current answer is “at least 30%.”

Capacity is a continuing challenge in the ocean freight business. According to spokesperson at container lessor Textainer: “New container orders dropped to their lowest in three years. The ocean container leasing market is in a slump due to slowing cargo growth, an earlier peak season, and Chinese production hiccups, but new environmental rules taking effect next year that may encourage slow steaming by carriers, which could lift demand for boxes.”

Both Maersk and ONE reported material weakness in their liftings at third-quarter earnings calls in late November, with Maersk down 7.6% and ONE down 9% in the period, compared with the previous year. Meanwhile, the spot market indices are unable to keep pace with heavy

discounting on exports from China.

According to a recent report by The Loadstar: “The idled containership fleet has breached the 1 million TEU capacity milestone—and is set to jump significantly higher as carriers prepare to temporarily suspend services rather than blank sailings.”

Truckload’s continuing challenge

Let’s take a step back for a moment and take a broad look at this vital sector. Trucking all-in moves $255.5 billion of freight annually. Common carriers generate more than $97 billion and private fleets another $121 billion. The tricky part is that, unlike rail, ocean, air, and even LTL, the truckload industry is hugely balkanized, with less than 1% having more than 100 power units.

This allows an almost unlimited number of scenarios for moving freight, even for small and mid-sized shippers. That also means that prices are quite variable, emulating a boom-and-bust cycle. Barriers to entry in truckload are very low, and when there’s excess capacity and rates fall, companies exit the market. When rates rise, new capacity enters the market until saturation occurs and rates begin to fall again. The trick is playing the right side of the curve to optimize freight spend and service.

Fueling uncertainty

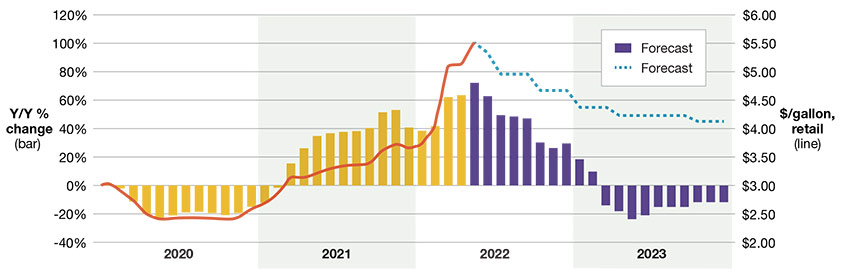

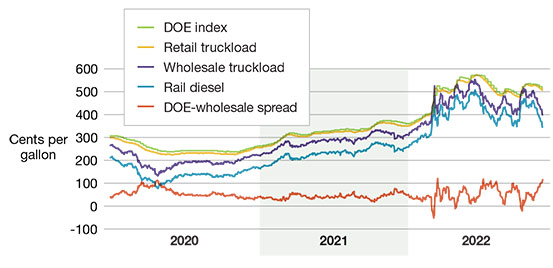

According to Matt Muenster, chief economist at Breakthrough, the expectation is that commercial transportation energy costs will remain high relative to the pre-pandemic experience from 2015-2019.

Given the current state of supply in the market and understanding that market rebalancing will be slow, diesel prices are likely to remain high and volatile through 2023. Breakthrough is forecasting U.S. wholesale diesel prices to remain closer to $4 per gallon versus $3 per gallon which represented the diesel price ceiling from 2015 to 2019.

The spread between wholesale—what well-managed carriers pay, plus or minus a point or two—and retail—what the DOE Index is based on—is at $1.11 per gallon as of November 30.

What can shippers do about high energy prices and mitigating the profit margin baked into the standard fuel surcharge?

Level up your benchmarking. Use benchmarking to track transportation energy costs and ensure you remain competitive. An advanced benchmarking strategy allows you to analyze market factors that influence price and fuel efficiency in real time. By spotting trends early and pivoting quickly, you can limit the impact of supply chain and transportation disruptions while minimizing fuel consumption.

Create a market-based fuel reimbursement program. Many shippers rely on base-rate surcharge schedules to reimburse carriers for fuel. Although this is a popular model, designing your fuel reimbursement program around a base rate distorts true fuel prices and does not provide accurate rate visibility.

Implementing a fuel reimbursement program that follows real-time fuel market dynamics can be critical in this era of ultra-volatile fuel cost. Linehaul and energy costs are subject to change, and they may not move in the same direction. Market-based fuel reimbursement programs account for this movement and foster better transparency in shipper–carrier relationships.

Lately the trucking industry, in general, has benefited from the large surge in freight moving as consumers “bulked-up” on consumer products during the pandemic and capacity was taxed. This led to higher freight rates and greater profitability for truckload carriers.

“With the Fed singularly focused on curbing inflation, I am cautious on carriers’ abilities to secure rate increases in 2023,” says veteran trucking industry analyst John Larkin. “Those in consolidated sectors like the parcel, rail, and LTL sectors should have some luck in securing very modest 1% to 3% increases.”

Shippers have limited choices in these sectors, and carriers know that. Those carriers in fragmented spaces like dry-van and refrigerated truckload and truckload brokerage may be less fortunate as carriers seem to want to “keep the wheels turning,” as even sluggish demand drives pricing below fully loaded cost.

Pricing, across the board, might firm up later in the year if the Fed begins to drop rates, bloated inventories are right-sized, and runaway inflation is finally slayed. However, the first half of 2023 will be challenging, and it’s possible that the entire year of 2023 will be difficult for carriers on the pricing front.

The LTL segment of the business is a very different animal, being not nearly as fragmented, with a few major players and high barriers to entry. “The LTL industry is relatively small, accounting for about 12% of the trucking market, with no new carriers entering the market since 1980,” say Satish Jindel of trucking analyst firm SJ Consulting. “It also has huge barriers to entry—think terminals and breakbulks, much manual labor. Rates are not likely to increase much, although costs may, when considering what happens with the cost of fuel.”

LTL carriers are likely to be able to continue pricing discipline, which will increase margins and allow for deployment of new and better technologies. There have been several false starts in shifting away from NMFC Class Rates to more accurate and fair parcel-like rates, based on shipment characteristics—weight and cube.

To date, no dent has been made in the old-school “class rate” methodology, and there are some 4,000 separate rate tables now. We see a concerted push over the next couple of years to migrate to a more practical, sensible solution, akin to what FedEx and UPS use, that will make the industry better for the carriers and the shippers, if not those who profit from the complex scenarios of today.

What about the on-going driver shortage? In an attempt to mitigate, Congress approved the Department of Transportation’s Safe Driver Apprenticeship Pilot Program in 2021 as part of the bipartisan infrastructure law. The program seeks to enroll several thousand 18-year-old to 21-year-old apprentices over three years.

Air freight rates decline more substantially on Asia to U.S. than Asia to E.U. this year

The goal is to help provide some of the 1.2 million truck drivers that will be needed over the next ten years. Keep in mind that the average age of a truck driver is 46—so a number on the north side of that will retire. You had to be 21 to drive a truck until the apprenticeship bill, but so far, the apprentice program is not going very well—too few truckers signing up and too few applying.

Parcel peculiarities

Parcel is one of the big winners during the pandemic, as millions shifted away from the brick-and-mortar experience to on-line shopping. The 2020 and 2021 capacity constraints caused two major movements in the small parcel delivery space, according to Brian Broadhurst, senior vice president of Supply Chain Consulting at Transportation Insight.

“First, shippers were motivated to solve for capacity by diversifying their carrier base in the form of regional and gig-economy carriers,” says Broadhurst. “Second, capacity constraints enabled flagship national carriers to announce record increases in 2022. Now, we’re forecasting softening in the market and less capacity constraints in 2022-2023.”

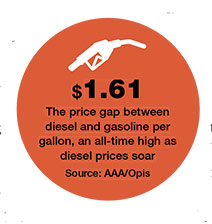

Diesel price outlook

Broadhurst’s recommendation is to maintain relationships with national carriers, and consider them foundational carriers—they have the network, delivery density, and history to warrant that position. “However, look at areas where you can complement your delivery network with alternative carriers,” he adds. “Just as we’ve seen a shift in inventory levels to combat disruption in supply, alternative carriers can combat disruption in final-mile movements—from both rate and capacity perspectives.”

According to Jindel, the two big carriers took a 6.9% GRI, but with significant excess capacity now in the network, contract GRIs will likely increase for volume shippers. “USPS also has significant capacity and is getting more aggressive in the package space,” he says. “Shippers are well-advised to get smart about their carriers’ capabilities with respect to their specific business needs. They need to use precise RFPs to present carriers with actual shipment characteristics and volumes—and all of this requires experience and skills at evaluation to get the best outcome.”

Railroads down the track

The biggest news was Congressional action to forestall—at least for now—a nationwide rail strike as of December 1. Whatever your politics, there’s little disagreement about the impact a strike would have had on the current state of the economy.

According to Larry Gross, president of Gross Transportation Consulting, the rate outlook for intermodal in 2023 will be challenging. “Truck rates will be moving down and domestic intermodal rates will be forced to follow suit,” he says. “The degree to which intermodal will have to underprice truck will depend on whether domestic intermodal can regain a degree of consistency and service reliability as it possessed in the past.”

U.S. diesel price history (January 2020-November 2022)

Oliver Wyman sees high inflation in both fuel and wages at least through the first half of 2023 and perhaps beyond. The diesel shortage has widened the spread between gasoline and diesel and has disconnected diesel costs from the cost of oil.

As rail is more fuel efficient than trucks, this keeps the upward pressure on truck rates and will allow continued pricing leverage for rail even in a recession. This is about as good a recession scenario as one could envision for the rail industry.

Hopefully the railroads will latch on to this opportunity and try to regain some of the market share they have lost in recent years. Shippers may be able to leverage supply chain savings out of improved service levels, but should not expect rate reductions in the trucking or rail industries in the coming year.

Aerial acrobatics

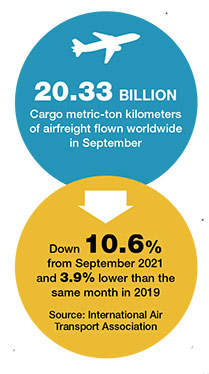

The airfreight market dropped during the fourth quarter of 2022, and there are no reasons to believe it will rebound in the face of declining demand in 2023. The Wall Street Journal recently pointed out that “the abrupt pullback in e-commerce demand is setting up turbulence in the air-cargo sector. Jaw-dropping amounts of money have poured into freighters over the past two years.”

Amazon, FedEx and UPS have been buying planes while the big ocean shipping lines are getting in on the action. Conversions of passenger jets to freighters are also at a record high. That includes big numbers of narrow-body aircraft, planes best suited for the smaller volumes in express operations.

However, airfreight demand is in retreat. According to air cargo intelligence firm WorldACD, global volumes fell 7% in the first week of November from the week before. FedEx is grounding some planes, and it looks like parking space for freighters may be in high demand.

“The market is extremely unpredictable, although the cargo carriers have made very good money this year,” says Ole Ringheim, former head of Exel Global Air. “The disruption in the supply chains around the world, especially in China, created huge bottlenecks, which largely has been cleared up by now, and historical high rates have been dropping like a stone. Expectations ahead of

Chinese New Year are very modest.”

Several of the larger forwarders—DHL, DSV and others—have started to operate their own capacity through longer term leasing agreements, and even some of the largest ocean carriers—Maersk and CMA—are buying or leasing airplanes, using some of the extraordinary profits they have made the last two years. The carrier and forwarders operations are getting better and more professional, but many of the airports need money to make suitable upgrades of facilities.

“Despite the roller-coaster ride of rates and volumes and the early peak season building inventory levels, some signs are encouraging,” says Chuck Clowdis, managing director of consulting firm Trans-Logistics. “Conversion of passenger aircraft to air cargo capabilities are continuing in a brisk path. Passenger airline cargo subsidiaries, like Alaska Air Cargo, are converting 737s to cargo exclusive use. Longer-haul operations are looking to appropriate conversions as well. This indicates a level of confidence that cargo operations are outgrowing belly-space and other solutions are attracting capital.”

There will also be the need for the fast delivery of a wide range of commodities. Same-day on longer distances are always vital to pharmaceuticals, for example. Vital production lines also will rely on air cargo as the most efficient mode. However, best suggestions are to keep an eye on Amazon and other retailers as well as domestic and global GDP.

Air cargo volumes declined 8% year on year in October—the eighth consecutive month of decline—and the outlook is equally downbeat. According to Xeneta-owned CLIVE Data Services, the market outlook “remains uncertain” and there is also nothing to indicate an upturn next year from its weekly market data.

The drop in demand, measured in chargeable weight, was also 3% below the pre-pandemic level in 2019. As falling demand meets rising capacity, load factors have been declining over the past 18 months.

The bottom line to all this: What tomorrow brings is a bit of a crap-shoot, as it is just about every year recently, with increasing volatility and decreasing predictability.