2018 Q4 European Logistics Update: Despite headwinds, opportunity thrives

The evolution of autonomous vessels and the need for improved liquid natural gas (LNG) transport and delivery are shaping the future of European logistics—and opening new doors for cooperation between the EU and the United States. Stakeholders on both sides of the Atlantic say that it’s time for more collaboration, not confrontation.

In these turbulent times, Europe’s transport and logistics industry has reason for concern as the search for a solution to Brexit seems to be heading nowhere and the threat of a trade war with the United States means dark clouds are looming across the Atlantic.

However, liquid natural gas (LNG) just might provide a chance for both sides to work out a deal. During his last meeting with President Trump, European Commission President Jean-Claude Juncker said that Europe would build more terminals to import LNG from the United States.

And while Europe is still debating whether and how to deliver on this promise and bring it in line with environmental protection and higher costs, LNG is not the only hot topic making its way around European logistics circles. In fact, “autonomous shipping” is rapidly picking up speed in Europe.

But whether the focus is on the evolution of autonomous vessels or LNG transport and delivery, both topics are clearly shaping the future of European logistics and opening new doors for further cooperation between the European Union and the United States.

Investments in LNG vessels and port infrastructure

As Logistics Management has previously reported, the International Maritime Organization (IMO) set a global limit for sulfur in fuel oil used on ships. Beginning January 1, 2020, it will be 0.50% mass by mass (m/m). The current global limit for sulfur content of ship’s fuel oil is 3.5% m/m. Therefore, the ocean cargo shipping industry has to seek alternatives. LNG is certainly an option, as the increasing number of LNG vessels continues to grow globally.

According to data provided by UK-based consultancy VesselsValue in August, there were 481 large LNG carriers, including floating storage and regasification units, of over 100,000 m3 in service. This fleet totaled 76.6 million m3 in capacity and was valued at $52.9 billion. There were on order another 89 such vessels with an aggregate capacity of 15.5 million m3 and a value of $18.2 billion.

Based a recent report from maritime shipping data provider DNV GL, more than two-thirds of the ships burning LNG are operating in Europe. One of the latest LNG vessels is the 15,000 twenty foot equivalent (TEU) container ship Afif that was recently put into service for Hapag-Lloyd, the company’s 17th LNG-ready ship. At the beginning of this year, the CMA CGM Group announced it would equip its next nine 22,000-TEU ships with LNG-powered engines. According to reports, those vessels are scheduled for delivery in 2020.

Whether switching to LNG, installing an exhaust gas cleaning system (EGCS), or using 0.5% low sulfur fuel, the shipping lines will decide how to cope with the new IMO regulations and the costs. In August, Maersk and Vopak, a Dutch tank storage operator, agreed to launch a 0.5% sulfur fuel bunkering facility in Rotterdam. According to the companies, this joint initiative will enable A.P. Moller-Maersk to deliver approximately 2.3 million metric tons of sulfur-cap compliant fuel per year.

Ports preparing for LNG

To cope with increasing demand, European ports are also moving ahead to expand their infrastructure for LNG bunkering and supply. The Port of Rotterdam, a leading European hub for the import, export, and regasification of LNG, has reported a 123.2% increase in LNG throughput in the first half of 2018 compared to the first half of 2017.

After regasification at the Gate terminal in Rotterdam, the gas is sent to the Dutch and European gas network by pipeline. Steps have also been taken to install the necessary bunkering infrastructure to serve the increasing number of vessels running on LNG. The Wes Amelie, the world’s first container ship converted to LNG propulsion, started its operation in the port last year, while Shell put the ocean-going vessel Cardissa into use. The vessel will supply customers throughout Europe with LNG from the Gate terminal in Rotterdam.

LNG bunkering at port of Antwerp.

Pioneers in LNG

The Belgian ports of Antwerp and Zeebrugge have a long tradition as LNG hubs. In 2012, together with other ports in Europe and the U.S., they started a cooperation within the World Ports Climate Initiative of the IAPH (International Association of Ports and Harbors) to develop guidelines for safe bunker procedures and LNG technology.

The LNG Work Group is currently collaborating under the auspices of the IAPH to develop an accreditation process called theLNG Accreditation Audit Tool. The first draft of this international safety standard was introduced this past April in Amsterdam.

In Antwerp, bunkering is already possible with truck-to-ship (TTS) transfers on dedicated bunkering locations. Barges and smaller seagoing ships are able to bunker LNG smoothly and flexibly around the clock by using LNG tanker trucks. Captains as well as LNG suppliers can reserve a slot online to moor at quay 526-528 and take on LNG.

A fixed bunker station for inland and smaller seagoing ships is also being built, and is to be operational by the end of 2019. A bunker pontoon is planned as well. The Antwerp Port Authority is currently identifying locations for ship-to-ship bunkering of deep-sea vessels. The Belgian-based infrastructure operator Fluxys is overseeing the work in the port of Antwerp and Zeebrugge.

The Zeebrugge LNG terminal serves as a gateway to Northwestern Europe.

The Zeebrugge LNG terminal serves as a gateway to supply LNG to Northwestern Europe by loading and unloading LNG ships of all sizes, transferring LNG from ship to ship and loading LNG containers or regasifying LNG into the Fluxys pipeline network to supply the Belgian and other European markets.

The Zeebrugge LNG terminal has a regasification capacity of about 40 million cubic meters (mcm) per day. LNG ships from 2,000 m³ to 266,000 m³ LNG can be loaded or unloaded there. Up to 380,000 m³ of LNG can be stored in four tanks at atmospheric pressure. A fifth tank is currently under construction and will be commissioned in 2019, adding 180,000 m³ of storage capacity.

Cooperation with the United States

Due to concerns about dependency on Russian gas supplies, especially in the Baltic States and Eastern Europe, there’s great interest in alternative sources for LNG—such as the United States.

This June, the Polish Oil & Gas Company (PGNiG) and the U.S. provider Venture Global LNG signed an agreement for the sale and purchase of LNG from the United States. The terms of the deal includes a 20-year contract for 2 million tons per annum (mtpa) of LNG, equaling about 2.7 billion cubic meters (bcm) after regasification.

The Calcasieu Pass and Plaquemines LNG terminals in Louisiana, planned for completion in 2022 and 2023, will supply the cargo. The Polish LNG terminal in Swinoujscie, near the German border, also announced the expansion of its LNG capacity from 5 bcm to 7.5 bcm. The Polish operator, Gaz-System, expects it to be completed by 2022.

LNG on the German map

Even in Germany, which does not yet have its own LNG import terminal, the subject is very much top of mind. While several locations in Germany are being considered, the most advanced plans are in Brunsbuettel, a port near Hamburg. German LNG Terminal GmbH is the name of a joint venture between the Dutch companies Gasunie and Vopak and the German company Oiltanking to build Germany’s first LNG terminal.

According to recent reports, the joint venture has successfully completed its first planning process. “We’re on schedule to make next steps and have started the necessary permit approval process,” says press officer Katja Freitag. “If all goes to plan, we’re due to make a final investment decision at the end of 2019. Following this, we will start construction work with the terminal possibly becoming operational by the end of 2022.”

The new terminal will offer a throughput capacity of approximately 5 bcm per year, a 220,000 cubic meters (cbm) tank for storage, and a jetty set up to handle Q-Flex vessels, a new generation of LNG mega-vessels. With a cargo-carrying capacity of 216,200 m³, the Q-Flex design makes these vessels 40% larger then the standard 150,000 m³ LNG carrier.

The Brunsbuettel terminal will also provide discharge and loading of LNG, storage, regasification and transfer to the natural gas network as well as bunkering and distribution via trucks, barges and railcars. At a briefing in August, Dr. Bernd Buchholz, minister of economic affairs and transport of the German state Schleswig-Holstein, confirmed that he received a clear signal from the federal government regarding financial support.

“The investor consortium can now safely count on a timely decision on funding,” said Buchholz, adding that he is convinced that the talks between EU Commission President Juncker and U.S. President Trump on the settlement of trade differences have had a positive effect on moving the project forward.

Autonomous shipping sets sail

There is a great interest in autonomous vehicles and vessels worldwide, but when it comes to introducing innovative technology to boost autonomous shipping, Northern Europe is the “hot spot.” In fact, Norway and Finland have become two major research and development centers.

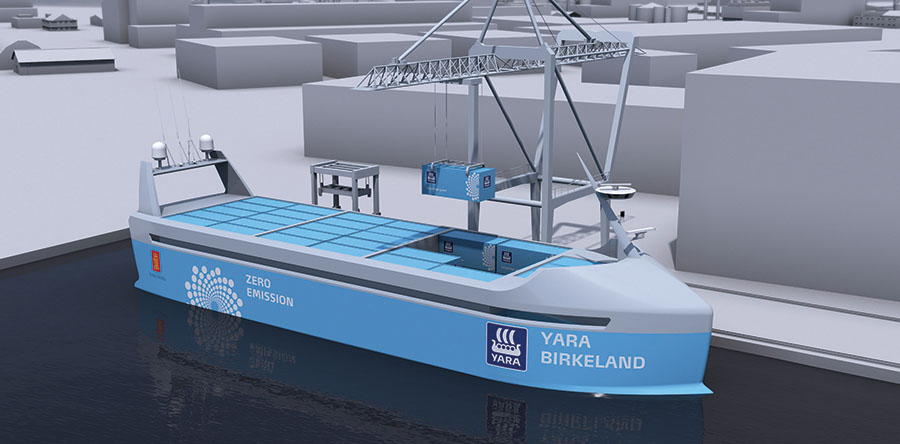

In Norway, Yara Birkeland, the world’s first zero emission, autonomous, electric container vessel, is one of the flagship projects. The project was introduced in May 2017 by Kongsberg, a Norwegian high-technological solutions provider, and Yara, an international producer and distributor of chemical products.

This August it moved a step closer to launching, as Yara signed a contract worth around $30 million with Vard, a global shipbuilder for specialized vessels. Vard plans to deliver the Yara Birkeland in early 2020, and the 120 TEU open-top containership will gradually shift from manned operation to fully autonomous operation by 2022.

The world’s first autonomous and electric container vessel, Yara Birkeland.

The vessel will decrease NOx and CO2 emissions by reducing diesel-powered truck transport by around 40,000 journeys per year. Loading and discharging will be done automatically, using electric cranes and equipment. It also includes a fully automatic mooring system that will not require special equipment dockside.

The autonomous ship will sail between three ports in southern Norway, staying within 12 nautical miles of the coast. The area carrying most of the ship traffic in this region is covered by the Norwegian Coastal Administration’s VTS system at Brevik. Three centers within this system will handle all aspects of peration, including emergency handling, condition and operational monitoring, decision support, surveillance of the ship and its surroundings, and all other safety aspects.

In April 2018, Kongsberg and the global maritime industry group Wilhelmsen joined forces to offer a complete value chain for autonomous ships, from design and development, to control systems, logistics services and vessel operations. “Through the creation of the new company named Massterly, we take the next step on this journey by establishing infrastructure and services to design and operate vessels, as well as advanced logistics solutions associated with maritime autonomous operations,” says Thomas Wilhelmsen, Wilhelmsen group CEO. “Massterly will reduce costs at all levels and be applicable to all companies that have a transport need.”

Finnish connection

Finland has also become a top location for development of autonomous vessels. At the beginning of the year, Rolls-Royce announced the opening of a research and development center in Turku, Finland. The new facility includes a remote and autonomous experience space to showcase the autonomous ship technologies the company has already introduced, as well as those in the development stage.

The new R&D center enables Rolls-Royce and its partners to carry out projects focused on autonomous navigation, the development of land-based control centers and the use of artificial intelligence in remote and autonomous shipping operations. Interest in co-operation also came from the United States, as Rolls-Royce also signed a contract with Google Cloud to develop its intelligent awareness systems further.

The deal now allows Rolls-Royce to use Google’s Cloud Machine Learning Engine to train the company’s artificial intelligence (AI) based object classification system for detecting, identifying, and tracking the objects a vessel can encounter at sea. Rolls-Royce will use Google Cloud’s software to create bespoke machine learning models that can interpret large and diverse marine data sets.

“Autonomous shipping is the future of the maritime industry,” says Mikael Mäkinen, president of marine business at Rolls-Royce. “As disruptive as the smartphone, the smart ship will revolutionize the landscape of ship design and operation.”