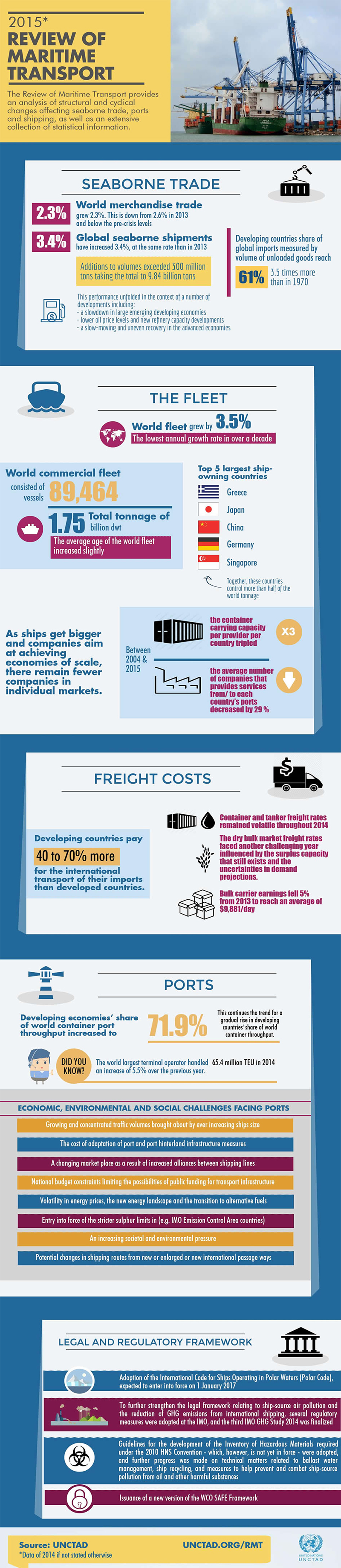

World’s Commercial Shipping Fleet Grew at Lowest Rate in 10 Years in 2014

Oversupply in the container shipping sector remains, Review of Maritime Transport 2015 report says.

The world’s commercial fleet grew by 3.5 per cent during the 12 months to 1 January 2015, the lowest annual growth rate in over a decade, the UNCTAD Review of Maritime Transport 2015 reveals.

At the beginning of the year, the fleet totalled 89,464 vessels, with overall 1.75 million in deadweight tonnage.

Despite its economic troubles, Greece remained the leading ship-owning country, with Greek companies accounting for more than 16 per cent of the world industry, followed by companies from Japan, China, Germany and Singapore.

Together, the top five ship-owning countries control more than half of the world deadweight tonnage.

Five of the top 10 ship-owning countries are from Asia, four from Europe and one – the United States of America - from continental America.

Over the last decade, China, Hong Kong (China), the Republic of Korea and Singapore have moved up in the ranking of largest ship-owning countries, while Germany, Norway and the United States have a lower market share today than in 2005.

“Maritime transport is the backbone of international trade and the global economy with around 80 per cent of global trade by volume and over 70 per cent of global trade by value are carried by sea and are handled by ports worldwide” Review of Maritime Transport 20151

In South America, the largest ship-owning country (in deadweight tonnage) continues to be Brazil, followed by Mexico, Chile and Argentina. The African country with the largest fleet ownership is Angola, followed by Nigeria and Egypt.

China ranked highest on the UNCTAD Liner Shipping Connectivity Index, which provides an indicator of a coastal country’s access to the global liner shipping network (the network of regular maritime transport services for containerized cargo). China was followed by Singapore, Hong Kong (China), the Republic of Korea, Malaysia and Germany.

The best-connected countries in Africa are Morocco, Egypt and South Africa, reflecting their positions at the corners of the continent. In Latin America, Panama ranks highest on the Liner Shipping Connectivity Index, benefiting from the Panama Canal and from being at the crossroads of main East–West and North–South routes, followed by Mexico, Colombia and Brazil. The 10 economies that rank lowest on the Index are all island States, reflecting their low-trade volumes and remoteness.

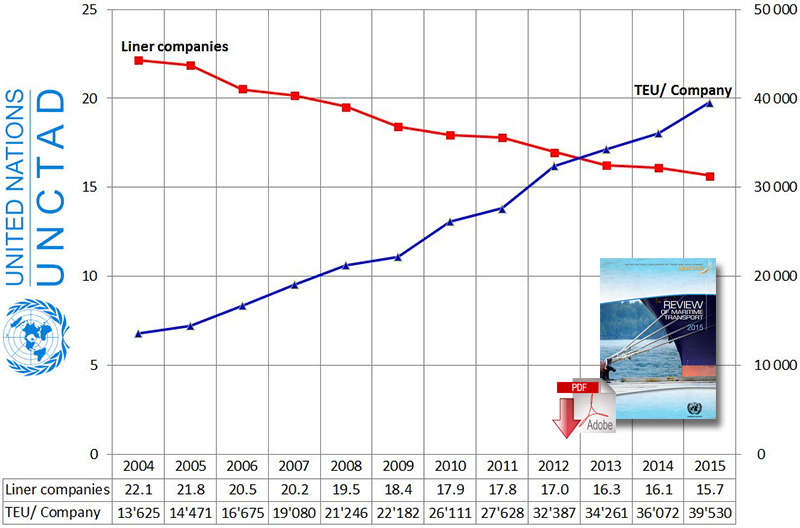

Data on fleet deployment illustrate the process of concentration in liner shipping, which has seen the recent mergers of Compañía Sudamericana de Vapores and Hapag Lloyd, and Compañía Chilena de Navegación Interoceánica and Hamburg Süd. While the container-carrying capacity per provider for each country tripled between 2004 and 2015, the average number of companies that provide services to each country’s ports decreased by 29 per cent.

Container ship deployment, 2004–2015

(Average per country)

Source: Review of Maritime Transport 2015 (UNCTAD).

Note: TEU = 20-foot equivalent unit.

Both trends illustrate two sides of the same coin: as ships get bigger and companies aim at achieving economies of scale, there remain fewer companies in individual markets. The Review of Maritime Transport 2015 says that it will be a challenge for policymakers to support technological advances and cost savings, for example through economies of scale, yet at the same time ensure a sufficiently competitive environment so that cost savings are effectively passed on to the clients, that is, importers and exporters.

At the beginning of 2015, the report reveals, the top 10 liner shipping companies operated more than 61 per cent of the global container fleet, and the top 20 controlled 83 per cent of all container-carrying capacity. Together, the three largest companies have a share of almost 35 per cent of the world total.

All companies with vessels on the order book are investing in larger vessels, with the average vessel size being larger than the current average container-carrying capacity. This attempt to realize economies of scale increases the risk of oversupply, UNCTAD notes.

The average vessel size for all new vessels on order by the top 15 companies is above 10,000 twenty-foot equivalent units, which is double the current average size of vessels in the existing fleet of each company. Only very few companies outside the top 20 carriers have placed any new orders and these orders are for far smaller vessel sizes.

Rates of tonnage added to the global fleet continued to decline in absolute terms compared to previous years. The report notes, however, that the overall growth rate of tonnage remained above indicators such as that of global gross domestic product and trade growth, and slightly higher than that of the growth of seaborne trade (3.4 per cent in 2014).

The Review of Maritime Transport 2015 says that total tonnage delivered in 2014 was only slightly more than half the tonnage delivered in the peak year of the historically largest shipbuilding cycle in 2011. The report explains that because several years pass between the placement of an order for a new ship and its delivery, ships are often ordered when the market is perceived as strong, only to be delivered years later, when the market may have become weaker.

As the report explains, tonnage delivered in 2014 had been ordered in some cases as long ago as 2008. While this oversupply may not be good news for shipowners, UNCTAD argues that it is a positive development for the revival of global trade because there is no shortage of carrying capacity and the cost of trade continues to decline in the long term.

In addition, the report reveals that, for the first time since the peak of the shipbuilding cycle, the average age of the world fleet increased slightly in 2014. The delivery of fewer new ships, combined with reduced scrapping activity, means that newer tonnage no longer compensates for the natural aging of the fleet.

Article Topics

UNCTAD News & Resources

Amazon’s New Status as an Ocean Freight Forwarder G6 Set For Shake-Up As CMA CGM Acquires NOL CMA CGM Confirms “Exclusive Talks” with NOL France’s CMA CGM Tipped as Favorite in Neptune Orient Lines Bid Maersk and CMA CGM in Talks to Buy NOL World’s Commercial Shipping Fleet Grew at Lowest Rate in 10 Years in 2014 Review of Maritime Transport 2015 More UNCTADLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation