Why the CFO & the Supply Chain Officer Need Each Other More Than Ever

CFOs are driving better business performance through strategic partnerships with the chief supply chain officer.

At the height of the financial crisis, when cost reduction leapt to the top of the corporate agenda, supply chains were one of the first places that CFOs turned to for savings.

Cost efficiency has since remained high on the corporate agenda but as companies get used to navigating ongoing economic uncertainty, the supply chain has taken on a new strategic significance.

It is essential to have a supply chain strategy that is aligned with the broader corporate and financial goals of the business. Efficiency is also paramount, to be able to respond to new market growth opportunities. As companies work to strike this balance, the supply chain leader’s role has become more prominent, and they now often sit on executive boards as peers to the CFO.

Leading CFOs’ contribution also now goes far beyond the traditional finance remit to encompass a strong strategic and commercial focus. To do this effectively, CFOs are collaborating closely with other internal functions – not just from a monitoring, reporting and risk management perspective, but also as supporters and enablers of performance.

CFOs and supply chain leaders are increasingly working together to understand, analyze and address supply chain issues. In companies where a business-partnering model is established, CFOs are drawing on their unique, fact-based view of the organization to solve business problems and provide insight to deliver informed decision-making.

Together, CFOs and supply chain leaders are creating alignment between strategy, finance, tax and operations, unlocking hidden value within the organization and strengthening financial performance.

Business partners are in the minority, but collaboration is growing

Our findings are based on a survey of 423 CFOs and heads of supply chain globally, and a series of in-depth interviews with CFOs, heads of supply chain and EY professionals.

Only 26% of finance executives and 21% of supply chain executives say that the CFO’s contribution to the supply chain is based around an enabling, collaborative, business-partnering role. However, 70% of CFOs and 63% of supply chain leaders say that their relationship has become more collaborative over the past three years.

The US, South Korea and Singapore take the lead

From country to country, there are significant differences in the proportion of supply chain leaders and CFOs with a business-partnering relationship in place. While the US, South Korea and Singapore top the list, Western Europe makes up the tail, with all respondents from France, Germany, Italy and Spain continuing to operate around a more traditional model. In the UK, however, business partnering is well established.

The business-partnering model relates to growth and strong financial performance

Companies with evidence of strong business partnering between the CFO and the supply chain leaders report better results than those with a traditional finance model in place. They are more likely to report closer alignment between finance and the supply chain functions, and a mutual understanding of risks and opportunities. Business partnering models have a stronger association with growth.

Among business partner respondents, 48% report EBITDA growth increases of more than 5% in their company over the past year, compared with just 22% of those with a more traditional relationship.

Analytics can be a powerful tool to drive a stronger business partnering relationship

Asked whether data and analytics present CFOs with a significant opportunity to drive a more collaborative, business partnering relationship with the supply chain, an overwhelming 85% of business partners agree. Robust information and insight are central to any business partnering relationship. CFOs’ access to financial information from across the business allows them to create a credible single version of the truth to drive decisions and performance measurement.

Four opportunities to business partner

We identify four focus areas where the CFO has an opportunity to enhance performance through business partnering with the supply chain:

- Creating consistency across the supply chain, the business and corporate strategy

- Supporting and challenging investment choices

- Monitoring and enhancing performance

- Managing risk and business continuity

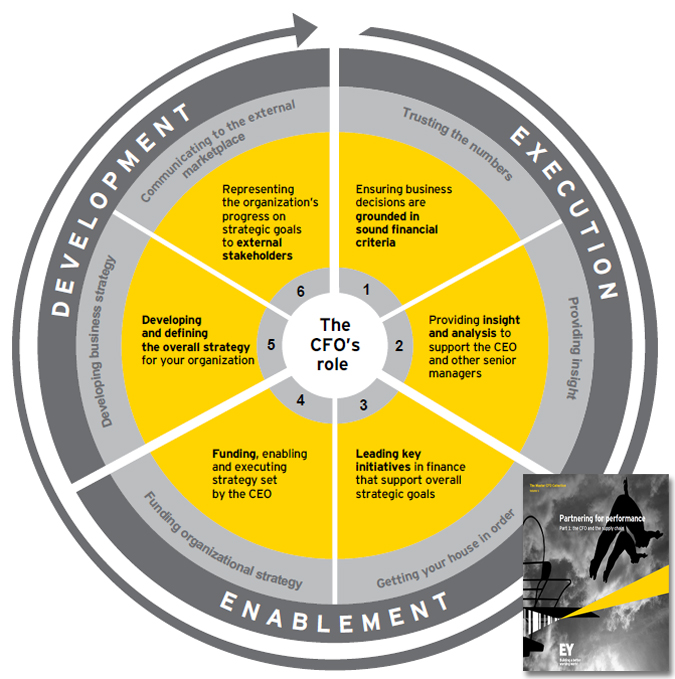

We believe these six segments represent the breadth of the CFO’s remit. The leading CFOs we work with typically have some involvement in each of these six − either directly or through their team. While the weighting of that involvement will depend on the maturity and ambition of the individual, the sector and scale of the finance function and economic stability, they are all critical to effective leadership.

Related Paper: Partnering for Performance

The CFO’s transition from a role focused on monitoring, reporting and controls to a broader business leadership role, has been the subject of much commentary. CFOs require a business-partnering model, with a collaborative focus on improving organizational performance.

Is the shift to business partnering happening?

When it comes to the supply chain, business partnering CFOs are still in the minority. Only 26% of finance executives and 21% of supply chain executives we surveyed say that the CFO’s contribution to the supply chain is based around a business-partnering model.

However, 70% of CFOs and 63% of supply chain leaders say that their relationship has become more collaborative over the past three years. In the next few years, we are likely to see the CFO increase their involvement in the supply chain further still.

Our survey suggests that collaboration is associated with stronger corporate performance. Among survey respondents with an established business partner model in place, 48% report EBITDA growth increases of more than 5% in their company over the past year, compared with just 22% of those that have not yet adopted this approach.

A focus on costs drive the CFO and supply chain together

When the crisis first hit in late 2008, many companies quickly faced severe liquidity constraints. To free up cash, improve working capital performance and strengthen balance sheets, companies embarked on ambitious cost-cutting programs. For many CFOs, the supply chain was the first place to look.

Five years on, the worst of the crisis is behind us, but the need for strong relationships between finance and the supply chain continues to grow. Although cost cutting remains high on the agenda, companies are turning their attention back to growth.

Today, the nature of growth opportunities has changed. Globalization and the rise of emerging markets present significant new opportunities, but also require companies to realign their supply chains and product portfolio to meet the needs of these non-traditional markets, while still ensuring that traditional developed markets remain served.

“CFOs should be taking active steps to align the finance organization with the manufacturing and supply chain to make sure that finance is right at the heart of that discussion,” says Simon Dingemans, CFO of GlaxoSmithKline, a pharmaceuticals company. “From my point of view, the supply chain is a very high priority in terms of shaping the operations of the company to support the strategy, but also to make it more efficient and agile.”

Evolving risk landscapes requires collaboration

In recent years, natural disasters and other events affecting global supply chains have rarely been far from the news. Worse, many companies struggle to identify the risks that lurk in their supply chains, particularly in secondary and tertiary layers.

Thanks to their broad perspective across the business, the CFO is in a position to improve end-to-end visibility across the supply chain and help identify and manage risks. They also have an opportunity to take a holistic view of the firm’s data and help protect both the financial and reputational health of the business using analytics and scenario-planning techniques.

Historical complexity creates opportunities for streamlining

Many companies’ supply chains have evolved in a piecemeal fashion. They have bolted on additional capacity to meet new demand, shifted internal resources to outsourcing relationships or acquired new assets through M&A deals.

As a result, global supply chains are often not only highly complex, but also poorly integrated, with a lack of end-to-end visibility and a reliance on different, often incompatible, systems and processes. In collaboration with the supply chain leader, the CFO can unpick the complexity and identify ways of improving visibility.

The supply chain’s increasing significance creates opportunities for alignment

In recent years, heads of supply chains have seen their role elevated within the corporate hierarchy. Many now hold board-level positions and have greater influence over strategic decision-making than ever. This is a major opportunity to create a new level of strategic alignment across finance and supply chain.

Business partnering relationships between the CFO and the supply chain yields rich returns

CFOs and supply chain leaders who say they are in a business partnering relationship are more likely to pinpoint organic or inorganic growth as the single most important priority for their business over the next three years. Below are five ways in which companies can benefit from business partnering between finance and the supply chain:

1. Drive cross-functional innovation

The best ideas frequently happen when companies look at a problem from a new perspective. By eroding organizational boundaries and bringing together teams from different functional areas, business partnering can act as a powerful catalyst of new ideas and innovation.

“Breakthroughs in performance and innovation happen when there is true partnership in place between functions to solve problems,” says Brian Meadows, Americas Supply Chain Leader at EY. “They don’t occur in functional areas in isolation; they happen when you break down organizational barriers and introduce connectivity into how work gets done.”

2. Creating alignment around priorities

Companies perform better when there is focus and alignment around corporate priorities. Yet, all too often, performance targets in different functional areas can have unintended consequences elsewhere in the business.

Business partner CFOs can serve as the “broker” between the commercial and operational sides of the business, and help ensure that there is consistency and alignment around objectives. “Once we have a good idea of how much product we are going to sell, we can build a strategy around that and optimize our manufacturing footprint to deliver it,” says Matt Hilzinger, CFO of UGS, a building supplies company.

Related: Starbucks Chief Financial Officer Picks up Tech, Supply-Chain Roles

3. Strengthen investment decision-making

Business partner CFOs play an active role throughout the investment life cycle. By bringing rigor and insight to support and challenge decision-making, they help to maximize the chances of making the right decisions.

Over time, this collaborative approach helps to educate partners in the supply chain to be more effective in making investment choices. “It’s not about finance telling the organization what it can and can’t do; it’s about serving the right information and engaging with the business in a collaborative way to make better informed decisions,” says Simon Dingemans, CFO of GSK.

Collaboration also helps to defuse the tensions that can often accompany decisions around resource allocation. Andrew Caveney, Global Supply Chain Advisory Leader at EY says, “The supply chain is in a better position to know what the organization needs to produce, and can start to direct capital investment to building the right capabilities in line with that strategy.”

4. Use end-to-end visibility to drive performance

Business partner CFOs help to eliminate information silos. This creates end-to-end visibility across the commercial and supply sides of the business. With better information flowing through the system, companies can create an accurate picture of demand. This helps to strengthen planning and forecasting, leading to much stronger working capital performance.

“To really make a difference in terms of working capital, you need to redesign your supply chain so that you speed up the manufacturing cycle and shorten production times,” says Mr. Dingemans. “If you can make the supply chain more responsive to the front end by centralizing demand planning in one place, then you can run with lower stock levels. And that creates a real benefit in terms of speed and responsiveness.”

5. Provide a stronger early warning system of risks

By embedding in the supply chain and improving the flow of information across the company, CFO business partners can develop a much deeper understanding of risks. Using tools such as analytics and scenario planning, they can also adopt a long-term and strategic perspective on risk, and ensure that the business is able to respond effectively when the unexpected happens.

“We are never going to get the same degree of control over our external suppliers as we do over the internal network, but we have processes in place to try to get as close to that as we can,” says Anthony Maddaluna, President of Global Supply at Pfizer. “We have a lot of quality indicators to tell us what’s going on and a very strong technical support group. So, when issues come up – because they do – we deal with them very quickly.”

Business partnering CFOs enhance, as well as monitor, performance

Traditionally, finance leaders have a strong role in monitoring performance, including:

- Defining and setting key performance indicators (KPIs)

- Assessing whether these targets are being reached

- Determining whether further action is needed to address performance issues

In a business-partnering relationship, CFOs go beyond this to help functional areas to really drive performance. Here are some of the ways finance leaders can make a difference.

Using data to create a “single version of the truth”

CFOs have an opportunity to help standardize the language, measurement, tools and KPIs across the organization. This creates consistency and clarifies the targets for different functional areas.

“CFOs have a unique skill to bring together different parts of the organization that may be at odds with each other or may not have a great mechanism for open communication,” says Stan Brown, a Partner in EY’s manufacturing practice in the US.

Evaluating and managing trade-offs

The CFO is unique in having a relatively objective view over the business, based on cold, hard figures. This means that they can serve as the broker between functional areas and evaluate trade-offs between different objectives.

“The CFO can add a valuable perspective to this discussion by evaluating the impact of increased service levels on other metrics, such as working capital,” says Sean Ryu, Supply Chain Leader for Asia Pacific at EY.

Considering tax as part of investment decisions

All too often, tax is an afterthought when companies evaluate operational investment decisions. Tax should never be the primary consideration for choosing where to locate an asset or entity. However, it can be an important influencer, which can yield significant bottom-line benefits.

CFOs should ensure that they participate in discussions around investment from as early a stage as possible, and consider tax throughout the process. Joost Vreeswijk, EY’s Tax Effective Supply Chain Management Leader in Europe, Middle East, India and Africa says, “If tax is left as an afterthought, the consequences can be severe. We have seen instances where make-versus-buy decisions and location choices have had to be completely revised due to the late inclusion of customs and indirect tax effects.”

Realizing the potential of government incentives

For a multinational business, choosing an investment destination is a complex decision. As countries around the world increasingly compete for inbound investment, they are establishing or increasing government incentives, such as R&D tax incentives, tax holidays and other benefits.

CFOs should ensure they consider these incentives when evaluating investment choices and form part of the cost-benefit equation. As with tax, they should not be the sole driver of a location decision, but they should be considered.

Helping to select the right operating model

Choosing the correct operating model for functions in the supply chain, such as procurement, can play an important role in driving performance improvements. Therefore, CFOs should be at the heart of this discussion.

A centralized model not only helps to increase cost efficiencies, but can also achieve a broader goal of value creation. By bringing together procurement expertise into one place, companies provide greater visibility, enable rigorous control and facilitate process improvement across the value chain.

Diageo, for example, has taken steps to centralize procurement to drive economies of scale and consistency across the business. “Although we have local procurement teams, they now form part of a centralized group,” says David Gosnell, President of Global Supply Chain and Procurement at Diageo. “We have category managers at the center who set strategies and manage contracts globally.”

Ten steps for CFOs towards successful business partnering

1. Make time for the supply chain

Most CFOs juggle many different priorities and struggle to meet demands on time. To make business partnering effective, there needs to be a genuine commitment of time and resources. Business partner CFOs surveyed spend an average of 25% of their time, or more than one day a week, working with the supply chain. Those in traditional relationships, spend around 12% of their time on the supply chain.

2. Allocate finance resources to the supply chain

Business-partnering responsibilities should not rest exclusively with the CFO. Finance leaders need to think carefully about how the finance function supports the supply chain and ensure there is a structure in place to encourage collaboration. A common model is to “embed” finance business partners in the supply chain, with a hard reporting line back to finance and a dotted reporting line into the functional head.

3. Participate in the sales and operations planning process

The sales and operations planning (S&OP) process is the nerve center of the business and a vital bridge between the commercial and supply sides. CFOs have not traditionally played a central role in S&OP, but there is a real opportunity for them to provide insight and information to the process to help ensure alignment across functions and with the broader strategy. The CFO’s relative detachment from the day-to-day operations also allows them to bring a more neutral perspective to the process, which can help to keep it “honest.”

4. Own your organization’s data

Many companies rely on multiple data sources in different functional areas. This leads to inconsistency in the data-driving decisions and benchmarks. By helping to eliminate these “information silos” from the business, CFOs can provide a more consistent picture and prevent multiple interpretations. Taking ownership of data and presenting a “single version of the truth” defuses arguments over which numbers to believe and facilitates a more constructive dialog around how to turn insights into action.

5. Stay involved throughout the investment cycle

Business partners go beyond the traditional finance responsibility as the “gatekeeper” of investment and budget allocation. They also play a more supporting role by helping to strengthen the business case for investments, explore alternatives between “make-or-buy” decisions and educate their partners in the supply chain about how to be more effective in making investment choices. This means being involved throughout the investment life cycle, from choosing an asset for investment through to managing its performance, retiring it or reinvesting in it.

6. Help build an integrated operating model

When high-performing companies design their business model, they make sure they address all the layers that can enhance performance. This includes not only the physical, people and organizational structures, but also indirect taxes, transfer pricing, the effective tax rate and legal structure.

Ultimately, market competition comes down to how one operating model performs against another. The CFO and the supply chain leader have an opportunity to build an integrated, cost-efficient, effective structure that puts the company in a better position to create shareholder value.

7. Focus the supply chain on the metrics that matter

Over time, many companies add new metrics and key performance indicators (KPIs) to the supply chain to deal with specific challenges and priorities. However, when teams have too many different metrics as incentives, the result can be confusion and lack of clarity around the real objectives of the organization.

CFOs can play an important role in simplifying the performance management structure and reducing the number of KPIs. With a focus on a few metrics, companies are better able to provide clear direction and align the business behind the objectives and goals that matter.

8. Identify performance incentive misalignment

Specific incentives within a function may help to improve performance, but they can sometimes have unintended consequences. Consider, for example, a manufacturing function that is encouraged to push as many products through the supply chain as possible to keep down unit costs. While achieving their own objectives, this can cause problems elsewhere with a buildup in unnecessary inventory.

CFOs can play an important role in anticipating and avoiding these unintended consequences, and ensuring alignment of incentives to meet the objectives of the business.

9. Consider centralizing business functions

CFOs should advise on the right operating model for the supply chain, often drawing on their own experiences of finance transformation. A more centralized model for functions, such as procurement, enables companies to achieve economies of scale. It also facilitates better performance by bringing together expertise in one place and then leveraging it globally.

Some companies are taking the next step in centralization by creating multifunction shared service centers. These single, unified business services organizations can manage end-to-end processes across a range of different functions, including finance and HR, as well as procurement.

10. Look deep in the supply chain for risks

Most companies today have highly global complex supply chains that comprise primary, secondary and sometimes tertiary layers. With operations happening far from a company’s direct control, it can be challenging to identify exposures, understand and mitigate these risks.

Working together with heads of supply chains, CFOs should focus on gaining visibility into secondary and tertiary layers of the supply chain and ensure that they have appropriate control over their external partners.

Source: Ernst & Young

Related Content: Why Employee Fulfillment Increases Supply Chain Performance