Why Procurement and Supply Chain Don’t Talk as Often as They Should

Many companies launch initiatives that rapidly achieve short-term value, but they fail to maintain momentum long-term because cross-functional support drops off, core players are pulled into other initiatives, and new players are not trained in time.

Intuitively, leaders understand cross-functional issues, but there are three key reasons why they don’t succeed when attempting to address them.

1. Inability to address cross-functional trade-offs and maximize value. Often, senior managers lack the comprehensive perspective and pragmatic approaches needed to tackle cross-functional challenges. It’s rare for them to have systematic methodologies with which to understand and arbitrate among inherent trade-offs.

Too often, their fact bases are incomplete (for example, supply chain planners may order smaller batch sizes because they lack a clear understanding of the contracted volume discounts) and they have too few tools to make an impact—for instance, the kinds of sophisticated tools that can analyze total cost of ownership of products, including inventory carrying and ordering costs.

Moreover, there may be only limited links between the business strategy and supply chain strategy, and between the supply chain strategy and the quality of supply chain implementation.

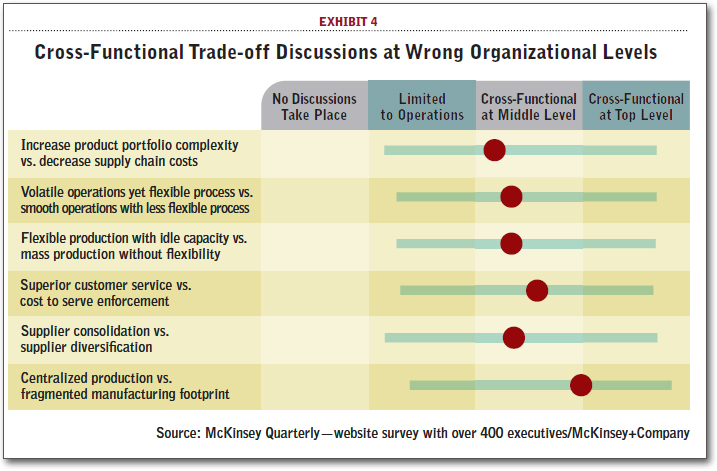

2. Dealing with issues in the wrong forums and without proper enabling elements. A recent executive survey shows that top cross-functional trade-off discussions still take place at the wrong organizational levels.

Companies that succeed over the long term tend to focus on both “performance” and “health,” with heavy emphasis on upfront training in new tools, processes, and approaches so they can build up a cadre of experienced managers who can sustain this effort far into the future.

There is too little recognition of the factors that really enable change, and inadequate means to implement them even if they are recognized. It’s common for there to be too little transparency, inadequate performance metrics, and too few incentives to drive true end-to-end integration. Worse: when middle managers attempt to resolve issues, they typically fight for what’s best for the function and not to what’s best for the company.

3. Incentives are often misaligned. Even if procurement and supply chain managers do talk with each other, their incentives don’t often match the objectives that they should share. Procurement may be measured on savings from applying traditional procurement levers using a total cost of ownership (TCO) approach, while supply chain managers are usually incentivized based on service levels, logistics costs, and inventory levels.

A perfect example of such conflict was evident at a large retailer, where procurement defined volume-based supplier contracts that were executed early in a finite financial period whereas supply-chain operations only ordered as needed in order to minimize inventory levels. This resulted not only in increased procurement costs (higher logistics costs) but also in the loss, later on, of substantial volume discounts.

Read the related article “Bridging the Procurement-Supply Chain Divide: Six Factors That Make a Difference”

Article Topics

Directworks News & Resources

Why Procurement and Supply Chain Don’t Talk as Often as They Should Bridging the Procurement-Supply Chain Divide: Six Factors That Make a Difference Procurement Excellence - What It Is and How to Achieve It Supply Chain for Leaders: Lessons Learned from a CPO Roundtable How Important is the Inbound Supply Chain to Shareholder Value? Creating Shareholder Value Through Supplier ManagementLatest in Supply Chain

Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Supply Chain