Why Are We Letting Digital Marketers Define The Future World View of The Supply Chain?

Supply chain leaders are expressing rising frustration about the gap of what they see as possible in the digital age and what they experience in their day-to-day world in their offices - it is a conundrum.

We live in a digital age in our personal lives. However, this is not the case in our supply chains.

In my travels, I find supply chain leaders expressing rising frustration about the gap of what they see as possible in the digital age and what they experience in their day-to-day world in their offices. It is a conundrum.

Two weeks ago, I sat in the audience at Pivotcon, a conference focused on the advancement of digital business. I listened to digital marketers wax eloquently on the future of business. In their world view, the future would be the coalescence of robotics, learning systems, and voice automation.

They shared a vision of the world where everyone had more voice - expressions through social media - but everyone is heard less. Their expressed world view of digital printing, a collaborative economy, and automated systems has major ramifications for the supply chain. The portrait was a world of no smokestacks and few workers. As they talked, I winced. Manufacturing is core to the middle class and a healthy economy. Digital business offers so much more opportunity.

At the end of the session, I felt tired. I asked myself, “Why are we letting digital marketers define the world view of the future of supply chain?” As I stomped through the rain puddles back to the train station, I mused. The Pivotcon perspectives seem so rarefied, and out of touch with the greater reality that I see…. I asked myself, “How do I help?” I feel stuck between the world that digital marketers project - where they want to propel processes quickly into new forms of digital business that I don’t think make sense - and the traditional supply chain leader that is struggling to make their processes work today.

At the end of 2014, many leaders that I work with are preparing their 2015 strategies. The word digital is everywhere in their presentations - digital path to purchase, digital agriculture, and digital manufacturing. As I read them, I laugh. I give them credit. They are trying to be more ‘sexy’.

Digital business processes are now the buzz with sex appeal. While supply chain professionals would like to embrace some of the more advanced concepts, and no one likes the systems and technologies that they have today, most feel stuck. It is an awkward feeling. I feel their pain. They don’t know the right questions to ask and how to get started. They want to embrace the new, but they are having problems making their current systems and technologies work today. This is the goal of this blog post.

Research in Review - Insights from 2014 Studies

No two supply chains are alike, but supply chain leaders across all industries face common challenges. The supply chain is becoming more strategic - an engine of growth and the driver of new business models - to drive new opportunities. For supply chain leaders, it is no longer just a discussion of cost and inventory management.

However, frustration abounds. Companies struggle to improve balance sheet results in the face of rising complexity and slowing growth. While all companies have improved revenue per employee, this efficiency improvement has not translated into operating margin improvements; and while cash-to-cash cycles have improved, it is not due to improvements in inventory positions. Most companies feel stuck, as if they are being held hostage by traditional supply chain practices.

In this report, we highlight the current state of supply chains - the supply chain organization, technologies, and process evolution - to enable supply chain leaders to take the next step in their strategy development. This report reflects the current state of supply chains, and is designed as a foundational document for supply chain leaders to build their 2015 strategies.

For many, it is a paradox. How do supply chain leaders modernize their visions? What is a fad and what drives real value?

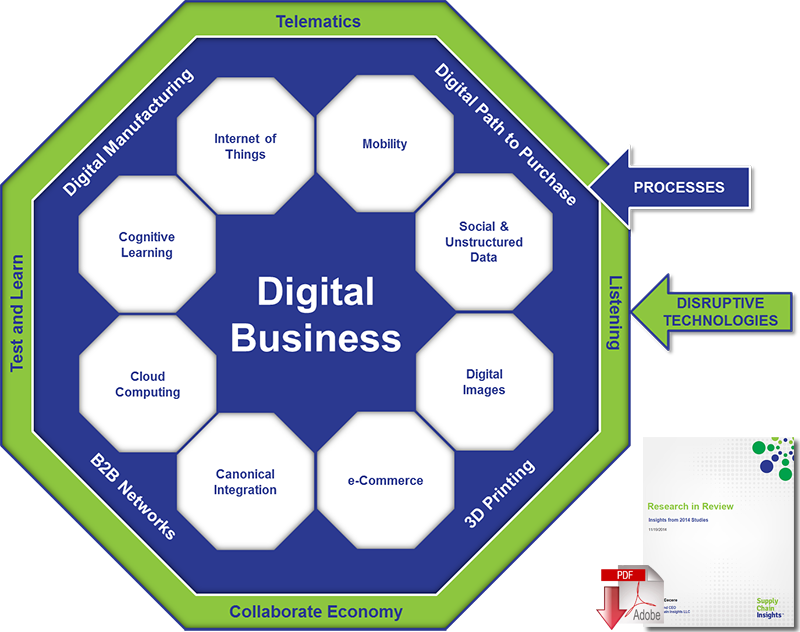

The technology shifts are many: the Internet of Things, mobility, analytics for social and unstructured data, cognitive learning, cloud-based software, canonical integration in B2B networks, e-commerce, and digital images. We are starting to see the convergence of these technologies into digital processes, but only for early adopters. Here are some insights from our recent research:

Digital Path to Purchase: In a study on trade promotion management in early 2014, we find that 60% of marketing teams within consumer packaged goods companies are working on a digital path to purchase strategy. This includes the automation of the list and driving demand before the store, driving demand in the store, mining the data from checkout, and listening to sentiment post-purchase.

We find that most of these efforts are bogged down by the concepts of traditional Customer Relationship Management solutions and the lack of a basic understanding of supply chain. Only 57% of retailers have a perpetual inventory signal, and too few companies (22%) have invested in mining channel data through the use of a Demand Signal Repository (DSR). Too few companies understand the differences between syndicated data sources and the use of channel data. We are very early in our understanding of outside-in processes.

Digital Manufacturing: We have been trying to finish a research study on digital manufacturing for ten months. It is hard to find enough people knowledgeable on the subject of digital manufacturing to finish the research. This gap is telling. We have 100 completes with 41 respondents from process-based industries and 60 completes with discrete-based businesses. Only 5% are attempting to use mobility within manufacturing and only 15% of the discrete manufacturers are actively pursuing 3D printing for production-based processes (digital printing is being used more for prototypes).

Cognitive Learning: I think that we are five years away from supply chain planning systems that can learn as we sleep. Today, 9% of process-based companies in a 120 respondent survey on analytics are experimenting with cognitive learning. These technologies allow the sensing, learning and acting of processes based on rules-based ontologies. As you build your 2015 plans, experimentation is the operative word and promise should be capitalized in the following sentence.

B2B Networks: We have completed three studies on the use of B2B networks and the evolution on canonical integration structures. No doubt about it, these many-to-many data models and more advanced forms of integration offer significant advantages to the traditional EDI integration, but the primary technology for B2B networks today is the Excel spreadsheet. Only 9% of commerce flows through B2B networks. For all, this is an opportunity.

Big Data and Analytics: We are also completing a study on big data and advanced analytics. We now have 106 completes, but only 21% of companies have a team focused on experimenting with big data concepts. Data lakes, streams and pools offer opportunities that manufacturers will not be able to use unless they open their wallets.

E-commerce: What a difference a decade makes in the definition of e-commerce. While e-commerce at the beginning of the decade was relegated to retailers, today, it should be a strategy for almost every manufacturer. Selling directly to the consumer is a powerful engine of growth, but requires the redesign of logistics systems to embrace the ‘each’. Many companies that I work with are quickly moving into 2-6% direct sales, but learning the hard way that it requires rethinking warehouse management and order management.

What should you do? In short, get started. No one likes what we have today, and I think that we are in a world of hurt if we allow the digital marketing folks to define the future of supply chain.

My Recommendations:

1) Brainstorm the Future Cross-Functionally. Schedule some time with your digital marketing teams and brainstorm how their efforts and yours could coalesce. Focus on how the supply chain can be the engine of growth through the use of concepts from the collaborative economy, test-and-learn strategies, or e-commerce. Think through what the future of the channel means to your supply chain. Before you have the meeting, you might want to listen to Jeremiah Owyang’s podcast on the Collaborative Economy.

2) Fund New Forms of Analytics. One of the issues in today’s supply chain is that we cannot get to data. In our investments over the last decade, we have successfully put data into systems, but companies are unable to get data out and use it successfully in analytics. (One of my clients uses the analogy of “Hotel California.” Data checks in, but cannot check-out.) Manufacturers are behind other sectors like insurance and banking. There are many reasons- lack of clear analytics strategy, belief that it is an add-on from an ERP vendor, and lack of funding (manufacturers are cheap when it comes to spending on analytics).

In a recent webinar on the Race for Supply Chain 2020, Marty Kisliuk, Global Operations Director at FMC commented when he heard Chris Clowes’, Supply Chain Manager at Costa Enterprises, presentation on the Internet of Things and the automation of coffee machines using the Internet of Things at Costa Coffee, that “Maybe, we should give funds to our 30-year old teams to experiment.” Many in the audience laughed, but I think that there is wisdom in Marty’s statement. New forms of analytics - QlikView, Tableau, and Spotfire - are easier to expense and faster to deploy than the more conventional analytics from traditional analytics vendors. Why not let the younger members on the team experiment with new forms of analytics? In 2015, why not put aside some money for testing? I love the insights from Fran O’Sullivan, General Manager of IBM.

3) Imagine What the Supply Chain Can Be. Free yourself from today’s paradigms. To help you, we are working on a series of webinars and research projects. Check out our recent webinar on the Race for Supply Chain 2020 and join us for a panel discussion with Roddy Martin from Accenture, and Mickey North Rizza from Bravo Solutions (both Roddy and Mickey were past AMR Research analysts) for a Review of 2014 Infographics. To help, we just published a collection of our best research articles from 2014 and in the first quarter of next year, we will be publishing a number of articles on Big Data, Digital Manufacturing, Mobility, Digital Path to Purchase and the Internet of Things. This is a countdown to our Supply Chain Insights Global Summit on September 9-10, 2015 at the Phoenician, in Scottsdale, AZ. At this conference, we will challenge supply chain leaders to rethink business models and break traditional paradigms. I hope to see you there!

4) Build Organizational Muscle. Our recent research studies show that we are losing the battle on talent development. More and more companies are rating themselves lower on their ability to hire and train supply chain talent. Check out the research on talent, and start to focus on how to build that mid-management muscle and enable it through digital business.

About the Author

Lora Cecere is the Founder and CEO of Supply Chain Insights, the research firm that’s paving new directions in building thought-leading supply chain research. She is also the author of the enterprise software blog Supply Chain Shaman. The blog focuses on the use of enterprise applications to drive supply chain excellence. Her book, Bricks Matter, was published in December of 2012.

Related: Three Supply Chain Questions Supply Chain People are Afraid to Ask

Download Qlik Visual Analytics Resources

Balancing Priorities in the Supply Chain

This paper demonstrates how Data Discovery software helps generate insight and provides decision-makers with increased visibility to help identify risks and opportunities.

The Sustainable Supply Chain

A key priority for developing a sustainable supply chain is the ability to collect and analyze insights from data, however, deriving and sharing these across stakeholders can be impeded by the huge volume and complexity of the data.

Aberdeen Group’s Supply Chain Intelligence: Descriptive, Prescriptive, And Predictive Optimization

The goal of any analytics solution is to provide the organization with actionable insights for smarter decisions and better business outcomes, however, different types of analytics provide different types of insights.

Article Topics

Qlik News & Resources

Why Don’t People Think Supply Chain Is Sexy? Lemonade and the Supply Chain Why Are We Letting Digital Marketers Define The Future World View of The Supply Chain? Balancing Priorities in the Supply Chain The Sustainable Supply Chain Supply Chain Intelligence: Descriptive, Prescriptive, and Predictive OptimizationLatest in Supply Chain

Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Supply Chain