Why Amazon’s $8Trillion B2B Bet is Flying Under the Radar Screen

AmazonSupply.com launched quietly in April 2012 with 500,000 items for sale. Two years later, with the site still officially in beta, that list of products has grown to more than 2.2 million.

Amazon CEO Jeff Bezos is all too happy to talk about delivering packages by unmanned drones, same-day grocery delivery and a rumored foray into the smartphone market, but the real stealth bomber in his arsenal may well be AmazonSupply.

According to an article by Clare O’Connor of Forbes, “… there’s one thing Bezos hasn’t been talking about: AmazonSupply, an e-commerce site targeting the unsexy but hugely lucrative wholesale and distribution market. His silence is especially surprising as the site has the potential to turn into the most important development in the company’s history since it started selling books. Yet Bezos has uttered only 28 words in public - ever - about AmazonSupply, describing it in passing as ‘an incredible category’ during the company’s 2012 annual meeting.”

While Amazon is now famous for its many disruptive moves and for extremely high customer satisfaction levels, one thing it’s not known for is profitability. In fact, the company estimates an operating loss of up to $455 million in the next quarter. And that elusive search for profitability may explain why AmazonSupply has been in stealth mode since it launched in April 2012. The opportunity is simply enormous.

According to O’Connor, “While U.S. retailers took in more than $4 trillion in revenues according to the most recent U.S. Census, wholesalers brought in $7.2 trillion selling everything from Bunsen burners to toner cartridges. Even better for Amazon: Of America’s 35,000 distributors, almost all are regional, family-run companies pulling in annual revenues of $50 million or less, and only 160 have more than $1 billion in sales annually.”

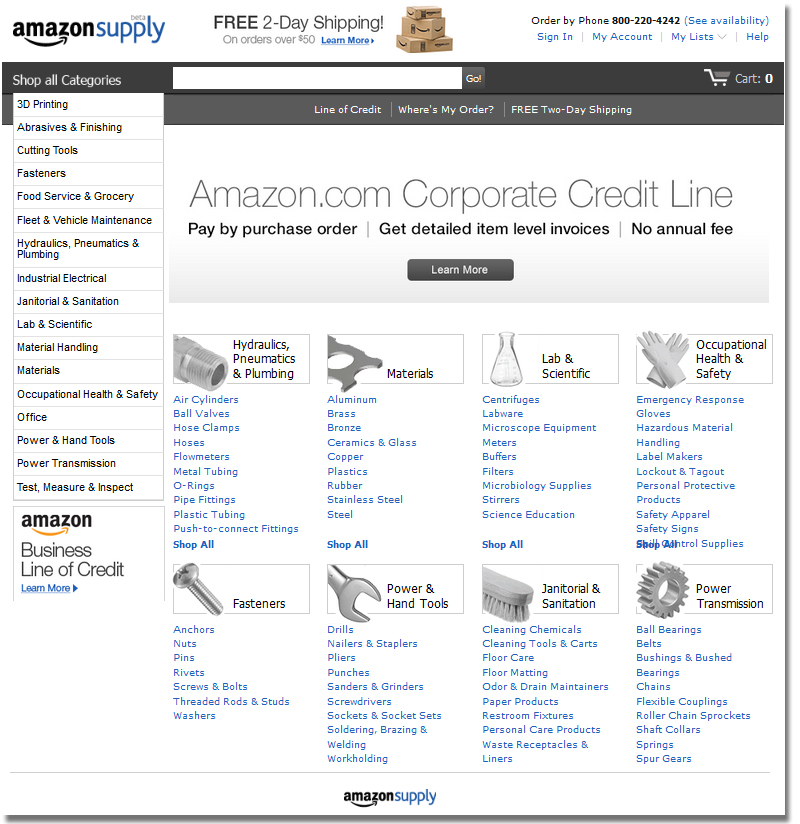

Adds O’Connor, “AmazonSupply.com launched quietly in April 2012 with 500,000 items for sale. Two years later, with the site still officially in beta, that list of products has grown to more than 2.2 million - covering 17 product categories from tools and home improvement to janitorial supplies, stocking everything from 12-packs of Hawaiian Punch to schedule-40 stainless steel pipe. If 2.2 million products doesn’t sound like a staggering figure on its own, consider that the average wholesaler sells closer to 50,000 products online.”

Even the industrial supplies giant W. W. Grainger may have a hard time competing. “A Boston Consulting Group study found AmazonSupply’s prices to be about 25 percent lower than the rest of the industry on common items.” O’Connor explains. Clearly Amazon has its sights set on taking a significant share of Grainger’s high-volume, low-margin business. According to O’Connor, “… just a couple of years into the game, AmazonSupply has already beaten Grainger in sheer volume of online inventory, with its 2.2 million products for sale dwarfing the latter’s 1.2 million.”

AmazonSupply’s aspirations are certainly lofty - its stated goal is “… to supply everything needed to rebuild civilization.” Competing with its fulfillment and logistics capabilities as well as its treasure trove of consumer data will be a daunting task for B-to-B distributors of every size, mainly because Amazon is willing to sacrifice short-term profitability for long-term domination. As Bezos said in an earlier interview with Forbes, “We don’t focus on the optics of the next quarter; we focus on what is going to be good for customers.”

If there’s a silver lining to Amazon’s foray into B-to-B distribution, it is that companies that have been complacent about innovation and investment in distribution and logistics capabilities are being forced to take a hard look at their infrastructure to see where they can become more competitive against such a massive, disruptive force. Amazon is, after all, not perfect.

As Forbes publisher Rich Karlgaard noted in the same issue, “Amazon has grown like a weed, but it can’t or won’t show a profit, and investors are losing patience. Amazon pledges allegiance to data and analytics, but its employee turnover is the highest in both technology and retail. This means that Amazon’s extraordinary data-driven efficiency is hurt by its higher costs in recruiting, retraining and retention.”

Related: What is the Amazon Effect?