Where Do New Products Come From?

Insights from a new National Bureau of Economic Research study on innovation in manufacturing.

A recent NBER working paper offers up some interesting new survey data on innovation in U.S. manufacturing industries.

Authors Ashish Arora, Wesley M. Cohen, and John P. Walsh surveyed more than 5000 U.S. manufacturing firms in 2010, asking whether or not they brought new products to market in the previous three years.

Most notably, the data shows that the number of truly innovative manufacturing firms is relatively small. In the aggregate, it finds that 43 percent of firms introduced new products in the past three years, but only 18 percent of firms introduced new products that were wholly new to their market.

In other words, one quarter of firms, and more than half of firms introducing new products, introduced “imitation” products following the lead of other companies. The percent of firms introducing totally new products ranged significantly between industries, from just 10 percent of firms in the “Wood” and the “Metals” industries, to 44 percent in the “Instruments” industry.

The survey also breaks down the results in a number of interesting ways, including where the innovations originated. It finds that the most common source of innovation is customers. This is particularly true in intermediate industries that sell to other firms, probably because it’s easier to gather data from and build relationships with a small number of B2B customers than a large consumer base.

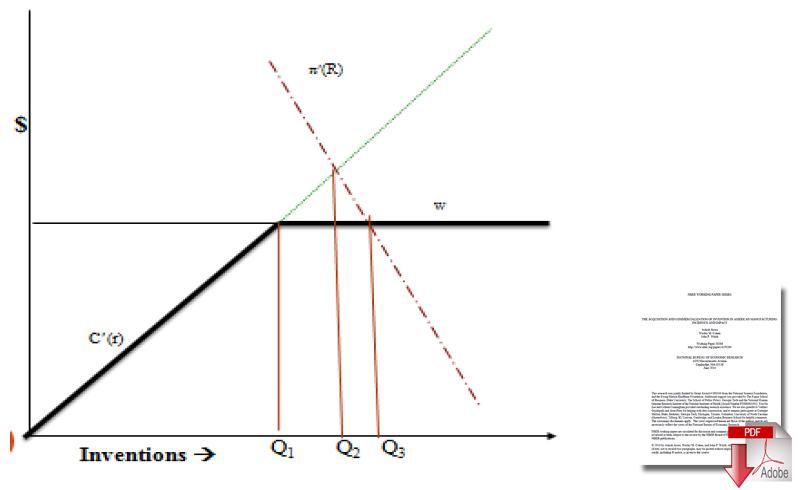

Supply and Demand for Innovation

However, while customer-based innovations are the most common type, they appear to be less valuable to firms than other types of innovation—customer-based innovations are generally easy and cheap to implement, but don’t provide enough differentiating advantage in the marketplace to bring in significantly higher value to the firm.

In contrast, a smaller but still significant portion of innovations come from “technological specialists,” a category that includes universities, independent inventors, and specialty research firms. Innovations from these sources tend to be in more technology-intensive industries, like semiconductors, plastics, and medical equipment. Correspondingly, innovations sourced from technology specialists tend to be higher value to these firms than customer-sourced innovations.

The paper also breaks down how firms that acquired innovations from external sources went about doing so. Collaborative R&D was by far the most common channel overall, used by 61 percent of firms, followed by informal sources, used by 36 percent of firms. Certain industries departed sharply from these averages, however. In particular, in the pharmaceutical industry mergers and acquisitions and licensing accounted for nearly 80 percent of acquired innovation, reflecting both the independent nature of invention in those areas as well as the strong intellectual property protection they receive.

Overall, the paper shows that most manufacturers are unwilling to take many risks, though they are somewhat more inclined to make incremental improvements or imitate other successful companies. For risks of any size they are eager to share the costs through cooperative projects.

This means that the government has an important role to play, reducing the downsides of risky bets through programs like R&D tax credits, and also helping coordinate research efforts and establish innovation ecosystems.

Source: The Innovation Files sponsored by the Information Technology and Innovation Foundation (ITIF).

Related: United States Government R&D and Manufacturing Competitiveness

More SC24/7 Topics on “Innovation”