What to Expect from the Logistics & Shipping Sectors as E-Commerce Grows Up

Overcapacity in the container shipping industry and greater use of technology in manufacturing, retail and logistics industries are disrupting the sector.

Driven by new technologies and e-commerce growth, changes in the global supply chain are expected to impact industrial real estate for the foreseeable future.

Since 2012, Amazon has been aggressively expanding its logistics and shipping services worldwide, disrupting traditional supply chain operators with direct competition for their business.

Chinese “e-tail” giant Alibaba, meanwhile, has deployed technology that cuts into a portion of third-party logistics (3PL) operator profits.

Alibaba’s “One Touch” platform automates export-related services, such as customs clearance and logistics, to make it cost-efficient for small/medium-sized merchants to participate in the global marketplace.

Cyclical and structural factors, including overcapacity in the container shipping industry and greater use of technology in manufacturing, retail and logistics industries, are also disrupting the sector.

Automation and robots are replacing manufacturing, logistics and warehouse workers. A survey by PwC found that 59 percent of all U.S. manufacturers are using robots for some tasks.

A recent report from real estate services firm Colliers International analyzes how these changes are impacting the logistics landscape. The report also looks at the impacts on industrial and logistics properties.

Report author Bruno Berretta, associate director with Colliers International who leads the firm’s pan-European research activities, says that Amazon Prime has entered the logistics market to take control of its supply chain and improve delivery times. He notes that unofficially Amazon is becoming a 3PL service to third parties.

The company is making a big push to establish a logistics network, opening smaller distribution facilities near customers, according to Berretta, who suggests that Amazon is likely to start competing with traditional 3PL services as it opens new markets.

Additionally, Amazon wants to reduce shipping costs, which have a big impact on profits. The Colliers report notes that in 2015 Amazon spent $11.5 billion on shipping costs, which equated to 10 percent of its global sales. By delivering its own goods and using technology to streamline deliveries, the company estimates it would save $3 per package, or $1.1 billion annually.

Gearing up to take over its deliveries, Amazon leased 40 cargo planes for its “Prime Air” service last year and secured a license to act as a wholesaler for ocean container shipping between China, the U.S. and Europe.

As a result, the company now buys space on container ships for its customers and charges them wholesale rather than retail prices. Amazon’s expansion into the 3PL market would have a major impact on UPS and DHL, as 5 percent and 4 percent of their business, respectively, currently comes from Amazon merchandise.

In response, FedEx launched FedEx Fulfillment in February, an e-commerce solution for small and medium-sized enterprises (SMEs). This platform utilizes FedEx’s global transportation network, allowing SMEs to fulfill orders from variety of integrated selling channels.

According to FedEx, FedEx Fulfillment is designed to allow SMEs achieve scalable growth through warehousing, fulfillment, packaging, transportation and reverse logistics.

Customer expectations for fast deliveries have increased pressure on e-commerce retailers and distributors, which are deploying innovative strategies for delivering perishables and other merchandise to urban consumers in as little as two hours.

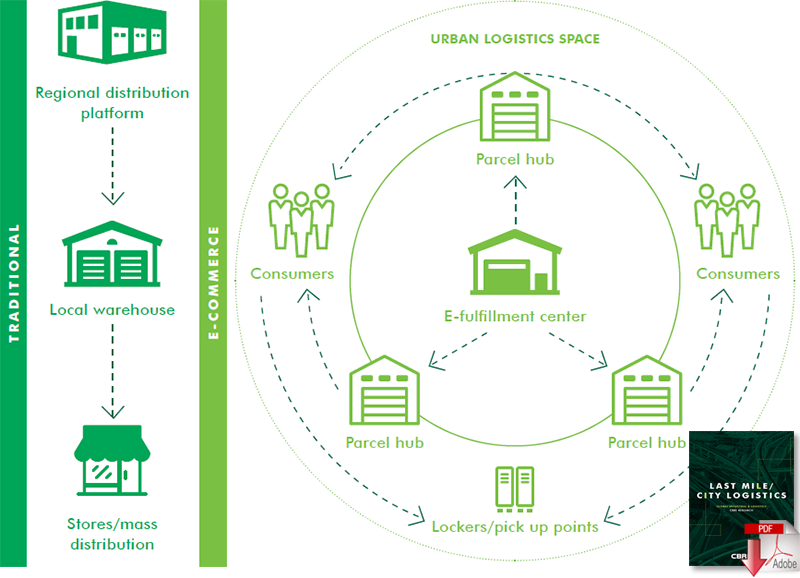

As a result, “the last mile” is now an important and challenging component of the supply chain, requiring distribution facilities in and around dense urban areas to accommodate fast delivery, according to a new global report by real estate services firm CBRE, “The Last Mile/City Logistics.”

The report notes that distributors have altered their supply chains, augmenting the traditional logistics platform that relies on regional distribution to include urban logistics facilities.

CBRE researchers identified some innovative strategies for dealing with last mile challenges:

- European cities are likely to impose regulations on the logistics sector to alleviate traffic congestion caused by parcel deliveries, potentially leading to consolidation centers on the periphery of urban cores.

- “Re-logistification” of retail and other property types is taking place in cities, effectively blending retail and logistics.

- As inventories are fully integrated into urban retail shops, they will be used as small warehousing facilities for e-fulfillment and processing returns.

- Fleets of mobile warehouses parked at strategic locations throughout cities may be created to provide flexible distribution.

Berretta also points out that with Chinese wages increasing, manufacturers in both the U.S. and Europe are near-shoring production to lower-wage countries, including Poland, Hungary, Czechoslovakia, Morocco, Turkey and other nations to eliminate the high cost of shipping from China.

As a result, he notes, “We’re seeing a lot of new warehouse space rising all over Europe.”

This trend is challenging transoceanic shipping companies to look at new approaches to stay profitable. Maersk, for example, recently announced a plan to diversify away from container shipping to inland logistics and transportation.

To pull this off the company will need to establish a distribution network that includes warehouse space to support its growth, Barretta says, noting that currently Maersk only has warehouses along seaport locations.

The entry of outsiders like Amazon and Maersk into the 3PL market could damage existing operators, but to compete effectively they will need to build scale and comprehensive services/facilities networks, which can be accomplished organically or through mergers and acquisitions.

Maersk has already expanded its trading capacity and market coverage with the acquisition of Hamburg Sud, an international logistics services company.

Alibaba and Amazon are generating new demand for both logistics and warehouse capacity by facilitating cross-border e-commerce transactions, with a global sale/distribution channel for smaller merchants.

Shoppers are increasingly comfortable buying products on foreign retail websites, and the retailers are willing to deliver anywhere in the world. By 2020, an estimated 45 percent of online shoppers will purchase goods from other countries, which represents a four-fold increase in the value of cross-border sales since 2014, according to the Colliers report.

But technology could have a downsizing effect on logistics and warehousing by improving inventory flow and eliminating inefficiencies. For example, Amazon has filed a patent for 3D-printing delivery trucks that would get products to customers faster and eliminate the need for storage space by 3D printing them “on the go.”

This impact, however, is likely to be offset by growth opportunities created by better-performing digital platforms, according to the report.

Source: National Real Estate Investor

Last Mile City Logistics: Traditional vs E-Commerce Logistics Schema

Article Topics

CBRE News & Resources

CBRE report points to a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights a decrease in ‘megawarehouse’ leases from 2022 to 2023 CBRE report highlights the ever-growing role of holiday season reverse logistics operations Top 20 Warehouses 2023: Demand soars and mergers slow Top 20 Warehouses 2023: Demand soars, mergers slow CBRE report highlights mixed Q3 industrial real estate directions Q3 Commercial Construction Starts Fall 37% vs. Q2 More CBRELatest in Transportation

Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation