What Supply Chain Users Want from Supply Chain Software Leaders

Here’s what analysts, supply chain pros, and a recent SCMR survey say customers want and expect from the leaders in the supply chain software space.

Working your way to the top and staying there isn’t an easy feat for any company. Operating in a market that grows year-over-year in both prowess and complexity, supply chain software leaders have overcome that challenge and firmly established themselves as the “go to” sources for supply chain management software applications, maintenance, and services (or SCM).

As part of that evolution, each one has put considerable time and effort into figuring out what customers want and how to fulfill those needs.

At the highest level, says Steve Banker, director of supply chain solutions for ARC Advisory Group, most users are looking for payback on their software investments within two years or less. “If they’re promised a certain ROI they want to get that ROI,” says Banker, whose firm has developed a criteria-based supplier selection service tool to rank vendors and locate those with specific domain expertise.

In addition to their ROI expectations, Banker adds, companies want software that’s easy to implement and use, and that provides features like inline analytics and role-based actions (in which certain operations are assigned to specific roles). Unfortunately, users don’t always get what they want. “With many different types of software,” the analyst says, “there’s a gap between shippers’ expectations and what they actually get.”

Weighing Out Their Options

According to a 2012 Supply Chain Management Review survey of supply chain professionals, attaining those ROI goals requires a collaborative effort between user and software provider. While 70 percent of respondents to the technology survey indicated that the vendors helped them maximize their ROI “to some extent,” only 17 percent said it helped “to a great extent.” Clearly, while the software leaders appear to be doing well overall, there is still room for improvement.

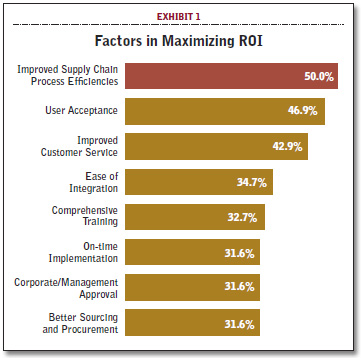

Asked what were the key factors in a successful software implementation and ROI, respondents put having efficient supply chain processes already in place at the top of the list. This was followed closely by user acceptance. (Exhibit 1 shows the eight factors cited most often.)

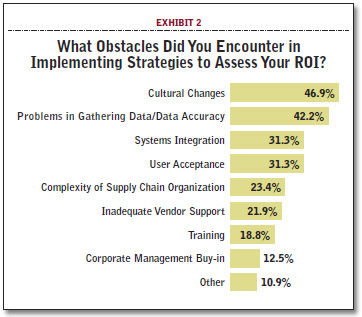

With regard to the biggest obstacles in implementation and ROI success, cultural resistance and data-gathering issues topped the list, cited by 47 and 42 percent of respondents respectively.

Inadequate vendor support was perceived to be relatively less of a problem, mentioned by only 22 percent. (See Exhibit 2.)

Pointing to recent information from the research firm Supply Chain Insights, Banker says that Transportation Management Systems (TMS) tend to cause the least disappointment among companies that implement such solutions. “TMS has come a long way in this area,” says Banker, who adds that at one point, over-promising and under-delivering was a common thread among TMS vendors.

“When we first looked at it 15 years ago, the ROI on TMS was appalling. Today it has one of the best application success rates out there.”

Credit the growth of on-demand solutions with helping to buoy the reputations of both TMS and Warehouse Management Systems (WMS) in the eyes of users.

While not as robust as their licensed counterparts, on-demand subscription models have helped alleviate some budgetary issues for users. “On-demand is much closer to a ‘pay as you go’ model,’” says Banker.

“Shippers can get a very functional system for $50,000 a year (plus implementation costs), versus spending $250,000-plus upfront on a licensed system that may or may not meet the company’s needs.”

It Doesn’t End There…

Longevity also comes into play when companies are shopping for software—a criteria that works in the leading vendors’ favor. “If you’re putting out $1 million to purchase, install, and implement a solution, you want to know that the vendor is going to be around in four or five years,”

Banker explains. “In most cases, that means not buying a solution from a supplier with less than $50 million in annual revenues; it’s just too big of a risk.”

Belinda Griffin-Cryan, global supply chain executive program manager at Capgemini Consulting, says that shippers also want tried-and-tested, functional software products that are well supported by their vendors. “Not only do they want the products,” says Griffin-Cryan, “but they also want a team to provide support both during and after implementation. That’s an area where the supply chain leaders continue to demonstrate their capabilities.”

And let’s not overlook scalability as another key consideration for buyers of supply chain software in today’s rapidly changing business environment. “It’s not about building a monument that can’t ever be changed,” Griffin-Cryan points out. “Companies have to be more adaptive and responsive than ever and their software has to be able to keep up with that.”

Great Expectations

When asked what they expect from SCM leaders, supply chain professionals offered up a wide range of answers. Tom Dadmun, who recently retired from his position as vice president of supply chain operations for ADTRAN in Huntsville, Ala., says he likes working with vendors whose systems operate well across the entire “value chain”—that is, inclusive of customers’ customers and suppliers’ suppliers. “It’s about gaining as much visibility as possible across the entire chain,” says Dadmun, “and having solutions that gather data across an integrated platform.”

Dadmun says that predictive analytics are becoming increasingly important as companies move away from decision-making based on historical algorithms. “As shippers, we need a real-time control center that provides spontaneous and quick input from our customers,” says Dadmun. “We can then turn around and use that data to change forecasts on the fly and keep up with the speed of business today. We can’t wait for monthly and quarterly data anymore.”

William Gwinnell, senior program director at Wipro Technologies in East Brunswick, N.J., finds that the larger ERP solutions lack sophisticated functionalities like cost-effective routing, labor management system (LMS) capabilities, storage location optimization, and transportation route optimization.

To fill those gaps, Gwinnell says many organizations are turning to non-ERP, best-of-breed vendors that focus on specific areas of the supply chain. “Within the four walls of the DC core ERP functionality has improved markedly,” says Gwinnell. “Peel back another layer, however—to do voice or RF picking—and that’s where the rubber meets the road.”

In most cases, Gwinnell says a DC using straightforward processes can “live with” the supply chain functionality of an ERP. “Otherwise it starts breaking down,” he says, offering his opinion that the recent merger of RedPrairie and JDA Software Group could result in a powerful offering that addresses such gripes. “If [JDA] can successfully combine the supply chain outside of the four walls with the sophistication within the four walls,” says Gwinnell, “they will become a potent player in the marketplace.”

Some Prefer “Plain Vanilla”

When it comes to supply chain software, one practitioner says that he uses an out-of-the- box approach and avoids excessive tweaks and customizations. John Donnelly, materials manager for Hobart Corp.’s Weigh Wrap Group, says this practice has served him well in an era where software solutions have become more and more complex.

Calling himself a “plain vanilla guy,” Donnelly says that running programs as-designed also helps when upgrade time rolls around. “The big supply chain software systems are very complicated and interactive,” says Donnelly. “We like using them as-is instead of trying to recreate them into systems that we used to have, or that we’d like to have.”

When working with leading software vendors, Donnelly says he’d like to see more transparency around their systems’ capabilities. In many cases, he says, these are revealed after the fact. “I learn a lot about our solutions by talking to my counterparts,” says Donnelly. “We kick ideas around and figure things out that way. But it would be great if we knew at the outset exactly what the systems could and couldn’t do.”

At Dairy Farmers of America in Kansas City, Mo., Randy Harman, vice president of S&OP, feels that the ERP providers that are at the top of the supply chain software list lack the specific tools that he needs. With three SAP implementations under his belt— the most recent of which took place 2-1/2 years ago across 28 Dairy Farmers’ plants— Harman says he now looks to best-of-breed players to fill in some of the holes.

Take alert and optimization tools, for example. Harman says that while ERPs are effective when it comes to generating exception messages, they don’t always provide alert tools, alert tools management, or optimization tools. He says SAP’s Advanced Planner and Optimizer (APO) module includes such capabilities, but notes that it is “labor intensive to set up and maintain.”

Also missing from the larger provider’s lineups are capabilities around safety stock and target inventory levels. “Most don’t help you calculate these important measures,” says Harman, “or what they do offer in this area is entirely based on demand volatility. The ERPs are stuck in the 1970s’ Economic Order Quantity (EOQ) model,” says Harman, “and no one has done much with that.”

In terms of implementation and support, Harman says most of the larger software providers rely on systems integrators to handle the task. And while some vendors offer online help tools and other support mechanisms, Harman says that in many cases “we do better with getting support from an integrator, or by simply Googling a topic online to see what others are saying about it.”

Despite the user challenges and numerous “wish list” items cited in this article, Griffin-Cryan says that supply chain software leaders are “doing a pretty good job of meeting customer needs.” Results from SCMR’s technology survey support that observation.

Respondents overall were quite satisfied with the speed of ROI on their software investment. Fully 20 percent reported realizing a return on their investment within the first six months of implementation while another 33 percent did so within a year.

Most are proactive about introducing new functionalities and keeping up with user needs—after all, they wouldn’t be the leaders in their fields if they weren’t now, would they? “The best vendors are out there in the market talking to customers and getting to know their wants and needs,” says Griffin-Cryan, “and then developing products around those needs as quickly as possible.”