Walmart Beats Earnings Estimates as CEO McMillon Pursues Turnaround

Wal-Mart Stores Inc. topped third-quarter profit estimates and increased the low end of its annual forecast, a sign the retailer is making progress with costs and revamping its stores.

Wal-Mart Stores, Inc’s President & CEO Doug McMillon, who took the reins last year, has invested in e-commerce and smaller-format stores - a bid to cope with online rivals like Amazon.com Inc.

But Wal-Mart’s supercenters remain key to his turnaround bid, and he’s working to make them more enticing.

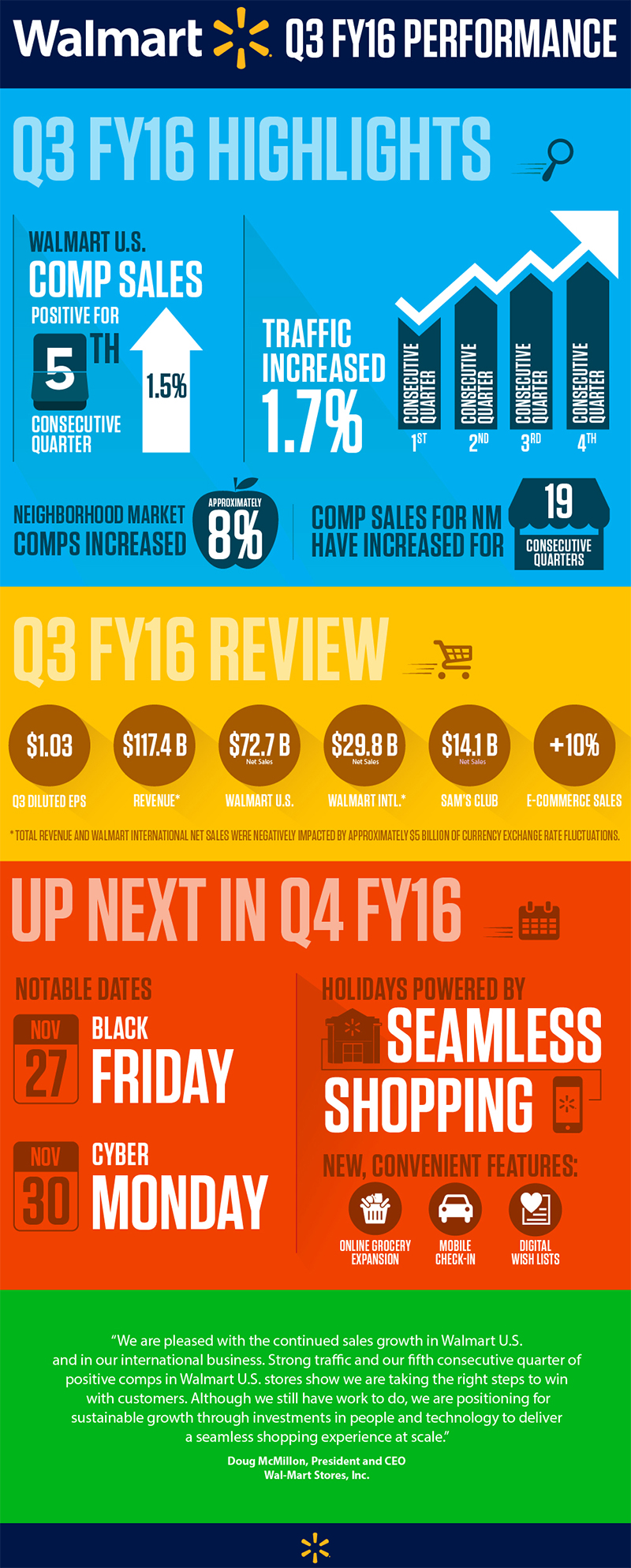

Same-store sales rose 1.5 percent in the U.S. last quarter, while traffic grew 1.7 percent.

Earnings were 99 cents a share in the period, excluding some items, the Bentonville, Arkansas-based company said in a statement today.

Analysts had predicted 98 cents on average, according to data compiled by Bloomberg. The company now expects profit of $4.50 to $4.65 a share this year, up from a previous forecast of at least $4.40.

“We are pleased with the continued sales growth in Walmart U.S. and in our international business. Strong traffic and our fifth consecutive quarter of positive comps in Walmart U.S. stores show we are taking the right steps to win with customers. Although we still have work to do, we are positioning for sustainable growth through investments in people and technology to deliver a seamless shopping experience at scale.” - Doug McMillon, President and CEO, Wal-Mart Stores, Inc.

The outlook brought a dose of good news to investors after a dour profit forecast crushed the shares last month. Wal-Mart suffered its worst stock decline in more than 27 years on Oct. 14 when it said earnings would decrease as much as 12 percent next year. The strong dollar also has hurt the value of Wal-Mart’s overseas sales, contributing to a 1.3 percent revenue decline last quarter.

As reported by Bloomberg, the store-improvement plan is beginning to bear fruit. In February, only 16 percent of its 4,600 U.S. locations were at the standards the company had set for customer service, cleanliness and convenience. That number has now reached 70 percent, Wal-Mart said on Tuesday.

But McMillon’s push to modernize Wal-Mart has taken a toll on profit. The wage increase and training programs will add $2.7 billion in expenses over a two-year period, and investments in e-commerce are forecast to total as much as $1.5 billion this year.

Third-quarter net income fell 11 percent to $3.3 billion, or $1.03 a share, from $3.71 billion, or $1.15, a year earlier. Revenue dropped to $117.4 billion, missing the $118 billion that analysts had predicted.

While Wal-Mart’s online sales are increasing, their pace is slowed. They rose 10 percent in the quarter, compared with 16 percent in the previous three months and 21 percent a year earlier. The growth was dragged down by slowing demand in China, Brazil and the U.K., Wal-Mart said.

“We still have plenty of work to do,” McMillon said. “There are areas of our business that must perform better.”

Article Topics

GT Nexus News & Resources

The Current and Future State of Digital Supply Chain Transformation Infor Coleman AI Platform to ‘Rethink Supply Chain’ and Maximize Human Work Potential End-to-End Visibility: Handling the Demands of Retail Mastering Supply Chain Finance ERP Suppliers’ Changing Role New Logistics TMS Platform Sets Sights on SAP Amazon Selects Infor for Global Logistics Business More GT NexusLatest in Supply Chain

How Much Extra Will Consumers Pay for Sustainable Packaging? FedEx Announces Plans to Shut Down Four Facilities U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia More Supply Chain