U.S. Manufacturing Still At a Two-Year Low

Growth in the U.S. manufacturing sector showed no month-over-month change during September, staying at August's sluggish pace which was the weakest in almost two years.

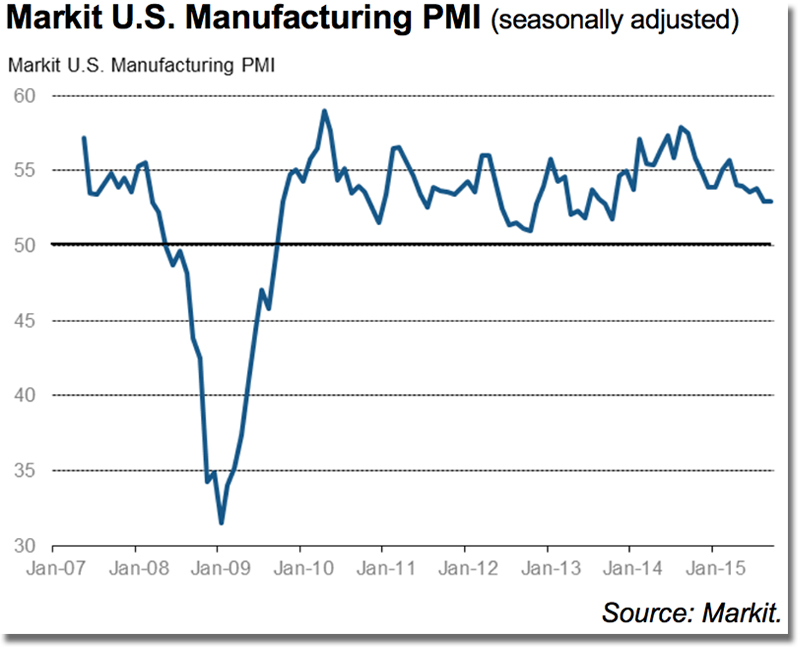

The latest flash reading of the purchasing manager’s index (PMI) from Markit Economics was 53, unchanged at a 22-month low.

But above 50, manufacturing is still in expansion, not contraction.

“Manufacturing remained stuck in crawler gear in September, fighting an uphill battle against the stronger dollar, slumping demand in many export markets and reduced capital spending, especially by the energy sector,” Chris Williamson, chief economist at Markit said in the release.

September data highlighted another month of relatively subdued growth momentum across the U.S. manufacturing sector.

The headline seasonally adjusted Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™) registered 53.0 in September, unchanged from August’s 22-month low, to signal one of the slowest rates of overall manufacturing sector expansion in the past two years.

The latest index reading was also weaker than the post-financial crisis average (54.3).

Although output rose at a slightly faster pace in September, softer rates of new business and employment growth placed downward pressure on the headline PMI reading. The latest increase in new work was the weakest since January 2014, which manufacturers linked to greater caution among clients and subdued overall business conditions.

New export orders picked up marginally in September, despite widespread reports that the strong dollar had weighed on demand from abroad. Although only slight, the latest rise was the most marked since February.

Weaker overall new order growth and heightened uncertainty regarding the global economic outlook encouraged inventory streamlining and more cautious job hiring across the manufacturing sector in September.

The latest increase in payroll numbers was only marginal and the weakest since July 2014. A number of firms commented on the non-replacement of departing staff and efforts to boost productivity at their plants.

Stocks of finished goods meanwhile decreased for the second month running, and the rate of contraction was the fastest since June 2014. Pre-production inventories rose at the slowest pace for over a year in September, which manufacturers linked to subdued business conditions.

Average cost burdens decreased in September, thereby ending a four-month period of rising input prices. Manufacturers cited lower prices for a range of raw materials, particularly metals, alongside decreased oil-related costs.

Meanwhile, factory gate charges dropped for the first time since August 2012. Anecdotal evidence from survey respondents suggested that falling commodity prices, intense competitive pressures and softer demand conditions were all factors contributing to price discounting in September.

Commenting on the flash PMI data, Williamson further stated:

“The survey is indicating the weakest manufacturing growth for almost two years, meaning the sector will have acted as a drag on the economy in the third quarter.

The disappointing performance of the goods producing sector has so far been offset by stronger expansion in the larger services sector, which means the economy looks to have grown at a reasonable 2.5% annualised pace in the third quarter, but there are question marks over whether this growth can be sustained as we move towards the end of the year. Inflows of work showed the smallest rise since the start of 2014, and job creation has also slowed.

The sluggish growth, weaker forward-looking indicators and downturn in price pressures all point to the Fed holding off with rate hikes until next year.”

Article Topics

ITIF News & Resources

Stop Talking About US Manufacturing Jobs Coming Back, Because They’re Not! U.S. Manufacturing Still At a Two-Year Low Is U.S. Manufacturing In a Technical Recession? Why Americans Are So Nostalgic About The Manufacturing Industry The Myth of America’s Manufacturing Renaissance: The Real State of U.S. Manufacturing The Myth of America’s Manufacturing Renaissance The Acquisition and Commercialization of Invention in American Manufacturing: Incidence and Impact More ITIFLatest in Business

Spotlight Startup: Cart.com Walmart and Swisslog Expand Partnership with New Texas Facility Nissan Channels Tesla With Its Latest Manufacturing Process U.S. Manufacturing Gains Momentum After Another Strong Month Biden Gives Samsung $6.4 Billion For Texas Semiconductor Plants Apple Overtaken as World’s Largest Phone Seller Walmart Unleashes Autonomous Lift Trucks at Four High-Tech DCs More Business