US Manufacturing Only 5 Percent More Costly Than China, Strengthens Case for Reshoring

This study by the Boston Consulting Group supports a previous report on why large US manufacturers are reshoring production back to the US from these previous low cost manufacturers.

Five economies traditionally regarded as low-cost manufacturing bases China, Brazil, the Czech Republic, Poland, and Russia have seen their cost advantages erode significantly since 2004 while US Manufacturing has considerably improved its cost structure, according to a new study released Friday.

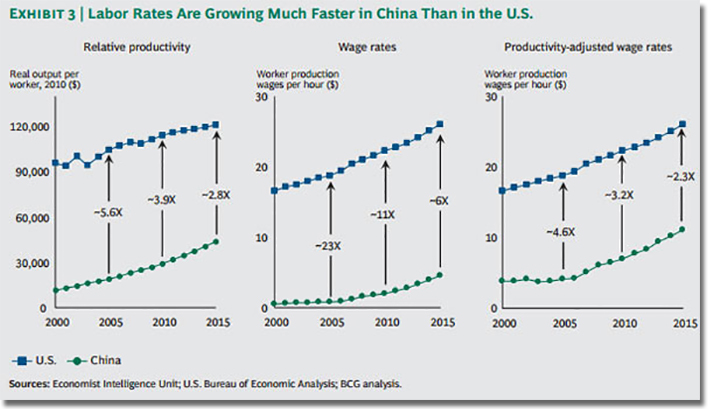

The erosion in the cost advantage has been driven by a confluence of sharp wage increases, lagging productivity growth, unfavorable currency swings, and a dramatic rise in energy costs, states the Boston Consulting Group (BCG) based on a study of 25 nations that account for nearly 90 percent of global exports of manufactured goods.

BCG’s Global Manufacturing Cost-Competitiveness Index has tracked changes in production costs over the past decade on the basis of wages, productivity growth, energy costs, and currency exchange rates – four direct economic drivers of manufacturing competitiveness.

“Manufacturing cost competitiveness around the world has changed dramatically over the past decade so dramatically that many old perceptions of low-cost and high-cost nations no longer hold,” states the BCG report.

The BCG index now rates Brazil as “one of the highest-cost countries”, and the UK as “the cheapest location in western Europe”.

Mexico now has lower manufacturing costs than China, whose manufacturing-cost advantage over the U.S. has shrunk to less than 5 percent (5%). Costs in eastern European nations are at parity or above costs in the U.S while costs in much of eastern Europe are basically at parity with the U.S, states the BCG report.

Part of BCG’s ongoing research into the shifting economics of global manufacturing, the report states that 10 countries with the lowest manufacturing costs “include a mix of nations from around the world.

Six of the 10 are in Asia, while several others are in North America and eastern Europe.

The overall manufacturing-cost structures of Mexico and the U.S. have significantly improved relative to nearly all other leading exporters across the globe.

The key reasons were stable wage growth, sustained productivity gains, steady exchange rates, and a big energy-cost advantage that is largely driven by the 50 percent fall in natural-gas prices since large-scale production of U.S. shale gas began in 2005.

“Many companies are making manufacturing investment decisions on the basis of a decades-old worldview that is sorely out of date,” said Harold L. Sirkin, a BCG senior partner and a coauthor of the analysis.

“They still see North America and western Europe as high cost and Latin America, eastern Europe, and most of Asiaespecially Chinaas low cost. In reality, there are now high- and low-cost countries in nearly every region of the world.”

A handful of countries held their manufacturing costs constant relative to the U.S. from 2004 to 2014 and have significantly improved their competitiveness within their regions.

Declining currencies, along with productivity growth that largely offset wage hikes, helped keep overall costs in check in Indonesia and India.

The UK and the Netherlands, on the other hand, have kept pace thanks to steady productivity growth. As a result, the cost structures of Indonesia and India have improved relative to Asia’s other major exporters, while the UK and the Netherlands have boosted their cost competitiveness relative to other exporters in western and eastern Europe.

“While labor and energy costs aren’t the only factors that influence corporate decisions on where to locate manufacturing, these striking changes represent a significant shift in the economics of global manufacturing,” said Michael Zinser, a BCG partner who is coleader of the firm’s Manufacturing practice.

“These changes should drive companies to rethink their sourcing strategies, as well as where to build future capacity. Many will opt to manufacture in competitive countries closer to where goods are consumed.”

The findings have implications for both companies and governments as they consider their manufacturing options. Several countries that have lost ground since 2004 risk becoming even less cost competitive if current wage and productivity trends continue.

In some nations with low direct-manufacturing costs, BCG found that competitiveness could be undermined by other factors, such as a difficult business environment or poor logistical infrastructure.

You can download the entire study and the eBook now for FREE on your kindle at Amazon here.

Majority of Large Manufacturers Are Now Planning or Considering ‘Reshoring’ from China to the U.S.

This study by the Boston Consulting Group supports a previous report on why large US manufacturers are reshoring production back to the US from these previous low cost manufacturers.

More than half of US manufacturing executives at companies with sales greater than $1 billion are planning to bring back production to the U.S. from China or are actively considering it, according to a new survey by The Boston Consulting Group.

The share of executives who are planning to “reshore” or are considering it rose to 54 percent, compared with 37 percent of executives who responded to a similar BCG survey in February 2012. The new survey, conducted last month, elicited responses from more than 200 decision makers at companies across a broad range of industries. Virtually all of the companies manufacture in the U.S. and overseas and make products for both U.S. and non-U.S. consumption.

The survey also found a sharp increase in the percentage of executives who are actively engaged in the process of shifting production to the U.S. When asked whether they expect to move production in light of rising wages in China, 21 percent of respondents—around twice as many as in 2012—said they are “actively doing this” or that they “will move production to the U.S. in the next two years.”

The increase in willingness to reshore supports earlier BCG findings that are part of the firm’s Made in America, Again series, produced by its Operations and Global Advantage practices. The series explores the shifting economics of global manufacturing and how the changes are starting to favor the production of certain goods in the U.S.

In a report released in August, Behind the American Export Surge: The U.S. as One of the Developed World’s Lowest-Cost Manufacturers, BCG projected that production reshored from China and higher exports due to improved US manufacturing competitiveness in manufacturing could create 2.5 million to 5 million American factory and related service jobs by 2020.

“Over the past couple of years, we’ve projected an improvement in U.S. manufacturing competitiveness by 2015 that would help drive an American manufacturing revival,” said Harold L. Sirkin, a BCG senior partner and a coauthor of the study. “The results of our latest survey make clear that a profound shift in attitude is beginning.”

The top three factors cited as driving future decisions on production locations were labor costs (cited by 43 percent of respondents), proximity to customers (35 percent), and product quality (34 percent). More than 80 percent of respondents cited at least one of these reasons as a key factor. Other leading factors include access to skilled labor, transportation costs, supply-chain lead time, and ease of doing business.

“The wide range of reasons executives cite for shifting production shows that companies are becoming more sophisticated in their understanding of all the factors that must be considered when deciding where to manufacture,” said Michael Zinser, a BCG partner who leads the firm’s manufacturing work in the Americas. “When you look at the total cost of production for many goods, the U.S. appears increasingly attractive.”

“These findings confirm that the reshoring trend is more than anecdotal,” said Justin Rose, a BCG partner who along with Sirkin and Zinser is a coauthor of The US Manufacturing Renaissance: How Shifting Global Economics Are Creating an American Comeback(Knowledge@Wharton, 2012). “As the costs and benefits become more apparent, we expect more companies to consider manufacturing in the U.S. if their products are to be consumed in the U.S.”

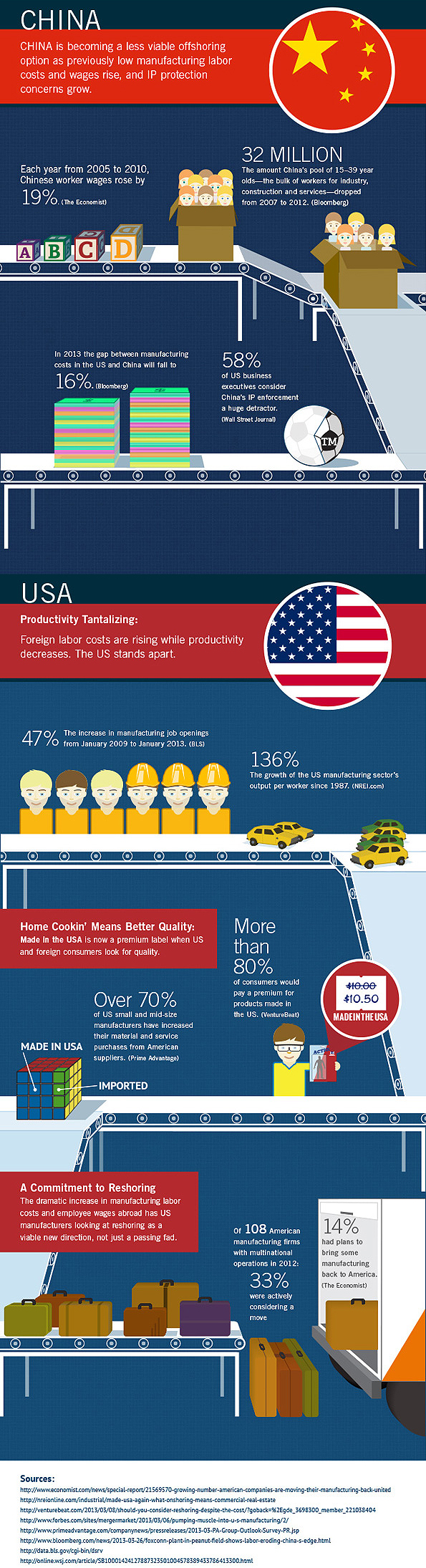

The State of Reshoring 2013 (Infographic from West Monroe Partners)

US manufacturing companies have long offshored operations due to dramatically lower labor costs in emerging markets. Today’s changing economic landscape abroad and at home has sparked a reversal. “Reshoring,” bringing manufacturing back to America, is now a bona fide movement. Management and technology consulting firm West Monroe Partners dove into this emerging trend to identify how it started, where reshoring is today and where it’s going tomorrow.

Source: Cerasis Blog

Search SC24/7 on “Reshoring”