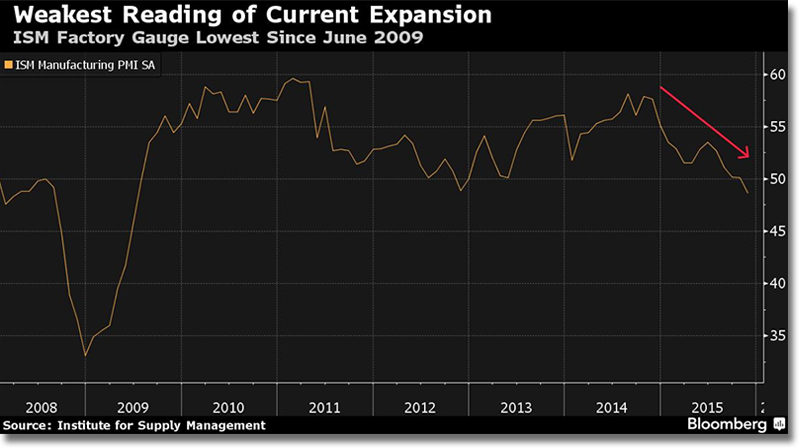

U.S. Manufacturing Activity Hits 6-Year Low

U.S. factory activity in November fell to the lowest level since the end of the recession, as a weak global economy and strong dollar continued to buffet the manufacturing sector.

As reported by Bloomberg Business, U.S. Manufacturing unexpectedly contracted in November at the fastest pace since the last recession as elevated inventories led to cutbacks in orders and production.

The Institute for Supply Management’s index dropped to 48.6, the lowest level since June 2009, from 50.1 in October, a report from the Tempe, Arizona-based group showed Tuesday.

The November figure was weaker than the most pessimistic forecast in a Bloomberg survey. Readings less than 50 indicate contraction.

The report showed factories believed their customers continued to have too many goods on hand, indicating it will take time for orders and production to stabilize.

Manufacturers, which account for almost 12 percent of the economy, are also battling weak global demand, an appreciating dollar and less capital spending in the energy sector.

“It’s the perfect storm for manufacturing,” said Brett Ryan, a U.S. economist at Deutsche Bank Securities Inc. in New York, whose forecast was among the closest in the Bloomberg survey. “Traditionally, the manufacturing sector has been the canary in the coal mine when it comes to slowing growth. To what extent does this bleed over into other sectors of the economy - that’s yet to be seen.”

Ten of the 18 industries surveyed by the purchasing managers’ group shrank, including apparel, plastics and machinery. Five industries posted growth.

The median forecast in a Bloomberg survey of economists called for an ISM reading of 50.5, with estimates ranging from 49 to 52.

Global Manufacturing

Globally, results were mixed last month. While factory conditions in China were the weakest in more than three years, manufacturing strengthened in the euro area and cooled in the U.K. from a 16-month high, according to other reports Tuesday. Figures from Markit Economics showed U.S. manufacturing continued to expand in November, although at a slower pace.

Markit U.S. Manufacturing PMI™

The U.S. ISM group’s production measure dropped to 49.2 from 52.9 in October. New orders fell to 48.9 in November from 52.9. Both gauges were the weakest since August 2012. The index of export orders held at 47.5 in November, the sixth month of contraction.

Factories in November made more progress than their customers in reducing inventories. The stockpile gauge at the nation’s producers dropped to 43, the lowest level since the end of 2012.

Bloated Inventories

An index of customer inventories was little changed at 50.5 after 51 a month earlier. It marked the fourth straight month above 50, the longest such stretch during an economic expansion since October 2006 through February 2007.

The slowdown will probably be short-lived as U.S. consumer spending remains healthy, Bradley Holcomb, chairman of the ISM factory survey, said on a conference call with reporters.

“My sense is this is a short-term thing where hopefully we’ve found bottom in this particular cycle,” Holcomb said. A recovery would involve “consumers going back to the store and buying products. Certainly December is a month that that can certainly happen.”

The economy grew at a 2.1 percent annualized pace in the third quarter, faster than the initially reported 1.5 percent advance, Commerce Department data showed last week. Most of the revision reflected smaller cutbacks in stockpiles.

Reducing Stockpiles

Efforts to trim the remaining inventory overhang will probably come at the expense of growth in future quarters as companies pare orders to align supply with demand.

Jobs were a bright spot in the ISM’s report. The group’s employment measure increased to 51.3 in November from 47.6.

“It is a good sign when you add employment,” said Holcomb. “That’s generally in anticipation of new orders to follow.”

Friday’s jobs report will provide another look at how industry employment fared in the month of November. Economists are projecting payrolls rose by about 200,000 last month after a 271,000 increase in October.

Federal Reserve policy makers will take the manufacturing data into consideration as they debate whether the economy is strong enough to withstand higher tighter monetary policy this month. The Federal Open Market Committee meets Dec.15-16 and is expected to raise their benchmark interest rate by 0.25 percentage point.

Source: Bloomberg Business

Related: Building the Manufacturing Talent Pipeline

Article Topics

Institute for Supply Management News & Resources

U.S. Manufacturing Gains Momentum After Another Strong Month Services sector sees continued growth in March, notes ISM Manufacturing sees growth in March, snaps 16-month stretch of contraction Services sector activity sees continued growth in February, ISM reports Services sector activity sees continued growth in February, reports ISM February manufacturing output declines, reports ISM February manufacturing output declines amid strong seasonal factors More Institute for Supply ManagementLatest in Supply Chain

Microsoft Unveils New AI Innovations For Warehouses Let’s Spend Five Minutes Talking About ... Malaysia Baltimore Bridge Collapse: Impact on Freight Navigating TIm Cook Says Apple Plans to Increase Investments in Vietnam Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Spotlight Startup: Cart.com is Reimagining Logistics Walmart and Swisslog Expand Partnership with New Texas Facility More Supply Chain