UPS Strong Q3 Earnings, Orders 14 Boeing 747-8 Cargo Jets, Expects Record Holiday Delivery

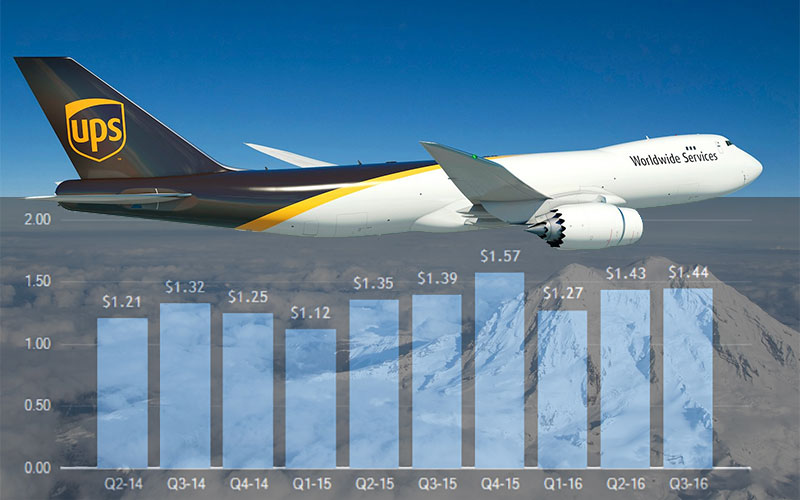

UPS announced third-quarter 2016 diluted earnings per share of $1.44, a 3.6% increase over the same period last year, international operating profit increased 14% to $576 million, achieving the seventh consecutive quarter of double-digit growth.

UPS continued its strong 2016 momentum with very strong third quarter earnings results, which were released today.

Quarterly revenue was up 4.9 percent annually at $14.9 billion, and earnings per share saw a 3.6 percent gain to $1.44, which matched Wall Street expectations.

Among the drivers for the company’s strong quarterly performance were gains in domestic deliveries driven by e-commerce, strong deferred air shipments and next-day air, international daily package growth and an increase in daily export shipments, among other factors.

“These results represent increased demand for our products and disciplined execution of our initiatives,” said UPS CEO David Abney on an earnings call today.

“Global economic growth remains modest, but U.S. consumer fundamentals remain healthy and accounted for most of the economic expansion while the outlook for industrial production remains weak. Over all, global GDP forecasts remain weak, and for the balance of 2016 we continue to see mixed economic signals across some industrial markets.”

“Under these conditions our diversified business model and our winning strategies still enable UPS to take advantage of high-growth markets such as cross-border trade and e-commerce. To facilitate growth, we are adding capacity and increasing efficiency in our globally-integrated network.”

The UPS CEO added that trade lanes and product portfolio enhancements are important components of the company’s plans, not it has improved time in transit for several cities in the U.S. and Canada based on increased export opportunities. And it has also dramatically improved service times for cross-border shipments between several major European cities.

Individual Segment Results

- U.S. domestic revenue rose 4.8 percent to $9.3 billion, with operating profit off 0.5 percent at $1.3 billion, average daily package volume up 5.7 percent (Deferred Air products up 10 percent, Next Day Air up 5.9 percent, and Ground products up 5.2 percent. Revenue per package inched up 0.9 percent, with Next Dai Air down 1.6 percent at $19.59, Deferred up 0.7 percent at $11.99, and Ground up 1.1 percent at $8.11;

- International Package operating profit was up 14 percent at $576 million, which UPS said was a third quarter record, citing volume growth in all products, base-rate increases, and network efficiency gains for the improved results. Revenue was up 2.2 percent at $3.0 billion, while revenue per package dropped 2.8 percent annually to $16.21 and currency-neutral yields fell 1.9 percent. UPS said that lower fuel surcharge rates reduced revenue-per-package growth, and changes in trade lanes and product mix offset base rate improvements. Total daily International Package volume was up 7.5 percent at 2.788 million; and

- Supply Chain and Freight revenue was up 8.1 percent to $2.6 billion, due in large part to last year’s acquisition of Coyote Logistics. UPS said weak market conditions in the airfreight forwarding and LTL markets weighed on top-line growth, as was the case in the second quarter. LTL revenue was off 5.3 percent at $701 million, with revenue per hundredweight up 3.7 percent

New aircraft order: On the earnings call, UPS CEO Abney said that the company has ordered 14 new Boeing 747-8 cargo jets that will meet increased demand for its air shipping services (the company’s first aircraft purchase since 2013). He said the expectations in the e-commerce sector and specialized markets like healthcare logistics have continued to shift to faster delivery options, which has led to increased demand for domestic and international air products.

And UPS said that the 747-8s will enable UPS to begin a cascade of aircraft route reassignments that will add significant air capacity to the company’s busiest lanes, thereby optimizing global air network capacity well beyond the impact of adding new cargo jets. The 14 new aircraft will be delivered between 2017-2020 and includes options for 14 additional jets in the future. Delivery of the first two jets will take place at the end of 2017 and are a net-add to the company’s fleet.

Peak Planning: UPS said on the call that it’s forecasting record holiday deliveries of more than 700 million packages, an increase of more than 14 percent, or 100 million, between Black Friday to New Year’s Eve. Part of the reason for this projected increase is two additional delivery days during 2016.

And it added that it has increased the level of planning and collaboration with its largest holiday shippers, as it has in the past, to develop early seasonal shipping forecasts. What’s more, UPS said that it anticipates 13 of the 21 delivery days before Christmas to top 30 million packages, compared to a typical day of around 18 million packages for a non-peak shipping period.

“The dramatic growth of online shopping and subsequent returns is expected to lift UPS package levels to a record-high,” said Kate Gutman. UPS senior vice president of sales and marketing on the call.

“We have deepened the level of collaboration with even more customers. We have started earlier and are communicating more frequently. This better aligns UPS solutions and capacity with [customers] seasonal promotional plans and fulfillment strategies, helping customers shift demand, have inventory earlier and optimize their operations. Customer experience continues to gain importance in the marketplace, making collaboration a shared objective for both shippers and UPS.”

Looking at the second quarter results, Jerry Hempstead, president of Hempstead Consulting, said that today’s earnings results indicate that UPS, as a reflection of the new e-commerce economy, is doing very well over all.

“All segments are robust. UPS is well managed and they hit EPS right, which most were expecting,” he said.

“The important thing was for 6 quarters they missed the revenue expectation and this quarter beat it by $200 million, despite lower revenue from fuel surcharges. They are in great shape and prepared for what I predict will be a very busy fourth quarter. UPS are now masters of the holiday surge.”

Related: UPS Expands Worldwide Express Plus, Adds 200 Hybrid Electric Vehicles to Alternative Fuel Fleet

Article Topics

UPS News & Resources

UPS reports first quarter earnings declines Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx More UPSLatest in Transportation

The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws More TransportationAbout the Author