UPS Q2 Profit Spikes 171% on International Freight and Supply Chain Business

United Parcel Service Inc.’s second-quarter profit skyrocketed after getting a lift from its international and supply chain and freight divisions, with the Atlanta-based package shipper’s revenue dipping 1.2 percent to $14.1 billion. but profits spiked 171 percent to $1.23 billion.

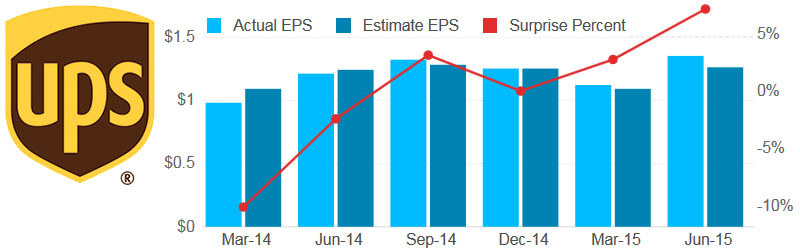

This marks the second straight quarter of EPS growth for UPS, which UPS CEO David Abney said on an earnings call demonstrates the company is successfully executing an generating improved performance, adding that UPS grew operating profits and expanded margins across all three of its key segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

“We are making good progress this year and are highly focused on executing our strategy to create unmatched value for UPS customers and UPS shareholders,” he said. “We will accomplish this by continuing to build on the strategies guiding our business. They are: expanding our network capacity; improving operational efficiency; focusing on high-growth markets; and delivering industry-specific solutions.”

In the second quarter, UPS delivered 1.1 billion packages, which marked a 2.1 percent annual improvement and was paced by gains in Deferred Air and International Export shipments, which saw 14.6 percent and 5.5. percent annual gains, respectively.

UPS’s U.S. domestic package revenue headed up 1.6 percent to $8.8 billion, and along with the nearly 15 percent gain in Deferred Air package growth, UPS SurePost, its economy ground service for delivery to residential locations, was up more than 8 percent annually.

Total U.S. domestic package volume at 14.565 billion was up 1.8 percent, and ground was up 0.9 percent. UPS said that the slower pace of total daily deliveries was due to a slower pace of B2C (business-to-consumer) growth.

Consolidated revenue per piece at $10.61.7 was down about 2 percent, with U.S. domestic packages and international package averages at $9.45 (down 0.3 percent) and $17.03 (down 10.2 percent), respectively.

International package revenue was down 6.4 percent to $3.045 billion but was up 1.5 percent on a currency-adjusted basis, with operating profit up 17.2 percent to $551 million. Average daily package volume was up 3.6 percent at 2.645 million, and revenue per piece was down 2.4 percent at $17.03, and average international daily package volume was for domestic and exports were up 2.3 percent and 5.5 percent, respectively.

The gain in exports was driven by an 8.5 percent increase in intra-Europe shipments, with a strong dollar pacing U.S. import growth, with exports down slightly, said UPS.

Revenue for UPS Supply Chain and Freight dropped 4.5 percent to $2.2 billion, due to Forwarding revenue management initiatives, currency and lower fuel surcharges at UPS Freight, while operating profit was up 17.6 percent at $207 million.

On the less-than-truckload side, UPS Freight revenue was down 3.7 percent at $647 million, with revenue per hundredweight up 1.4 percent at $22.81, and total shipments down 0.3 percent at 2.728 million.

“UPS had an interesting quarter,” said Jerry Hempstead, president of Orlando, Fla.-based parcel consultancy Hempstead Consulting.

“The surprising contributor was its “Deferred Air” products showing an impressive 14 percent uptick. I think this is driven by e-commerce companies attempting to compete with Amazon’s speed of order delivery. One offsets the inventory carting costs and distribution center operation with faster (but much higher) transportation costs.

Of course the hybrid UPS/USPS Sure Post is still cranking but at a much slower pace than previously reported and it may be a sign that e-commerce orders are starting to plateau on an annual basis. Obviously there is a limit to how much stuff we can all buy on any given day. Very encouraging is the strong growth in International but offsetting to the P&L,however with this blessing is the curse of currency conversions and with the Euro declining against the dollar.

Another factor is the fall of fuel prices, which results obviously in lower fuel surcharges, and this in turn hurts the top line revenue number.”

Related Read: UPS Said to Be in Talks to Buy Coyote Logistics for $1.8 Billion

Article Topics

Hempstead Consulting News & Resources

Amazon Prime Days are expected to see its highest-ever volumes Q&A: Jerry Hempstead, president of Hempstead Consulting An In-depth Look at Parcel and Express Markets FedEx Rolls Out Rate Increases For 2018 Judge Finds UPS Liable for Shipments of Cigarettes Parcel Market Trends & Advice for Shippers UPS Strong Q3 Earnings, Orders 14 Boeing 747-8 Cargo Jets, Expects Record Holiday Delivery More Hempstead ConsultingLatest in Transportation

FedEx Announces Plans to Shut Down Four Facilities The Two Most Important Factors in Last-Mile Delivery Most Companies Unprepared For Supply Chain Emergency Baltimore Bridge Collapse: Impact on Freight Navigating Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? More TransportationAbout the Author