U.S.-bound shipments begin 2020 with a decline, reports Panjiva

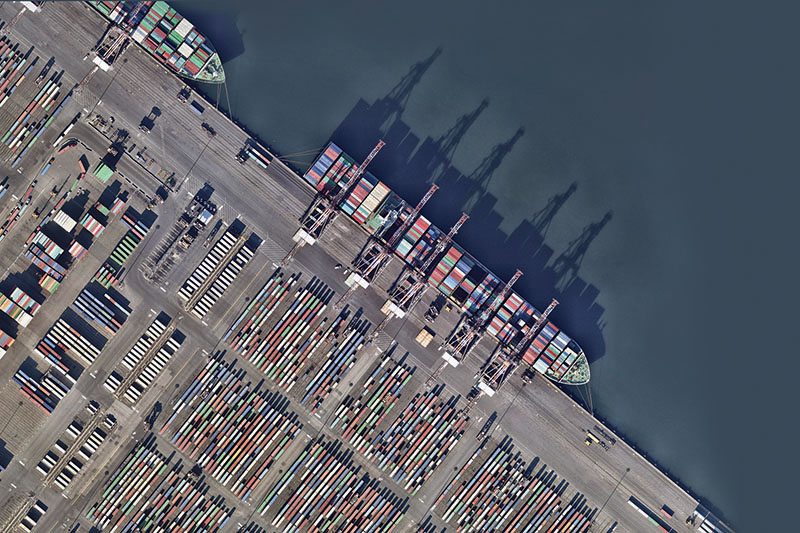

United States-bound waterborne shipments began 2020 in the same pattern that the final four months of 2019 did, declining for the fifth consecutive month, according to data issued this week by global trade intelligence firm Panjiva.

January shipments—at 1,026,714—fell 3.6% annually. And containerized freight shipments were off 2.8% annually, with Panjiva saying that it was notable there was a decline even with the earlier timing of the 2019 Lunar New Year. Looking back, for calendar year 2019, total shipments—at 12,243,739—slipped 1.0% compared to 2018, marking its worst annual output going back to 2009.

Panjiva explained that the combination of the earlier 2020 Lunar New Year, coupled with the associated accelerated shipping activity compared to a year earlier, is evident in the slowing of U.S.-bound imports from China, which saw a 7.3% annual decline in December, while the entire fourth quarter was off 17%. What’s more, it said it is unlikely there will be a major uptick in shipments out of China, due to the coronavirus and also because the Phase 1 trade deal between the U.S. and China leaves current tariffs in place and also cuts the list rate for importers.

And it added that the pattern of sourcing diversions in 2019 resultant of tariffs on Chinese imports carried over into January, with imports coming to the U.S. from Vietnam up 33.1% annually in January and imports from Asia, excluding China, headed up 3.5%.

U.S.-bound imports coming out of the European Union dropped 7.3%, with Panjiva noting that this decline may partially be a response to the imposition of tariffs on EU luxury goods related to a WTO ruling against aerospace subsidies.

Addressing the impact of the coronavirus on U.S.-bound waterborne shipments, Panjiva said that it will not be seen in its data until later this month, due to the amount of time shipping takes to cross the Pacific.

Looking at certain commodity categories, Panjuva said that for the sectors in which tariffs on imports from China have been well established, there are some signs that pressure on shipments is alleviating. That was seen in January furniture imports—that had tariff initially applied in September 2018 and increased in May 2019—dropping 0.1% annually, off of a 14.9% fourth quarter decline. Apparel imports, which saw tariffs first applied in September 2019 and are set to but cut in mid-February, down 12.7%, following a 9% fourth quarter decline. Chemical imports dropped 8.4% in January and machinery and electronics fell 6.7%.

Panjiva Research Director Chris Rogers said in an interview that with one month of data for 2020, it is hard to draw meaningful conclusions for various reasons.

“The Lunar New Year is earlier than last year so the January data tends to be higher in a January when there is a Lunar New Year,” he said. “At this time last year, things were a bit off kilter, due to a pre-tariff rush but that subsided. On top of that, there were waves of tariffs that came in throughout the year, with some segments like furniture, whose tariffs took effect in September 2018, dragged and reached an end in January, whereas apparel is still suffering a drag from tariffs. On a top-line basis, it is all very messy.”

Data for February, March, and April are going to be distorted by the impact of the coronavirus, he explained, with February data distorted by goods that did not ship at the end of January and the beginning of February, coupled with signs that Chinese factories have begun to reopen, even though there is a lack of firm data supporting that.

“Shipping should restart, but does that mean we are going to effectively see a bubble in exports in March that will hit U.S. ports in April,” said Rogers. “This makes things incredibly difficult for logistics companies like container lines and freight forwarders to actually know where to put their capacity and when. I think it is inevitable that we are going to get this fairly toxic mixture of idled capacity because people made the wrong choice on where to put it and then bottlenecks because it was not put in the right place at the right time. That is not to say logistics companies are doing a bad job. It has more to do with them working in an incredibly uncertain environment. The temptation is to take capacity off the table, so we have seen a lot of blank sailings, as well as airlines cutting off cargo capacity.”

Further down the line, Rogers said it is likely that shipping levels are likely to be down annually, but there will still be bottlenecks for specific products and companies. And the status for just-in-time supply chains for autos, electronics, and capital goods will have issues, while more consumer-focused seasonal goods like apparel, furniture, toys, and other goods are likely to be less affected.