Trump Pulls U.S. Out of Trans-Pacific Partnership Trade Deal

US President Donald Trump dealt a death blow to the Trans-Pacific Partnership, a trade deal being negotiated between 12 nations who represent more 40% of the global economy.

President Trump’s first executive action was to pull out of the Trans-Pacific Partnership today, generating a mixed reaction from trade and supply chain analysts.

Harry J. Kazianis, Director of Defense Studies at the Center for the National Interest, (a Washington DC think tank) told Logistics Management that with the U.S. leaving the trade pact – a massive deal that would have included close to 40% of world trade, or roughly $28 trillion – the agreement is now “ancient history.”

What happens next will be vital for the Trump administration, he adds,

“We must remember, TPP, at its core, was never about trade,” he says.

“It provided very little economic benefits to the United States, as Washington already had many trade agreements with the various signatories of TPP.”

Kazianis maintains that TPP’s real goal was to demonstrate to our Asian trading partners that the U.S. was providing a “safety blanket” – insurance that Washington was in Asia to stay, as China continues its aggressive expansion policies in the region.

U.S. President Donald Trump has acted on his promise to cancel America’s participation in the Trans-Pacific Partnership (TPP). He considers the free trade agreement, that hadn’t come into effect yet, as a threat to the U.S. economy.

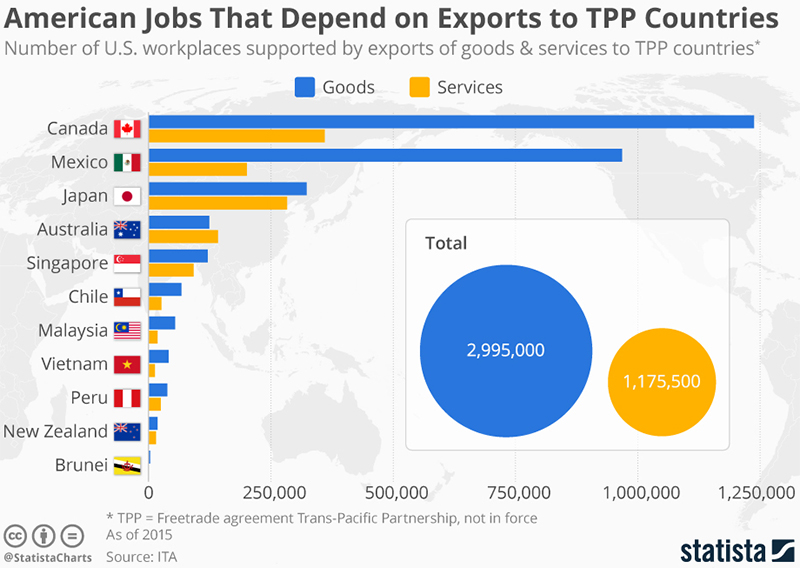

Whether this is true or not, America is already trading with the proposed member countries and jobs are on the line. According to the International Trade Administration, many jobs are supported by exports to direct neighbors Canada and Mexico, which are also members of NAFTA.

Importantly, China wasn’t one of the countries taking part in the TPP agreement. Some proponents of TPP saw the pact as an active counterbalance to China's economic dominance in the region. So from some observer’s perspective, also with Mr. Trumps China–critical rhetoric in mind, his actions might actually be welcomed by the Chinese government.

For Rosemary Coates, president of Blue Silk Consulting and author of Rules for Sourcing and Manufacturing in China. just the opposite reaction may take place.

“Outside influence and funding from USAID and other organizations is important to continue this trade standardization work and stabilize this region,” she says.

“But it is very likely with the US backing away from TPP and other trade deals in the Pacific under the new Trump administration, China will step in to fill the void, influence and accelerate the development across Asia.”

Chris Rogers, a Research Analyst for Panjiva, an online search engine with detailed information on global suppliers and manufacturers, says Trump may still “strike a less immediately hawkish tone” than during or since the election campaign.

“With regards to NAFTA the notice-to-withdraw is being held back as a threat if negotiations are refused,” he observes.

“The commitment to have the Department of Commerce take a more rigorous line on trade violations remains, but it nonspecific.”

Brandon Stallard, CEO of TPS Logistics, a Troy, Mich.-based third party logistics management provider with global operations, agrees that NAFTA might be different story.

“We support our president, and it looks like he’s doing the right thing about getting out of the TPP. We were not about to enter a level playing field, and most of U.S. manufacturing was not going to gain much by participating.”

Stallard believes that NAFTA is “a different ball game,” however.

“Here in Michigan, our automotive suppliers recently got together and concluded that President Trump is a real businessman. He’s not going take any chances with hemispheric supply chains if they are really working.”

Related TPP Related White Papers

Bracing for Instability in Global Trade for 2017

As we move into 2017, global trade management executives need to brace against disrupters that have the potential to send supply chains into tailspin. Download Now!

Supply Chain Visibility & Total Landed Cost in the Global Supply Chain

Global shippers are well aware of the number of new trade agreements being inked that will make it easier for U.S. organizations to not only source product from emerging markets, but also open the door to deliver goods into quickly growing consumer bases. Download Now!