Study Finds Traditional Industrial Distributor Model Faces Mounting Risks

Companies must adapt amid rapid change fueled chiefly by millennials and a shift to e-marketplaces; a surge of purchases coming directly from manufacturers and e-marketplaces, bypassing distributors.

Asset-light e-marketplaces and other nontraditional shopping channels, combined with shifting demographics, are upending industrial distributors’ inventory-heavy model more rapidly than previously thought.

As a result, distributors must quickly adapt and address threats with everything from sharper mobile offerings to upgraded customer service, a new white paper from UPS shows.

According to the UPS Industrial Buying Dynamics Study: Buyers Raise the Bar for Suppliers, the biggest shift comes from millennials (defined for this study as those currently ages 21-34) who grew up in a digital era and are bringing their tech-savvy and nontraditional purchasing habits - for example, bypassing the middle man and working directly with the manufacturer - with them into the workplace.

The impact on the future of industrial products purchasing may be among the most profound of any modern generation of buyers and provide a glimpse of the future.

The report, the third such study compiled since 2013, captures a sector undergoing demand changes and channel shifts at a startling speed: 81 percent of buyers have purchased directly from manufacturers, up 64 percent from the 2015 report.

Read: The Five “New Rules” of e-Commerce Fulfillment

Meanwhile, 75 percent of buyers surveyed have shopped at an e-marketplace, soaring from just 20 percent in 2013.

What’s more, 80 percent of buyers are likely to shift to suppliers with a more user-friendly web presence, up from 72 percent two years ago.

“With e-commerce, industrial buyers can choose from numerous suppliers with the click of a button, leaving the traditional business-to-business distributor model threatened,” said Matthew Guffey, vice president of UPS segment marketing.

“Maintaining the status quo, even just for now, is not an effective solution. Distributors have to up their game.”

The paper identifies four main ways for distributors - including those with smaller ambitions or limited funds – to remain competitive and offers solutions to reach these young corporate buyers where and how they want to interact:

- Recognize rising threats: It is imperative to consider strategic investments that bring services to parity with competitors. The paper found that more than half of respondents working primarily with distributors intend to increase e-marketplace spending, representing a looming risk to distributors.

- Think digital: Online channels are a necessity and distributors need to strengthen e-commerce capabilities, particularly for mobile ordering. Thirty percent of corporate buyers use mobile channels to order industrial products, and 24 percent are “extremely likely” to do so in the future. Nearly half of all buyers &ndndash; and 69 percent of millennials – indicated they would likely shift business to a distributor offering a mobile app.

- Address buyers’ needs by product: Partnerships can help make businesses more competitive. Look into purchasing insurance on products and shipments to mitigate risk and to help protect and improve cash flow; leverage a logistics provider’s global network to ramp up service more quickly and reach more pockets of growth.

- Go beyond the sale: Buyers want interaction beyond the sale (i.e. post-sales support), with half of respondents stating they would switch to a supplier offering assistance with returns, training and on-site maintenance or repairs. Thirty-six percent of millennials need services at least once per month, compared with just eight percent of Baby Boomers, according to the study.

UPS and TNS conducted the survey of 1,500 buyers of industrial products who are between the ages of 21 and 70 in the United States.

Respondents purchased industrial parts, products or supplies in five product categories: equipment sold in a business-to-business transaction; final assembly OEM (original equipment manufacturer) parts; MRO (maintenance, repair and operations) parts; consumables/raw materials – input items used in a manufacturing process; and janitorial and sanitation.

Participants came from companies of all sizes, with roughly one-third reporting annual revenue of $1 million; one-third reporting between $1 million and $10 million; and one-third reporting more than $10 million.

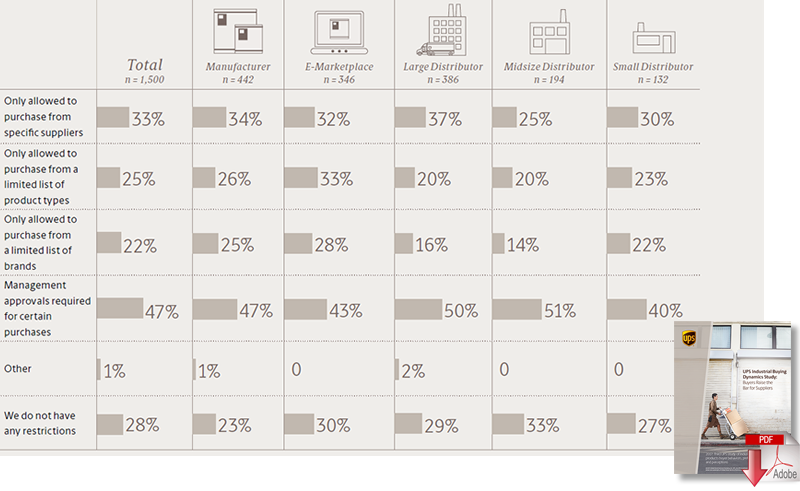

Study Buying Policies

Buyers report being constrained in their purchasing roles. They may have to choose from a specific list of suppliers, or from a certain selection of products, as shown below.

Download the White Paper: UPS Industrial Buying Dynamics Study

Article Topics

UPS News & Resources

UPS reports first quarter earnings decline Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 FedEx and UPS to Charge Additional Delivery Fees in Major U.S. Cities Parcel Experts Weigh in on New Partnership Between UPS and USPS Parcel experts examine the UPS-United States Postal Service air cargo relationship amid parcel landscape UPS To Become USPS’s Main Air Cargo Provider, Replacing FedEx UPS is set to take over USPS air cargo contract from FedEx More UPSLatest in Business

North Carolina Welcomes Amazon’s Newest Mega-Warehouse How Supply Chains Are Solving Severe Workplace Shortages SAP Unveils New AI-Driven Supply Chain Innovations FedEx Announces Plans to Shut Down Four Facilities Women in Supply Chain: Ann Marie Jonkman of Blue Yonder U.S. Manufacturing is Growing but Employment Not Keeping Pace The Two Most Important Factors in Last-Mile Delivery More Business