Top 3 Actions to Know if Your Transportation Management Performance is Up to Par

In today’s fast changing environment, supply chain leaders are struggling to answer some difficult questions about the market and their transportation management performance.

The fact is, many supply chain leaders struggle to know if they are leading or lagging with respect to their transportation management capabilities and performance.

However, best in class supply chain leaders will generally conduct the following 3 key actions to understand where their performance stands in the market:

- Know the Top Trends Driving the Transportation Market

- Understand the Competitiveness of Transportation Costs

- Compare Transportation Management Performance to Best in Class Performance

With these three key actions, companies gain the insight to know if their transportation management is up to par.

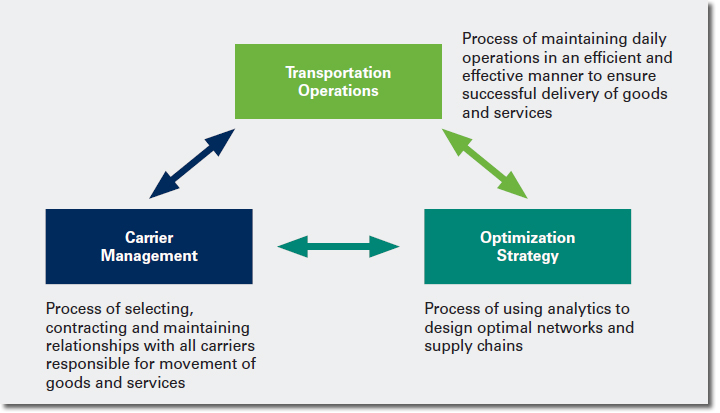

Components of Transportation Management

1. Know the Top Trends Driving the Transportation Market

Supply Chain leaders should be aware of the five trends affecting pricing and capacity in the transportation market in 2014:

- Increasing regulations concerning issues such as emissions, driver hours of service, import/export and safety are putting pressure on trucking capacity and pricing.

- Despite increased oil production in the US, fuel prices are expected to remain stable as increases in demand, proposed tax increases, and upheaval in the Middle East continue to put upward pressure on prices.

- The market for Transportation Management Systems (TMS) is still evolving as adoption hovers between 40-50%, with most companies generally using only a fraction of the system’s capability.

- Overcapacity in the market continues to keep ocean freight rates competitive as steamship lines deploy increasingly larger vessels at a time of poor market demand.

- The increase in crude oil movements by rail has created congestion in the network, increasing lead times and hurting reliability, thus forcing shippers to explore alternative transport modes and increase utilization of equipment.

2. Understand the Competitiveness of Transportation Costs

Having visibility into your transportation costs is the first half of the equation. Supply chain leaders also need to know how well they are doing vs. competition and how companies in other industries are doing. Industry benchmarks can be a useful tool, and have demonstrated a vast array of performance across a number of cost and resource metrics. Some examples:

- Companies in all industries tend to have more resources dedicated to outbound transportation than other transportation functions

- However, as the trend for outsourcing to 3PLs continues to increase, the number of FTEs needed for both inbound and outbound transportation processes will decrease

- While freight costs per $1,000 of revenue is higher for industrial companies, they comprise a larger percentage of sales for consumer goods companies

3. Compare Transportation Management Performance to Best in Class Performance

Best in class supply chain leaders tend to employ many of the below transportation best practices that span process, people, and systems.

Oftentimes, supply chain leaders will adopt a certain set of best practices as a way to maintain their transportation strategy in light of the changing conditions in the dynamic market. For instance:

- High use of third parties necessitates that companies instill transportation best practices that control the size of the supply base (process), encourage the use of approved carriers (people) and employ an integrated Transportation Management System or TMS (systems / platform)

- As external factors continue to make transportation rates volatile, leaders look to optimize costs by periodically reviewing spend (process), maximizing weight and cube usage (process) and using TMS for transportation routing (systems / platform)

Select Transportation Management Best Practices

Process

- Supply base is consolidated to a rational number of carriers for each mode/region

- Standardized routing guide exists with direct electronic integration to all carriers

- Standard accessorial and fuel surcharge schedules are implemented across carrier base

- Mode and carrier decisions are made using predefined rules based on calculated analytics

- Transportation spend is periodically reviewed and strategically sourced

- Order building practices maximize weight and cube usage

- Efficiency increasing strategies such as multi-stop and break-bulk are employed

People

- Well-defined organization structure for logistics management is in place

- Centralized dispatch, routing and fleet operations are in one group

- Documented internal training exists for core processes

- Sharing of best practices occurs across the enterprise

- Third parties are effectively used to augment non-core capabilities

- Enterprisewide policy to use approved carriers is in place and enforced

- Well-defined communication channels exist to other departments such as finance, planning, procurement, and customer service

Systems/Platform

- Transportation management system (TMS) is employed throughout the network and is regularly updated with current information (rates, lanes, carriers, transit times, etc.) and integrated to an ERP system

- Data and reports flow on-line and via established EDI or Internet links

- Self-invoicing or an audit mechanism (e.g., third-party freight auditor) is used to help ensure compliance with negotiated rates

- Transportation routing and costing optimized enterprisewide using automated tools (e.g., TMS) are in place

- Balanced metrics are aligned with goals and based on industry standards and measured with an external customer point of view

Source: The Hackett Group Best Practices

Strategic Implications

It is important for supply chain leaders to have an external view of their transportation management operations. This can be accomplished by monitoring the trends in the transportation market, benchmarking costs to the industry and understanding the best practices employed by the competition.

Once supply chain leaders have this visibility they can truly know that their transportation management performance is up to par – or not.

About the Authors

Robert Allen

Principal, Strategy and Operations Practice; Supply Chain Practice Lead

Bob is the operations practice leader for The Hackett Group based in Chicago. He is a recognized leader with a 25-year record of achievement in both consulting and business management. Bob serves a broad array of industries and brings expertise across all aspects of supply chain management including strategy, planning, procurement, manufacturing, logistics and product lifecycle management.

Hanna Hamburger

Director, Strategy and Operations Practice

Hanna is a director in the Strategy and Operations practice at The Hackett Group based in Chicago. Hanna has over 25 years of consumer products industry and consulting experience. She has worked extensively with consumer products and retail companies in the areas of sales, marketing and supply chain process, technology/tools, and organization performance improvement.

Bryan Cochie

Manager, Strategy and Operations Practice

Bryan is a manager in the Strategy and Operations practice at

The Hackett Group based in New York. He has over 10 years of supply chain experience focusing on transportation management, mode optimization and distribution network design. Prior to joining The Hackett Group, Bryan worked in the third-party logistics industry in various commercial, operational and advisory positions in both Asia and North America.

Related: 8 Trends That Are Driving Double-Digit TMS Adoption

Article Topics

The Hackett Group News & Resources

2014/15 Top 50 Global & Domestic U.S. Third-Party Logistics Providers Final thoughts from ISM 2015: Innovation, transformation and cost reduction Top 3 Actions to Know if Your Transportation Management Performance is Up to Par “Borderless Business Environment” Driving New Pressure, Changing Priorities for Procurement Leaders The Hackett Group’s “The CPO Agenda: Procurement’s Key Issues in 2013” Research ReportLatest in Transportation

Talking Supply Chain: Doomsday never arrives for Baltimore bridge collapse impacts Amazon Logistics’ Growth Shakes Up Shipping Industry in 2023 Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 More Transportation