Top 30 U.S. Ports: Digging deep

With the Panama Canal expansion planned to meet its deadline in late 2015, shippers are busy determining which top gateways will best serve their future needs. Meanwhile, even more strategic complexity has been introduced with further consolidation of ocean carrier services. Are niche ports ratcheting up their game to catch residual volume?

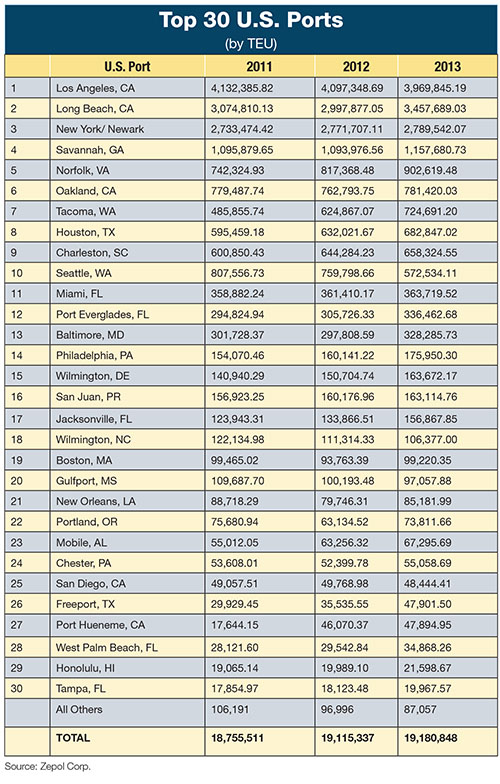

Even the most dominant U.S. ports can’t afford to become complacent in the face of several competitive factors converging at mid-year, say industry analysts. And while no major shift in Logistics Management’s Top 30 U.S. Ports list will be made evident over the course of this year, niche upstarts with NAFTA connections in Canada and Mexico may further cloud the picture in terms of rankings in the future.

“With winter over, retailers are stocking up in anticipation of a busy spring and summer,” says Jonathan Gold, vice president for supply chain and customs policy at the National Retail Federation (NRF). “All the top ports are considered when contingency plans are needed, so we may be seeing more volumes spread around the regions.”

According to Ben Hackett, president of the maritime consultancy Hackett Associates and an author of the monthly Port Tracker newsletter, major retailers appear to be content with the existing deployments and ports of call—even with the P3 and G6 carrier alliances taking form.

“New York and New Jersey will always be a major destination because of the population concentration, and the same is true of LA/Long Beach,” says Hackett. “Oakland and Savannah are important because they represent two of the best export gateways, while Norfolk and Seattle/Tacoma are attractive because they have sufficiently deep harbors to handle the mega vessels.”

Hackett notes that alliance carriers will also continue to use their respective terminals, thereby ameliorating dockside disruption. Hackett does concede, however, that drayage at heavy retail ports may be complicated in the future. “With the influx of these massive container ships, truckers will have many more boxes to move at once,” he observes. “As a consequence, you can expect ports to demand more transparency in the drayage process.”

While relatively minor, the Gulf ports of New Orleans and Corpus Christi play a significant role as a transshipment hub, as does the Port of Boston and Philadelphia in the East. On the West Coast, the niche Port of Portland and Vancouver U.S. remain viable for many shippers as well and may begin to slowly eat away at some of the volume of the perennial top ports, says Hackett.

Analysts suggest that Lazaro Cardenas in Mexico or Montreal up in Canada may also represent a threat to U.S. gateways, but for Nelson Cabrera, manager of business development at Lilly & Associates International, a global freight forwarder based in Miami, the emerging hubs in the Caribbean Basin are the ones to watch.

“With the Panama Canal expansion moving ahead on schedule, we see ports in the Bahamas, Dominican Republic, and Panama itself as major competitors,” Cabrera says. Unburdened by many of the strict regulatory compliance procedures conducted at U.S. ports, these foreign rivals can attract beneficial cargo owners with promises of expedited throughput. This, according to Cabrera, represents exponential savings in net load and inventory costs.

“Thanks to advances in information technology and harmonized tariff codes, these smaller ports can seize a political advantage by not carrying the expense of Customs and security personnel,” says Cabrera. “Even ports in Columbia and Chile are realizing this advantage.”

Paul Rasmussen, U.S. trade expert and CEO of Zepol, agrees, stating that Jamaica is also getting into the fray. “The Jamaican government has signed a preliminary agreement with one of China’s leading construction companies for the development of a transshipment hub off its southwest coast,” says Rasmussen. “This could pose a big threat to some of the smaller ports in Florida.”

East Coast: Improving communication

Last summer’s operational problems at The Port Authority of New York and New Jersey prompted leadership there to organize a “Port Performance Task Force” comprising a cross-section of industry representatives.

According to Rick Larrabee, the port authority’s commerce director, computer glitches at Maher Terminals along with longshore labor shortages and construction delays needed to be addressed if the port was to remain its current status in Zepol’s rankings.

“If there was a silver lining from last summer, it was the recognition that everyone in this port has to work together,” says Larrabee. “We haven’t had everyone in the room like this before.”

Task force members include terminal operators, ocean carriers, the International Longshoremen’s Association, the New York Shipping Association, the Metropolitan Marine Maintenance Contractors Association, truckers, beneficial cargo owners, railroads, intermodal equipment providers, and third-party logistics providers (3PLs). The port authority chairs the group.

According to Larrabee, issues now being discussed include chassis management, terminal gate throughput, and performance metrics. “We want to find ways to measure performance, because what you can measure, you can manage,” he says.

At the Port of Virginia, the focus has been on making motor carriers more efficient and increasing overall cargo velocity. “An investment in technology and conveyance equipment, smarter allocation of manpower, and reactivating mothballed equipment, has been key to success,” says John Reinhart, CEO and executive director of the Virginia Port Authority.

According to Reinhart, the port is extending hours at its gates and empty yards when and where needed and setting up various express-type lanes for motor carriers that are either in operation or on their way. “We’re taking concrete steps to address some immediate concerns and building this foundation for the future,” he says. “Over the long-term, these moves will help us better align our volumes with revenues and improve the overall flow of cargo across our terminals.”

The immediate effort is concentrated on Norfolk International Terminals, a 693-acre facility that has more than a mile of wharf space, two transfer zones, and the port’s largest (on-dock) rail operation.

Last year, The Port of Virginia set a record in terms of TEU volume, but revenues did not correspond. It became apparent that an overall review of container conveyance systems and subsequent investment to address the recommended changes was needed there, Reinhart says.

Since the beginning of the year, the emphasis has been on improving the throughput of truck freight. But as Russell Held, senior vice president of business development at the port, says, “Our port’s double-stack rail service provides the needed access to the nation’s heartland.”

For the neighboring Port of Savannah, the $35 million in additional port deepening funds proposed by Georgia Gov. Nathan Deal has been approved by the state legislature. Along with previous funding, Georgia has now allocated $266 million, fulfilling the state’s portion of the Savannah Harbor Expansion Project.

Deepening the Savannah Harbor from 42 feet to 47 feet will accommodate an increase in the number of super-sized container vessels transiting the Panama Canal after its 2015 expansion. With a deeper channel, larger and more heavily laden ships can arrive and depart with greater scheduling flexibility. Furthermore, say analysts, these “Post Panamax” vessels will lower shipping costs per container slot.

Gulf of Mexico: Racing the clock

Surging demand for warehousing and rail service has created a new set of challenges for the Port of Houston, the Gulf’s dominant ocean cargo gateway. Roger Guenther, deputy director of operations at the Port of Houston Authority, says that the port is examining intermodal rail in an effort to extend their reach farther inland for containerized cargo.

At the same time, there may be no more urgent deadline facing the Houston economy than dredging the Houston Ship Channel in time to handle super-size container ships that will be transiting the expanded Panama Canal in about 20 months.

“By working with the Army Corps of Engineers, we’re on the verge of obtaining the necessary permits to prepare our container terminals for the larger ships that we’ll see from the Panama Canal expansion—and we achieved this objective in about half the expected time,” says Guenther.

According to Zepol, the port set container volume and cargo tonnage records in 2013. Container volume reached an all-time-high 2 million TEUs and cargo totaled an unprecedented 36 million tons. Furthermore, a six percent year-over-year increase in loaded container movements outpaced all other U.S. ports in that category.

Meanwhile, the neighboring Port Corpus Christi has been targeted as a key ocean entry for plant machinery and container cargo destined for South Texas as well as to important industrial conglomerates of Northern Mexico. To expand this opportunity, it has negotiated a Memorandum of Understanding with the city of Pharr, Texas, to promote the efficient intermodal land and seaport route between the Pharr International Bridge, and this vital niche port.

West Coast: Staying ahead

The ports of LA/Long Beach are still without executive directors, but analysts say that they should hardly be troubled by this development, as the massive scale of their operations will sustain them through the coming months.

Walter Kemmsies, Ph.D. and chief economist for engineering firm Moffat & Nichol, is among those who contend that West Coast ports are not neglecting to build for the future.

“The fact that seaports must invest in modernization and new efficiencies is actually good news for the Port of Long Beach, which is several years into a decade-long, $4 billion capital improvement program,” says Kemmsies. “The port is also active where it can be in trying to find the means to improve efficiencies and productivity at its terminals.”

The Port of Seattle, which is also searching for a new leader, is still holding it’s own in today’s overheated inbound marketplace. Peter McGraw, spokesman for the Seattle’s Seaport and Real Estate division, says that a joint marketing plan with Port of Tacoma is “just a concept,” but one worth exploring.

“We see the entire Puget Sound coming together in future years to address some of our common challenges and to meet our common goals,” says McGraw. “It’s an exciting time to be in the port business.”

Industry analysts say that market share is safe at all major load centers here, including the Port of Oakland as well as at the burgeoning Port of Portland. However, all are vulnerable to a major disruption if progress is not made with the International Longshore and Warehouse Union (ILWU) contract negotiations in June.

“There’s too much at stake for these talks to fail,” says Kemmsies. “Both sides should understand what it means to work together at this critical juncture in maritime history.”