Top 25 Freight Forwarders Thriving in the Complexity of Global Trade

Freight forwardering leaders adhere to one fundamental business practice, building upon established worldwide networks.

When Deutsche Post DHL recently unveiled details about the company’s plans to build on its significant presence in the Asia-Pacific region and to further expand its competitive position in China, analysts were hardly caught off guard.

“DHL Global Forwarding grew through the acquisition of highly respected companies like Danzas—and both companies are legacy branches in Europe and Asia,” says Dick Armstrong, chairman of the supply chain and third party logistics consultancy Armstrong & Associates.

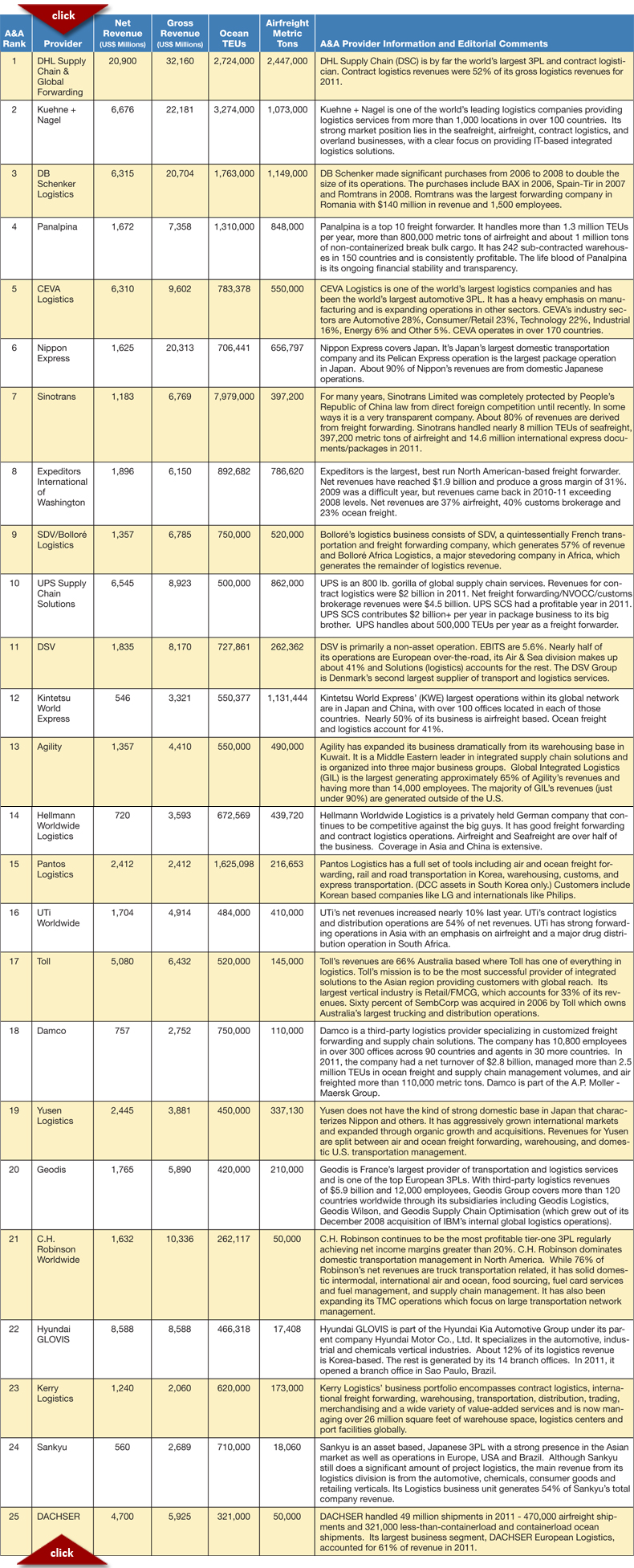

And for the second year in a row, DHL Global Forwarding shows up first in Armstrong & Associates’ list of top 25 freight forwarders by revenue.

According to Armstrong, DHL has been able to keep its lead due to its broad scope of services that allows its customers to more easily adjust to vendor supply chains. “Contract logistics revenues were 52 percent of its gross logistics revenues for 2011,” says Armstrong.

“Contract logistics revenues for Exel [part of DHL’s supply chain operations] are $4.1 billion with 456 warehouses and 111 million square feet of space. Exel has operations of virtually every kind on every continent.”

Armstrong adds that in combination with its strong ocean freight services, the company is well placed to capitalize on the expected acceleration of transport and trade of products within Asia, as well as between Asia and other emerging markets in the Middle East, Africa, and Latin America.

“The Asia-Pacific region already accounts for almost 20 percent of the DHL’s revenues today,” says CEO Frank Appel, adding that by 2017, revenues generated in Asia Pacific should contribute around one-third to the DHL top line.

“We are well positioned for prolonged profitable growth across the region,” says Appel.

Measured but consistent growth

Last year at this time, forwarders were forecasted to move quickly to take advantage of the burgeoning economic recovery. Some big players took a more measured approach, however.

UPS Supply Chain Solutions, for example, dropped from 5th to 10th place this year. Nonetheless, says Armstrong, UPS is the “800-pound gorilla” of global supply chain services.

“It’s important to remember that UPS does not break out its numbers along the pure ‘freight forwarding’ silo,” he says.

“They are a highly diversified 3PL, and the company has redesigned its supply chain operations to concentrate on high-tech, medical, and some retail/consumer goods customers—operations that are well integrated between value-added and package delivery services,” adds Armstrong. “Revenues per employee run $175,000 to $180,000.”

In March 2012, UPS announced the purchase of Netherlands-based TNT Express, the largest European express carrier with 18 percent market share. The purchase will complete a successful expansion by UPS into Europe and add a blanket of coverage in Europe, the Middle East, Africa, and the Asia-Pacific.

The sale price is estimated at $6.8 billion; but for UPS, the deal opens significant market opportunities particularly in spare parts and medical logistics.

Closer to home, Armstrong says that “election-year politics” will have a negative impact on Expeditors International—the leading domestic forwarder in 2012—as there are still too many regulatory obstacles in the works.

“Expeditors is the largest, best run North American-based freight forwarder,” says Armstrong. According to Armstrong’s report, net revenues have reached $1.9 billion and produce a gross margin of 31 percent. While 2009 was a difficult year, Expeditors revenues came back in 2010 and 2011 exceeding 2008 levels.

At the same time, however, Expeditors is the largest forwarder/NVOCC in the Asia/U.S. lane. It handles over 890,000 twenty-foot equivalent units (TEUs) per year globally, with nearly 50 percent being shipped from Asia to the U.S. Expeditors’ European operations are primarily in airfreight and constitute about 13 percent of revenues.

“Expeditors limits its participation in value-added warehousing and distribution,” says Armstrong, adding that it’s a company with very sound fundamentals.

Will energy hinder growth?

While diesel and other fuel rates had been in decline during the first half of 2012, the top 25 freight forwarders will continue to factor in this vital metric, says Armstrong. Again, he fault’s the “lack of political will” with keeping the U.S. dependent on foreign energy sources for the short term.

“While Asia remains a hot market, many middlemen will be mitigating risk by moving goods within NAFTA networks over the next few years,” he says. “I’m sure this will be reflected in the revenue rankings in 2013.”

Derik Andreoli, Ph.D.c., a senior analyst at Mercator International LLC and Logistics Management’s popular Oil & Fuel columnist, agrees, noting that the volatility of energy expenses will be a given for the remainder of this year.

“Oil and fuel markets are extremely complex, and forecasting price moves requires insight into both supply and demand for oil, diesel, gasoline, and dollars,” says Andreoli. “Since late last spring, crude oil prices have fallen by a staggering 22 percent.

This decline was largely due to the rapidly evolving opinion among Wall Street oil traders that tight oil markets were set to soften.”

But he observes that this sentiment is certainly not out of line with the news flowing from Europe or the recent lackluster performances of emerging markets—especially China.

“As Greece continues to dance with default and expulsion from the Eurozone, Moody’s has downgraded France’s credit rating, and bond yields across Portugal, Italy, Greece, and Spain have skyrocketed,” he says.

“As borrowing becomes more expensive, the only choices that are available are to cut spending or leave the Euro. Neither of these options is attractive.”

Andreoli adds that the problem with austerity is that spending—be it by the government, consumers, or businesses—greases the wheels of growth. The problem with leaving the Euro is that the value of the drachma would plummet, causing Greece to muddle through a prolonged recession.

“The irony, of course, is that the underperformance of Eurozone economies has kept the value of the Euro suppressed against the level that it would be if every Eurozone economy performed similarly to Germany,” says Andreoli. “As a consequence, Germany’s exports remain cheaper than they would otherwise be.”

Andreoli adds that as the Eurozone skirts recession, European oil demand will remain suppressed. So too are European imports from China and other emerging markets, which suppresses economic activity in these countries.

“Of course, Middle East and North Africa oil consumption was also significantly reduced as the Arab Spring chopped away at economic activity leaving a wide swath of economic disruption across the region,” says Andreoli.

Make way for contenders

Global forwarders contending to make the top 25 next year will face a number of barriers, but niche players can still capture significant market share, says Asa Chang, CEO of Encompass Global Logistics, an upstart forwarder headquartered in Hong Kong.

According to Chang, by investing in human resources and the latest technology, even a mid-sized middleman can compete in the global arena. “Our concentration on production and operations management in the Far East, the U.S., and Australasia is a key differentiator,” he says.

“We have built up a core network focusing on this trade triangle, and we have confidence in the potential and sustainability of these economies.”

Chang adds that smaller, more flexible forwarders are also able to aim at satisfying the shipper through the primary stages of supply chain, such as sourcing. “Rather than defer purchase of new technology, we have embraced it and use it for customized service throughout our scope of work,” he says.

Another advantage favoring the small forwarder is that management can “empower” staff to make immediate decisions for the shipper, says Chang. He notes that this kind of “on-the-spot” dynamic creates more velocity in the supply chain.

“By building a long-term relationship with the shippers, we’re demonstrating that we can handle multinational and multicultural challenges just like the big forwarders. More importantly, though, is that we show we can get through these turbulent times together.”

Article Topics

C.H. Robinson News & Resources

Q&A: Mike Burkhart on the Recent Nearshoring Push Into Mexico Q&A: Mike Burkhart, VP of Mexico, C.H. Robinson C.H. Robinson introduces new touchless appointments technology offering C.H. Robinson President & CEO Bozeman provides overview of key logistics trends and themes at SMC3 JumpStart 2024 C.H. Robinson touts its progress on eBOL adoption by LTL carriers and shippers Retailers Pivot Supply Chain Strategy, Seek Red Sea Alternatives C.H. Robinson announces executive hire to run new Program Management Office More C.H. RobinsonLatest in Transportation

Nissan Channels Tesla With Its Latest Manufacturing Process Why are Diesel Prices Climbing Back Over $4 a Gallon? Luxury Car Brands in Limbo After Chinese Company Violates Labor Laws The Three Biggest Challenges Facing Shippers and Carriers in 2024 Supply Chain Stability Index: “Tremendous Improvement” in 2023 Trucking Association CEO on New Biden Policy: ‘Entirely Unachievable’ Two Weeks After Baltimore, Another Cargo Ship Loses Power By Bridge More TransportationAbout the Author